Despite Oracle holding over $500 billion in backlog orders, Wall Street was spooked by a $15 billion additional spending plan. The company introduced an 'unprecedented' new model: instead of cloud vendors fully purchasing hardware, clients (such as OpenAI) bring their own chips to the table. Executives are eager to prove, 'We don't need to take on as much debt as you might think.'

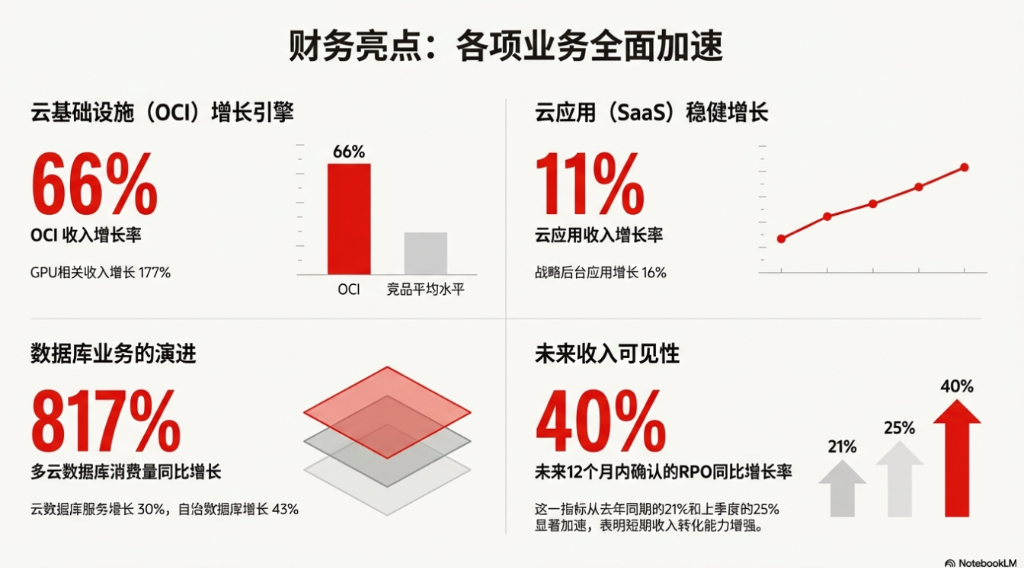

Amid widespread discussions about an AI bubble,$Oracle (ORCL.US)$Oracle released its latest earnings report overnight, showcasing a strong performance with revenue growing 13% year-on-year and cloud infrastructure (OCI) surging 66%.

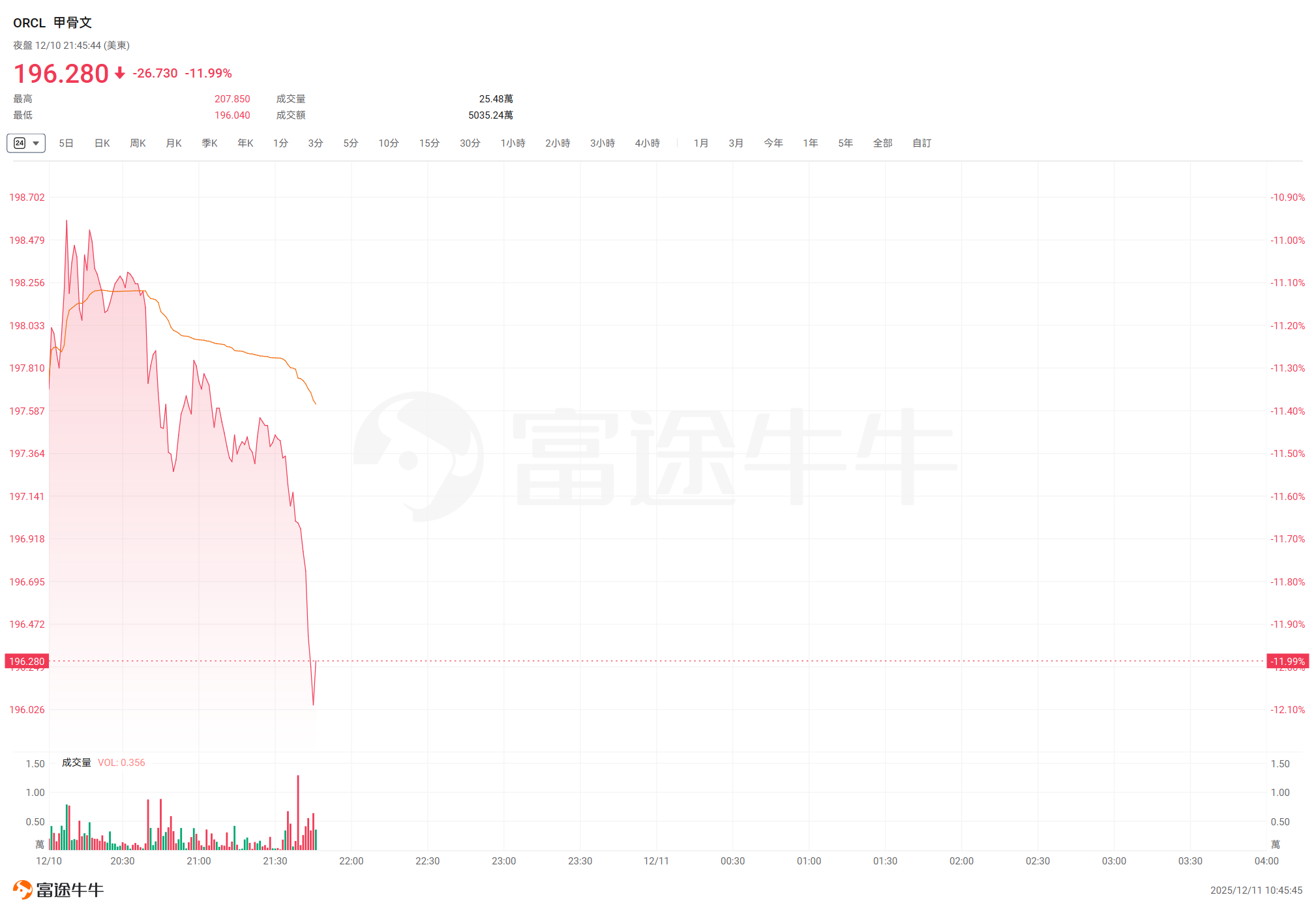

However, market attention was entirely focused on the company's aggressive capital expenditure plan. Although Oracle has an impressive backlog of contract orders totaling $523.3 billion (RPO), the announcement of an additional $15 billion in capital expenditures frightened investors, leading to a post-market share price plunge of more than 10% due to this 'cash-burning' pace.

