Top News

Before the market opened on Thursday, Oracle's earnings report raised concerns about massive artificial intelligence expenditures, causing the three major U.S. stock index futures to decline, with Dow futures down 0.11%, Nasdaq futures down 0.75%, and S&P 500 futures down 0.52%.

$明星科技股(LIST2518.US)$ General decline before the market opens, $NVIDIA (NVDA.US)$ 、 $Broadcom (AVGO.US)$ 、 $Advanced Micro Devices (AMD.US)$ with declines exceeding 1%. $Tesla (TSLA.US)$ 、 Google (GOOGL.US) Slight decline.

$热门中概股(LIST2517.US)$ Most stocks fell before the market opened. $PDD Holdings (PDD.US)$ falling more than 2%. $Alibaba(BABA.US)$ 、 $XPeng Motors (XPEV.US)$ 、 $Bilibili (BILI.US)$ 、 $Li Auto(LI.US)$ Down more than 1%.

$加密货币概念股(LIST20010.US)$ Trading lower pre-market, $SharpLink Gaming(SBET.US)$Falling more than 4%, $Bitmine Immersion Technologies(BMNR.US)$Fell more than 3%. $Strategy(MSTR.US)$ 、 $MARA Holdings(MARA.US)$ 、 $CleanSpark(CLSK.US)$ Dropped more than 2%.

$加密货币概念股(LIST20010.US)$ Trading lower pre-market, $SharpLink Gaming(SBET.US)$Falling more than 4%, $Bitmine Immersion Technologies(BMNR.US)$Fell more than 3%. $Strategy(MSTR.US)$ 、 $MARA Holdings(MARA.US)$ 、 $CleanSpark(CLSK.US)$ Dropped more than 2%.

Surpassing Gemini 3? GPT-5.2 Release Imminent

OpenAI is set to launch GPT-5.2 soon. Screenshots circulating in the developer community show that options for GPT-5.2 and GPT-5.2-thinking have appeared in Cursor's model drop-down menu. Various clues suggest that GPT-5.2 may have surpassed Gemini 3. OpenAI's Chief Research Officer previously stated that GPT-5.2 has outperformed Gemini 3 and Anthropic's Opus 4.5 in programming and logical reasoning tasks. In terms of long-range task execution, GPT-5.2 is reportedly capable of performing 'significantly longer tasks than any other OpenAI model.'

Microsoft CEO announces: 'Next-generation' Agentic AI model to be unveiled on Friday

Amid uncertainty surrounding OpenAI’s GPT-5.2 release plans, $Microsoft(MSFT.US)$ Microsoft announced it will independently roll out a new generation of AI models. Microsoft CEO Satya Nadella, speaking Thursday at an event in Bangalore, India, stated that the company will release a new AI model on Friday that 'will elevate AI agents to a new level.'

Wall Street Commentary on Oracle's Earnings Report: Seemingly Exceeding Expectations, but Profits Are 'Inflated'; Investment Logic Has Shifted from 'Order Focus' to 'Execution Focus'.

