Top News

Fed Decision: Cut Rates by 25 Basis Points, Purchase $40 Billion in Treasury Bills within 30 Days

As expected by the market, the Federal Reserve cut interest rates by 25 basis points for the third consecutive time, but faced three dissenting votes on the rate decision for the first time since 2019. Trump's appointed governor, Milan, continued to advocate for a 50-basis-point rate cut. Two regional Fed presidents and four non-voting members supported maintaining the current stance, resulting in an actual seven-member opposition—the largest division reportedly seen in 37 years.

The statement reiterated that inflation remains slightly elevated and that downside risks to employment have increased in recent months. It removed the phrase 'remains low' regarding the unemployment rate, noting a slight increase as of September. The statement introduced considerations about the 'magnitude and timing' of further rate cuts, which is seen as a signal of a higher threshold for future cuts. It also stated that reserves have fallen to adequate levels and that short-term bond purchases will commence this Friday to maintain sufficient reserves.

The New York Fed plans to purchase $40 billion in short-term bonds over the next 30 days, with expectations that Reserve Management Purchases (RMP) of short-term bonds will remain high into the first quarter of next year. The median value of rate expectations remained unchanged from the previous meeting, suggesting one rate cut each in the next two years. The dot plot’s projection for next year’s rates shifted slightly more dovish compared to the last release, with the number of officials expecting no cuts decreasing by one to seven.

The New York Fed plans to purchase $40 billion in short-term bonds over the next 30 days, with expectations that Reserve Management Purchases (RMP) of short-term bonds will remain high into the first quarter of next year. The median value of rate expectations remained unchanged from the previous meeting, suggesting one rate cut each in the next two years. The dot plot’s projection for next year’s rates shifted slightly more dovish compared to the last release, with the number of officials expecting no cuts decreasing by one to seven.

Economic forecasts were revised upward for GDP growth expectations this year and over the next three years, while inflation projections for this year and next were slightly lowered, along with a minor downward adjustment to the unemployment rate forecast for the following year.

Powell: A rate hike is currently not the base case for anyone.

Federal Reserve Chair Powell stated at a press conference that, given the new forecasts from central bank policymakers do not reflect the baseline scenario, the Fed's next move is unlikely to be a rate hike. He remarked, "I don't think a rate hike is the base case for anyone." Meanwhile, Powell hinted that interest rates may remain unchanged in the short term.

The probability of the Federal Reserve maintaining rates unchanged in January next year is 77.9%.

According to CME’s 'FedWatch': The probability of the Federal Reserve cutting rates by 25 basis points in January next year is 22.1%, while the probability of maintaining the current rate is 77.9%. By March next year, the cumulative probability of a 25-basis-point rate cut is 40.7%, maintaining the current rate is 52%, and a cumulative 50-basis-point rate cut is 7.4%.

Trump criticizes the Federal Reserve for insufficient rate cuts.

The Federal Reserve cut interest rates by 25 basis points as expected, but for U.S. President Trump, it was not enough. On Wednesday afternoon, during an event at the White House, Trump stated that a 25-basis-point rate cut was "a fairly small number, which could have been doubled — at least doubled." He also reiterated his long-standing criticism of Federal Reserve Chair Jerome Powell.

Hassett: Trump to Finalize Fed Chair Nominee Within the Next One to Two Weeks

Kevin Hassett, Director of the White House National Economic Council, stated on Wednesday local time that U.S. President Trump will finalize the selection of the next Federal Reserve Chair within the next one to two weeks. Hassett, a leading candidate for the next Fed Chair, noted during an interview with Fox News’ America Reports program that 'a 50-basis-point rate cut, or even more, could certainly be justified based on stronger economic data.'

Goldman Sachs: Hawkish Faction at the Fed Pacified; Future Easing Depends on Labor Market

Goldman Sachs analyst Kay Haigh stated that the Federal Reserve has reached the end of its 'preventive rate cuts.' She believes that 'further weakening in labor market data would be necessary to justify additional near-term easing.'

