Key Points: The Federal Reserve cut interest rates by 25 basis points for the third consecutive time as expected by the market, but faced three dissenting votes on the rate decision for the first time since 2019. Trump's “hand-picked” Governor Bowman continued to advocate for a 50-basis-point cut, while two regional Fed presidents and four non-voting members supported keeping rates unchanged. In total, seven individuals opposed the decision, marking the largest division in 37 years. The statement reiterated that inflation remains slightly elevated and downside risks to employment have increased in recent months. It removed the phrase that unemployment remained “low,” noting a slight increase as of September. The statement added consideration of the “extent and timing” of further rate cuts, seen as an indication of higher thresholds for future cuts. The Fed stated that reserves had fallen to adequate levels and would begin purchasing short-term bonds this Friday to maintain sufficient reserves. The New York Fed plans to purchase $40 billion in short-term bonds over the next 30 days, with expectations that the Reserve Management Purchases (RMP) of short-term bonds will remain high through the first quarter of next year. The median expectation for interest rates remained unchanged from the previous forecast, suggesting one rate cut each in the next two years. The dot plot showed a slightly more dovish projection for next year compared to the last release, with one fewer member expecting no rate cuts, bringing the total to seven. Economic forecasts were revised upwards for GDP growth expectations for this year and the following three years, while inflation forecasts for this year and next year were slightly lowered, along with a minor reduction in unemployment expectations for the year after next. The “new Fedwire” commented that the Fed hinted it may temporarily refrain from further rate cuts due to a “rare” divergence within the committee over whether inflation or employment poses a greater concern. The Fed proceeded with another conventional rate cut as anticipated by the market but revealed the largest internal divisions among voting members in six years, signaling a slower pace of action next year and possible inaction in the near term. The Fed also initiated reserve management as expected by Wall Street figures, deciding to purchase short-term Treasuries before year-end to address pressures in the money market.

On Wednesday, December 10, Eastern Time, following the conclusion of the Federal Open Market Committee (FOMC) meeting, the Federal Reserve announced a reduction in the target range for the federal funds rate from 3.75% to 4.00% down to 3.50% to 3.75%. This marks the third consecutive FOMC meeting where the Fed has cut rates by 25 basis points, accumulating a total of 75 basis points in cuts this year and 175 basis points since the easing cycle began in September of last year.

