Top News

Bessent proposed reforms to the Financial Stability Oversight Council, potentially moving towards a more relaxed and liberalized approach.

US Treasury Secretary Bessent plans to make significant adjustments to the US financial regulatory approach, shifting the focus of the Financial Stability Oversight Council (FSOC) from strengthening regulation to deregulation. This policy shift marks a potential fundamental change in the regulatory framework established since the 2008 financial crisis.

Bessent proposed changing the regulatory approach of the Financial Stability Oversight Council (FSOC), moving away from its previous focus on strengthening oversight and supervision of financial institutions toward fostering a more relaxed regulatory environment. Bessent will also establish a working group dedicated to exploring opportunities for using artificial intelligence to enhance the resilience of the financial system while monitoring potential financial stability risks posed by AI applications.

The number of US unemployment benefit claims surged by 44,000, marking the largest increase since 2020, while the continued claims figure dropped sharply to an eight-month low.

The number of US unemployment benefit claims surged by 44,000, marking the largest increase since 2020, while the continued claims figure dropped sharply to an eight-month low.

The number of Americans filing for unemployment benefits surged by 44,000 last week, recording the largest weekly increase since the onset of the pandemic, indicating potential deeper strains in the labor market beyond the holiday-related seasonal fluctuations.

Data released by the U.S. Department of Labor on Thursday showed that initial claims for unemployment benefits rose to 236,000 for the week ending December 6, marking the highest increase since March 2020. The prior week’s figure had hit a near-60-year low of 192,000 during the Thanksgiving holiday week.

The data shows that large-population states such as California, Illinois, New York, and Texas were the main driving factors, with California making a particularly significant contribution. In sharp contrast to the substantial increase in initial jobless claims, there was a marked decline in continuing claims. As of the week ending November 29, continuing claims dropped to 1.84 million, marking the largest weekly decline in four years.

The acting chairman of the US Commodity Futures Trading Commission (CFTC) announced the withdrawal of outdated digital asset guidance.

Washington – Acting Chairman Caroline D. Pham of the Commodity Futures Trading Commission announced that, in light of significant developments in the crypto asset market, the CFTC will withdraw outdated guidance related to the actual delivery of 'virtual currencies.' 'Eliminating outdated and overly complex guidelines that penalize the cryptocurrency industry and stifle innovation is a goal of this administration this year,' said the acting chair. 'Today’s announcement demonstrates that decisive action can lead to tangible progress in facilitating safe access to US markets for the public, thereby better protecting American citizens.'

The withdrawal of this guidance allows the US Commodity Futures Trading Commission (CFTC) to continue advancing the implementation of recommendations from the President’s Working Group on Financial Markets Report, considering whether updates to guidance or FAQs are needed. The CFTC encourages public feedback through its 'Crypto Sprint' initiative.

The motion for the impeachment of President Trump in the U.S. House of Representatives was shelved after a vote.

On December 11 local time, the U.S. House of Representatives voted 237 in favor and 140 against to shelve the motion to impeach President Donald Trump proposed by Texas Congressman Al Green. All Republican lawmakers supported the so-called 'motion to table,' and although many Democratic members privately believed that Trump should not continue as president or should be impeached, most were reluctant to advance this resolution.

The Federal Reserve reappoints 11 regional Fed presidents, easing concerns over personnel uncertainties.

The Federal Reserve announced on Thursday that its Board of Governors had unanimously voted to reappoint 11 regional Fed presidents for five-year terms starting March 1 next year. The Fed stated that the reappointment followed a comprehensive evaluation of the regional Fed presidents by the boards of directors of the respective regional Feds and was made with 'unanimous consent' from the Fed's Board of Governors. According to legal requirements, all regional Fed presidents and their first vice presidents serve five-year terms. The current terms are set to expire on February 28, 2026. This move addresses a key issue surrounding the future composition of the Fed’s monetary policy committee. Previous reports suggested that Trump might attempt to appoint his allies to review these reappointment decisions — part of a broader effort to increase pressure on the Federal Reserve.

Trump: Signing an executive order to block states from enforcing their own artificial intelligence regulations.

U.S. President Trump stated that he will sign an executive order on Thursday to prevent states from enforcing their own artificial intelligence regulations, with the aim of creating a "single national framework" for artificial intelligence. White House aide Will Scharf said, "This executive order requires all government departments to take decisive action to ensure that artificial intelligence operates within a single national framework rather than facing state-level regulations that could weaken the industry."

JPMorgan: Labor force may be the biggest national security threat to the United States.

JPMorgan noted in its latest report that 40% of American adults lack basic digital skills. This report provides new supporting arguments for the bank's recently announced $1.5 trillion U.S. investment plan. The report defines the labor shortage as a national security threat to the United States, rather than merely an economic issue, emphasizing that without a talent pipeline, increased funding in critical sectors such as AI and energy will not be effectively utilized.

The Trump administration proposes expanding corporate tax R&D deductions.

The US Department of the Treasury is preparing to issue a corporate tax 'workaround' that will provide $Salesforce(CRM.US)$ 、 $Qualcomm(QCOM.US)$ Companies will see significant tax savings. The 15% minimum corporate tax introduced during the Biden administration (applicable to companies with annual revenues of at least $1 billion) prevents companies from fully claiming these R&D deductions.

Zelenskyy: Ukraine Submits Updated Peace Plan to the United States

According to reports by CCTV News, on Thursday local time (December 11), Ukrainian President Volodymyr Zelenskyy stated that Ukraine has submitted a revised peace plan to the United States, hoping to accelerate ceasefire negotiations with Russia. However, major obstacles remain in the talks regarding whether territorial concessions should be made.

The EU is set to finalize an “indefinite” freeze on Russian assets on Friday, paving the way for long-term financing for Ukraine.

According to CCTV News, several EU diplomats have indicated that EU member states aim to reach an agreement on Friday to indefinitely freeze Russian central bank assets currently held in Europe, replacing the current practice of renewing the freeze every six months.

This move forms the basis of the EU’s “Ukraine Refinancing Loan” program. The EU intends to utilize Russian sovereign assets frozen within the EU to provide Ukraine with a loan, enabling the country to maintain fiscal operations between 2026 and 2027 and ensuring its defense capabilities amid the ongoing conflict with Russia.

Reports suggest there may be some flexibility in the EU's '2035 ICE vehicle ban.'

The latest information indicates that, under pressure from countries such as Germany and Italy, the EU is considering extending the deadline for allowing sales of new hybrid and range-extended internal combustion engine vehicles by five years to 2040. The European Commission was originally scheduled to announce the review results this Wednesday but has now postponed it to December 16.

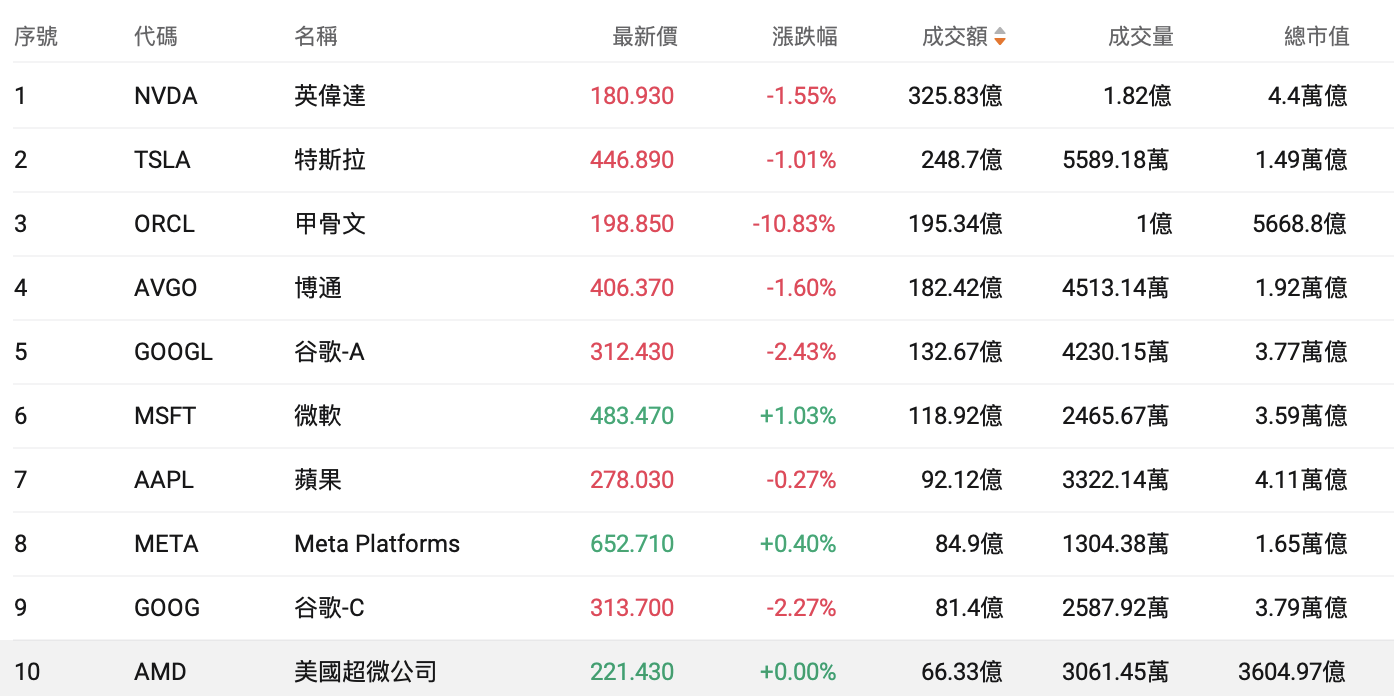

U.S. Stock Market Recap

The Dow Jones Industrial Average and the S&P 500 Index both closed at record highs, while Oracle's sharp decline of nearly 11% weighed on the Nasdaq Composite.

