Adobe issued an optimistic annual earnings guidance, but investors reacted with indifference. They have been seeking clearer signs that the software maker can thrive in the age of artificial intelligence (AI).

According to Zhitong Finance APP, $Adobe (ADBE.US)$ released an optimistic annual earnings guidance, but investor reaction was muted. They have been looking for clearer signs that the software maker can thrive in the artificial intelligence (AI) era.

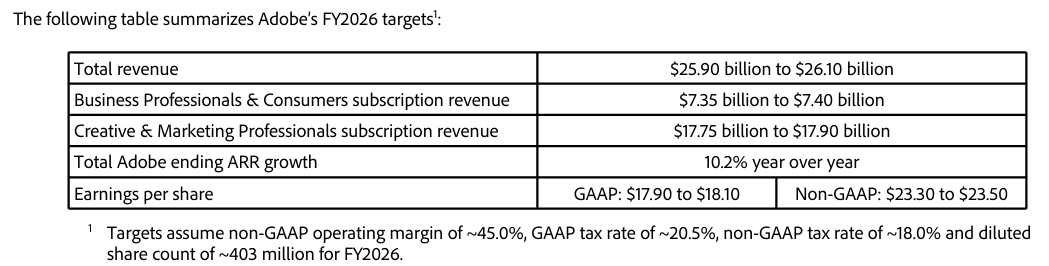

Adobe said on Wednesday that it expects revenue for the fiscal year 2026, ending November 2026, to reach between $25.9 billion and $26.1 billion. Although the median of this forecast range exceeded the average expectations of Wall Street analysts, it fell short of some analysts' projections of over $26.4 billion. The company also forecasts adjusted earnings per share for fiscal year 2026 to be between $23.30 and $23.50, with the median of this forecast range slightly above the average analyst estimate of $23.37.

Meanwhile, the earnings report released on Wednesday showed that for the fourth quarter of fiscal year 2025, which ended on November 28, Adobe's revenue increased by 10% year-over-year to a record $6.19 billion, surpassing the average analyst estimate of $6.11 billion. Non-GAAP net profit was $2.29 billion, up 8% from $2.13 billion in the same period last year. Adjusted earnings per share were $5.50, better than the average analyst estimate of $5.39.

Meanwhile, the earnings report released on Wednesday showed that for the fourth quarter of fiscal year 2025, which ended on November 28, Adobe's revenue increased by 10% year-over-year to a record $6.19 billion, surpassing the average analyst estimate of $6.11 billion. Non-GAAP net profit was $2.29 billion, up 8% from $2.13 billion in the same period last year. Adjusted earnings per share were $5.50, better than the average analyst estimate of $5.39.

The digital media division, which includes Adobe's flagship creative and document processing software, reported revenue of $4.62 billion, up 11% year-over-year; the division's annual recurring revenue (ARR) was $19.2 billion. The digital experience division generated revenue of $1.52 billion, representing a 9% increase year-over-year.

Adobe’s performance in fiscal year 2025 surpassed market expectations. Chief Executive Officer Shantanu Narayen stated that this reflects Adobe's 'increasingly important position in the global AI ecosystem and the rapid adoption of our AI-driven tools.'

However, Adobe did not update some of its AI-related metrics disclosed three months ago. In September this year, the company had stated that its AI-impacted annual recurring revenue had exceeded $5 billion, while sales of AI-priority products had surpassed $250 million.

Investors have been concerned that generative AI might pose a challenge to Adobe's business. Adobe is facing multidimensional challenges. On one hand, smaller companies like Canva and Figma are capturing more market share; on the other hand, large technology firms such as Meta are integrating more AI functionalities. More concerning is that AI-native tools like Midjourney are challenging Adobe's long-standing leadership in the creative software field. While AI features in applications like Photoshop have been used tens of billions of times, many other popular tools—such as Google's (GOOGL.US) video generation model Veo—are being developed by other companies.

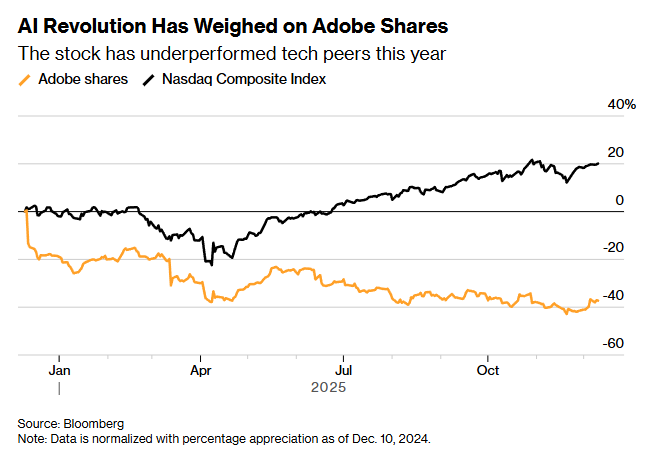

Due to investor concerns that Adobe may lag behind in the AI era, the stock has underperformed its tech peers year-to-date. Jefferies analyst Brent Thill wrote in a report prior to the earnings release: 'Concerns about AI disruption are troubling Adobe and the broader application software sector.' He noted that investors may be waiting for 'sufficiently significant and sustainable growth acceleration to dispel fears of AI disruption before re-entering the market.'

To ensure its features are accessible to a wider audience, Adobe announced on Wednesday that it would integrate Photoshop and Acrobat into OpenAI’s ChatGPT and offer some features to chatbot users free of charge.

Editor/jayden