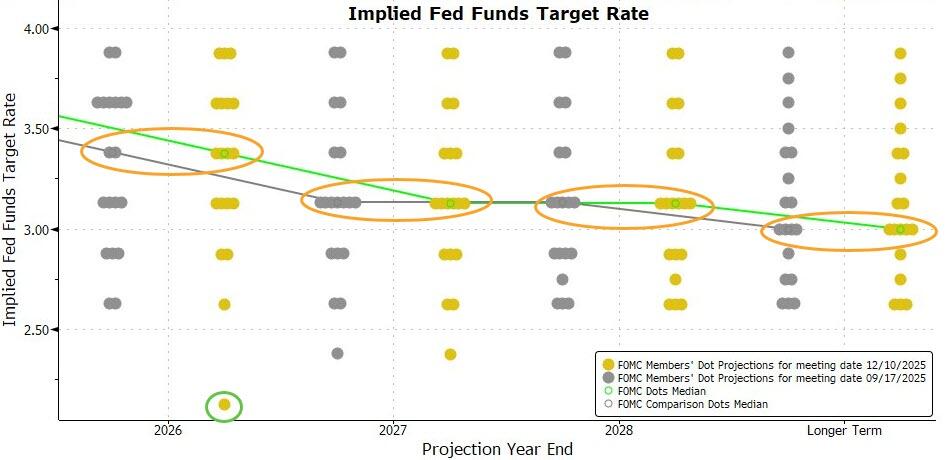

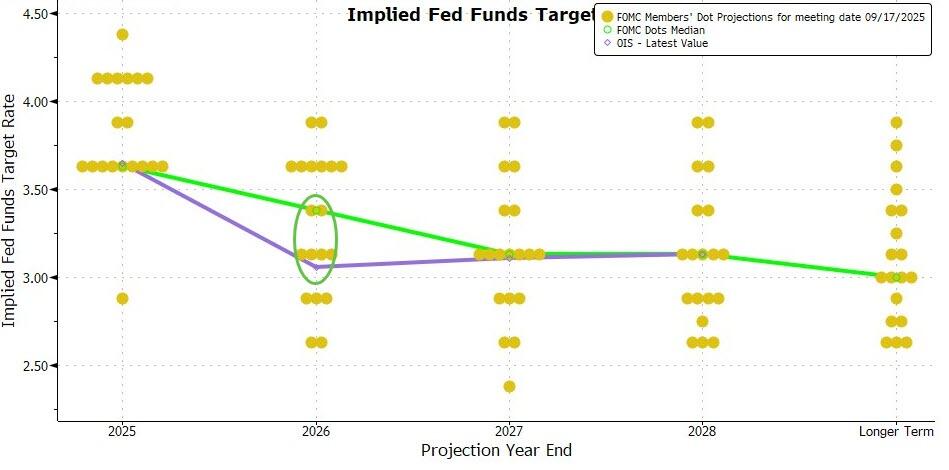

The dot plot released after the meeting showed that the Fed policymakers’ projections for the interest rate path remained consistent with those published three months ago, still anticipating one 25-basis-point cut next year. This indicates that the pace of rate cuts next year will slow significantly compared to this year.

This rate cut and the hint of slower action next year were almost entirely within market expectations. As of Tuesday’s close this week, CME tools indicated that futures markets priced in an approximately 88% probability of a 25-basis-point cut this week, while the probability of at least another 25-basis-point cut did not reach 71% until June of next year. Probabilities for such reductions at the January, March, and April meetings next year all remained below 50%.

This rate cut and the hint of slower action next year were almost entirely within market expectations. As of Tuesday’s close this week, CME tools indicated that futures markets priced in an approximately 88% probability of a 25-basis-point cut this week, while the probability of at least another 25-basis-point cut did not reach 71% until June of next year. Probabilities for such reductions at the January, March, and April meetings next year all remained below 50%.

The predictions reflected by the aforementioned CME tool can be summarized by the recently debated term “hawkish rate cut.” It refers to the Fed cutting rates this time but simultaneously signaling a potential pause in further action, with no additional rate cuts likely in the near term.

Nick Timiraos, a senior Fed reporter often referred to as the “new Fedwire,” wrote after the Fed’s meeting that the central bank “hinted it may temporarily refrain from further rate cuts” due to a “rare” divide within its ranks over whether inflation or the labor market is a more pressing concern.

Timiraos pointed out that three officials dissented against the 25-basis-point cut at this meeting, making it one of the most contentious meetings in recent years due to stagnating disinflation and cooling labor market conditions.

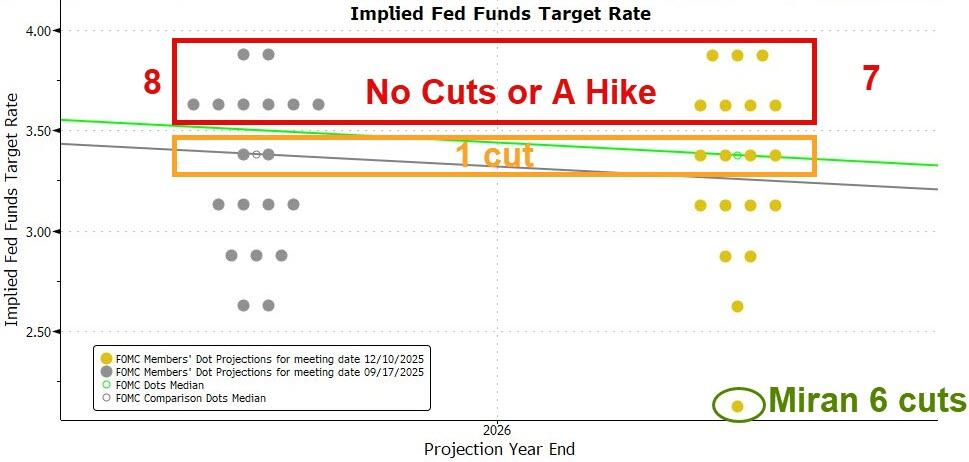

Other commentary noted that the dot plot released at this meeting showed that, including two voting FOMC members, a total of six individuals expected no rate cut in December, meaning a total of seven opposed the 25-basis-point cut this time—marking the largest divergence in 37 years based on these numbers.