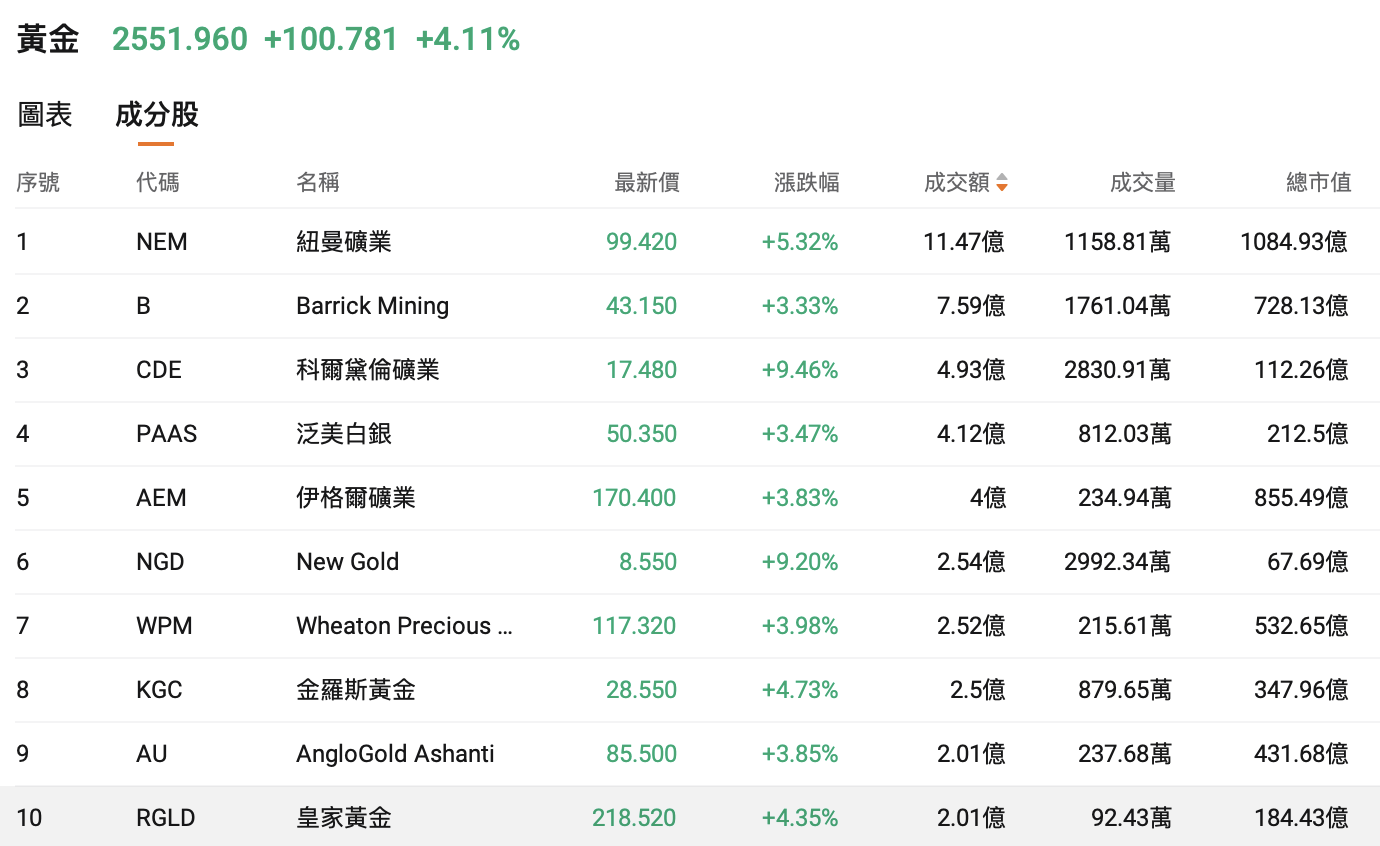

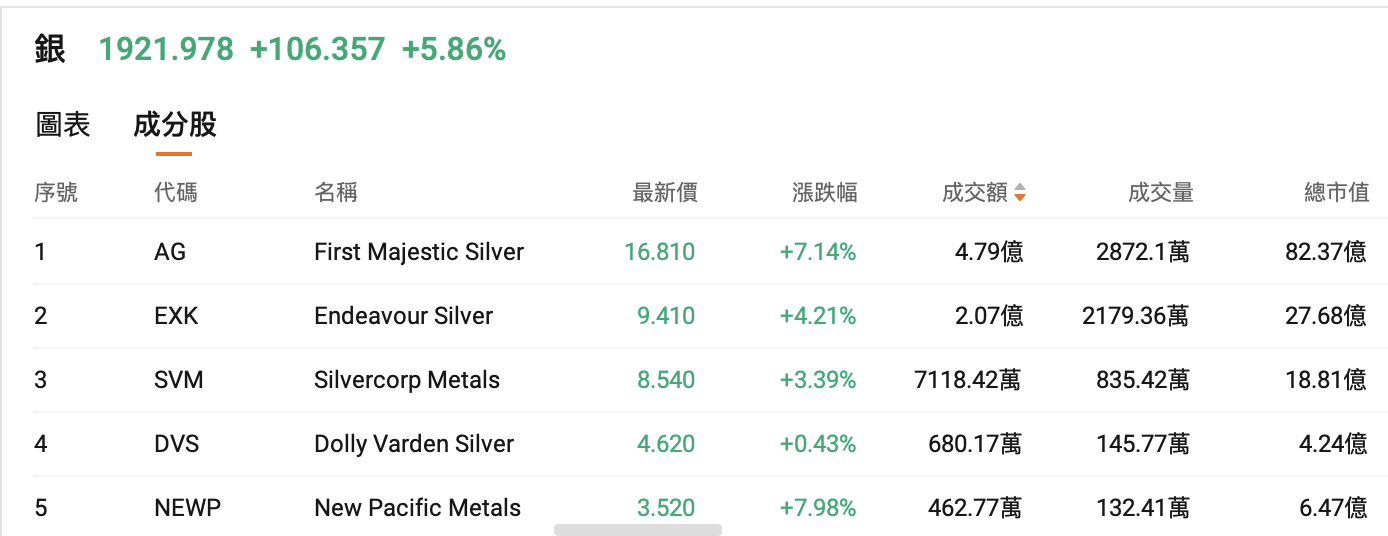

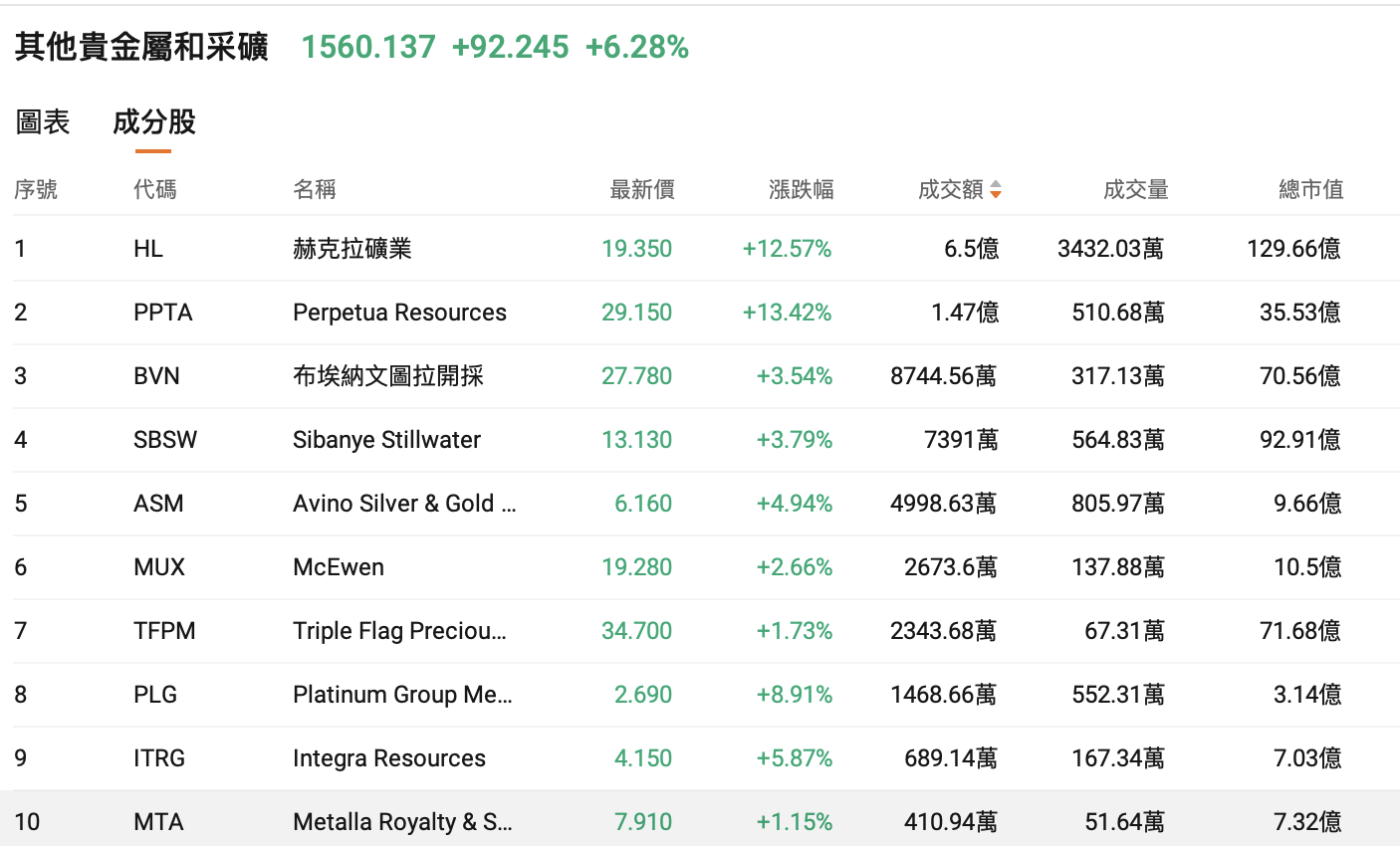

The US stock market witnessed a dramatic rotation of investment styles. Technology stocks were hit while small-cap and cyclical stocks gained. Precious metals performed strongly against the backdrop of the Federal Reserve’s interest rate cuts, with LME copper reaching an all-time intraday high. Silver prices rose for the third consecutive session to a new record, while gold also strengthened simultaneously.

The three major indices ended mixed as of the market close,$Dow Jones Index (.DJI.US)$Up 1.34%,$Nasdaq Composite Index (.IXIC.US)$falling by 0.25%,$S&P 500 Index (.SPX.US)$up by 0.21%.

$明星科技股(LIST2518.US)$Most have declined.$Oracle (ORCL.US)$ falling more than 10%, $Google-C (GOOG.US)$ falling more than 2%. $Tesla (TSLA.US)$ 、 $NVIDIA (NVDA.US)$ Down more than 1%.

$热门中概股(LIST2517.US)$ Mixed gains and losses, $KE Holdings (BEKE.US)$rose nearly 3%. $Nio (NIO.US)$ Up nearly 2%, $Baidu(BIDU.US)$ rising more than 1%, $Alibaba(BABA.US)$ with declines exceeding 1%. $PDD Holdings (PDD.US)$、 $XPeng Motors (XPEV.US)$ Dropped more than 2%.

$Silver/USD (XAGUSD.FX)$ once surged to $64, continuing to set new all-time highs.

$黄金(LIST2110.US)$ Stocks related to the concept generally rose, $Coeur Mining, Inc. (CDE.US)$ rising over 9%, $Newmont (NEM.US)$ Up more than 5%.

$Silver (LIST2093.US)$ Concept stocks continued to rise, $First Majestic Silver(AG.US)$ 、 $New Pacific Metals(NEWP.US)$ Up more than 7%.

$Other Precious Metals and Mining (LIST2507.US)$ Stocks generally rose, $Hecla Mining (HL.US)$ rose more than 12%, $Perpetua Resources(PPTA.US)$ with gains exceeding 13%.

$Diversified Banks (LIST2481.US)$ generally rose. $JPMorgan (JPM.US)$ 、 Wells Fargo & Co (WFC.US) Rose more than 2%.

$加密货币(LIST20781.US)$ 、 $Semiconductor(LIST2015.US)$ The sector declined, $Robinhood(HOOD.US)$ Dropping more than 9%, $Arm Holdings(ARM.US)$ 、 $Intel (INTC.US)$ Dropped more than 3%.

Individual stock news

Broadcom's Q4 results exceeded expectations; however, due to AI product impacts, the gross margin for fiscal Q1 2026 is expected to narrow by 1%.

$Broadcom (AVGO.US)$ Both adjusted earnings per share and revenue exceeded market expectations, driven by strong demand for artificial intelligence. Broadcom provided robust guidance for the current quarter. The company stated that first-quarter revenue is projected to be approximately $19.1 billion, a year-over-year increase of 28%, surpassing the analysts' average estimate of $18.3 billion. CEO Hock Tan stated in the announcement that Broadcom anticipates artificial intelligence chip sales to double year-over-year to $8.2 billion this quarter.

However, Broadcom’s CFO noted during the earnings call that the gross margin for the first fiscal quarter will narrow by 1% due to artificial intelligence (AI) products. Affected by this news, Broadcom shares fell more than 5% in post-market trading after initially rising over 4%.

Apple loses appeal court ruling in Epic App Store dispute

The U.S. Federal Appeals Court in the Epic vs. $Apple(AAPL.US)$ In the long-standing dispute, the court supported Epic Games, upholding the lower court's contempt ruling against Apple, and directed a judge to determine how much commission Apple can charge developers for transactions occurring outside its app store. In a 54-page decision issued on Thursday, the Ninth Circuit Court of Appeals in San Francisco noted that Apple’s 27% fee on relevant transactions violated the lower court’s injunction and affirmed U.S. District Judge Rogers’ ruling that Apple was in contempt. However, the three-judge panel stated that Rogers should reconsider how much Apple can charge developers for using its intellectual property.

The court stated: 'Apple is entitled to reasonable compensation for the use of intellectual property that directly enables Epic Games and other parties to complete external purchases.' More than five years ago, Epic Games accused Apple of illegally stifling competition in its app store, leading to a protracted legal battle between the two companies. In April, Rogers ruled that Apple had willfully defied her 2021 order, which required Apple to allow developers to direct consumers to cheaper online payment options. Apple’s commission of 15% to 30% on most in-app purchases has long frustrated developers.

As the race with Google intensifies, OpenAI launches the more advanced model GPT-5.2, causing Google’s stock to drop by over 2%.

Eastern Time on December 11, OpenAI announced in a statement that the company launched the GPT-5.2 artificial intelligence model on Thursday, claiming improvements in general intelligence, coding, and long-context understanding. A few weeks ago, Google (GOOGL.US) the widely popular Gemini 3 was released, putting the startup on the defensive. OpenAI stated that the new model promises greater economic value for users due to its enhanced performance in creating spreadsheets, building presentations, and handling complex multi-step projects.

According to reports, the GPT-5.2 Instant, Think, and Pro versions will be rolled out sequentially in ChatGPT starting Thursday, with paid subscribers gaining early access. GPT-5.2 is priced at $1.75 per million input tokens and $14 per million output tokens, with a 90% discount for cached inputs. OpenAI also stated that it currently has no plans to deprecate GPT-5.1, GPT-5, or GPT-4.1 in the API. CEO Altman stated: 'The impact of Gemini 3 on us was not as severe as we feared.' Altman expects OpenAI to exit 'red alert' status by January next year and return to normal operations with strong momentum.

Following the news, Google (GOOGL.US) Dropped more than 2%.

Microsoft CEO: Plans to integrate the GPT-5.2 model into Microsoft Foundry and Copilot Studio.

Eastern Time on December 11, $Microsoft(MSFT.US)$ the CEO stated:

We are thrilled about the launch of GPT-5.2 by our partner OpenAI. By natively integrating it into Microsoft tools used daily and combining it with your work data, the full potential of this new model can be unleashed.

