Source: Chuanyue Global Macro

Authors: Tao Chuan, Zhong Yumei, Wu Shuo

How should we interpret the upcoming economic meeting's tone-setting for next year’s work? We believe that, as the opening year of the '15th Five-Year Plan,' the overall planning is likely to focus on “seeking momentum from industry, enhancing productivity through technology, and driving growth through consumer welfare.” Under this framework, macroeconomic policies emphasizing “counter-cyclical and cross-cyclical adjustments” are expected to re-enter investors’ focus.

What new expectations might arise in terms of macroeconomics and industrial policy? We provide a forward-looking analysis around the following five key questions:

Question One: How will next year’s economic work be characterized?

In 2026, an ambitious growth target will be maintained while advancing the optimization of the macroeconomic policy framework. Historical patterns indicate that during the first year of every five-year plan, economic priorities are given significant attention, with growth targets often set as interim highs for the subsequent five years. As the inaugural year of the '15th Five-Year Plan,' 2026 holds undeniable importance. The economic growth target will continue to align with potential growth rates, aiming to create room within a reasonable range for the entire '15th Five-Year Plan' period.

In 2026, an ambitious growth target will be maintained while advancing the optimization of the macroeconomic policy framework. Historical patterns indicate that during the first year of every five-year plan, economic priorities are given significant attention, with growth targets often set as interim highs for the subsequent five years. As the inaugural year of the '15th Five-Year Plan,' 2026 holds undeniable importance. The economic growth target will continue to align with potential growth rates, aiming to create room within a reasonable range for the entire '15th Five-Year Plan' period.

Accordingly, the macroeconomic policy framework also needs upgrading, shifting from a primary focus on short-term stabilization through counter-cyclical measures to a dual emphasis on both short-term growth stability and medium-to-long-term structural optimization through a combination of counter-cyclical and cross-cyclical adjustments.

Question Two: Within the “counter-cyclical + cross-cyclical” framework, what can be anticipated in fiscal and monetary policies for 2026?

While “implementing proactive fiscal policy” remains crucial, “enhancing fiscal sustainability” has also been emphasized in the '15th Five-Year Plan.' Therefore, fiscal policy must adopt a “counter-cyclical + cross-cyclical” approach. Considering constraints on government debt levels, the adjustment space for the fiscal deficit target in 2026 is expected to be limited. Meanwhile, fiscal support will not only come through moderate expansion within the budget but also via extra-budgetary channels (e.g., supporting debt restructuring, optimizing corporate debt structures), with the broad fiscal deficit rate potentially increasing by approximately 0.5 percentage points.

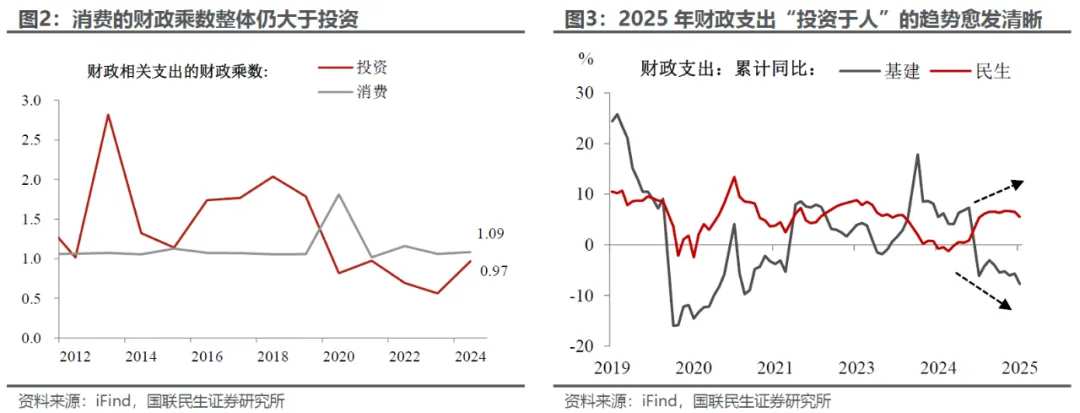

Fiscal policy will shift from simple aggregate “expansion” to a more efficiency-focused “effectiveness enhancement,” transitioning from “investment in physical assets” to “investment in human capital.” Based on empirical evidence showing that the fiscal multiplier for consumption significantly exceeds that for investment, fiscal resources will tilt more heavily toward areas such as education, healthcare, and social security—sectors that directly improve livelihoods and unlock consumer potential—to maximize the utilization of limited fiscal resources.

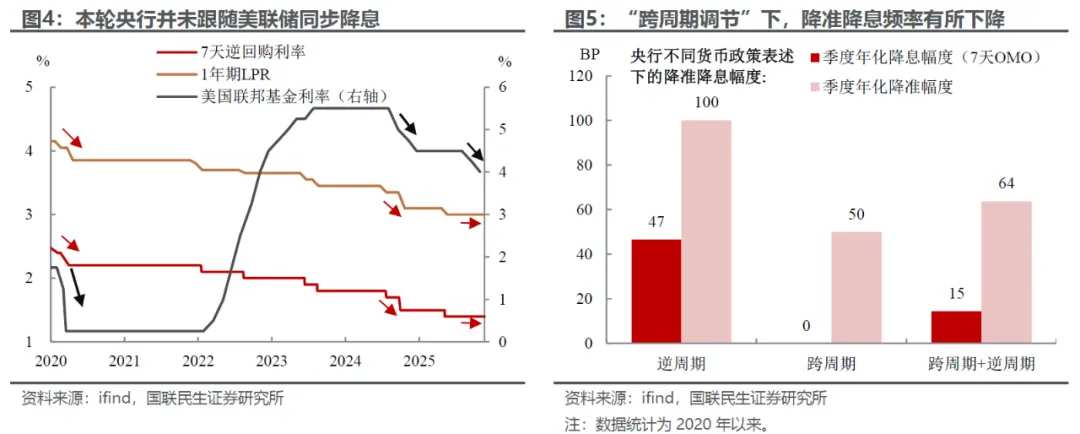

Monetary policy will further deepen the integration of 'counter-cyclical and cross-cyclical' considerations, while becoming more domestically oriented. As a core strategic deployment for the '15th Five-Year Plan,' the concept of a 'financial power' anchors long-term monetary policy direction, reinforcing the emphasis on domestic priorities. This will result in reduced synchronization with the Federal Reserve’s policies. Additionally, the central bank has reintroduced 'cross-cycle adjustments,' focusing on systematically resolving medium- to long-term structural issues. This implies that alongside reductions in reserve requirements and interest rates, there will likely be increased use of structural monetary policy tools to provide targeted support to key areas and vulnerable sectors.

Meanwhile, the coordination mechanism between monetary and fiscal policy is expected to become deeper and more routine (e.g., government bond trading), serving as an important tool to facilitate policy transmission and stabilize market expectations.

Question Three: How can domestic demand be systematically activated?

The policy focus on 'stimulating consumption' is undergoing subtle changes and optimization. With the diminishing effects of the 'Two New' policies, the necessity for their expansion may decline by 2026. Moderate reductions in 'Two New' funding create space for a strategic shift toward fiscal 'investment in people,' which could lead to the introduction of consumer subsidies targeting the services sector on a certain scale.

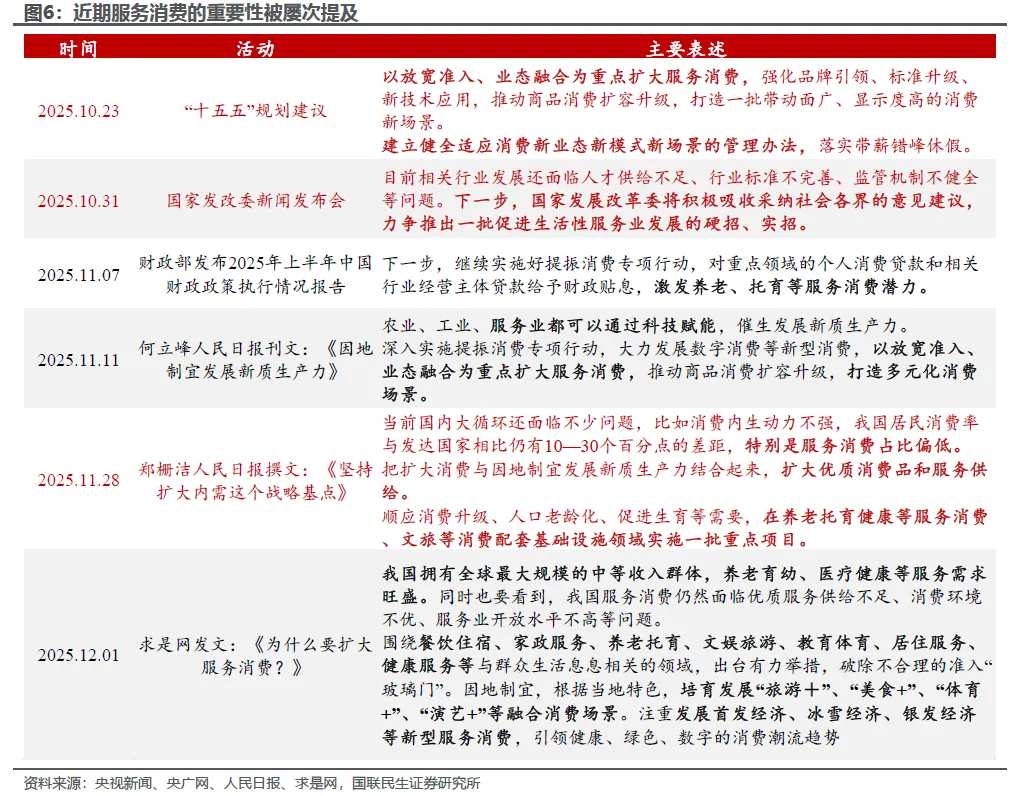

Expanding service consumption has become the 'golden key' to activating domestic demand. The '15th Five-Year Plan' establishes 'easing access and fostering industry integration' as the core approach. Recent high-level discussions have highlighted bottlenecks such as 'low share of service consumption,' 'insufficient talent supply,' and 'inadequate standards and regulation.' Identifying these issues represents the first step in systematic policy implementation, marking the expansion of service consumption as a clear priority at the top level.

In particular, China possesses the world’s largest middle-income population, holding immense potential for service consumption. Areas such as elderly care, childcare, cultural tourism, health and wellness, and domestic services, which align with demographic trends and societal needs, are expected to become leading forces in expanding and upgrading domestic demand under more precise subsidies and policy support.

Question Four: How strong is the need to stabilize investment?

At least for the first quarter, achieving a 'strong start' will inevitably rely on investment. In recent years, investment growth in the first quarter has been impressive, particularly in infrastructure. Given that infrastructure investment is primarily funded by the government, it is more controllable compared to manufacturing and real estate investment. Moreover, with new policy-based financial instruments and additional special bonds recently allocated to project construction, their policy effects are expected to continue into the first quarter of next year.

However, infrastructure efforts will be more precisely focused on key areas guided by national strategies, including major iconic projects such as 'urban renewal, strategic backbone corridors, new energy systems, major water conservancy projects, and national major scientific and technological infrastructure.' These projects combine strategic importance with practical needs, providing concrete levers for investment growth.

While ensuring 'risk prevention' in real estate policy, there must be a shift toward a new approach centered on high-quality development oriented around people's livelihoods and social security. Although downward pressures in the real estate market persist, their drag on the macroeconomy has somewhat diminished. Therefore, in the short term, real estate policy will continue to prioritize 'risk prevention,' adhering to a 'bottom-line mindset' to guide the market out of its downturn and gradually stabilize. Meanwhile, the '15th Five-Year Plan' period, as a transitional phase for high-quality development in real estate, requires further anchoring housing's residential attributes and core role in people's livelihoods. Focus will be placed on building 'quality homes,' renovating existing housing stock, and urban renewal, establishing a new model for real estate development. This will drive the industry’s transition from scale expansion to quality enhancement, better meeting residents’ housing needs.

In the manufacturing sector, with the easing of export pressures and the implementation of service consumption policies, related manufacturing investments are expected to stabilize gradually. However, it is important to note that the manufacturing industry may face constraints due to enterprises expanding overseas, potentially leading to a reduction in domestic investment share.

Question Five: What are the key highlights on the journey to 'building a modern industrial system'?

We believe there will be three key highlights on the industrial front by 2026: First, observing the trend—namely, the globalization expansion of enterprises. Enterprises 'going global' is driven by economic laws, with benefits reflected in the growth of Gross National Income (GNI). This implies that while paying attention to Gross Domestic Product (GDP), greater focus should be placed on the global accumulation of national wealth.

Second, examining empowerment—namely, the deep integration and application of artificial intelligence. The emphasis lies in closely aligning artificial intelligence with industrial development and livelihood security to seize the high ground in industrial applications. By lowering application barriers in areas such as employment, health, and elderly care, a cycle of 'innovation driving application and application promoting innovation' can be formed, systematically empowering various industries.

Third, assessing the foundation—namely, the accelerated forging of emerging pillar industries. This is expected to become a key driver in constructing new productive forces and ensuring both quantitative and qualitative economic growth. It is crucial to seize opportunities presented by the technological revolution, transforming sectors such as new energy, new materials, aerospace, and low-altitude economy into new growth pillars while continuously enhancing the proportion and quality of the entire strategic emerging industries sector.

Risk Warning: Future policies may fall short of expectations; changes in the domestic economic situation may exceed expectations; export fluctuations may surpass expectations.

Editor /rice