First time since 2019 that three votes opposed the rate decision

Compared to the resolution issued after the October meeting, the biggest difference in this meeting’s statement was that, among the 12 FOMC voting members, three voted against the 25-basis-point cut, one more dissenting vote than at the October meeting. This marks the first time since 2019 that a Federal Reserve rate decision faced opposition from three voting members.

The statement showed that a total of nine FOMC members, including Fed Chair Jerome Powell and Governor Cook, whom U.S. President Trump had publicly called to dismiss, supported continuing to cut interest rates by 25 basis points. The three dissenting votes were from Stephen Miran, the Fed governor “handpicked” by Trump this year, Austan Goolsbee, President of the Chicago Fed, and Jeffrey Schmid, President of the Kansas City Fed.

Among them, similar to the first two meetings he attended since taking office, Miran has consistently advocated for a 50-basis-point rate cut. Schmid dissented again as he supports keeping rates unchanged, consistent with his stance in the previous meeting. Goolsbee, who previously supported a 25-basis-point cut, changed his position this time and joined Schmid’s camp.

This year, there have been dissenting votes in four of the Fed's FOMC meetings. In July and at the last meeting, two FOMC voters dissented, while in September, Miran was the sole dissenter.

These voting discrepancies reflect that, amid a government shutdown leading to delays or permanent loss of some official data, Fed policymakers are not unified in their assessment of the risks regarding inflation and employment. Those opposing rate cuts mainly worry about stagnation in progress toward lower inflation, while supporters believe further action is necessary to prevent accelerated job losses and worsening labor market conditions.

New considerations added for the 'magnitude and timing' of further rate cuts.

Another major change in this meeting’s statement compared to the previous one lies in the forward guidance on interest rates. Although a rate cut was decided this time, the statement no longer vaguely mentioned that the FOMC would assess future data, continuously changing outlooks, and risk balance when considering further rate cuts. Instead, it explicitly considers the 'magnitude and timing' of rate cuts. The statement now reads:

“In considering the magnitude and timing of further adjustments to the target range for the federal funds rate, the (FOMC) Committee will carefully evaluate the latest data, evolving (economic) outlooks, and risk balance.”

Immediately following this sentence, the Fed’s statement reiterated its firm commitment to supporting maximum employment and bringing inflation back to the Fed’s target level of 2%.

This adjustment aligns with what Wall Street analysts anticipated. They predicted the statement would return to the style of a year ago by reusing the phrase 'further adjustments in magnitude and timing.' Goldman Sachs noted that such an adjustment reflects that “the threshold for any further rate cuts will be higher.”

Removed reference to unemployment rate 'remaining low,' stating instead that it 'rose slightly as of September.'

Most of the other economic assessments in the statement reiterated the wording from the previous statement. To reflect the impact of insufficient official data, it reaffirmed that 'available indicators suggest a moderate pace of expansion in economic activity.'

The statement reiterated that employment growth this year has slowed, with slight adjustments to the description of the unemployment rate. Last time, it said 'the unemployment rate has edged up but remained low as of August,' whereas this time it was revised to 'the unemployment rate edged up as of September,' removing the phrase 'remained low.' Following these statements, the declaration noted that more recent indicators were consistent with these trends, reaffirming that the inflation rate had risen since the beginning of the year and remained slightly elevated.

As with the last statement, this one also mentioned that the FOMC 'is attentive to the risks facing its dual mandate and judges that downside risks to employment have increased in recent months.'

Plans to Purchase $40 Billion in Short-Term Bonds Over the Next 30 Days; RMP Purchases Expected to Remain High in Q1 Next Year

Another significant change in this meeting's statement compared to the last is the addition of a new paragraph specifically pointing out the purchase of short-term bonds to maintain an ample supply of reserves in the banking system. The statement reads:

'The Committee believes that reserve balances have declined to an adequate level and will begin purchasing short-term Treasury securities as needed to continuously maintain an ample supply of reserves.'

This amounts to the announcement of the initiation of so-called reserve management, rebuilding liquidity buffers for the money market. This is because market disruptions often occur at the end of the year when banks typically reduce their activities in the repo market to support their balance sheets for regulatory and tax settlements.

The full text of the statement is translated below. The black font indicates sections identical to the October 2025 FOMC meeting statement, while the red font highlights additions made in December 2025. The blue font in parentheses shows wording removed from the October statement (please cite the source when reproducing):

Available indicators suggest that economic activity has expanded at a moderate pace. Job growth has slowed this year, and the unemployment rate increased slightly as of September (but remained low through August); more recent indicators are consistent with these changes. Inflation has risen compared to the beginning of the year and remains somewhat elevated.

