Global capital is re-engaging with China’s stock market, driven by consensus logic around AI capabilities, valuation attractiveness, and resilience. The MSCI China Index has surged approximately 30% this year, with foreign capital shifting from passive inflows to anticipation of active fund returns. Institutions believe that technological innovation and reflation present structural opportunities, while domestic capital and $23 trillion in household savings may become the primary drivers of the next phase of growth, extending the rally into 2026.

China’s stock market is regaining favor with global investors thanks to its strength in artificial intelligence and resilience amid geopolitical tensions. Wall Street widely expects this upward trend to continue into 2026.

Major global asset managers, including Amundi SA, BNP Paribas Asset Management, Fidelity International, and Man Group, all anticipate further gains in China's equity markets. JPMorgan Chase & Co. recently upgraded its rating for the Chinese market to “overweight,” while Allspring Global Investments noted that this asset class is becoming “indispensable” for foreign investors.

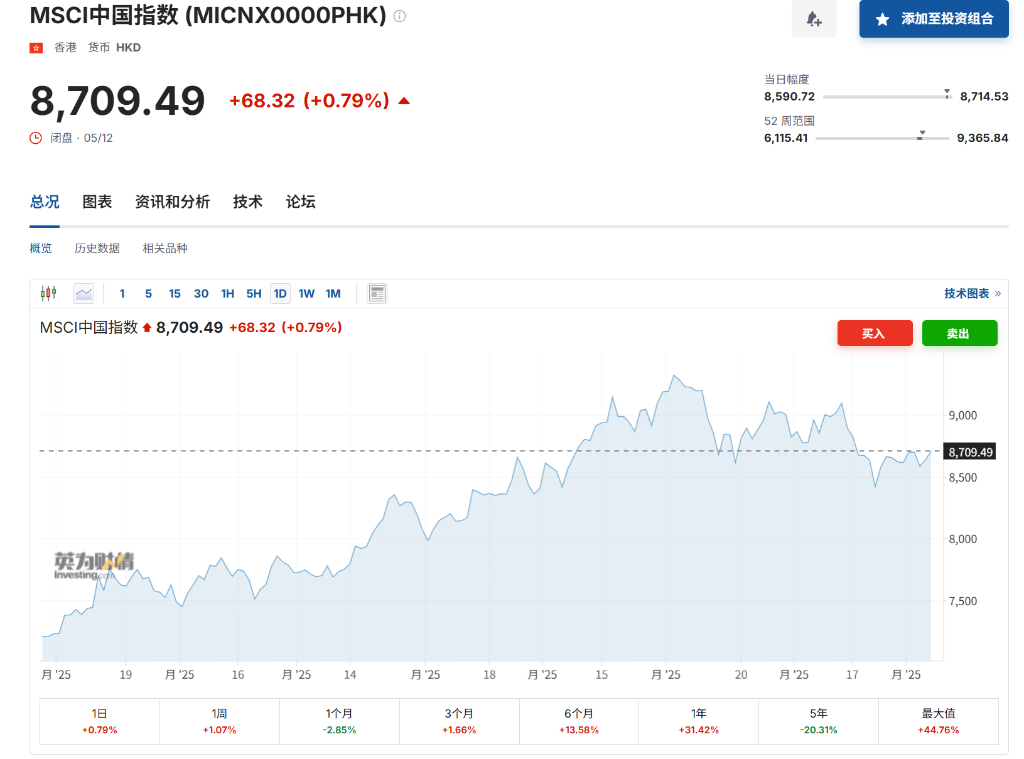

This optimism has spurred a fundamental shift in investor sentiment, transitioning from initial skepticism to recognition that China’s market can deliver unique value through technological advancements. According to Bloomberg data, the MSCI China Index has soared approximately 30% this year, marking its largest outperformance since 2017.$S&P 500 Index (.SPX.US)$, adding $2.4 trillion in market capitalization.

This optimism has spurred a fundamental shift in investor sentiment, transitioning from initial skepticism to recognition that China’s market can deliver unique value through technological advancements. According to Bloomberg data, the MSCI China Index has soared approximately 30% this year, marking its largest outperformance since 2017.$S&P 500 Index (.SPX.US)$, adding $2.4 trillion in market capitalization.

Although current inflows are primarily driven by passive funds, market participants broadly expect that improving corporate earnings and signs of reflation will encourage the return of active fund managers, leading the next phase of the rebound and reinforcing upward momentum.

Sentiment Reversal and Valuation Appeal

Investor perceptions of China’s market have undergone significant change. “China has turned a corner, demonstrating greater resilience. Investors are increasingly embracing an ‘investable’ China, which offers diversification and innovation,” said George Efstathopoulos, a Singapore-based portfolio manager at Fidelity International, who favors buying on dips. Gary Tan of Allspring Global Investments also believes that Chinese assets are becoming indispensable.

In addition to improved sentiment, valuation advantages remain a key draw for capital. Despite the recent surge, Chinese equities remain inexpensive compared to their global peers. The forward price-to-earnings ratio for the MSCI China Index stands at 12x, versus 15x for the MSCI Asia Index and 22x for the S&P 500. However, institutions caution that returns next year may not match this year’s intensity. Nomura Holdings’ base-case scenario forecasts a roughly 9% rise in the MSCI China Index from current levels, while Morgan Stanley predicts an approximate 6% increase.

According to data from Morgan Stanley, as of November this year, foreign long-only funds have purchased approximately US$10 billion worth of stocks in the mainland China and Hong Kong stock markets, reversing a capital outflow of US$17 billion in 2024.

**** Wu, head of Asia-Pacific equity strategy at Bank of America, stated that given the strong performance of the U.S. market, the threshold for investing in China remains high. However, she emphasized that improvements in corporate earnings could change this situation: 'The next phase of China's stock market rebound will be driven by global funds.'

Technology-Driven and Reflation Opportunities

The core rationale for being optimistic about China’s stock market lies in the positive outlook for its vast group of tech giants, particularly in sectors such as chips, biopharmaceuticals, and robotics. The boom surrounding artificial intelligence has driven$Alibaba (BABA.US)$and $Cambricon (688256.SH)$ a significant rise in share prices of companies like these.

Meanwhile, sectors that have underperformed the broader market this year, especially consumer-related sectors, are also considered to have potential for a rebound. Andrew Swan, head of Asian equities at Man Group, noted that opportunities lie in stocks influenced by economic stabilization rather than purely reflation:

If reflation represents the next phase for China’s economy, it will present substantial opportunities.

Some argue that foreign investors are not a prerequisite for a rally in China's stock market. Local mutual funds are buying, and demand from insurance companies is also rising following regulatory initiatives earlier this year.

The greatest hope for the market lies in China’s vast household savings, with Chinese families holding approximately $23 trillion in deposits seeking investment opportunities. Many investors believe this massive pool of capital will help drive the market higher. Florian Neto, Head of Asian Investments at Amundi SA, stated:

“If we confirm a return of mainland investors’ sentiment toward their domestic market, the stock market will continue to soar.”

Editor/Rocky