The three major U.S. stock indexes closed collectively higher, $Dow Jones Index (.DJI.US)$ Up 1.05%, $Nasdaq Composite Index (.IXIC.US)$ Up 0.33%,$S&P 500 Index (.SPX.US)$increased by 0.68%.

Most large-cap technology stocks rose.$Tesla (TSLA.US)$、$Amazon(AMZN.US)$、$Broadcom (AVGO.US)$、 $Google-C (GOOG.US)$ rising over 1%, $Meta Platforms(META.US)$ down more than 1%,$Microsoft(MSFT.US)$dropped more than 2%.

Top 5 Gainers in U.S. Equity ETFs

$2x Leverage GEV ETF-Tradr (GEVX.US)$ Surged 31.49%, with a trading volume of $25.96 million.

In terms of news, driven by the explosive expansion of AI data centers, GE Vernova, a leading American electric equipment company, surged 15% after announcing an increase in its earnings guidance for the coming years, doubling its dividend, and raising its stock repurchase authorization, reaching a historic high with confidence.

$2x Leveraged Long VOYG ETF-Tradr (VOYX.US)$ Rose 22.03%, with a trading volume of $400,800.

The $2x Leveraged FLY ETF-Tradr (FLYT.US) Increased 19.35%, with a trading volume of $849,100.

$2x Leveraged ASTS ETF-Tradr (ASTX.US)$ Rose 16.81%, with a trading volume of $81.98 million.

$2x Leverage RKLB ETF-Defiance (RKLX.US)$ Surged 15.24%, with a trading volume of $70.09 million.

In terms of news, space-related stocks saw another wave of gains, with ASTS rising over 8% and RKLB climbing more than 7%.

Top 5 Decliners on US Stock ETFs

$2x Leverage AVAV ETF-Defiance (AVXX.US)$ Fell 27.10%, with a trading volume of $3.30 million.

$2x Leveraged OSCR ETF-Leverage Shares (OSCG.US)$ Fell 16.11%, with a trading volume of $23,500.

$2x Leveraged OSCR ETF-Defiance (OSCX.US)$ Fell 16.06%, with a trading volume of $2.09 million.

$2x Leverage Short RKLB ETF - Defiance (RKLZ.US) Fell 15.58%, with a trading volume of $2.87 million.

$2x Leverage LYFT ETF-Tradr (LYFX.US) Fell 15.37%, with a trading volume of $525,900.

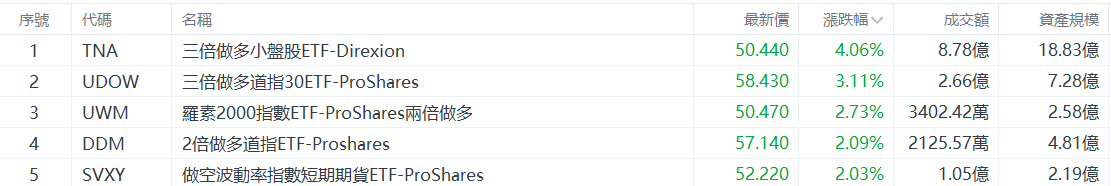

Top 5 Gainers in U.S. Large-Cap Index ETFs

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Rose 4.06%, with a trading volume of $878 million.

ProShares UltraPro Dow30 (UDOW.US) Rose 3.11%, with a trading volume of $266 million.

$ProShares Ultra Russell 2000 (UWM.US)$ Rose 2.73%, with a trading volume of $34.02 million.

ProShares Ultra Dow30 (DDM.US) Rose 2.09%, with a trading volume of $21.26 million.

ProShares Short VIX Short-Term Futures ETF (SVXY.US) Increased by 2.03%, with a turnover of 105 million US dollars.

In terms of news, the Federal Reserve announced a 25 basis point interest rate cut, marking the third consecutive cut since September. Boosted by this, the three major U.S. stock indexes collectively closed higher, with the Dow Jones Industrial Average rising over 1%.Russell 2000 IndexSurged over 1.3%, hitting another all-time high.

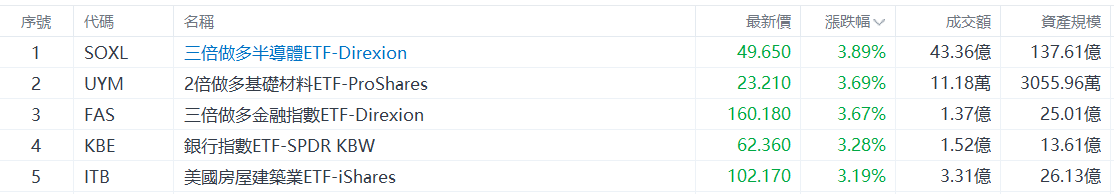

Top 5 Industry-Specific ETFs by Gains

$Direxion Daily Semiconductor Bull 3X Shares (SOXL.US)$ Increased by 3.89%, with a turnover of 4.336 billion US dollars.

$2x Leveraged Basic Materials ETF-ProShares (UYM.US) Increased by 3.69%, with a turnover of 111,800 US dollars.

$Direxion Daily Financial Bull 3X Shares (FAS.US)$ Increased by 3.67%, with a turnover of 137 million US dollars.

$SPDR KBW Bank ETF (KBE.US)$ Increased by 3.28%, with a turnover of 152 million US dollars.

$iShares U.S. Home Construction ETF (ITB.US)$ Increased by 3.19%, with a turnover of 331 million US dollars.

Top 5 Increases in Bond ETFs

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Increased by 1.06%, with a turnover of 328 million US dollars.

$iShares Global Treasury Bond ETF (IGOV.US)$ Increased by 0.67%, with a turnover of 3.0919 million US dollars.

$Invesco International Corporate Bond ETF (PICB.US)$ Up 0.59%, with a trading volume of $1.21 million.

$ProShares Ultra 7-10 Year Treasury (UST.US)$ Up 0.58%, with a trading volume of $184,100.

$Vanguard Long-Term Corporate Bond ETF (VCLT.US)$ Up 0.55%, with a trading volume of $293 million.

Top 5 Gainers in Commodity ETFs

$2x Leveraged Junior Gold Miners ETF - Direxion (JNUG.US) Up 3.49%, with a trading volume of $72.73 million.

$2x Leveraged Gold Miners ETF - Direxion (NUGT.US) Up 3.13%, with a trading volume of $139 million.

$ProShares Ultra Silver ETF (AGQ.US)$ Up 3.11%, with a trading volume of $596 million.

$Invesco Solar Energy ETF (TAN.US)$ Up 2.76%, with a trading volume of $61.06 million.

$First Trust Global Wind Energy ETF (FAN.US)$ Up 2.35%, with a trading volume of $282,400.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen