The three major U.S. stock indices all closed slightly higher, $Dow Jones Industrial Average (.DJI.US)$ rose by 0.22%, $Nasdaq Composite Index (.IXIC.US)$ rising 0.31%,$S&P 500 Index (.SPX.US)$up 0.19%.

Most large-cap technology stocks rose.$Broadcom (AVGO.US)$up more than 2%, $Alphabet-C (GOOG.US)$ 、 $Meta Platforms (META.US)$ rising over 1%, $Apple (AAPL.US)$ 、$NVIDIA (NVDA.US)$The decline was less than 1%.

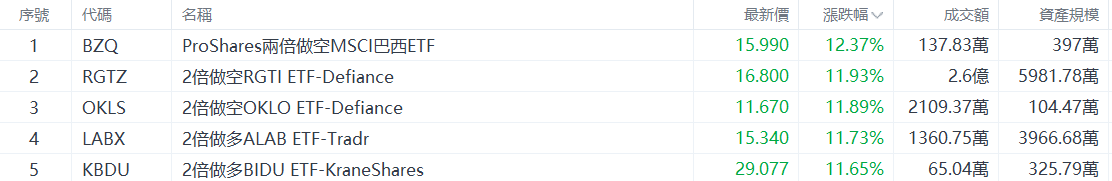

Top 5 Gainers in U.S. Equity ETFs

$ProShares UltraShort MSCI Brazil Capped (BZQ.US)$ Increased by 12.37%, with a trading volume of $1.3783 million.

$Defiance Daily Target 2X Short RGTI ETF (RGTZ.US)$ Increased by 11.93%, with a trading volume of $260 million.

$Defiance Daily Target 2X Short RGTI ETF (RGTZ.US)$ Increased by 11.93%, with a trading volume of $260 million.

In market news, the quantum computing sector experienced a broad-based decline, with RGTI falling more than 6%.

$Defiance Daily Target 2X Short OKLO ETF (OKLS.US)$ Increased by 11.89%, with a trading volume of $21.0937 million.

In market news, U.S.-listed nuclear power stock Oklo fell more than 6%. This follows the company's announcement of a $1.5 billion 'at-the-market' (ATM) stock offering plan.

$Tradr 2X Long ALAB Daily ETF (LABX.US)$ Increased by 11.73%, with a trading volume of $13.6075 million.

$KraneShares 2x Long BIDU Daily ETF (KBDU.US)$ Up 11.65%, with a trading volume of $650,400.

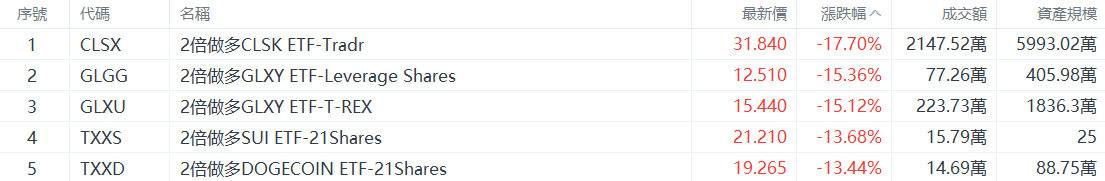

Top 5 Decliners on US Stock ETFs

$Tradr 2X Long CLSK Daily ETF (CLSX.US)$ Down 17.70%, with a trading volume of $21.4752 million.

$Leverage Shares 2X Long GLXY Daily ETF (GLGG.US)$ Down 15.36%, with a trading volume of $772,600.

$T-REX 2x Long GLXY Daily Target ETF (GLXU.US)$ Down 15.12%, with a trading volume of $2.2373 million.

$21Shares 2x Long Sui ETF (TXXS.US)$ Down 13.68%, with a trading volume of $157,900.

$21Shares 2x Long Dogecoin ETF (TXXD.US)$ Fell by 13.44%, with a trading volume of USD 146,900.