The Committee seeks to achieve maximum employment and an inflation rate of 2% over the long run. Uncertainty about the economic outlook remains high. The Committee is closely monitoring risks that may affect its dual mandate and assesses that downside risks to employment have increased in recent months.

In support of its objectives and reflecting changes in the balance of risks, the Committee decided to reduce the target range for the federal funds rate by 0.25 percentage points to 3.50% (3.75%) to 3.75% (4%). In determining the future adjustments to the target range for the federal funds rate, including their magnitude and timing, the Committee will carefully assess incoming data, evolving outlooks, and the balance of risks. (The Committee decided to conclude the reduction of its total holdings of securities on December 1.) The Committee is firmly committed to achieving maximum employment and bringing inflation back to its target of 2%.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. If risks emerge that could impede the attainment of its goals, the Committee will be prepared to adjust the stance of monetary policy as appropriate. The Committee’s assessments will take into account a wide range of information, including labor market conditions, inflationary pressures and inflation expectations, as well as financial and international developments.

The Committee judges that reserve balances have declined to an ample level and will purchase short-term U.S. Treasury securities as needed to maintain a consistently sufficient supply of reserves.

Voting in favor of this monetary policy decision were: Jerome H. Powell, Chair of the FOMC; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Susan M. Collins; Lisa D. Cook; (Austan D. Goolsbee,); Philip N. Jefferson; Alberto G. Musalem; and Christopher J. Waller.

Voting against this decision were Stephen I. Miran, who preferred to lower the target range for the federal funds rate by 0.5 percentage points at this meeting, and Austan D. Goolsbee and Jeffrey R. Schmid, who preferred to leave the target range for the federal funds rate unchanged at this meeting.

The New York Fed, responsible for open market operations, simultaneously issued an announcement on Wednesday, stating plans to purchase $40 billion worth of short-term Treasury securities over the next 30 days.

The New York Fed's announcement stated that it received instructions from the FOMC to increase the holdings of securities in the System Open Market Account (SOMA) by purchasing short-term Treasury securities in the secondary market and, if necessary, buying Treasury securities with a remaining maturity of up to three years to maintain an ample level of reserves. The scale of these Reserve Management Purchases (RMP) will be adjusted based on expected trends in demand for Federal Reserve liabilities and seasonal fluctuations, such as those caused by tax day impacts.

The announcement reads:

The monthly RMP amount will be announced around the ninth business day of each month, along with a tentative purchase plan for the next approximately 30 days. The trading desk plans to announce the first schedule on December 11, 2025, at which time the total amount of short-term Treasury bills in the RMP will be approximately $400 billion, with purchases set to begin on December 12, 2025.

The trading desk anticipates that, to offset the expected substantial increase in non-reserve liabilities in April (next year), RMP purchases will remain at elevated levels over the coming months. Thereafter, the overall pace of purchases may significantly slow down in response to the anticipated seasonal fluctuations in Federal Reserve liabilities. Purchase amounts will be appropriately adjusted based on the outlook for reserve supply and market conditions.

Dot plot shows seven dissenters against this decision; next year’s interest rate forecast shifts slightly dovish compared to the previous one.

The median value of the Federal Reserve officials’ interest rate projections released after Wednesday's meeting this week indicates that the expectations of Fed officials in this round are identical to their previous projections announced in September. The specific median forecasts are as follows:

The federal funds rate is projected to be 3.4% by the end of 2026, 3.1% by the end of 2027, and 3.1% by the end of 2028, with the longer-run federal funds rate at 3.0%, all unchanged from September’s projections.

Based on the above median interest rate projections, consistent with the previous forecast, Fed officials currently expect approximately one 25-basis-point rate cut each in the next year and the year after, following three rate cuts this year.

The dot plot shows that six individuals projected the year-end rate to be between 3.75% and 4.0%, accounting for over 30% of the total number of participants providing projections. This implies that a total of six individuals believed that rates should have remained unchanged at this meeting, including two voting members of the FOMC who cast dissenting votes, as well as four Fed officials without voting rights at this meeting. Including Governor Milan, who advocated for a more aggressive rate cut, the total number of dissenters against a 25-basis-point rate cut at this meeting reached seven.

Previously, many anticipated that the future interest rate movements reflected in the dot plot would indicate a more hawkish stance among Fed officials. However, this dot plot showed no such inclination and instead leaned slightly dovish compared to the last one.

Among the 19 Fed officials providing projections, seven projected next year’s rate to fall between 3.5% and 4.0%, compared to eight in the previous projection. This means that the number of officials expecting no rate cuts next year decreased by one compared to the previous forecast.

The dot plot also reveals that eight officials projected the rate to fall between 3.0% and 3.5% this time, an increase of two individuals compared to the last projection. Three officials predicted next year’s rate to fall between 2.5% and 3.0%, a decrease of two individuals compared to the previous forecast, and one official projected the rate to be below 2.25%, whereas no one made such a prediction in the prior forecast.

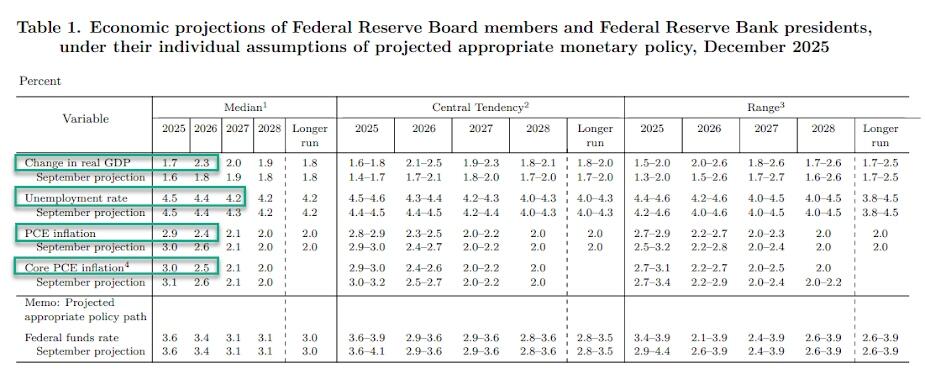

Upward revision of four-year GDP growth forecast, slight downward adjustment of inflation expectations for this and next year, and unemployment rate expectations for the year after next

The economic outlook released after the meeting showed that Federal Reserve officials raised their GDP growth forecasts for this year and the following three years. The largest upward adjustment was for next year’s growth, increasing by 0.5 percentage points, while other years saw only a modest increase of 0.1 percentage points. The unemployment rate forecast for 2027, or the year after next, was slightly lowered by 0.1 percentage points, with no changes to unemployment rate projections for other years. This adjustment indicates that the Federal Reserve believes the labor market is more resilient.

At the same time, Federal Reserve officials slightly lowered their PCE inflation and core PCE inflation forecasts for this and next year by 0.1 percentage points each. This reflects a slight increase in the Federal Reserve's confidence in inflation easing over the coming period.

As in the previous forecast, Fed officials still expect inflation to return to the Fed’s long-term target level of 2% by 2028, which would mark the first time U.S. inflation reaches the Fed’s target after seven consecutive years of exceeding it.

The specific forecasts are as follows:

The expected GDP growth rate for 2025 is 1.7%, compared to the September forecast of 1.6%. For 2026, the projected growth rate is 2.3%, up from the September forecast of 1.8%. For 2027, the expected growth rate is 2.0%, compared to the September forecast of 1.9%. For 2028, the projected growth rate is 1.9%, up from the September forecast of 1.8%. The longer-term expected growth rate remains unchanged at 1.8%, consistent with the September forecast.

The unemployment rate forecast for 2025 is 4.5%, and for 2016, it is 4.4%, both unchanged from the September forecast. For 2027, the forecast is 4.2%, down from the September forecast of 4.3%. For 2028 and the longer term, the unemployment rate forecast remains unchanged at 4.2%, consistent with the September forecast.

The PCE inflation rate forecast for 2025 is 2.9%, down from the September forecast of 3.0%. For 2026, the forecast is 2.4%, down from the September forecast of 2.6%. For 2027, the growth forecast is 2.1%. For 2028 and the longer term, the forecast remains unchanged at 2.0%, consistent with the September forecast.

The core PCE forecast for 2025 is 3.0%, down from the September forecast of 3.1%. For 2026, the forecast is 2.5%, down from the September forecast of 2.6%. For 2027, the forecast is 2.1%, and for 2028, it is projected to be 2.0%, unchanged from the September forecast.

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/Joryn