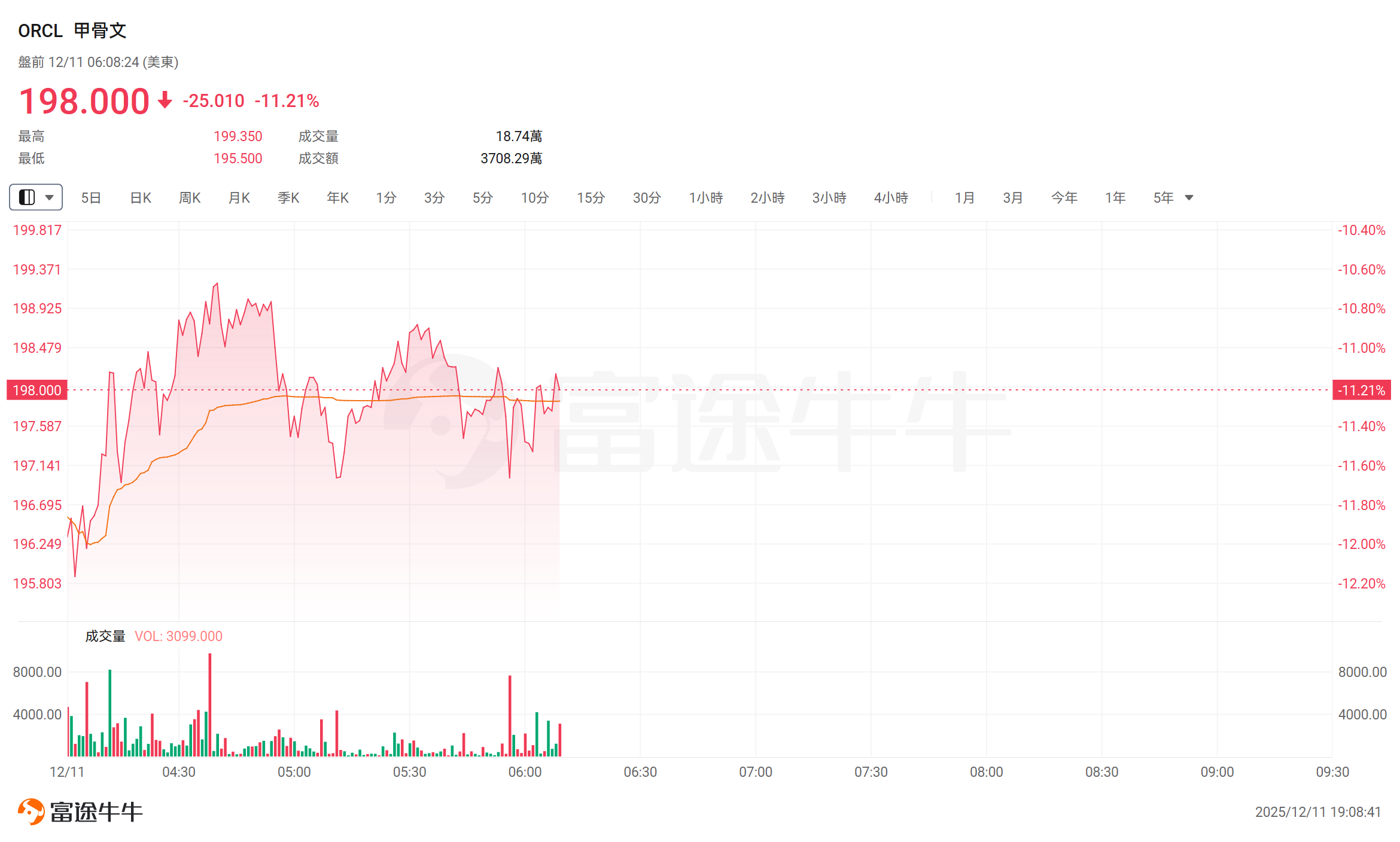

$Oracle (ORCL.US)$ Shares plunged over 11% in pre-market trading as the company’s earnings report sparked heated discussions on Wall Street. Despite non-GAAP EPS significantly beating expectations and a record-high backlog of $523 billion, actual profits were inflated by a one-time gain of $2.7 billion, putting pressure on core profitability and cash flow. Order growth failed to mask concerns over conversion rates, cloud business growth fell short of expectations, and surging capital expenditures pushed free cash flow into negative territory. Following the earnings release, the stock price plummeted 10%, prompting UBS Group and Bank of America to cut their target prices, while Morgan Stanley placed its rating under review. Market attention has now shifted toward profit quality and order realization.

Netflix plans to raise substantial debt again to fund its acquisition of Warner Bros.

Streaming giant $Netflix (NFLX.US)$Shares rose over 1% pre-market as the company plans a large-scale debt issuance to acquire Warner Bros. Discovery. Despite adding tens of billions in new debt, analysts believe its credit profile has improved significantly compared to the past. Netflix intends to ultimately replace existing financing with up to $25 billion in bonds, a $20 billion delayed-draw term loan, and a $5 billion revolving credit facility, with some funds also repaid in cash. While Morgan Stanley analysts warn that the sharp increase in debt poses risks, S&P Global Ratings maintains Netflix’s A rating, though it could face a downgrade to BBB. Most analysts, however, view the risk as manageable.

