Goldman Sachs noted that Broadcom delivered a strong performance in the fourth fiscal quarter with significant growth in AI revenue. However, the stock may face short-term pressure as the company did not raise its full-year guidance for fiscal 2026. The firm maintains its 'Buy' rating, citing Broadcom's solid position in the custom chip market and underappreciated growth potential in its AI business, expecting it to outperform in the medium to long term. With a backlog of orders reaching $73 billion, new client acquisitions and large-scale contracts are reinforcing growth momentum.

Despite $Broadcom (AVGO.US)$ Despite failing to raise its full-year guidance for the fiscal year 2026 as expected by some investors, and potentially facing short-term stock price correction pressures, Goldman Sachs has reiterated its 'Buy' rating for the company. The Wall Street giant believes that Broadcom's dominance in the custom chip sector is strengthening, and the fundamentals of its AI business have never been more solid.

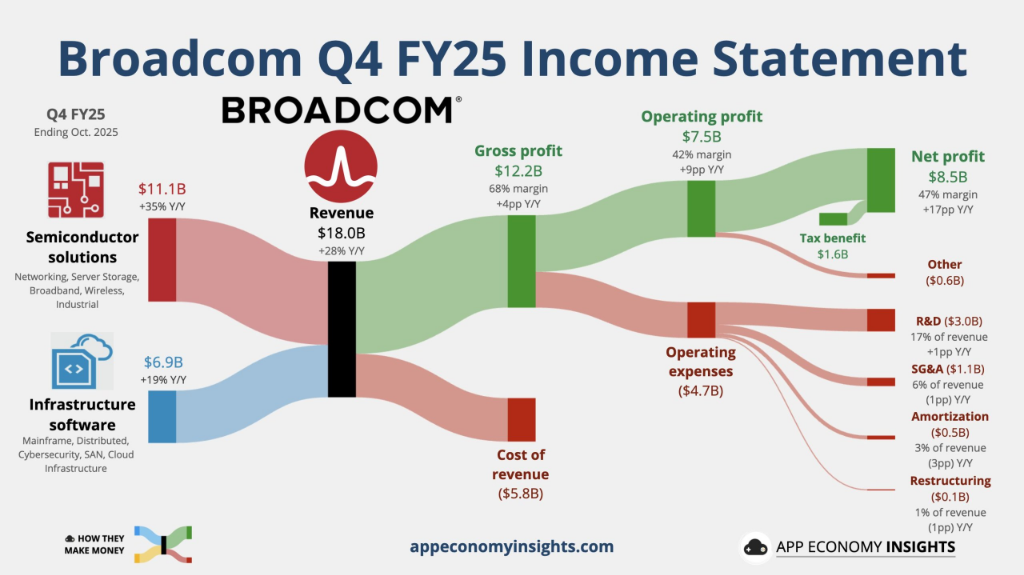

According to Storm Chaser Trading Desk, Broadcom reported robust fourth-quarter results with revenue reaching $18 billion, surpassing market expectations of $17.5 billion. More importantly, the company’s revenue guidance for the first quarter of fiscal 2026 came in at $19.1 billion, significantly higher than analysts’ expectations of $18.3 billion. This growth was primarily driven by a surge in AI semiconductor revenue, which recorded a 74% year-over-year increase in the fourth quarter.

However, the market’s reaction to this earnings report may be mixed with disappointment. In their latest research note, Goldman Sachs analyst James Schneider’s team pointed out that despite strong results and an optimistic outlook for the first quarter, management did not update or raise its previously issued AI revenue growth guidance for the full year of fiscal 2026. Considering that investors had already taken constructive long positions ahead of the earnings release, and given the accelerating signs in the AI business, the lack of a formal upward revision to the full-year guidance could be seen as a letdown, potentially leading to a short-term pullback in the stock price.

However, the market’s reaction to this earnings report may be mixed with disappointment. In their latest research note, Goldman Sachs analyst James Schneider’s team pointed out that despite strong results and an optimistic outlook for the first quarter, management did not update or raise its previously issued AI revenue growth guidance for the full year of fiscal 2026. Considering that investors had already taken constructive long positions ahead of the earnings release, and given the accelerating signs in the AI business, the lack of a formal upward revision to the full-year guidance could be seen as a letdown, potentially leading to a short-term pullback in the stock price.

Nevertheless, Goldman Sachs emphasized that this does not alter its long-term bullish thesis and raised Broadcom’s 12-month target price from $435 to $450. Goldman Sachs stated that any weakness in the stock should be viewed as a buying opportunity. The firm is confident that Broadcom’s leadership in custom chips (XPUs) is solidifying its core position in the low-cost inference market for hyperscale computing enterprises, with sustained demand from major clients like Google expected to drive its AI business to consistently outperform peers in the medium to long term.

The absence of an updated full-year guidance may trigger a pullback.

During this earnings call, although Broadcom’s management indicated that AI revenue growth is accelerating from 65% in fiscal 2025 and projected approximately 100% growth for the first quarter, they did not provide a formal update on AI revenue growth expectations for fiscal 2026.

James Schneider wrote in the report that given the lack of upside space for a guidance raise for fiscal 2026, despite strong quarterly results and guidance above Wall Street expectations, a stock price correction is still expected. Investors had already established constructive positions, so this “missing guidance update” might weigh on market sentiment in the short term.

However, based on its proprietary industry research model, Goldman Sachs predicts that Broadcom’s AI revenue growth for fiscal 2026 will actually far exceed 100%. Analysts believe that management’s conservatism does not reflect the actual business momentum, and Goldman Sachs’ confidence in Broadcom’s AI business continuing to outperform the broader market is increasing.

AI Customer Expansion: Anthropic's $10 Billion Order and New Clients

Setting aside guidance issues, Broadcom has made substantial progress in customer expansion. The report shows that Broadcom not only maintained strong momentum with its largest client, Google, in the TPU project but also disclosed significant developments with new key clients.

Goldman Sachs emphasized that Broadcom has announced the acquisition of a fifth XPU customer (explicitly stated not to be OpenAI), with early revenue expected to commence in fiscal year 2026. Additionally, Anthropic, Broadcom's fourth-largest XPU customer, has placed an incremental order worth up to $11 billion for fiscal year 2026.

The current backlog of orders also underscores robust demand. Management disclosed that the AI order backlog for the next 18 months has reached $73 billion and continues to expand as additional orders are added. Besides Google, management mentioned that other clients, including Apple and Cohere, have begun adopting its TPU-related technology, although two existing customers remain focused on their custom chip projects.

Outperformance in Financial Results and Margin Trends

In terms of specific financial data, Broadcom's performance exceeded both Goldman Sachs' and Wall Street's consensus expectations across the board. In the fourth fiscal quarter, the company’s AI semiconductor revenue reached $6.5 billion, surpassing the expected $6.2 billion; total semiconductor solutions revenue amounted to $11.1 billion, higher than the anticipated $10.7 billion; and infrastructure software revenue came in at $6.9 billion, slightly above expectations.

In terms of profitability, Broadcom's gross margin for the fourth fiscal quarter was 77.9%, slightly above market expectations. For the first quarter of fiscal year 2026, the company provided guidance for an adjusted EBITDA margin of 67%.

Notably, Goldman Sachs mentioned in its report that as Broadcom begins delivering full-rack solutions to Anthropic and potentially OpenAI in the second half of fiscal year 2026, these solutions—due to their higher proportion of pass-through components—may cause some dilution to gross and operating margins on a percentage basis. However, the company anticipates that this business will continue to have a strong accretive effect in absolute dollar terms and plans to offset some of the dilutive impact through operational leverage and other cost optimization measures.

Valuation Framework and Risk Factors

Based on upward revisions to AI revenue forecasts and improved visibility into the industry cycle, Goldman Sachs maintained its price-to-earnings (P/E) multiple of 38x but raised its normalized earnings per share (EPS) estimate from $11.50 to $12.00, resulting in a new target price of $450. As of this writing, Broadcom shares fell 4.47% after hours to $406.

Goldman Sachs reiterated that Broadcom’s dominance in the custom chip space allows it to offer low-cost inference solutions to hyperscale enterprises and model builders, forming the core of its investment thesis.

At the same time, the report outlined key downside risks for the stock, including: a slowdown in AI infrastructure spending, loss of market share in the custom computing segment, ongoing inventory digestion issues in non-AI businesses, and intensified competition faced by VMware.

Editor/jayden