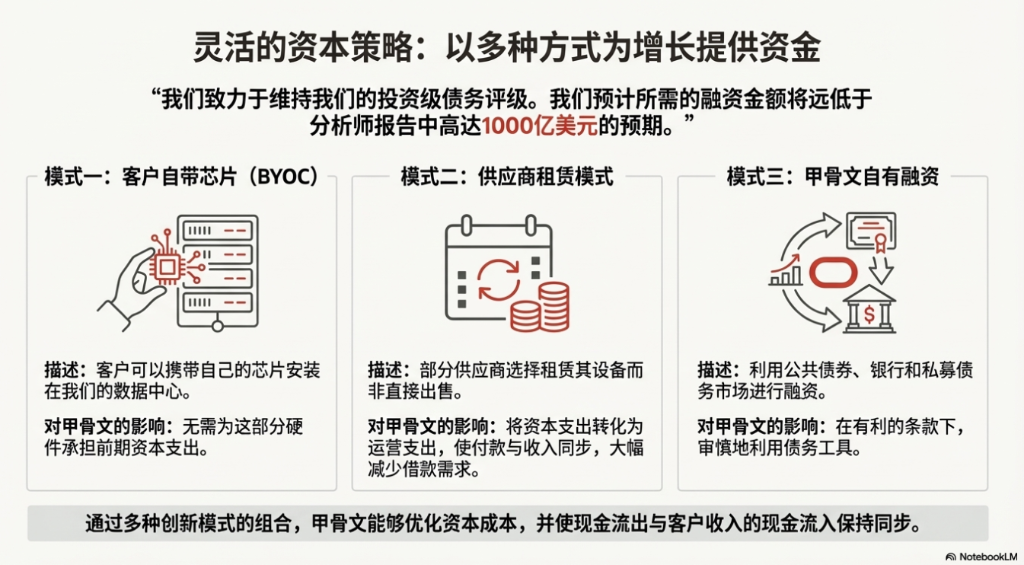

In response to market skepticism about a 'debt black hole,' management launched an intense defense during the earnings call, attempting to demonstrate that this is not reckless expansion but rather a real demand driven by major clients.

In response to market skepticism about a 'debt black hole,' management launched an intense defense during the earnings call, attempting to demonstrate that this is not reckless expansion but rather a real demand driven by major clients.

During the call, the executive team, including co-founder Larry Ellison, spent significant time explaining why this investment is safe and how Oracle plans to use 'financial engineering' to avoid falling into a debt crisis.

Notably,$Oracle (ORCL.US)$Management also introduced an unprecedented defensive narrative in the cloud industry: instead of cloud providers fully purchasing hardware, clients (such as OpenAI) bring their own chips. This move aims not only to rescue cash flow but also reveals an industry insight—relying solely on renting expensive NVIDIA GPUs makes it difficult even for Oracle to generate substantial profits.

Key takeaways from the call:

The surge in capital expenditure (CapEx) triggered panic: the company announced that its FY2026 capital expenditure forecast would be $15 billion higher than previously projected after Q1 (reaching $50 billion), causing post-market share prices to plummet by more than 10%.

Management strongly defended against debt concerns, introducing a 'client-bring-your-own-chips' model: addressing Wall Street’s fears about 'borrowing billions' for infrastructure, Oracle executives emphasized that through the 'client-bring-your-own-chips' and leasing models, actual borrowing needs are 'far lower than most people’s model predictions,' committing to maintaining an investment-grade rating. Media commentary noted that 'client-bring-your-own-chips' is unprecedented in the cloud industry, fundamentally altering the traditional 'buyout-and-rent' business logic of cloud providers.

Risk Management: Regarding client concentration risk, CEO Clay Magouyrk emphasized that its AI infrastructure is highly 'fungible,' allowing computational capacity to be transferred from one client to another 'within hours,' demonstrating strong operational flexibility.

Backlog (RPO) Surges Explosively: RPO reached an astonishing $523.3 billion, a year-over-year increase of 433%, primarily driven by compute contracts with giants such as Meta and NVIDIA.

Larry Ellison's Vision for the AI Endgame: Ellison believes the future of AI lies in 'multi-step reasoning on private data' and claims that Oracle’s AI data platform enables large models to connect to all databases (including non-Oracle data), which is key to breaking down data silos.

Infrastructure (OCI) Growth Outpaces Competitors: IaaS revenue grew by 66%, GPU-related revenue surged by 177%, and 96,000 NVIDIA GB200 chips were delivered.

‘Not only build data centers but also let customers bring their own chips’: Countering rumors of $100 billion debt.

$Oracle (ORCL.US)$Following the earnings release, the market's biggest concern was whether Oracle has sufficient capital to support this hyper-scale AI infrastructure. Some analysts had predicted that Oracle would need to raise $100 billion in debt to complete the construction.

In response, Oracle Cloud Business CEO Clay Magouyrk directly refuted this forecast when answering a pointed question from a Deutsche Bank analyst about financing needs. He revealed Oracle’s currently adopted atypical financing model:

“We have read many analyst reports predicting we will need to raise as much as $100 billion… Based on what we are seeing now, the amount of financing we require will be less than, or even significantly less than, that figure.”

Clay further explained the intricacies: $Oracle (ORCL.US)$The company is adopting a 'Bring Your Own Chips' model.

This is an almost unprecedented move within the cloud services industry. Traditional$Amazon(AMZN.US)$cloud orGoogle (GOOGL.US)cloud models involve cloud providers purchasing servers at their own expense and renting them out to clients. However, according to an analysis by The Information, as the profit margins from simply leasing expensive NVIDIA chips have become increasingly thin, Oracle is attempting to transfer this substantial capital expenditure risk.

Under this model,$Meta Platforms(META.US)$clients such as OpenAI purchase expensive GPUs themselves and install them in Oracle’s data centers.

“In these models, it is clear that Oracle does not need to incur any upfront capital expenditures.” Clay added. Moreover, some suppliers are willing to provide equipment through leasing rather than outright sales, allowing Oracle to 'synchronize payments with receipts,' significantly alleviating cash flow pressures.

The Secret Behind OpenAI and the Texas Supercluster?

This new model perfectly corroborates earlier market rumors. Previous reports indicated that OpenAI was negotiating to lease NVIDIA chips in Texas instead of purchasing them directly. During its earnings call, Oracle coincidentally mentioned that its supercluster in Abilene, Texas, was proceeding smoothly.

Market speculation suggests that OpenAI may be$Oracle (ORCL.US)$one of the first key adopters of this “customer-brings/leases-chips” model. If this model proves successful, Oracle will transition from a heavy-asset “landlord + furniture provider” to a relatively asset-light “sub-landlord,” significantly improving its long-term Return on Invested Capital (ROIC).

Through this 'financial engineering,' Oracle aims to capture the dividends of this AI wave without disrupting its balance sheet.

The $15 billion 'overspend': Because 'orders are coming in too fast'

Regarding the sudden increase of $15 billion in capital expenditure expectations, CFO Doug Kehring explained it as a 'sweet problem.'

He pointed out that RPO (Remaining Performance Obligation) increased by $68 billion in Q2, with the vast majority being urgent demands that need to be converted into revenue in the short term.

'Only when all components are in place, and we are confident of delivering on time with reasonable profitability, will we accept customer contracts.' Clay Magouyrk emphasized that this money is not for stockpiling GPUs but because customers have signed contracts and paid deposits, urgently awaiting the deployment of computing power.

Over-reliance on OpenAI? Oracle: Infrastructure can be 'switched within hours'

In addition to funding issues, investors are equally concerned about$Oracle (ORCL.US)$the risk of over-reliance on a few major clients. If one of these large clients fails to pay or changes plans, what will happen to the data centers customized for them?

CEO Clay Magouyrk provided a surprising answer: Oracle's AI infrastructure is highly flexible and 'fungible.' He stated that the cloud services provided to AI clients are 'entirely the same' as those offered to all other clients, thanks to the company's early strategic choices in technologies such as bare-metal virtualization and hardware security erasure.

'How long does it take to transfer capacity from one client to another? The answer is 'in hours,'” Magouyrk said. He further explained that when the company has idle capacity, given its large customer base of over 700 AI clients and robust demand, 'it will be quickly allocated and deployed.'

This rapid conversion capability implies that Oracle's infrastructure investments are not deeply tied to a single client, thereby significantly reducing the potential risks associated with client concentration.

Larry Ellison's Ambition: AI Is Not Just About Chatting, It’s About 'Private Data Reasoning'

When analysts questioned$Oracle (ORCL.US)$the moat in the AI ecosystem, Larry Ellison, the company's founder and CTO, took the microphone. Instead of discussing computing power, he focused on data. He argued that the next phase of AI competition would shift from 'public data training' to 'private data reasoning.'

"Training AI models on public data is the largest and fastest-growing business in history. However, reasoning on private data will be an even bigger and more valuable business," said Ellison.

He painted a scenario where companies no longer need to move their data around. Oracle's AI data platform allows models like OpenAI and Google Gemini to directly 'connect' to a company’s private databases, ERP systems, and even competitors’ data storage.

"Through the lens of AI, you will soon be able to see everything happening in your business in real time." Ellison concluded his vision with this statement, hinting that Oracle's core value lies in its control over the critical data (ERP/databases) of global enterprises—a stronghold that AWS and Azure find difficult to reach.

OCI Growth Rate at 66%: It’s Not Just About AI

While the market is concerned about an AI bubble, according to$Oracle (ORCL.US)$Oracle, growth has been all-encompassing. OCI (Oracle Cloud Infrastructure) revenue for this quarter reached $4.1 billion, growing by 66% year-over-year, a rate far exceeding$Amazon(AMZN.US)$AWS and$Microsoft(MSFT.US)$Azure.

"Our cloud infrastructure business continues to grow much faster than our competitors." Kehring pointed out that not only has the GPU business grown by 177%, but database services and multi-cloud consumption are also surging.

In response to the sharp decline in stock prices, the core message conveyed by management is clear: market panic stems from a misunderstanding of traditional infrastructure models, while Oracle is leveraging its unique data position and flexible financing methods to make a highly leveraged but 'guaranteed' bet amid the AI wave.

$Oracle (ORCL.US)$Full transcript of the Q2 2026 earnings call, translated as follows (assisted by AI tools):

Meeting Name: Oracle Fiscal Year 2026 Second Quarter Earnings Call

Meeting Time: December 10, 2025Presentation Session

Operator:

Hello everyone, thank you for your patience. My name is Tiffany, and I will be your operator today. Welcome to Oracle Corporation's fiscal year 2026 second-quarter earnings conference call. All lines have been muted to prevent background noise. After the speakers' remarks, there will be a question-and-answer session. (Operator instructions) Now, I will turn the call over to Ken Bond, Head of Investor Relations. Sir, please begin.Ken Bond (Head of Investor Relations):

Thank you, Tiffany. Good afternoon, everyone. Welcome to the Oracle Q2 Fiscal Year 2026 Earnings Call. Today, we have with us Chairman and Chief Technology Officer Larry Ellison; Chief Executive Officer Mike Sicilia; Chief Executive Officer Clay Magouyrk; and Chief Financial Officer Doug Kehring.

Copies of the press release and financial statements, including GAAP and non-GAAP reconciliation tables, other supplemental financial information, and a list of customers who have recently purchased Oracle Cloud services or gone live on Oracle Cloud, are available on our investor relations website. As a reminder, today's discussion will include forward-looking statements, and we will discuss some important factors related to the business. These forward-looking statements are also subject to risks and uncertainties that could cause actual results to differ materially from those expressed in today's statements. Therefore, we caution you not to place undue reliance on these forward-looking statements and encourage you to review our latest reports, including the 10-K and 10-Q forms and any applicable amendments. Finally, we want to clarify that we have no obligation to update our results or these financial forward-looking statements even if circumstances change.

Before we take questions, we will first make some prepared remarks. Now I will hand the meeting over to Mike—sorry, I mean Doug.Doug Kehring (Chief Financial Officer):

No, actually it's Kehring, not Mike. Thank you, Ken. I'm Doug. Regarding the data we are about to present, the following points apply to the second quarter results and the guidance for the third quarter. First, we will discuss the financial situation using fixed exchange rate growth rates, as this is how we manage the business. Second, unless otherwise stated, we will present the data on a non-GAAP basis. Finally, regarding the exchange rate, it had a positive impact of 1% on second quarter revenue and a positive impact of $0.03 on earnings per share.For the third quarter, assuming exchange rates remain at current levels, the exchange rate is expected to have a positive impact of 2% to 3% on revenue, and based on rounding, a positive impact of $0.06 on earnings per share. Regarding the performance in the second quarter, we have completed another quarter with excellent execution. The remaining performance obligations (RPO) reached $523.3 billion at the end of this quarter, an increase of 433% compared to last year, and an increase of $68 billion since the end of August, mainly due to contracts signed with companies such as Meta and NVIDIA. We are continuing to diversify our customer backlog.

RPO is expected to grow by 40% year-on-year over the next 12 months, compared to 25% in the previous quarter and 21% in the same period last year. Total cloud revenue, including applications and infrastructure, grew by 33% to reach $8 billion, significantly accelerating from the 24% reported last year. Cloud revenue now accounts for half of Oracle's total revenue. Cloud Infrastructure (OCI) revenue was $4.1 billion, up 66%, with GPU-related revenue skyrocketing by 177%. Oracle's cloud infrastructure business continues to grow at a pace far exceeding that of its competitors. Cloud database service revenue grew by 30%, with autonomous database revenue increasing by 43%, and multi-cloud consumption surging by 817%. Cloud application revenue was $3.9 billion, an 11% increase. Our strategic backend application revenue was $2.4 billion, growing by 16%.

As we complete the integration of industry cloud applications and Fusion cloud applications under a single sales organization across various regions globally, we are seeing an increasing number of cross-selling synergies, which is expected to drive higher growth rates for cloud applications in the future. In total, the total revenue for this quarter was $16.1 billion, an increase of 13%, surpassing the 9% growth reported in the second quarter of last year, continuing the trend of accelerating total revenue growth. Operating income grew by 8% to $6.7 billion. Non-GAAP earnings per share were $2.26, an increase of 51%, while GAAP earnings per share were $2.10, an increase of 86%. In this quarter, we recognized a pre-tax gain of $2.7 billion from the sale of our Ampere stake.

Turning to cash flow. The operating cash flow for the second quarter was $2.1 billion, while the free cash flow was negative $10 billion, and capital expenditures (CapEx) were $12 billion, reflecting investments made to support our accelerated growth. It should be noted that we want to clarify here that the vast majority of our capital expenditure investments are used for revenue-generating equipment entering data centers, rather than for land, buildings, or power facilities covered by leases. Oracle will not pay these lease costs until the constructed data centers and supporting facilities are delivered to us. Instead, equipment capital expenditures are purchased very late in the data center production cycle, allowing us to quickly convert cash expenditures into earned revenue when providing cloud services to contracted and committed customers.

Regarding the issue of funding our growth, we have a variety of funding sources within our debt structure in public bonds, bank, and private debt markets. Additionally, there are other financing options, such as customers potentially bringing their own chips installed in our data centers, and suppliers possibly leasing their chips to us rather than selling them outright. Both options allow Oracle to synchronize payments with receipts, significantly reducing our borrowing levels below what most models predict. As a fundamental principle, we expect and are committed to maintaining our investment-grade credit rating.

Turning to guidance. Let's first discuss the impact of the increased RPO booked in the second quarter on our future performance. The vast majority of these bookings involve opportunities where we have near-term available capacity, meaning we can convert the increased backlog into revenue more quickly. As a result, we now anticipate an additional $4 billion in revenue for fiscal year 2027. Our revenue expectation for the full fiscal year 2026 remains unchanged at $67 billion. However, given the added RPO this quarter that can be rapidly monetized starting next year, we now expect fiscal year 2026 capital expenditures (CapEx) to be approximately $15 billion higher than our forecast after the first quarter.

Finally, we are confident that our customer backlog is at healthy levels and that we possess the operational and financial strength to execute successfully. While we continue to experience tremendous and unprecedented demand for cloud services, we will only pursue further business expansion if it meets our profitability requirements and favorable capital terms. Specifically, for third-quarter guidance, total cloud revenue is expected to grow between 37% and 41% on a constant currency basis, and between 40% and 44% in dollar terms. Total revenue is projected to increase between 16% and 18% on a constant currency basis, and between 19% and 21% in dollar terms. Non-GAAP earnings per share are expected to grow between 12% and 14%, ranging from $1.64 to $1.68 on a constant currency basis, and between 16% and 18%, from $1.70 to $1.74 in dollar terms. With that, I'll turn the call over to Clay.

Clay Magouyrk (Chief Executive Officer):

Thank you, Doug. Our infrastructure business is experiencing accelerating year-over-year growth, reaching 66%. Everyone is well aware of the robust demand for AI infrastructure, but multiple segments within OCI are also driving this accelerated growth rate, including cloud-native, Dedicated Regions, and multi-cloud. The diversity of our capabilities within infrastructure sets us apart from emerging cloud vendors (Neoclouds) focused solely on AI infrastructure. Our unique combination of infrastructure and applications distinguishes us from other hyperscale cloud providers. We have ambitious yet achievable goals for capacity delivery on a global scale. OCI currently operates 147 live, customer-facing regions and plans to build an additional 64 regions. Last quarter, we delivered nearly 400 megawatts of data center capacity to customers. Our GPU capacity delivered this quarter was 50% higher than in the first quarter. Progress on our Abilene, Texas supercluster is on track, with over 96,000 NVIDIA Grace Blackwell GB200 units already delivered. This quarter, we also began delivering AMD MI355 capacity to customers. Our pace of capacity delivery continues to accelerate.We continue to observe strong demand for AI infrastructure used in training and inference. Before accepting customer contracts, we follow a very stringent process. This process ensures that we have all the necessary components in place to achieve customer success at a margin that makes sense for our business. We analyze land and power for data center construction, component supply (including GPUs, networking equipment, and optics), labor costs across various stages of construction and low-voltage engineering, engineering capabilities for design, construction, and operations, required revenue and profitability, and capital investment. Only when all these components align do we accept customer contracts, confident that we can deliver the highest quality service on time.

As Doug mentioned, this quarter we signed an additional $68 billion in RPO. These contracts will rapidly add to the revenue and profit of our infrastructure business. We continue to carefully evaluate all future infrastructure investments, proceeding only when all necessary components align to ensure profitable delivery to our customers.

The holiday season represents a peak period for many retail and consumer customers. OCI is responsible for providing the safest, highest-performing, and most highly available infrastructure to support the scale required by these customers. Uber now runs over 3 million cores on OCI, powering its record traffic during this year's Halloween. Team Move expanded to nearly 1 million cores during Black Friday and Cyber Monday. Additionally, we supported thousands of other customers through our retail and other applications, helping them navigate their largest and most successful holiday seasons. OCI’s features and services continue to expand. We recently launched Acceleron, offering enhanced networking services to all OCI customers, along with other offerings like AI agent services. However, we cannot provide all services ourselves; we rely on our rapidly expanding partner community to deliver the best experience on OCI. We added new AI models from Google, OpenAI, and xAI to ensure our customers have access to the latest and greatest AI capabilities. Driven by partners like Broadcom and Palo Alto, our marketplace consumption grew by 89% year-over-year.

These partners drive OCI consumption by building SaaS businesses on OCI. Palo Alto launched their SASE and Prisma Access platforms on OCI, while Cyber Region and Newfold Digital continue to rapidly expand their operations. These partnerships enrich our ecosystem, benefiting our customers, and as partners build solutions on our infrastructure, this growth directly translates into more OCI growth.

Demand for Oracle Database services is increasing across all clouds. Multi-cloud database consumption grew by 817% year-over-year. This quarter, we launched 11 multi-cloud regions, bringing our total live regions on AWS, Azure, and GCP to 45, with plans to add another 27 in the coming months. We are seeing growing customer demand, with a confirmed pipeline worth billions of dollars.

This quarter, we launched two key initiatives for multicloud. The first is Multi-cloud Universal Credits, which allows customers to commit once to using Oracle Database services and utilize them across any cloud with the same pricing and flexibility. The second is our Multicloud Channel Reseller Program, enabling customers to procure Oracle Database services through their preferred channel partners.

We also rolled out nine services across different clouds, such as Oracle Autonomous AI Lakehouse. This combination of best-in-class services, universal availability, consistent and straightforward pricing and procurement, along with partner support, is accelerating the adoption of Oracle Database services across our customer base. OCI is the only complete cloud service available to individual customers. We introduced Dedicated Region 25, which provides the full functionality of OCI within a compact three-rack footprint. OCI is also the only cloud that enables partners to become cloud providers themselves through our Alloy program, and our new footprint is available to all Alloy providers.

Consumption of Dedicated Regions and Alloy has grown by 69% year-over-year. We launched a Dedicated Region for the IFCA Group in Oman, while NTT Data and SoftBank each launched an Alloy region this quarter. This brings our total real-time Dedicated Regions to 39, with plans to add 25 more.

In summary, the four segments of our infrastructure business are growing at an impressive pace. This will help our infrastructure revenue continue to accelerate over the next few quarters. Customers choose OCI for its performance-optimized architecture, unwavering focus on security, consistently low and predictable pricing, and unparalleled depth in databases and enterprise integration. These priorities have been part of our strategy from the beginning and are the driving force behind this growth. OCI is in a constant state of reinvention, and you can see the value it delivers to customers. When we combine our commitment to delivering the best performance, efficiency, and security with the growing demand we see for cloud infrastructure services, I am incredibly excited about what comes next.

That's all I have to say. (Can't hear clearly.)Larry Ellison (Co-founder, Chairman, and CTO):

Thank you very much, Clay. Over the years, Oracle has developed software in three critical areas: databases, applications, and Oracle Cloud. We use AI to enhance our database software, and our autonomous software eliminates manual labor and human error, thereby reducing operational costs and making our systems faster, more reliable, and more secure.Now, with the development of Oracle AI Database and Oracle AI Data Platform, we are bringing together all three layers of our software stack to address another very important issue: enabling the latest and most powerful AI models to perform multi-step reasoning on all private enterprise data while keeping that data private and secure. Training AI models on public data represents the largest and fastest-growing business in history. However, AI models performing reasoning on private data will be an even larger and more valuable business.

The Oracle Database contains a significant portion of the world’s high-value private data. Oracle Applications also hold vast amounts of highly valuable private data. Oracle Cloud includes all top AI models, including OpenAI ChatGPT, xAI Grok, Google Gemini, and Meta LLaMA. Oracle's new database and AI data platform, combined with the latest version of Oracle Applications, enable all these AI models to perform multi-step reasoning on your database and application data while maintaining the privacy and security of that data.

All of our database and application customers want to do this because it gives them a unified view of all their data for the first time. AI models can respond to a single query by reasoning across all your databases and applications. By treating all data holistically, the combination of AI models with Oracle AI Database and AI Data Platform breaks down the barriers that have historically isolated and fragmented data.

The Oracle AI Data Platform makes all of your data—every single piece of it—accessible to AI models, not just the data from Oracle databases and Oracle applications, but also data from other databases. Cloud storage from any cloud, and even data from your own custom applications, can be accessed by AI models using the Oracle AI Data Platform. With our AI Data Platform, you can unify all your data and use the latest AI models to perform inference across all of it. This is key to unlocking all the value in all your data. Soon, through the lens of AI, you'll be able to see everything happening in your business in real time. Mike, over to you.

Mike Sicilia:

Thank you, Larry. As Doug shared, total revenue grew 13% in constant currency. I think it’s worth noting that this marks three consecutive quarters of double-digit total revenue growth. So it was a solid quarter, and we see better days ahead. Let me break down some numbers further, all stated in constant currency.Cloud application revenue grew 11%, bringing our annualized run rate to about $16 billion. Within that, Fusion ERP grew 17%. Fusion SCM grew 18%. Fusion HCM grew 14%. NetSuite grew 13%. Fusion CX grew 12%. In our industry clouds, specifically, hospitality, construction, retail, banking, food service, local government, and communications—all combined—grew 21% this quarter. So high growth on a large base. In our healthcare business, we now have 274 customers running clinical AI agents live in production, and that number increases daily. Also in healthcare, our brand-new AI-based ambulatory EHR is now fully available and has received U.S. regulatory approval. Finally, in healthcare, we expect significant acceleration in both bookings and revenue in Q3.

Overall, cloud applications grew 11% on a larger base. That's very meaningful because we believe this business will continue to accelerate. We achieved this growth while undertaking significant sales force reorganizations in many regions globally. This is something we've been talking about for years—the synergy between our back-office applications and our industry applications. We are seeing more and more deals where industry applications pull Fusion or Fusion applications pull industry solutions. And as we see more transactions, we are also witnessing larger deals encompassing more components.

Therefore, recently, we merged the industry application sales team and the Fusion sales team into a single sales organization. This allows our salespeople to engage in more strategic one-on-one conversations with customers to sell higher-end products and sell more. Then, when you consider our very large on-premise application customer base, these strategic conversations are driving upgrades. You’ve heard us say before that simply moving a customer to the cloud delivers 3 to 5 times the annual revenue uplift compared to supporting revenue.

Now, on top of that—beyond the sales force, the single go-to-market motion, and the industry suites—imagine combining our AI Data Platform with this unparalleled suite of applications. This creates an extremely unique opportunity for our customers to realize value from enterprise-grade AI very quickly. This combination allows customers to merge industry-leading foundational models with company-specific proprietary data, much of which, as Larry mentioned, comes from Oracle applications. Of course, the AI Data Platform also incorporates non-Oracle applications, competitive data sources like MongoDB or Snowflake, object storage, and even fully customized unstructured data. So we believe this allows our customers to very easily build enterprise data lakes, AI agents, and transform their businesses with applications leveraging built-in—not bolted-on—AI.

So to repeat, AI is certainly a great OCI play, but for Oracle, it’s also a broader software play. It’s driving growth in both our applications and database businesses. Let me highlight a few key wins.

In the communications industry, Digital Bridge Holdings selected ERP and SCM, Salaam Telecom selected SCM, and Motorola Solutions selected ERP, SCM, and CX. TIM Brazil, as the 5G leader in Brazil, just signed a new five-year expansion agreement to accelerate AI adoption and transform customer experience at scale, all built on OCI. In fact, this five-year deal extends the partnership that began in 2021 when TIM Brazil migrated its entire data center to OCI. They are now building AI agents to support real customer interactions, including content agents that automatically compare customer bills month-over-month and explain discrepancies. In pilot programs, AI agents built on OCI have already increased problem resolution speed by 18%, with further improvements expected as the rollout continues. They have 24 projects underway, seven of which are already in production. In just a few months, six more will launch, all enabled by a multi-cloud architecture, with Oracle as a key AI infrastructure partner. As a result of this initial rollout, customer satisfaction has improved by 16%, call center processes are managed end-to-end with 90% accuracy, resulting in a 30% reduction in customer service time and a 15% decrease in network fault interventions, all powered by predictive analytics—again, OCI’s built-in AI copilot. So we are the personalized AI engine enabling transformation nationwide for TIM Brazil.

In financial services, Core Civic selected ERP, SCM, and HCM; PrimeLife Technologies selected ERP; and Mutual Insurance selected ERP. In the public sector, the City of Costa Mesa selected ERP, SCM, and HCM; the U.S. Space Force selected ERP and HCM; and the City of Santa Ana selected ERP, SCM, and HCM. In the high-tech industry, SolarEdge Technologies selected ERP and SCM; Zscaler selected ERP; and Dropbox selected ERP and SCM.

I could go on and on about these wins, but I think it gives you a sense of the number of multi-pillar victories and why it's so important that we give customers so many different choices in the back office and the front office. On the go-lives this quarter, we're going to have 330 cloud application customers go live. That's multiple go-lives every day. Virgin Atlantic went live in September with Fusion ERP, HCM, and Payroll. Broadridge just recently went live again with our Fusion ERP and EPM. LifePoint Health just went live with their third wave of Fusion ERP, SCM, and HCM. Saudi Telecom has gone live with Fusion SCM, followed by ERP and HCM. DocuSign is now live with Fusion Data Intelligence. Again, I could go on and on about the go-lives, 330 within the quarter, which gives you a sense that we've had some really significant go-lives lately.

Cloud applications deferred revenue grew 14%. That's above the 11% cloud applications revenue growth, and that's just to reinforce my earlier statement that we expect applications growth to continue to accelerate. So it was a solid quarter all around. We are in the late stages of a sales reorganization focused on unifying sales across the applications portfolio. We're seeing a clear AI halo effect for cloud applications, which is driving upgrades. Our AI data platform combined with our applications is absolutely a game-changer, bringing Oracle Database and all of our applications into the center of the modern Agentic enterprise. Looking ahead, we're executing well against a large and growing pipeline, and I expect both revenue and earnings to accelerate off a much larger base.

Ken, back to you.Ken Bond (Head of Investor Relations):

Thank you, Mike. Tiffany, if we could have the audience ask questions.Q&A Session

Operator:

(Operator Instructions) Your first question comes from Brad Zelnick from Deutsche Bank. Please go ahead.Brad Zelnick (Analyst):

Thank you. Congratulations to you, and especially to Mahesh and team for building so much capacity this quarter. My question is for Clay, and perhaps Doug as well. Oracle is clearly the destination of choice for the most sophisticated AI customers, but this is obviously a proposition that is far more capital-intensive than anything Oracle has done historically. Very specifically, how much capital does Oracle need to raise to fund its future AI growth plans? Thank you.Clay Magouyrk (Chief Executive Officer):

Thank you for your question, Brad. This is Clay. I'll answer this question in two parts. First, let me explain why it's difficult to provide a definitive answer. I think what many people don't understand is that we actually have a variety of options for how we deliver these capacities to our customers.

Clearly, there is the approach that most would typically consider: we pre-purchase all the hardware. As I discussed at the financial analysts' meeting, we won't incur any costs related to this until these large data centers are actually operational.

Then the question becomes, how do you pay for what goes into the data center, and what does the cash flow look like? Well, we have been exploring several other interesting models. One of them is where customers can bring their own chips. In such models, Oracle obviously doesn’t need to bear any upfront capital expenditure.

Similarly, we are working with different vendors on various models, some of whom are very interested in adopting a capacity-leasing rather than selling model. You can imagine that this brings different cash flow implications, which are favorable and reduce Oracle’s overall borrowing needs and required capital.

So you can imagine that as we evaluate all these commitments, we will use a range of approaches to minimize the overall cost of capital. Of course, in some cases, we will raise our own funds. As part of this, I think everyone must understand that we remain committed to maintaining our investment-grade debt rating.

To give you some more specific information now, I would say that we have been reading a lot of analyst reports, and we’ve seen quite a few indicating that Oracle may need up to $100 billion to complete construction. Based on what we're seeing currently, the amount of financing we’ll need to fund this construction will be less, if not substantially less, than that figure. I hope this helps address your question, Brad.Brad Zelnick (Analyst):

Very helpful. Thank you for taking the question.Operator:

Your next question comes from Ben at Melius Research. Please go ahead.Ben (Analyst):

Hey, everyone. Thank you very much. It's great to speak with you all. Given the answer to that question, the path of OCI margin seems crucial for improving EBITDA and cash flow. So, at the analyst meeting, you mentioned that within customer contract periods, OCI's AI workload margin will be in the range of 30% to 40%. My question is, how long will it take for all your OCI data centers' AI margins to reach that level, and what needs to happen to achieve that?Doug Kehring (Chief Financial Officer):

Yes. Thank you for the question, Ben. The answer really depends on the circumstances. The good news is that, as I mentioned earlier, we actually don’t incur any expenses until after the data center is built and operational. Then, we have highly optimized the process of delivering capacity and handing it over to customers, which means the period during which we incur costs without the corresponding revenue and gross margin profile is only a few months. So, in this case, that time frame isn't significant. A few months isn't a long time.

What is more important is the overall mix of our online data centers and their growth relative to our total global expansion. So, I think as we go through this construction phase — and we are now in a very rapid construction phase where most of the capacity isn't yet online — obviously, the overall blended margin will be lower. But when we actually bring most of that capacity online — and that's really our focus. The best way to quickly improve margins is to deliver capacity faster. This will ultimately ensure very quickly that we achieve a 30% to 40% gross margin profile across all our AI data centers.Ben:

Thank you.Operator:

Your next question comes from Tyler Radke of Citi. Please proceed.Tyler Radke (Analyst):

Yes, thank you for taking my question. This one is for Larry or Clay. Oracle has clearly established itself as an AI lab and, in some cases, a leading AI infrastructure provider for enterprise customers. How do you view the opportunity to sell additional platform services, such as databases, middleware, and other parts of the portfolio, similar to how cloud providers in the early days of public cloud added these services? What similarities or differences do you see between the cloud platform-as-a-service market and the emerging AI platform-as-a-service market? Thank you.Clay Magouyrk (Chief Executive Officer):

Let me start with traditional cloud and the traditional Oracle database. I think the biggest change we've made there is making our database available in everyone's cloud. So you can purchase Oracle Database on Google or Amazon, as well as on Microsoft Azure and OCI. So that’s step one — perhaps the first move we’ve taken in what we call multicloud, where we actually embed OCI data centers into other clouds. This way, they can access the latest and greatest version of Oracle Database.

The second thing we’ve done is that we've actually transformed Oracle Database or added functionalities to Oracle Database to allow you to vectorize, which essentially points to — and vectorizes all your data, whether it’s in object storage across different clouds, whether it’s in custom applications, or whether it’s in another database. It will essentially take your data universe, catalog that data, vectorize it, and allow LLMs (large language models) to reason over all this data.

What’s truly remarkable about this is, think about just asking one query, posing one question, and the model will look at all your data. Typically, when you ask a question, you have to point it to this database or that application. You can’t say, look, I just want to know who my next customer should be for sales. As a salesperson in a region, I want to look at all the accounts within my region, and I want to see who the best potential customers are in my area. That usually means looking at contract data, public data, our sales systems, support systems, all these separate systems. Well, suddenly, all that data is unified. We take all your data and unify it. So you can ask a single question, and the AI model can find the answer to that question, no matter which data store it resides in. This is really a unique proposition, and we believe this will significantly drive the usage of our database and our cloud.Tyler Radke:

Thank you.Operator:

Your next question comes from Brent Thill of Jefferies. Please go ahead.Brent Thill (Analyst):

Thank you. A question for Larry and Clay regarding the fungibility of your infrastructure. If a large customer is unable to pay, what steps do you need to take to transition a data center from one customer to another?Clay Magouyrk (Chief Executive Officer):

Yes. Thank you, Brent. So I think the first thing to understand is that what we deliver for AI infrastructure is exactly the same cloud that we deliver to all of our customers. We made specific choices at the outset of OCI around things like bare metal virtualization and how we do things such as hardware security scrubbing.

So the reason I bring this up is that anyone who holds a credit card right now can come and sign up for any one of the hundreds of regions I talked about earlier, and you can spin up a bare metal machine in minutes. At the end of that, you can turn it off, I will recycle it, and I can have it available to the next customer in less than an hour.

So when you ask how long it takes to move capacity from one customer to another, it is measured in hours. Actually, I think a corollary to that question is, how long does it take for a customer to adopt it? Thankfully, we have a lot of experience in getting more than 700 AI customers onto our platform, including the vast majority of large model providers already running on OCI. When we give them capacity, they are typically able to utilize it within two to three days.

So when I think about how long it takes me to take capacity and hand it over to a customer, it is not a laborious process, it's not a unique process. The other thing I would say is that I think many people don't realize this about our cloud, but it happens all the time. So we have a lot of customers who might sign up for thousands of some type of GPU and then come back and say, actually, I want to get more capacity elsewhere, can you take this back. We do this all day, every day, constantly moving customers and increasing total net capacity.

So we have the technology, we have the secure foundation to do this, and we also have a large customer base with significant demand so that whenever we find ourselves with unused capacity, it gets allocated and provisioned very quickly.Brent Thill (Analyst):

That is very helpful. I appreciate it.Operator:

Your next question comes from Mark Moerdler from Sanford Bernstein. Please go ahead.Mark L. Moerdler (Analyst):

Thank you very much for taking my question, and congratulations on the quarter. Doug, you provided some information earlier that I would like to delve deeper into. Clay presented a slide at the financial analysts' meeting where he showed revenue and expenses for an individual data center. Doug and Clay, could you discuss cash flow for the same data center, starting from the commitment to the data center, then the hardware, and how it turns into positive cash flow? And then, how does this aggregate across multiple data centers? If you could provide some color on that, I would really appreciate it.Larry Ellison (Co-founder, Chairman, and CTO):

Of course. I’m happy to answer that, Mark. As we discussed earlier in this call, it begins with the actual data center itself and the associated power capacity. The way we structure it is that we don't incur any cash outflows until the data center is fully delivered, configured, and fit-for-purpose.

So it really comes down to what the cash flow looks like for the capacity coming into the data center. As I mentioned earlier, it largely depends on the exact business and financial model we use to procure that capacity. In some cases, customers want to bring their own hardware, in which case we have no capital expenditure, and it revolves around the data center itself, along with perhaps some network equipment and labor costs.

We have other models where vendors want to lease that capacity, in which case rental payments start when the capacity is provisioned for the customer. So, customer cash flows in, and we then take that cash flow and push it out to all the different suppliers.

Clearly, there is also a model where Oracle uses its own cash to prepay for the hardware and then deploy the capacity. That is obviously the most cash-intensive upfront. Then there is a depreciation schedule over the following years.

So it really depends on the exact commercial and financial model used for each data center. Then you asked, how do they stack together? Well, thankfully, we don’t need calculus to solve that. Basic arithmetic is sufficient because they essentially just layer on top of each other. So if you have a timeline for one data center and a timeline for a second data center, the cash flows add together. Clearly, if one data center comes online earlier, you will have both expenditures and revenues coming in earlier. If one data center shifts out, then both expenditures and revenues shift out as well.Mark L. Moerdler (Analyst):

Very helpful. I appreciate it.Operator:

Your final question comes from John Don DiFucci of Guggenheim Securities. Please go ahead.John DiFucci (Analyst):

Alright, I won’t force you to kiss my ring. Actually, I’m John DiFucci. Anyway, sorry about that. Look, a lot of questions have already been asked about infrastructure, and they are very important because that’s a significant part of your growth. But I have a question about the applications business. Mike, you said applications will accelerate this year. Why are you confident about this business when all your SaaS peers are seeing the opposite — that growth is slowing? Especially since we had a similar thought about Oracle’s application business last year, but it didn’t really start showing until Q4.

We’ve heard some things on the ground about 'One Oracle,' your go-to-market motions, with applications and infrastructure being more integrated rather than separate. You also mentioned combining vertical and horizontal application teams here. Is that mainly about the go-to-market motion? Are there other aspects, such as product or otherwise, that we should be considering? Thanks.Mike Sicilia (Co-CEO, responsible for Applications):

Well, yes, thank you for the question. First, I think it’s a combination of several things. But let me start with what I believe is happening in the industry. Most of our competitors are largely in the 'best-of-breed' business because they’re not in the full application business. They’re not in the back-office business, they’re not in the industry-specific business, and they’re not in everything in between. They’re not in the front office, back office, or middle office. We are the only application company in the world selling a complete suite of applications.

Then you add the built-in AI — the halo effect of AI directly baked into our applications. So we already have over 400 AI features live in Fusion. I mentioned 274 customers live on our clinical AI agents. But those clinical AI agents, for us, are Uberator SaaS applications measured in weeks. So you look at an industry like healthcare, where doing anything at this scale typically takes months or years, and now it’s just weeks — by the way, John, customers are implementing these entirely on their own, right? They don’t need us to help them. You just roll them out, and they work.

So we’re in the industry application suite business. We’re integrating AI into our back-office applications, our front-office applications. We’re building applications that themselves are AI agents. That’s why you see our industry applications growing at 21% this quarter. Our Fusion ERP grew 17%, SCM grew 18%, HCM grew 14%, and CX grew 12%. Again, all on larger bases.

I think the next piece of this is adding the AI data platform. So if you want an industry application suite, and then you want to create your own AI agents, and you want to unlock your own enterprise data on top of that, we are the only ones providing all of these elements to customers. I think when you look at customers who are tired of spending on 'best-of-breed' solutions because integration costs are too high, and it’s difficult to bolt AI onto all of that without actually retiring any part of the process, we are in a very unique position. I think we’re starting to see this reflected in the numbers, John. Deferred revenue for applications is now growing at 14%, faster than the 11% revenue growth within the quarter. So for all these reasons, I’m optimistic about the future of our applications business. It’s Oracle’s ongoing growth engine.John DiFucci (Analyst):

Thank you, Mike. As you were speaking — while you were speaking, I sort of clarified it in my mind a bit. When I thought about 'an Oracle,' I used to think — when I first heard about it, I thought it was an IPO move, but it's more than that. It actually is also — it’s also something on the product side. It's everything. So thank you very much.Mike Sicilia:

Thank you.Ken Bond:

Thank you, John. A replay of this conference call will be available on our investor relations website for 24 hours. Thank you all for joining us today. With that, I'll now turn the call back over to Tiffany to conclude.Operator:

Ladies and gentlemen, this concludes today’s conference. Thank you for your participation. You may now disconnect.---

This transcript may not be 100% accurate and may contain spelling errors or other inaccuracies.

![]() Market volatility is inevitable; instead of reacting passively, it is better to manage proactively. While keeping an eye on Oracle’s movements, you may also consider diversifying your strategy with structured products like FCN, aiming to find certainty of returns amid volatility.

Market volatility is inevitable; instead of reacting passively, it is better to manage proactively. While keeping an eye on Oracle’s movements, you may also consider diversifying your strategy with structured products like FCN, aiming to find certainty of returns amid volatility.

As a structured product with fixed dividends, FCN offers the following advantages:

1. Stable monthly dividend: Receive agreed coupon payments monthly during the holding period, ensuring stable and predictable cash flow.

2. Downside protection: As long as the price does not fall below the safety line at maturity, investors can recover 100% of the principal even if the stock price declines.

3. Flexible underlying stocks: Investors can choose single or multiple stocks (underlying assets), making it easier to align with different risk preferences and investment objectives.

Click here to view FCN products>>

Editor/melody