Top 5 Gainers in U.S. Large-Cap Index ETFs

$ProShares UltraPro QQQ ETF (TQQQ.US)$ Rose by 1.15%, with a trading volume of USD 4.072 billion.

$Direxion Daily Small Cap Bear 3X Shares ETF (TZA.US)$ Rose by 1.12%, with a trading volume of USD 674 million.

$Proshares Trust Pshs Ulshrus2000 (Post Rev Split) (TWM.US)$ Rose by 0.84%, with a trading volume of USD 13.476 million.

$Proshares Ultra QQQ ETF (QLD.US)$ Up 0.83%, with a trading volume of $268 million.

$ProShares Short VIX Short-Term Futures ETF (SVXY.US)$ Up 0.62%, with a trading volume of $42.5064 million.

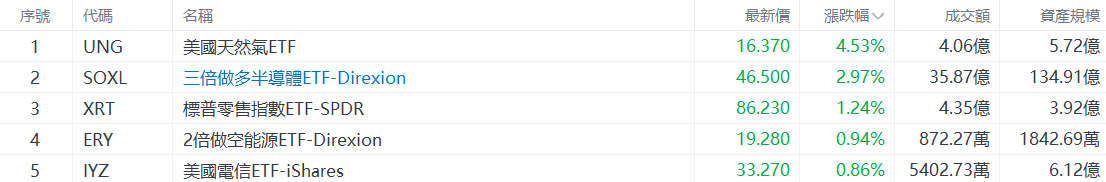

Top 5 Industry-Specific ETFs by Gains

$United States Natural Gas (UNG.US)$ Up 4.53%, with a trading volume of $406 million.

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ Up 2.97%, with a trading volume of $3.587 billion.

$SPDR S&P Retail ETF (XRT.US)$ Up 1.24%, with a trading volume of $435 million.

$Direxion Daily Energy Bear 2X Shares (ERY.US)$ Increased by 0.94%, with a trading volume of 8.72 million US dollars.

$iShares US Telecommunications ETF (IYZ.US)$ Increased by 0.86%, with a trading volume of 54.03 million US dollars.

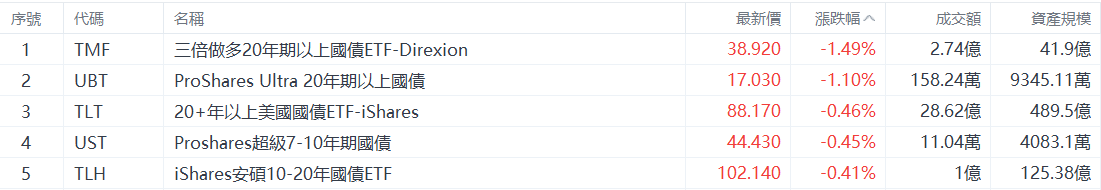

Top 5 Decliners in Bond ETFs

$Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF.US)$ Decreased by 1.49%, with a trading volume of 274 million US dollars.

$Proshares Trust Proshares Ultra 20+Yr Treasury (UBT.US)$ Decreased by 1.10%, with a trading volume of 1.58 million US dollars.

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ Down 0.46%, with a turnover of $2.862 billion.

$Proshares Trust Proshares Ultra 7-10 Yr Treasury (UST.US)$ Down 0.45%, with a turnover of $110,400.

$Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ Down 0.41%, with a turnover of $100 million.

Top 5 Gainers in Commodity ETFs

$ProShares Ultra Silver (AGQ.US)$ Up 4.79%, with a turnover of $464 million.

In market news, silver's upward momentum continued as spot silver briefly broke through $59 to reach a new high.

$United States Natural Gas (UNG.US)$ Up 4.53%, with a trading volume of $406 million.

$Sprott Physical Silver Trust (PSLV.US)$ Up 2.31%, with a trading volume of $161 million.

$iShares Silver Trust (SLV.US)$ Up 2.30%, with a trading volume of $2.302 billion.

$Abrdn Silver ETF Trust (SIVR.US)$ Up 2.21%, with a trading volume of $131 million.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen