The three major U.S. stock indexes closed mixed. $Dow Jones Industrial Average (.DJI.US)$ Down 0.37%, $Nasdaq Composite Index (.IXIC.US)$ Up 0.13%, $S&P 500 Index (.SPX.US)$and another down by 0.09%.

$Alphabet-C (GOOG.US)$ 、$Broadcom (AVGO.US)$、$Tesla (TSLA.US)$Up more than 1%, $Meta Platforms (META.US)$ Down more than 1%.

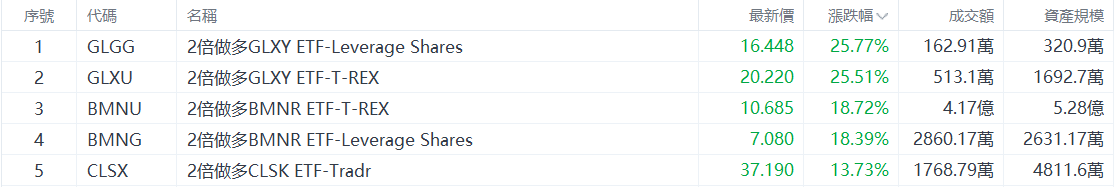

Top 5 Gainers in U.S. Equity ETFs

$Leverage Shares 2X Long GLXY Daily ETF (GLGG.US)$ Increased by 25.77%, with a trading volume of 1.6291 million US dollars.

$T-REX 2x Long GLXY Daily Target ETF (GLXU.US)$ Increased by 25.51%, with a trading volume of 5.131 million US dollars.

$T-REX 2x Long GLXY Daily Target ETF (GLXU.US)$ Increased by 25.51%, with a trading volume of 5.131 million US dollars.

$T-REX 2x Long BMNR Daily Target ETF (BMNU.US)$ Increased by 18.72%, with a trading volume of 417 million US dollars.

$Leverage Shares 2X Long BMNR Daily ETF (BMNG.US)$ Increased by 18.39%, with a trading volume of 28.6017 million US dollars.

$Tradr 2X Long CLSK Daily ETF (CLSX.US)$ Increased by 13.73%, with a trading volume of 17.6879 million US dollars.

In market news, Bitcoin briefly rebounded above $94,000, and cryptocurrency-related stocks generally rose, with Galaxy Digital up nearly 13% and BMNR rising over 9%.

Top 5 Decliners on US Stock ETFs

$Defiance Daily Target 2X Short BMNR ETF (BMNZ.US)$ Down 18.69%, with a trading volume of 115 million US dollars.

$T-REX 2X Inverse CRCL Daily Target ETF (CRCD.US)$ Down 12.37%, with a trading volume of 12.8714 million US dollars.

$T-Rex 2X Inverse Ether Daily Target ETF (ETQ.US)$ Down 12.15%, with a trading volume of USD 2.7365 million.

$ProShares UltraShort Ether ETF (ETHD.US)$ Down 12.04%, with a trading volume of USD 90.885 million.

$MicroSectors Gold Miners -3X Inverse Leveraged ETNs (GDXD.US)$ Down 10.87%, with a trading volume of USD 27.2118 million.

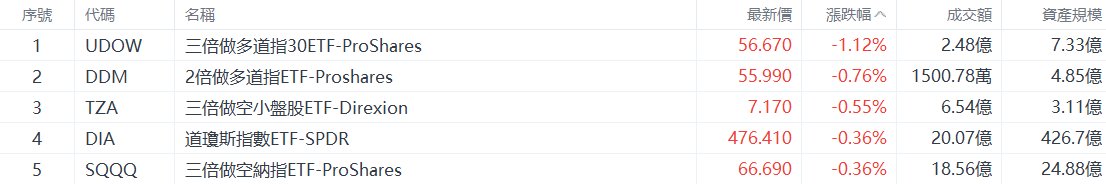

Top 5 Decliners in Major US Equity Index ETFs

$ProShares UltraPro Dow30 ETF (UDOW.US)$ Down 1.12%, with a trading volume of USD 248 million.

$Proshares Ultra Dow30 (DDM.US)$ Down 0.76%, with a trading volume of USD 15.0078 million.