Gemini Space Station shares surged pre-market after receiving CFTC approval, potentially positioning itself in predictive markets

$Gemini Space Station(GEMI.US)$ Shares surged 16% in pre-market trading as the company's derivatives trading division, Titan, obtained a Designated Contract Market (DCM) license issued by the U.S. Commodity Futures Trading Commission (CFTC), enabling it to begin offering prediction market services to U.S. customers.Futures Exchange,The license allows the company to provide prediction market services to U.S.-based clients.

Nextdoor shares surged in pre-market trading, with Eric Jackson stating that its AI potential remains underappreciated by the market.

American social platform $Nextdoor Holdings(NXDR.US)$ Shares soared 17% in pre-market trading after closing up an impressive 25.87% on Wednesday, with intraday gains initially reaching a staggering nearly 50%, marking the largest intraday jump in over four years. The overnight surge followed bullish sentiment from Eric Jackson, the mastermind behind several retail-driven stock rallies earlier this year, who expressed optimism about this community-focused social media app. In a recent social media post, Jackson described the company as 'one of the most misunderstood platforms in the market,' adding that its AI capabilities have yet to be fully recognized by investors. $Opendoor Technologies(OPEN.US)$ and $Better Home & Finance(BETR.US)$ only because Eric Jackson, the key figure behind several retail investor-driven stock surges earlier this year, expressed optimism about the community social media application. Jackson stated in a recent social media post that the company is “one of the most misunderstood platforms in the market,” and that its AI potential has yet to be recognized by the market.

Taiwan Semiconductor's monthly production of CoWoS is projected to reach 127,000 wafers next year, with NVIDIA accounting for over half of the capacity, followed closely by Broadcom and AMD.

According to reports, $Taiwan Semiconductor (TSM.US)$ Taiwan Semiconductor is aggressively expanding its advanced packaging capacity, with an expected monthly CoWoS production capacity of 127,000 units by the end of 2026, representing an increase of more than 20% compared to previous projections. NVIDIA has secured over half of this capacity, reserving 800,000 to 850,000 units for the entire year; Broadcom ranks second, securing 240,000 units primarily supplying Meta and Google; AMD ranks third, while MediaTek has also entered the ASIC market.

Synopsys reports nearly 40% revenue growth in Q4, surpassing earnings guidance expectations.

$Synopsys (SNPS.US)$ Shares reversed earlier gains and turned negative in pre-market trading following the release of its fiscal 2025 Q4 results. Sales amounted to $2.25 billion, reflecting a 38% year-over-year increase and surpassing analyst expectations of $2.24 billion. Adjusted earnings per share came in at $2.90, exceeding forecasts of $2.78. Revenue from its design automation business surged 65% year over year, accounting for 82% of total sales, driven primarily by inorganic growth following the acquisition of Ansys. The company expects adjusted earnings per share for fiscal 2026 to range between $14.32 and $14.40, above analyst estimates of $13.96.

Novo-Nordisk A/S suffers its worst year ever with a 50% plunge in 2025.

$诺和诺德(NVO.US)$ Shares rose more than 1% in pre-market trading. Due to poor clinical trial results, multiple profit warnings, and intense market competition, the company's stock is experiencing its worst year on record, plummeting over 50% year-to-date and nearly erasing the remarkable gains since Wegovy was approved for weight loss treatment in 2021. Investors are concerned that with the primary compound patent for semaglutide set to expire in the U.S. in 2032, the company faces uncertainty regarding future sales growth.

$Eli Lilly and Co (LLY.US)$ Shares surged nearly 4% in pre-market trading after the company’s experimental injectable drug showed a 23% reduction in body weight during trials.

$Ciena(CIEN.US)$ Shares soared 13% in pre-market trading as the company reported revenue of $1.35 billion for the previous fiscal quarter, up 20% year-over-year and surpassing expectations. Adjusted EPS stood at $0.91, and the company forecasted revenue of $5.7 billion to $6.1 billion for the fiscal year 2026.

UBS Group: Expects DDR to rise 35% quarter-over-quarter, with NAND shortages persisting at least until Q3 of next year.

According to UBS Group data, the storage industry is facing an unprecedented supply-demand imbalance. In terms of DRAM, the supply shortage is expected to persist until the first quarter of 2027, with DDR demand growing by 20.7%, far exceeding supply growth. The NAND shortage is anticipated to continue until the third quarter of 2026. UBS Group forecasts that DDR contract prices will increase by 35% quarter-on-quarter in Q4, while NAND prices will rise by 20%. This round of price increases significantly surpasses previous expectations.

Global macro

The Fed is 'less hawkish than expected,' and Wall Street remains confident in its rate cut bets, with Morgan Stanley and Citi both expecting another rate cut in January.

Wall Street generally believes that while the Fed’s December meeting revealed hawkish signals, such as rare internal divisions and an emphasis on data dependency, it did not alter its accommodative stance. Major Wall Street investment banks maintained their expectations for further rate cuts following the decision. Morgan Stanley and Citi predict another rate cut in January, asserting that the easing cycle is not yet over. Goldman Sachs and Barclays analyzed that the hawkish tone in the policy statement aims to “balance” this rate cut to avoid sending overly dovish signals.

Central Economic Work Conference: Deepen efforts to address 'internally competitive' practices and continue advancing comprehensive reforms in capital markets for investment and financing.

The Central Economic Work Conference was held in Beijing from December 10 to 11. The conference identified the following key tasks for economic work next year: Persist in advancing reforms, and strengthen the momentum and vitality for high-quality development. Formulate regulations for building a unified national market and intensively address 'involutionary' competition. Develop and implement plans for further deepening the reform of state-owned assets and enterprises, and improve supporting laws and policies for the Promotion of Private Economy Law. Expedite the clearance of overdue payments owed to enterprises. Promote win-win development among platform companies, operators within platforms, and workers. Expand pilot programs for market-oriented reform of factors. Improve the local tax system. Deepen the reduction and enhancement of small and medium-sized financial institutions, and continue to advance comprehensive capital market investment and financing reforms.

The Swiss National Bank kept interest rates at zero for the second consecutive time and lowered its inflation forecast.

The Swiss National Bank maintained the benchmark interest rate at zero on Thursday, in line with market expectations, marking the second consecutive hold. The bank simultaneously lowered its inflation forecasts for 2026-2027 and noted that recent inflation has remained persistently below projections, with currency appreciation and external economic pressures weighing on prices. The governor stated that monetary policy will support a gradual recovery in inflation, while reiterating that the threshold for returning to negative interest rates remains extremely high.

Is Japan’s central bank about to unleash a 'rate hike storm'? A former official predicts three more rate hikes after next week.

According to a former committee member, Bank of Japan Governor Kazuo Ueda’s policy path may include up to four rate hikes by 2027, with three more increases expected after the widely anticipated move next week. Former official Hideo Hayakawa stated in an interview on Wednesday: 'They may feel they are completely behind the curve, and Ueda might signal that this rate hike is not the end of the tightening cycle.'

Hideo Hayakawa made these remarks amid widespread expectations that the Bank of Japan will raise borrowing costs to 0.75% on December 19, marking its first action since January. The market focus will be on how the central bank characterizes its future policy trajectory. Hayakawa noted, 'They may return to a pace of roughly one rate hike every six months,' with the terminal rate potentially around 1.5%, implying three more rate hikes after next week’s anticipated move.

Top 20 pre-market trading volume stocks in the U.S. stock market

U.S. Stock Market Macroeconomic Calendar Reminder

(The following times are in Beijing Time)

21:30 U.S. Initial Jobless Claims for the Week Ending December 6 (in thousands), U.S. Trade Balance for September (in billions of USD)

23:00 US September Wholesale Sales Month-over-Month

23:30 US EIA Natural Gas Storage for the Week Ending December 5 (in billion cubic feet)

Early next morning

01:00 Federal Reserve releases data on the financial health of American households from the Q3 2025 Flow of Funds Report

After-hours Broadcom reports earnings

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO