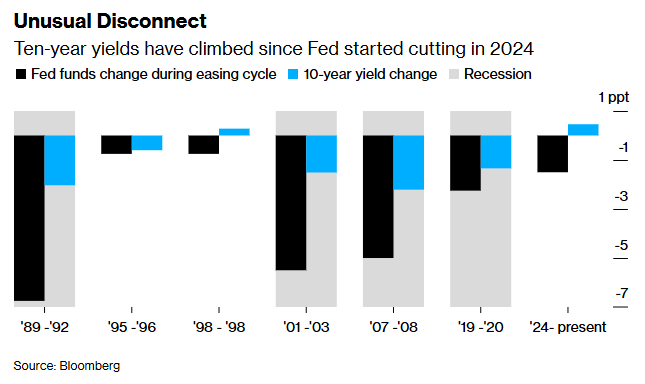

The reaction of the U.S. Treasury market to the Federal Reserve's interest rate cut has been highly unusual. By certain measures, such a pronounced divergence—where Treasury yields continued to climb despite the Fed's rate reduction—has not occurred since the 1990s.

According to Zhitong Finance APP, the reaction of the US Treasury market to the Federal Reserve's interest rate cuts has been highly unusual. By some measures, such a pronounced divergence—where US Treasury yields continued to rise despite the Fed’s rate cuts—has not occurred since the 1990s. This divergence has sparked intense debate, with opinions ranging from optimistic (indicating confidence that the economy will not fall into recession), to neutral (a return to pre-2008 market norms), to the explanation favored by so-called 'bond vigilantes' (investors losing confidence in the US's ability to control its ballooning national debt).

Since the Federal Reserve began cutting rates in 2024, the yield on the 10-year US Treasury bond has continued to rise.

However, one point is clear: the bond market does not agree with US President Trump's view that faster rate cuts would lead to a decline in Treasury yields, thereby reducing mortgage, credit card, and other types of loan rates. With Trump soon able to replace Fed Chair Powell with his own appointee, another risk is that the Fed may succumb to political pressure and ease monetary policy more aggressively, undermining its credibility—which could backfire, pushing already high inflation even higher and further driving up Treasury yields.

However, one point is clear: the bond market does not agree with US President Trump's view that faster rate cuts would lead to a decline in Treasury yields, thereby reducing mortgage, credit card, and other types of loan rates. With Trump soon able to replace Fed Chair Powell with his own appointee, another risk is that the Fed may succumb to political pressure and ease monetary policy more aggressively, undermining its credibility—which could backfire, pushing already high inflation even higher and further driving up Treasury yields.

Steven Barrow, head of G10 currency strategy at Standard Bank, stated: “The core objective of Trump's second term is to lower long-term yields. But putting a political figure into the Federal Reserve will not bring down bond yields.”

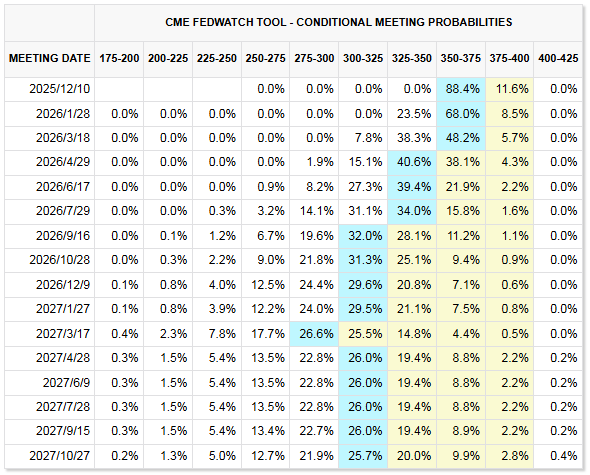

Since September 2024, the Federal Reserve has cut the federal funds rate from its highest level in over two decades, with cumulative reductions totaling 150 basis points, bringing it to a range of 3.75%-4%. Traders have fully priced in another 25-basis-point rate cut by the Fed this Wednesday and broadly expect two additional 25-basis-point cuts next year, which would bring the benchmark rate to 3.00%-3.25%.

However, the key US Treasury yields, which serve as the primary benchmark for borrowing costs for American consumers and businesses, have not declined at all. Since the Fed began easing monetary policy, the 10-year Treasury yield has risen by nearly half a percentage point to 4.1%, while the 30-year Treasury yield has climbed by more than 0.8 percentage points.

Typically, when the Federal Reserve raises or lowers short-term policy rates, long-term bond yields tend to follow suit. Even during the only two non-recessionary rate-cut cycles in the past four decades (in 1995 and 1998, when the Fed cut rates by 75 basis points each time), the 10-year Treasury yield either fell or rose much less than it has during this current easing cycle.

Jay Barry, head of global interest rate strategy at JPMorgan, believes there are mainly two factors behind this phenomenon. First, during the post-pandemic surge in inflation, the Fed raised rates so aggressively that markets had already priced in expectations of easing before the Fed actually pivoted, with the 10-year Treasury yield peaking at the end of 2023. This diminished the impact after this round of rate cuts began. Additionally, the Fed’s decision to cut rates significantly while inflation remains elevated has effectively reduced the risk of a recession, thereby limiting downward movement in Treasury yields. Barry stated: 'The Fed aims to sustain this economic expansion rather than end it. That is why Treasury yields have not fallen sharply.'

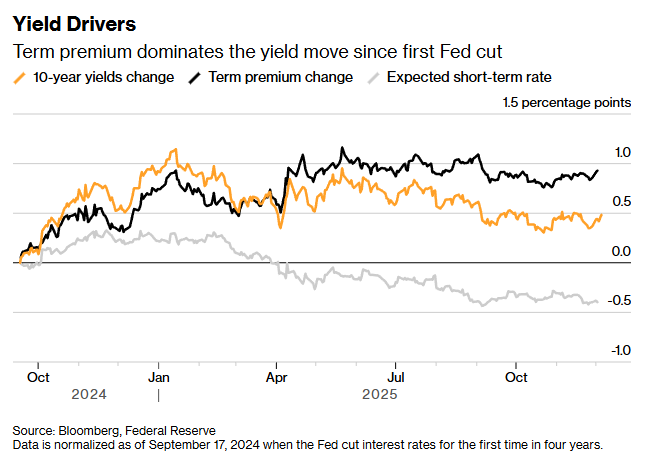

Some see a more pessimistic explanation in what is known as the term premium—the extra compensation investors demand for holding long-term bonds to account for potential future risks (such as high inflation or unsustainable fiscal deficits). According to estimates from the New York Fed, the term premium has risen by nearly a full percentage point since the start of this easing cycle.

Since the Federal Reserve's first rate cut of this cycle earlier this week, term premia have dominated yield movements.

Jim Bianco, President of Bianco Research, believes this is a signal that bond traders are concerned the Fed will continue to cut rates despite inflation remaining stubbornly above the 2% target and the economy persistently defying recession expectations. "The market is genuinely worried about policy, fearing the Fed has gone too far," he said. He added that if the Fed continues to cut rates, mortgage rates will "shoot up vertically."

In addition, there are concerns that Trump—whose approach starkly contrasts with his predecessors' respect for the Fed's independence—will successfully pressure policymakers into continuing rate cuts. Kevin Hassett, director of the White House National Economic Council and a staunch supporter of Trump, is currently viewed by betting markets as the most likely candidate to replace Powell when his term ends in May.

Markets Live strategist Ed Harrison stated: "If rate cuts increase the likelihood of stronger economic growth, they won’t lead to lower Treasury yields but rather higher ones. In many ways, this is because we are reverting to a normalized interest rate regime—2% real return + 2% Fed inflation target = a 4% floor for long-term yields. Add stronger growth into the mix, and this figure will only rise further."

However, so far, the broader bond market has remained relatively stable. The 10-year Treasury yield has hovered around 4% over the past few months. Breakeven inflation rates—a key measure of inflation expectations in the bond market—have also remained steady, suggesting that fears of a potential inflation spike triggered by the Fed might be overstated.

Robert Tipp, Chief Investment Strategist for Fixed Income at PGIM, a global insurance asset management giant, said this appears more like a move back toward pre-global financial crisis norms. The financial crisis ushered in an era of prolonged abnormally low rates, which abruptly ended post-pandemic. "We are returning to a world of normalized interest rates," he said.

Steven Barrow of Standard Bank noted that the Fed’s lack of control over long-term Treasury yields reminds him of a similar dilemma faced by the Fed in the early 2000s (albeit in the opposite direction)—the well-known 'Greenspan conundrum.' At the time, Fed Chairman Alan Greenspan was puzzled as to why long-term yields remained low even as he continually raised short-term policy rates. His successor, Ben Bernanke, later attributed this 'conundrum' to a massive inflow of excess savings from overseas into U.S. Treasuries.

Barrow stated that this dynamic has now reversed, with excessive government borrowing in major economies. In other words, the previous excess of savings has shifted to an oversupply of bonds, putting persistent upward pressure on yields. "Long-term yields may be structurally unable to decline. Ultimately, the Fed does not determine long-term interest rates," he said.

Editor/jayden