The 'hard dissent' among voting members and the 'soft dissent' reflected in the 'dot plot' highlight the hawkish faction of the Federal Reserve. The reintroduction of the phrase 'extent and timing' regarding future policy decisions in the statement is likely aimed at appeasing them. While this leaves room for potential future rate cuts, any weakening in the labor market must meet a high threshold.

Amid a historic surge in silver prices, the Silver Institute released a 'significant report.'

Silver prices have now breached the $62/ounce mark, reaching a new all-time high. A recent report published by the World Silver Institute shows that global industrial demand for silver is expected to continue rising over the next five years, driven by accelerating demand in key technological sectors such as solar energy, electric vehicles, and data centers.

Global solar installations are projected to grow at an annual rate of 17% before 2030, with silver being the preferred material for conductive silver paste in solar cells; demand for silver in the automotive industry is expected to increase by 3.4% annually between 2025 and 2031, reaching approximately 94 million ounces by 2031; global data center capacity has surged from 0.93 gigawatts in 2000 to nearly 50 gigawatts by 2025, a 53-fold increase, with core components such as servers, switches, and cooling systems all requiring silver.

KPMG forecasts that Hong Kong’s IPO fundraising will reach HKD 272.1 billion in 2025, ranking first globally, marking a 210% year-on-year increase.

A KPMG report predicts that Hong Kong’s initial public offering (IPO) fundraising will reach HKD 272.1 billion in 2025, up 210% year-on-year, placing it at the top globally. The report highlights that Hong Kong has completed 17 'A+H' listings so far this year, the highest on record, accounting for half of the total annual fundraising and further demonstrating Hong Kong’s unique advantage as a bridge connecting mainland China’s and international capital markets.

Meanwhile, Hong Kong has completed 14 listings of unprofitable biotech companies, a significant increase from four last year; there were also three special-purpose technology company listings, unchanged from last year.

ECB Governing Council Member Predicts: The World May Transition from 'Dollar Dominance' to 'Multipolar Currency' Era

Fabio Panetta, Governor of the Bank of Italy and member of the European Central Bank's Governing Council, said in a speech in Dublin on Tuesday (December 9) that although the U.S. dollar will remain the key currency, the world 'may gradually move towards a more multipolar system.'

“This shift could bring more diversification, but if coordination fails, it may also increase volatility and contagion risks.” Panetta stated that good governance is crucial to managing such risks.

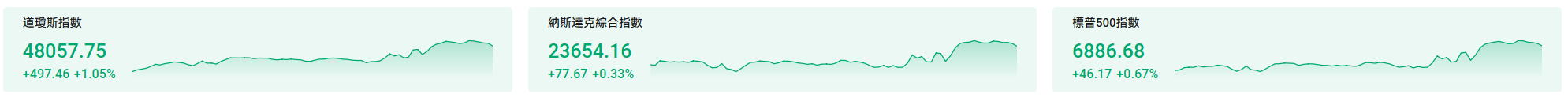

U.S. Stock Market Recap

The Fed cut rates as expected, with the three major indices rising in unison, and the S&P 500 index nearing a new historical high.

The Fed’s FOMC statement and Powell’s press conference announced a 25-basis-point rate cut as expected, marking the third consecutive meeting with a rate cut, in line with market expectations, bringing the cumulative rate cuts for the year to 75 basis points. All three major indices rose broadly, and as of the close,$Dow Jones Index (.DJI.US)$Increased by 1.05%,$Nasdaq Composite Index (.IXIC.US)$rose 0.33%,$S&P 500 Index (.SPX.US)$Rose by 0.67%, approaching an all-time high.

$Russell 2000 Index (.RUT.US)$Set a new all-time high.

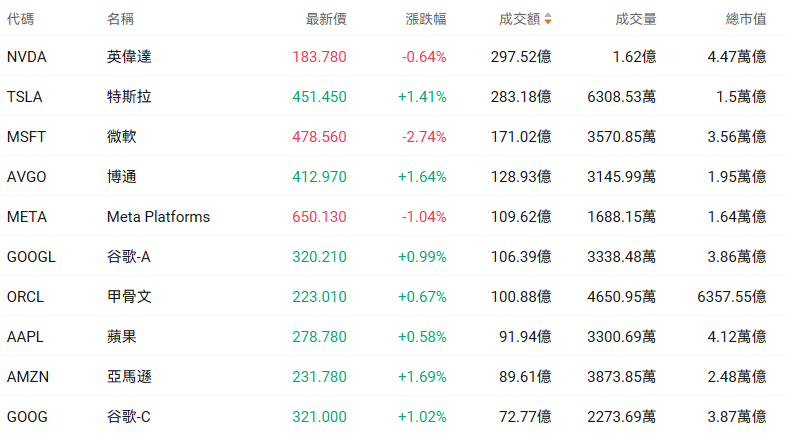

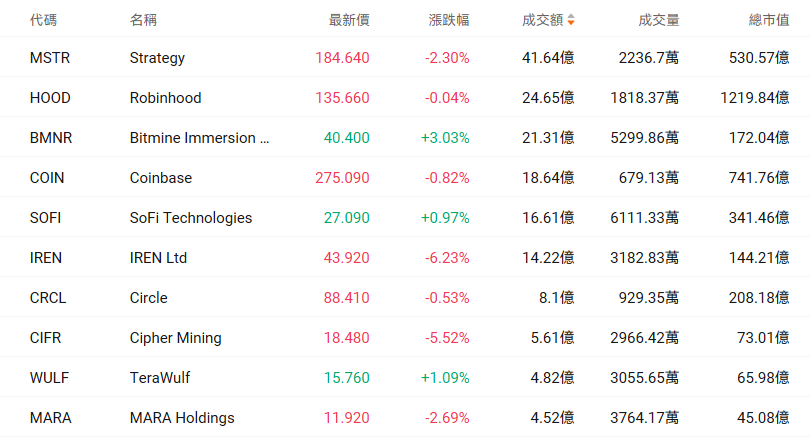

$明星科技股(LIST2518.US)$The majority rose, with Broadcom and Amazon up nearly 2%, Tesla and Google up over 1%, while Meta fell more than 1% and Microsoft dropped nearly 3%.

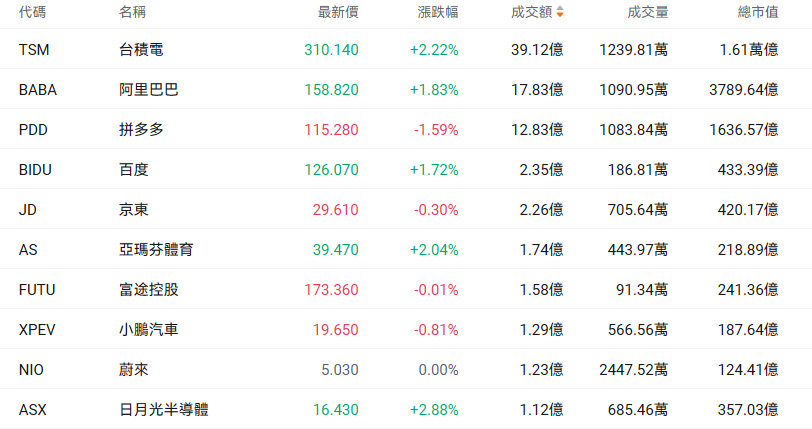

$热门中概股(LIST2517.US)$Mixed performance; the Nasdaq China Golden Dragon Index closed up 0.64%, Taiwan Semiconductor gained over 2%, Alibaba and Baidu rose nearly 2%, PDD Holdings fell over 1%, and XPeng Motors declined nearly 1%.

$存储概念股(LIST23925.US)$Leading gains, Western Digital surged over 7%, Sandisk rose over 6%, Pure Storage increased nearly 5%, and Micron Technology climbed over 4% to reach a new high.

$太空概念(LIST2556.US)$Broad-based gains, with EchoStar Communications rising over 11%, ASTS surging over 8%, and Rocket Lab gaining nearly 8%.

$储能概念股(LIST23939.US)$Mixed results, GE Vernova surged nearly 16% to hit a new high, GNRC gained over 4%, while CLSK dropped over 2%.

$US Infrastructure Stock (LIST2452.US)$Upward movement, JBHT gained over 4%, Caterpillar rose nearly 4%, CSX and Norfolk Southern both climbed nearly 2%.

$加密货币(LIST20781.US)$Most stocks declined, with BMNR rising over 2%, WULF up more than 1%, IREN falling over 6%, and Strategy and MARA down over 2%.

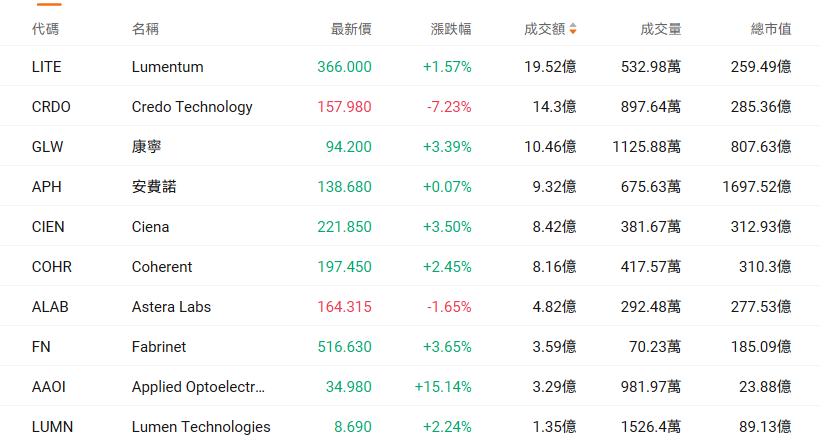

$光通信(LIST23979.US)$The majority of stocks rose, with AAOI surging over 15%, and Corning, CIEN, and FN climbing more than 3%.

Individual stock news

Oracle plummeted over 11% after-hours as its cloud business sales fell short of expectations.

$Oracle (ORCL.US)$The company reported disappointing cloud revenue, indicating that its recent large-scale artificial intelligence orders may take longer to materialize. Cloud sales grew by 34% to $7.98 billion, while the highly watched infrastructure business revenue increased by 68% to $4.08 billion. However, both figures were slightly below analysts' expectations.

In a statement on Wednesday, the company said that its remaining performance obligations (a measure of orders) jumped to $523 billion in the second fiscal quarter, compared to an average analyst estimate of $519 billion.

Gemini surged over 15% after-hours following the approval of its derivatives exchange application by the CFTC, potentially positioning itself in predictive markets.

$Gemini Space Station(GEMI.US)$Gemini's derivatives exchange application has been approved by the U.S. Commodity Futures Trading Commission (CFTC).

Gemini has not publicly disclosed which products it plans to trade on the exchange, but regulatory filings mention predictive markets covering various forecasts. This approval allows Gemini to potentially enter the predictive market space and increase the number of native cryptocurrency companies in the industry.

$Synopsys (SNPS.US)$Shares rose nearly 3% after-hours; Q4 FY25 revenue reached $2.255 billion, surpassing the midpoint of guidance, with an adjusted net profit of $543 million.

Amazon plans to expand its fresh food delivery business by 2026. Maplebear and Uber Technologies fell nearly 6% overnight, while DoorDash dropped over 4%.

On Wednesday, due to$Amazon(AMZN.US)$Amazon is actively promoting the success of its fresh grocery delivery services and its expansion into other cities across the United States.$Maplebear(CART.US)$、$DoorDash(DASH.US)$and $Uber Technologies(UBER.US)$The stock price came under pressure.

Amazon currently offers same-day delivery of fresh groceries in over 2,300 towns and plans to further expand its service coverage by 2026. Since August,$Amazon(AMZN.US)$the company has increased the variety of fresh products available for same-day delivery by more than 30%, including thousands of fresh items from Whole Foods Market.