$Direxion Daily Small Cap Bear 3X Shares ETF (TZA.US)$ Down 0.55%, with a trading volume of USD 654 million.

$SPDR Dow Jones Industrial Average Trust (DIA.US)$ Down 0.36%, with a trading volume of USD 2.007 billion.

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$ Down 0.36%, with a trading volume of USD 1.856 billion.

Top 5 Industry ETF Decliners

$United States Natural Gas (UNG.US)$ Down 6.44%, with a trading volume of USD 262 million.

$Direxion Daily Real Estate Bull 3X Shares ETF (DRN.US)$ Down 1.74%, with a trading volume of USD 2.5634 million.

$iShares Biotechnology ETF (IBB.US)$ Fell by 1.68%, with a trading volume of $260 million.

$iShares US Home Construction ETF (ITB.US)$ Fell by 1.57%, with a trading volume of $219 million.

$Ishares Trust U.S. Pharmaceuticals Etf (IHE.US)$ Fell by 1.35%, with a trading volume of $5.48 million.

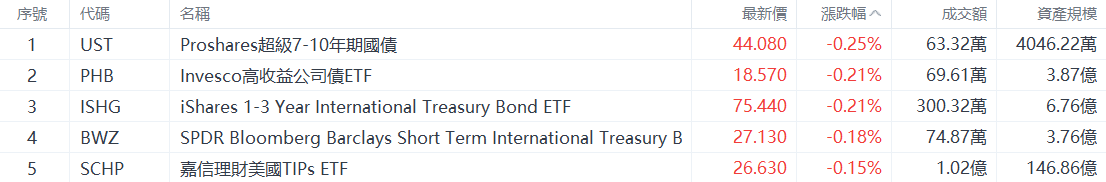

Top 5 Decliners in Bond ETFs

$Proshares Trust Proshares Ultra 7-10 Yr Treasury (UST.US)$ Fell by 0.25%, with a trading volume of $633,200.

$Invesco Fundamental High Yield Corporate Bond ETF (PHB.US)$ Fell by 0.21%, with a trading volume of $696,100.

$Ishares 1-3 Year International Treasury Bond Etf (ISHG.US)$ Fell by 0.21%, with a trading volume of $3.0032 million.

$SPDR Bloomberg Barclays Short Term International Treasury Bond ETF (BWZ.US)$ Fell by 0.18%, with a trading volume of $748,700.

$Schwab Strategic Tr Us Tips Etf (SCHP.US)$ Fell by 0.15%, with a trading volume of $102 million.

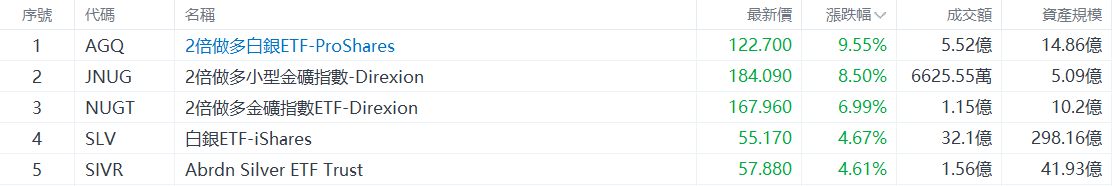

Top 5 Gainers in Commodity ETFs

$ProShares Ultra Silver (AGQ.US)$ Rose by 9.55%, with a trading volume of $552 million.

$Direxion Daily Junior Gold Miners Index Bull 2X Shares (JNUG.US)$ Up 8.50%, with a trading volume of 66.255 million US dollars.

$Direxion Daily Gold Miners Index Bull 2X Shares (NUGT.US)$ Up 6.99%, with a trading volume of 115 million US dollars.

$iShares Silver Trust (SLV.US)$ Up 4.67%, with a trading volume of 3.21 billion US dollars.

$Abrdn Silver ETF Trust (SIVR.US)$ Up 4.61%, with a trading volume of 156 million US dollars.

In market news, silver prices surged strongly, with spot silver breaking above 60 US dollars, once again setting a new historical high.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen