Oracle's earnings report has sparked heated discussions on Wall Street: although non-GAAP EPS significantly exceeded expectations and a record-high backlog of $523 billion in orders was reported, actual profits were inflated by a one-time gain of $2.7 billion, with core profitability and cash flow under pressure. Order growth failed to mask concerns over conversion, cloud business growth fell short of expectations, and a surge in capital expenditures caused free cash flow to turn negative. The stock price plunged 10% post-earnings, prompting UBS Group and Bank of America to lower their target prices while Morgan Stanley placed its rating under review. Market focus has now shifted to profit quality and the realization rate of the order backlog.

Oracle’s fiscal second-quarter 2026 earnings report triggered widespread discussion on Wall Street: while non-GAAP earnings per share surpassed expectations and the $523 billion in Remaining Performance Obligations (RPO) hit a new high, profits relied heavily on non-recurring gains, presenting an artificially inflated picture. Investors are no longer satisfied with just the 'order narrative.'

According to ZF Trading Desk, this has led several investment banks, including UBS Group, Morgan Stanley, and Bank of America, to either cut their target prices or reassess their ratings.

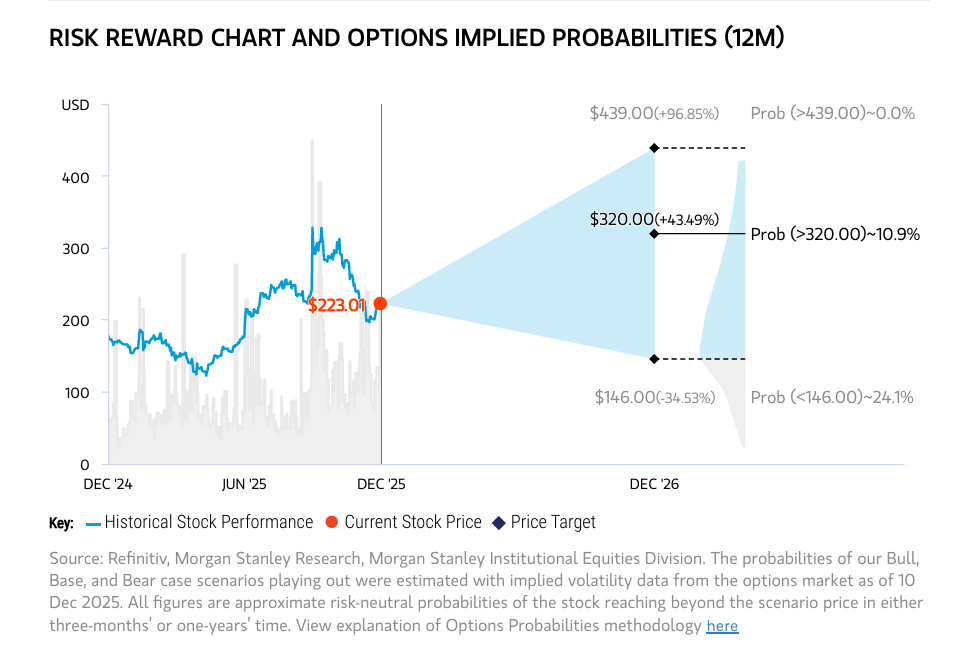

In a report issued on the 11th, Morgan Stanley’s Keith Weiss team stated that due to declining certainty in converting the backlog of orders into profits, market concerns have intensified. The bank has placed Oracle’s target price and model under review. Lacking clear catalysts, Oracle’s current share price requires investors to see more evidence that its emerging GPUaaS business can drive profitability and free cash flow growth.

In a report issued on the 11th, Morgan Stanley’s Keith Weiss team stated that due to declining certainty in converting the backlog of orders into profits, market concerns have intensified. The bank has placed Oracle’s target price and model under review. Lacking clear catalysts, Oracle’s current share price requires investors to see more evidence that its emerging GPUaaS business can drive profitability and free cash flow growth.

The UBS Group Karl Keirstead team noted that although Oracle’s second-quarter performance slightly missed investor expectations and its communication regarding financing leverage prospects was less clear, the substantial backlog of orders holds significant conversion potential for the second half of the year and fiscal 2027. As such, UBS Group maintains its 'Buy' rating on the company.

The Bank of America Brad Sills team expressed optimism, stating that despite Oracle being in the most capital-intensive phase of building AI infrastructure and facing a timing mismatch between increased spending and revenue conversion, this represents an issue related to the investment curve rather than a fundamental shift. Therefore, they reaffirmed their 'Buy' rating on the company.

Hidden Concerns Beneath the Order Narrative: $523 Billion RPO Fails to Mask Conversion Anxiety

Oracle delivered its strongest-ever order performance this quarter: RPO grew by $67.7 billion to reach $523 billion, with implied orders surging 583% year-over-year to $83.8 billion. The key driver was AI computing power procurement from giants like Meta and NVIDIA. Among these, the currently recognizable cRPO reached $53.1 billion, up 40% year-over-year, indicating solid short-term support for order fulfillment.

However, Wall Street’s focus has shifted from 'order growth' to 'conversion efficiency.'

Morgan Stanley pointed out that despite the continued expansion in order size, investors are losing confidence in their conversion into 'sustainable profit-generating revenue.' Data shows that total revenue grew 13% year-over-year (constant currency), slightly below market expectations; cloud infrastructure (OCI) revenue reached $4.079 billion, up 66% year-over-year, falling short of UBS Group's 68% forecast and the market consensus of $4.168 billion. Software business revenue declined 3% year-over-year, becoming a drag on overall growth.

UBS Group believes that the lag in order conversion is an industry-wide issue. Oracle's Abilene data center construction is proceeding as planned, with OCI growth expected to accelerate to over 80% in the third quarter.

However, Morgan Stanley cautions that the global restructuring of the sales team may lead to execution risks. Flexible contract models such as 'Bring Your Own Chip' (BYOC) could reduce Oracle’s capital expenditure pressure but might erode profit margins in its GPU sales segment, further exacerbating uncertainties in conversion profitability.

The Truth Behind 'Inflated' Profits: Non-recurring Gains Mask Core Pressures

The most notable contradiction in Oracle’s earnings report this quarter lies in the divergence between 'better-than-expected EPS' and 'weak profitability.'

The financial report shows non-GAAP earnings per share reached $2.26, significantly surpassing market expectations of $1.65. However, this impressive performance did not stem from improvements in core business operations.

Morgan Stanley’s breakdown reveals that the EPS beat was primarily driven by $2.7 billion in pre-tax non-recurring gains—proceeds from Oracle’s sale of its stake in Ampere. Excluding this factor, Oracle’s core profitability faced broad-based pressure: non-GAAP gross margin declined sharply by 470 basis points year-over-year to 41.9%, far below market expectations of 68.7%; non-GAAP operating margin fell by 150 basis points year-over-year, also missing the consensus forecast of 42.2%.

The core reason for weakening profitability is the surge in capital expenditures. Oracle’s capital spending reached $12 billion this quarter, surging more than 200% year-over-year, far exceeding UBS Group’s forecast of $9.2 billion and Morgan Stanley’s projection of $8.4 billion, directly resulting in negative free cash flow of -$10 billion. Management raised the fiscal year 2026 capital expenditure target by $15 billion to $50 billion, equivalent to 75% of the company’s projected annual revenue. The time gap between high investment and slow conversion further squeezed short-term profit margins.

Bank of America characterized this as a 'mismatch in the investment cycle,' rather than a deterioration in fundamentals, emphasizing that capital expenditures are necessary investments to meet AI computing demand.

However, Morgan Stanley expressed concerns that as the AI industry's 'arms race' intensifies and leading companies continue to ramp up capital expenditures, if Oracle cannot quickly achieve economies of scale, gross margins may face further pressure, potentially impacting its long-term profitability model.

Reconstruction of Valuation Logic: Collective Downgrades of Target Prices, Catalyst Shifts to Profit Verification

Following the earnings report release, Wall Street’s valuation logic for Oracle underwent a fundamental shift, moving from “premium reflecting order potential” to “discount addressing realization risks.” Three investment banks have lowered their target prices, reflecting a reassessment of its growth certainty and earnings quality.

UBS Group maintained its “Buy” rating but reduced its target price from $380 to $325, lowering its valuation basis from 44 times PE for fiscal year 2027 to 37 times. The rationale includes weaker-than-expected short-term performance and uncertainties regarding financing prospects. Bank of America similarly retained its “Buy” rating, cutting the target price from $368 to $300, adjusting its valuation anchor from 12.4 times EV/Sales for fiscal year 2027 to 10 times, aligning with the current trend of overall valuation contraction in the AI sector.

Morgan Stanley adopted a more cautious stance, announcing that it would place its rating and target price under “review,” becoming the only one among the three investment banks not to maintain its original rating. Its core concern lies in the weakening investor confidence regarding order conversion, gross margin trends, and cash flow improvements. These uncertainties could be further amplified in a high-interest-rate environment. Without clear catalysts for earnings improvement, the current valuation level of 28 times PE for fiscal year 2026 (in line with Microsoft and Amazon) may lack support.

The essence of the valuation divergence lies in differing judgments about the authenticity of Oracle's “AI transformation.”

UBS Group and Bank of America still see long-term realization potential in Oracle’s RPO of $523 billion, believing the current valuation already reflects short-term pressures. With accelerated OCI growth in the third quarter and the materialization of order conversions, there remains room for stock price recovery.

However, Morgan Stanley emphasized that the market requires clearer signals: whether it be accelerating revenue growth, stabilizing gross margins, or turning free cash flow positive. Only substantive improvements in key metrics can rebuild confidence in the profitability of Oracle’s AI computing power business.

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/Lambor