China's stock market is regaining favor with global capital. Mainstream Wall Street institutions generally predict that, driven by its strength in artificial intelligence, economic resilience, and relatively low valuations, China's stock market still has room for growth in 2026.

In a year of standout stock market performance, China has regained the favor of global investors. Market participants anticipate further returns from Chinese markets, buoyed by the country’s strength in artificial intelligence and its resilience amid evolving trade dynamics.

Global fund management firms Amundi, BNP Paribas Asset Management, Fidelity International, and Man Group all anticipate that China's stock market will continue to rise in 2026. JPMorgan recently upgraded its rating on the Chinese market to overweight, while Gary Tan of Allspring Global Investments noted that such assets are becoming 'indispensable' for foreign investors.

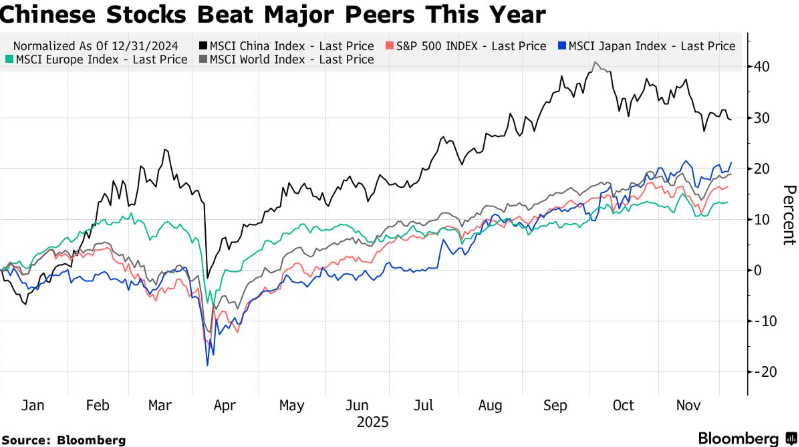

Investor sentiment toward China has shifted from skepticism to recognition: this market can deliver unique value through its technological advancements. The MSCI China Index has risen approximately 30% this year, marking its strongest outperformance since 2017 and adding $2.4 trillion in market capitalization.$S&P 500 Index (.SPX.US)$With most inflows driven by passive funds, the market anticipates the return of active fund managers to lead the rebound into its next phase.

Investor sentiment toward China has shifted from skepticism to recognition: this market can deliver unique value through its technological advancements. The MSCI China Index has risen approximately 30% this year, marking its strongest outperformance since 2017 and adding $2.4 trillion in market capitalization.$S&P 500 Index (.SPX.US)$With most inflows driven by passive funds, the market anticipates the return of active fund managers to lead the rebound into its next phase.

"China has reached an inflection point, demonstrating greater resilience. Investors are increasingly embracing an 'investable' China that offers diversification and innovation," said George Efstathopoulos, a Singapore-based portfolio manager at Fidelity International. "I am now more inclined to buy on dips in the Chinese market."

According to data from Morgan Stanley, as of November this year, long-term foreign funds have purchased approximately $10 billion worth of stocks in mainland China and Hong Kong, reversing a $17 billion outflow seen in 2024. The inflows were entirely driven by passive investors tracking indices, while active fund managers withdrew around $15 billion.

**** Wu, Head of Asia-Pacific Equity Strategy at Bank of America, stated that some global fund management companies believe that, given the equally strong performance of the U.S. market, the threshold for investing in China remains high. She frequently meets with investors to understand their views on the market. "The next leg of China's equity market rally will be driven by global inflows," she said.

"Slow bull" market

The optimism surrounding China's stock market is mainly driven by expectations for emerging technology giants in sectors such as semiconductors, biopharmaceuticals, and robotics. The wave of enthusiasm around artificial intelligence has significantly boosted stocks like Cambricon Technologies and Alibaba Group Holding Limited. However, sectors that have underperformed this year, particularly consumer stocks, could also see a rebound.

"Opportunities lie in stocks influenced by the theme of 'economic stabilization' rather than 'reflation,'" said Andrew Swan, Head of Equities for Asia-Pacific (excluding Japan) at Man Group. "If China’s next phase is 'reflation,' there are many opportunities embedded within that."

Investors also noted that Chinese equities remain inexpensive compared to their global peers. The forward price-to-earnings ratio of the MSCI China Index, which tracks stocks listed in mainland China and Hong Kong, stands at 12 times, compared to 15 times for the MSCI Asia Index and 22 times for the S&P 500 Index.

It is important to note: investors should not expect next year’s returns to match this year’s levels. Nomura Holdings’ base-case forecast for the MSCI China Index implies an upside potential of approximately 9% from current prices. Morgan Stanley also anticipates a rise of about 6% from current levels.

Some perspectives suggest that foreign investors are not essential for a rally in China’s stock market. Domestic public mutual funds are buying, while demand from insurance companies, spurred earlier this year by regulatory initiatives, is also providing support. State-related funds, known as the “national team,” are also ready to step in and purchase stocks during periods of market volatility.

However, the greatest hope stems from the country’s vast pool of savings. Chinese households hold approximately $23 trillion in deposits. Many investors believe this massive cash reserve will help propel the market higher.

"Has investor sentiment picked up in their own markets?" asked Florian Neto, Head of Asian Investments at Amundi. "If we confirm that improvement, the market will continue to soar."

Editor/melody