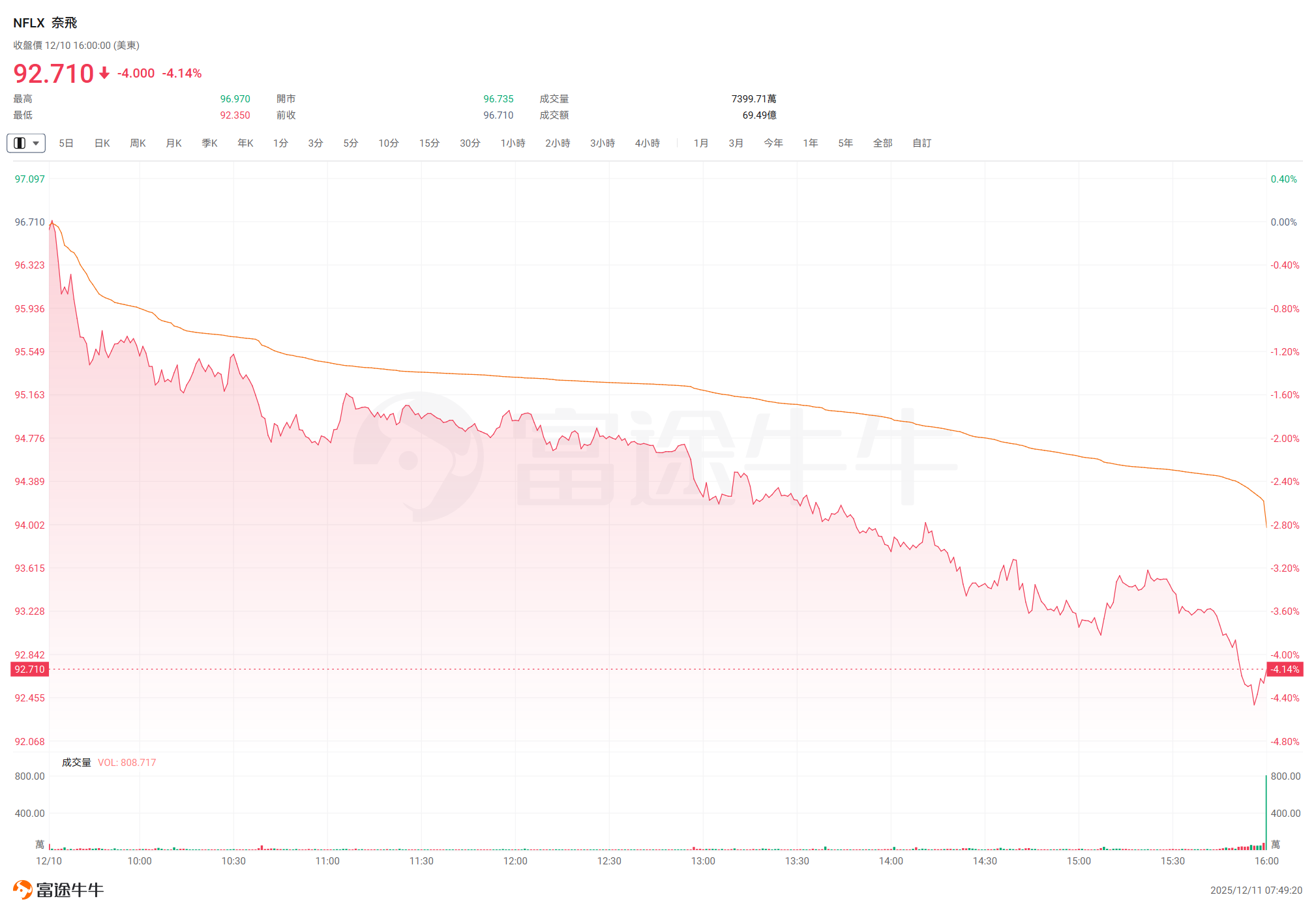

New twists emerge in Warner's acquisition case; Trump says CNN must be sold, Netflix falls over 4% overnight.

Warner Bros Discovery (WBD.US), which owns CNN,$Warner Bros Discovery(WBD.US)$is currently facing a competitive bid from$Netflix (NFLX.US)$and$Paramount Skydance(PSKY.US)$.

When asked about the matter, U.S. President Trump stated, "I think CNN must be sold because you certainly wouldn't want... those people to get a large sum of money, and then CNN spends even more to spread poison. The people currently in charge of CNN are either corrupt or incompetent."

According to a previous report by The Wall Street Journal, Paramount CEO David Ellison assured Trump administration officials during his visit to Washington in December that he would implement significant reforms at CNN if he acquired Warner. However, Netflix does not intend to acquire Warner's television division, where CNN is located, which would pose numerous challenges for the company if it seeks to address the President's concerns.