In GitHub Copilot, GPT-5.2 is an outstanding multi-functional model, particularly excelling in programming or researching complex codebases with its long-context processing and reasoning capabilities. This model has officially launched today.

We will also introduce the GPT-5.2 model into Microsoft Foundry and Copilot Studio, while gradually rolling it out in consumer-facing Copilot experiences.

NVIDIA to Host Event Addressing Power Shortages in Data Centers

According to several invitees, $NVIDIA (NVDA.US)$ NVIDIA plans to host a private summit next week, inviting startups focused on solving data center power issues — problems that could hinder the development of artificial intelligence. The summit will take place at NVIDIA’s headquarters in Santa Clara, California, indicating that energy shortages are impacting companies building facilities equipped with NVIDIA’s high-power AI server chips. Executives from startups in the fields of electricity and electrical engineering are expected to attend, including some companies in which NVIDIA has invested. These companies’ products span multiple areas, ranging from software to physical power equipment technologies. An NVIDIA spokesperson declined to comment.

CoreWeave announces an agreement with Runway to provide technical support for its next-generation AI video model.

Eastern Time, December 11 – the cloud platform dedicated to artificial intelligence $CoreWeave(CRWV.US)$ It was announced that Runway, a global artificial intelligence company dedicated to building the next generation of intelligence and advancing human creativity, has signed a contract with CoreWeave. CoreWeave will provide AI cloud solutions to expand and accelerate Runway’s next-generation video generation models.

Disney shares surged over 2% after it announced a $1 billion investment in OpenAI and authorized the use of its IPs, including Marvel and Star Wars, in Sora.

$Disney (DIS.US)$ Disney announced a $1 billion investment in the artificial intelligence (AI) research company OpenAI, while also authorizing the latter to utilize its extensive portfolio of IPs in the AI video generation tool Sora. Under the licensing agreement, starting early next year, Sora and ChatGPT Images will be able to create content featuring over 200 characters from Disney, Marvel, Pixar, and Star Wars.

Rivian Automotive, often referred to as 'Tesla's rival,' unveiled its own AI chip aimed at replacing NVIDIA’s products in future models, though its stock price plummeted by as much as 10%.

According to foreign media reports, Rivian Automotive, a U.S.-based electric vehicle company and often regarded as 'Tesla's rival,' $Rivian Automotive(RIVN.US)$ is developing its own artificial intelligence chips to replace $NVIDIA (NVDA.US)$ technology as part of a broader initiative to enhance and expand autonomous driving capabilities in its future vehicles. Rivian will equip its upcoming R2 sport utility vehicle with the Rivian Autonomous Processor chip (RAP1) and a new LiDAR sensor.

$Taiwan Semiconductor (TSM.US)$ will be responsible for manufacturing these chips. The development of new sensors and AI models will help Rivian achieve its ultimate goal of providing autonomous driving capabilities. It is reported that two RAP1 chips will power Rivian’s next-generation onboard computer, the Autonomy Compute Module 3, which can process five billion pixels per second, delivering performance four times that of the NVIDIA system currently used in Rivian’s existing models.

Tesla's November sales in the U.S. fell to a near four-year low as cheaper models failed to reverse the decline.

On December 12, despite $Tesla (TSLA.US)$ launching a more affordable version of its best-selling electric vehicle, the company’s sales in the U.S. in November dropped to their lowest level in nearly four years. Since the Trump administration canceled the $7,500 federal tax credit at the end of September, overall electric vehicle sales in the U.S. have been significantly impacted.

To address the decline in demand, Tesla introduced simplified configurations of the Model Y and Model 3 in October, priced approximately $5,000 lower than the previous base models. While standard version demand was expected to support November sales, data from Cox shows that Tesla’s total sales for the month still fell nearly 23% year-over-year, dropping from 51,513 units last year to 39,800 units, marking the lowest level since January 2022.

Eli Lilly and Co Announces New Weight-Loss Drug Data: Nearly a Quarter Reduction in Body Weight, Knee Pain Relief Exceeds Expectations

The latest trial data reveals that $Eli Lilly and Co (LLY.US)$ the next-generation weight-loss injection has helped participants shed an average of nearly a quarter of their body weight, positioning it to potentially become the most potent weight-loss medication to date. On Thursday, Eli Lilly published Phase III clinical trial data for retatrutide on its official website. The highest dose group (12 mg) experienced a 23.7% reduction in body weight over 68 weeks, with a 62.6% decrease in knee pain subscale scores. Prior Wall Street forecasts anticipated a weight reduction between 20% and 23%, with a 50% drop in knee pain subscale scores. Eli Lilly stated that the results exceeded expectations, with some patients even voluntarily withdrawing from the trial due to excessive weight loss.

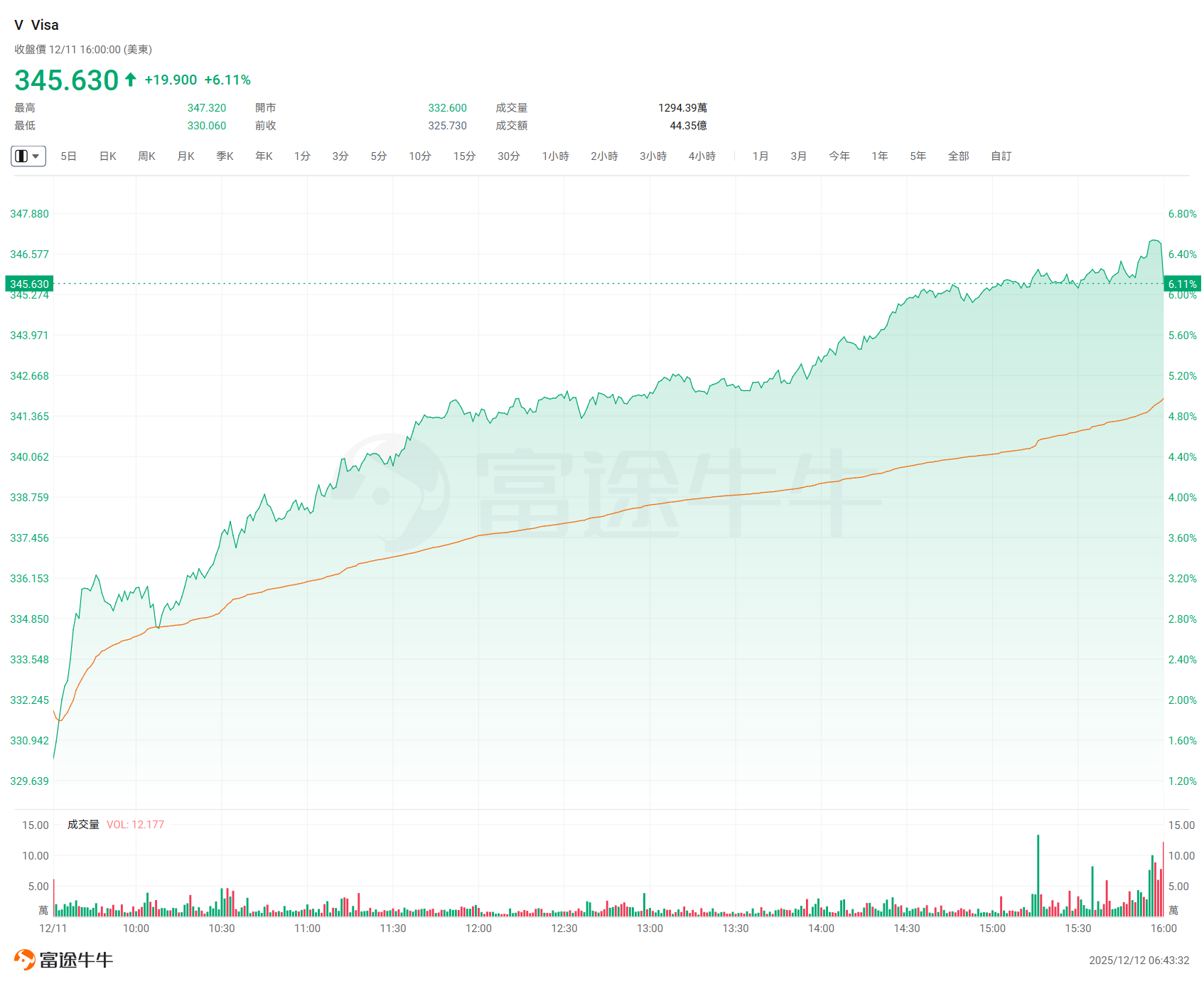

$Visa(V.US)$ Shares closed more than 6% higher as Bank of America Global Research upgraded Visa’s stock rating from Neutral to Buy.

$Costco (COST.US)$ Revenue for Q1 of fiscal year 2026 amounted to $67.31 billion, representing a 6.4% year-over-year increase, with adjusted earnings per share at $4.5, reflecting an 11.4% year-over-year growth.

$Lululemon Athletica(LULU.US)$ Revenue for Q3 of fiscal year 2025 reached $2.6 billion, up 7% year-over-year, with after-hours trading surging by 10%.

Ciena’s fourth-quarter results surpassed expectations, driven by robust demand for cloud computing and artificial intelligence, with shares rising over 9%.

Network equipment manufacturer $Ciena(CIEN.US)$ released its financial performance for the fourth quarter of fiscal year 2025, reporting revenue of $1.35 billion, surpassing analysts’ expectations of $1.29 billion. Adjusted earnings per share stood at $0.91, also exceeding forecasts of $0.77. The company attributed the better-than-expected performance to strong demand from cloud computing and service providers, along with expanding opportunities in artificial intelligence and data centers. Ciena anticipates first-quarter sales to range between $1.35 billion and $1.43 billion, above the expected $1.252 billion.

Top 20 by Trading Value

Market Outlook

Northbound capital purchased over HKD 1.2 billion worth of Meituan shares and over HKD 1 billion worth of Xiaomi Group shares, while selling more than HKD 500 million worth of China National Offshore Oil Corporation shares.

On December 11 (Thursday), southbound funds recorded a net purchase of HKD 791 million in Hong Kong stocks today.

$Meituan-W(03690.HK)$、$Xiaomi Group-W(01810.HK)$、$KE Holdings-W (02423.HK)$The respective net purchases amounted to HKD 1.279 billion, HKD 1.009 billion, and HKD 647 million.

$CNOOC Limited (00883.HK)$、$Alibaba-W (09988.HK)$、$SMIC (00981.HK)$The respective net sales amounted to HKD 518 million, HKD 417 million, and HKD 403 million.

The Hang Seng Hong Kong Connect Software and Semiconductor Index will be renamed, removing four stocks including SMIC and Huahong Semiconductor.

The Hang Seng Hong Kong Connect Software and Semiconductor (Investable) Index will be renamed as the Hang Seng Hong Kong Connect Software Theme Index. $China Literature Limited (00772.HK)$ 、 $Quzhi Group (00917.HK)$ 、 $Meitu(01357.HK)$ 、 Mobvista Technology (01860.HK) Four stocks will be added, and four stocks will be removed, $ASMPT(00522.HK)$ 、 $SMIC (00981.HK)$ 、 $Hua Hong Semiconductor (01347.HK)$ 、 $Innoscience (02577.HK)$ effective on Tuesday, December 16, 2025.

Leapmotor: Chairman Zhu Jiangming and shareholder Fu Liquan increased their holdings by 2.15 million shares, amounting to over HKD 100 million.

Leapmotor (09863.HK) In an evening announcement, it was disclosed that recently, Zhu Jiangming, shareholder, chairman, and CEO of the company, along with Fu Liquan, another shareholder of the company, collectively purchased 2,150,600 H-shares of the company (this increase in holdings) at an average price of approximately HKD 50.51 per share, totaling an investment exceeding HKD 100 million. Immediately following this increase in holdings, as of the date of this announcement, Mr. Zhu Jiangming, Mr. Fu Liquan, and the group constituting the single largest shareholder of the company collectively hold 209,100,538 H-shares and 128,517,839 domestically listed shares of the company, representing 23.75% of the company's total issued shares.

CIFI Holdings Group: Plans to repurchase seven corporate bonds with a total repurchase amount not exceeding RMB 220 million.

$CIFI Holdings Group (00884.HK)$ CIFI Group Co., Ltd., a domestic bond-issuing entity under its group, announced its intention to repurchase seven outstanding corporate bonds issued by the company using its own funds. The total upper limit for the proposed repurchase is RMB 220 million. In September this year, CIFI Holdings Group announced that restructuring plans for corporate bonds with a principal amount exceeding RMB 1 billion had been approved.

According to the approved proposal, bond repurchases will commence within three months after the resolution is passed, with the repurchase price set at 18% of the bond's face value. However, bondholders must forfeit all accrued interest. The announcement states that the subscription period for this bond repurchase will be from December 16 to December 23 (trading hours only), and the settlement date for the repurchase funds will be December 31.

Meituan drones launch the first batch of regular medical routes within Shanghai.

According to $Meituan-W(03690.HK)$ Following the upgrade of Hong Kong routes and the launch of nighttime delivery services in Shenzhen, Meituan drones have recently achieved significant breakthroughs in the medical delivery sector. On the morning of December 10, Meituan drones, in collaboration with Renji Hospital affiliated with Shanghai Jiao Tong University School of Medicine, successfully completed the first drone delivery of medical samples within Shanghai. This not only marks the official opening of Shanghai's first batch of regular drone medical delivery routes but also ushers in a new chapter in the intelligent development of domestic medical logistics.

Today's Focus

Keywords: Statements by Federal Reserve officials

In terms of economic data, there will be no releases in China or the US. Investors may focus on relevant economic data from Europe and Canada.

At 15:00, the final month-over-month CPI for Germany in November;

At 15:00, the three-month GDP month-over-month rate for the UK in October, the month-over-month manufacturing output for the UK in October, the seasonally adjusted trade balance of goods for the UK in October, and the month-over-month industrial production for the UK in October;

At 15:45, the final month-over-month CPI for November in France will be released.

At 21:30, the month-over-month wholesale sales data for October in Canada will be announced.

On the economic events front, following the release of the December interest rate decision, Federal Reserve officials are scheduled to make several appearances on Friday:

At 21:00, Harker, the 2026 FOMC voting member and President of the Federal Reserve Bank of Philadelphia, will deliver a speech on the economic outlook.

At 21:30, Harker, the 2026 FOMC voting member and President of the Federal Reserve Bank of Cleveland, will deliver remarks.

At 23:35, Goolsbee, President of the Chicago Federal Reserve, will participate in a moderated discussion ahead of the 39th Annual Economic Outlook Symposium hosted by the Chicago Fed.

Additionally, the White House will convene an Artificial Intelligence Supply Chain Summit on December 12 with allies such as South Korea, the UAE, and Australia, where agreements are expected to be signed in areas including energy, critical minerals, advanced manufacturing, semiconductors, AI infrastructure, and transportation logistics.

Finally, $Nasdaq 100 Index (.NDX.US)$ The annual index composition adjustment may be announced after the market closes on Friday.

![]()

Morning Reading by Niuniu:

To achieve tremendous success in investment, one cannot afford to rush; patience is required. Sometimes, it is even necessary to forgo immediate gains in pursuit of greater returns in the future.

— Charlie Munger

![]() AI Portfolio Strategist goes live!One-click insight into holdings, fully grasp opportunities and risks.

AI Portfolio Strategist goes live!One-click insight into holdings, fully grasp opportunities and risks.

Editor/Doris