Roche surged nearly 4% overnight after its breast cancer drug giredestrant reduced recurrence risk by 30% in a study.

$ROCHE HOLDING AG (RHHBY.US)$On Wednesday, Roche stated that its oral investigational drug giredestrant reduced the risk of breast cancer recurrence by 30% compared to standard endocrine therapy in a Phase III trial, marking the first major advancement in the field in over 20 years.

Three-year trial data showed that the disease-free survival rate in the giredestrant group was 92.4%, higher than 89.6% in the control group. Roche’s Chief Medical Officer noted this implies that 30% of recurrences that would have occurred were avoided. The results are expected to address long-standing recurrence challenges in ER-positive breast cancer, which accounts for approximately 70% of all cases.

GE Vernova, the gas turbine giant, soared nearly 16% overnight to hit a record high and raised its earnings guidance for the coming years.

Benefiting from the explosive expansion of AI data centers, American Electric Power, a leading player in the U.S. power equipment sector,$GE Vernova (GEV.US)$Shares hit a record high on Wednesday following announcements to raise earnings guidance for the coming years, double dividends, and increase stock repurchase authorization.

GE Vernova CEO Scott Strazik disclosed at an investor day event that with large data center construction driving up electricity demand, the company expects to sign 80 gigawatts of combined-cycle gas turbine contracts by year-end. Strazik further noted that the company has sold out all production capacity through 2028, with only 10% remaining for 2029.

Marvell Technology rose more than 4% overnight as JPMorgan reiterated its “Overweight” rating on Marvell: Microsoft and Amazon orders are secured through 2026, and market skepticism is purely 'noise.'

During a closed-door communication event hosted by the company’s management team,$Marvell Technology (MRVL.US)$a 'reassurance' was provided to the market: AWS Trainium 3 XPU ASIC chips have successfully secured full-year orders for 2026; Microsoft’s 3nm Maia AI XPU ASIC chips are proceeding as planned, with mass production expected to begin in the second half of 2026 and ramp up through 2027.

Moreover, for the next-generation solutions using 2nm technology, both parties have already initiated design work in advance. This indicates that the deep partnership between the two major cloud computing giants and Marvell on "multi-generational AI custom chips" has not only remained intact but has advanced into the research and development phase for next-generation products ahead of schedule.

Meta is fully transitioning to closed-source models, with the new model Avocado potentially launching in spring next year, while Alibaba rose nearly 2% overnight.

Several months after investing tens of billions of dollars to build the most expensive team in tech history,$Meta Platforms(META.US)$CEO Zuckerberg is deeply involved in daily R&D and pushing the company’s strategy toward directly monetizable artificial intelligence models. According to insiders, a new model codenamed 'Avocado' is expected to be released in spring 2026 and may be launched as a closed-source model (strictly controlled by Meta with access rights sold externally). Additionally, insiders revealed that META utilized$Alibaba(BABA.US)$Qwen (QWEN) to optimize its new AI model.

Adobe announces the launch of Photoshop, Express, and Acrobat for ChatGPT.

On Wednesday local time,$Adobe(ADBE.US)$the company announced on its official website the launch of Photoshop, Express, and Acrobat for ChatGPT. Photoshop is the well-known image editing tool, commonly abbreviated as 'PS'.

The press release stated that ChatGPT users will be able to access these software tools directly within the chatbot: using PS to enhance photos via text descriptions, designing letters with Express, and editing PDFs using Acrobat. These tools can be used for free within ChatGPT, without requiring users to leave the chatbot interface (albeit with some limitations).

For Adobe, this collaboration represents an opportunity to showcase its products to over 800 million weekly active users of ChatGPT.

If SpaceX goes public next year with a valuation of $1.5 trillion, Elon Musk could become the world's first 'trillionaire.'

According to the Bloomberg Billionaires Index, if Elon Musk's space company SpaceX successfully goes public next year with a valuation reaching $1.5 trillion, his personal net worth will surge from the current $460.6 billion to approximately $952 billion, bringing him just one step away from becoming the world's first 'trillionaire.'

Currently, Musk holds approximately 42% of SpaceX's shares. Based on a pre-IPO valuation of $1.5 trillion, the value of his stake in the company alone would rise to over $625 billion, far exceeding the current value of approximately $136 billion. This does not include his multi-billion-dollar stakes in several other companies, including the world’s most valuable automaker.$Tesla (TSLA.US)$。

Top 20 by Trading Value

Market Outlook

Northbound funds bought over HKD 600 million worth of Xiaomi Group shares and nearly HKD 400 million worth of Agricultural Bank of China shares; Tencent was sold for over HKD 600 million.

On December 10 (Wednesday), southbound funds net sold HKD 1.018 billion worth of Hong Kong stocks.

$Xiaomi Group-W(01810.HK)$、Agricultural Bank of China (01288.HK)、$Alibaba-W (09988.HK)$They were net purchased for HKD 620 million, HKD 395 million, and HKD 343 million, respectively.

Tracker Fund of Hong Kong (02800.HK)、$Tencent (00700.HK)$、$SMIC (00981.HK)$They were net sold for HKD 1.559 billion, HKD 606 million, and HKD 451 million, respectively.

The Hong Kong Monetary Authority cut interest rates by 25 basis points.

The Hong Kong Monetary Authority (HKMA) lowered the base rate by 25 basis points to 4.0%, following a 25-basis-point rate cut by the Federal Reserve overnight.

Today marks the listing of JD Industrial.

Today$JD.com Industrial (07618.HK)$Listing,$HASHKEY HLDGS(03887.HK)$、$Guoxia Technology (02655.HK)$Subscription.

Alibaba's Qwen3-TTS, the speech synthesis model, has been comprehensively upgraded.

$Alibaba-W (09988.HK)$Qwen3-TTS, part of the Qwen series, has been comprehensively upgraded. Qwen3-TTS is a flagship speech synthesis model that supports multiple voices, languages, and dialects, currently accessible via the Qwen API. Key improvements include: richer voice options, enhanced multilingual and multi-dialect capabilities, as well as more natural prosody and speech rhythm, making it sound increasingly human-like.

CSPC Pharma: The Group's developed recombinant fully human anti-Act RIIA/IIB monoclonal antibody (JMT206) has been approved by the U.S. FDA for clinical trials in the United States.

$CSPC Pharma (01093.HK)$The announcement stated that the Group’s developed recombinant fully human anti-Act RIIA/IIB monoclonal antibody (JMT206) has received approval from the U.S. Food and Drug Administration (FDA) to conduct clinical trials in the United States. The product also received approval from the National Medical Products Administration of the People’s Republic of China in November 2025 to carry out clinical trials in China.

Today's Focus

Keywords: Federal Reserve interest rate decision, Powell's speech, Broadcom earnings, unemployment claims data

In terms of economic data, attention can be paid to the number of initial jobless claims for the week ending December 6 in the United States, as well as trade balance data for September.

03:00 Federal Reserve interest rate decision (upper limit) as of December 10, United States

03:30 Federal Reserve Chair Jerome Powell holds a press conference on monetary policy

17:00 IEA releases its monthly oil market report;

To be determined, OPEC releases its monthly oil market report (generally published between 18:00-21:00 Beijing time);

At 21:30, the U.S. initial jobless claims for the week ending December 6 and the U.S. trade balance for September will be released;

At 23:00, the U.S. wholesale sales month-over-month rate for September will be announced.

In terms of financial reports, optoelectronic communication concept stocks$Ciena(CIEN.US)$will release earnings before the U.S. stock market opens, while after the U.S. stock market closes,$Broadcom (AVGO.US)$、$Costco (COST.US)$、$Lululemon Athletica(LULU.US)$companies such as will release their financial reports. Regarding new stock offerings, $JD.com Industrial (07618.HK)$Today is上市.

![]()

Morning Reading by Niuniu:

Investors must adopt the mindset of a tortoise, observing slowly and trading cautiously.

— Isao Kawasemi

![]() AI Portfolio Strategist goes live!One-click insight into holdings, fully grasp opportunities and risks.

AI Portfolio Strategist goes live!One-click insight into holdings, fully grasp opportunities and risks.

Editor/melody