Top News

Before the market opened on Friday, bets that the Federal Reserve would adopt a looser policy pushed silver prices to a new high, with spot gold reclaiming the $4,300 mark. However, following Broadcom's earnings report, concerns about AI persisted, leaving the three major U.S. stock index futures mixed: Dow Jones futures rose 0.24%, Nasdaq futures fell 0.54%, and S&P 500 futures dropped 0.13%.

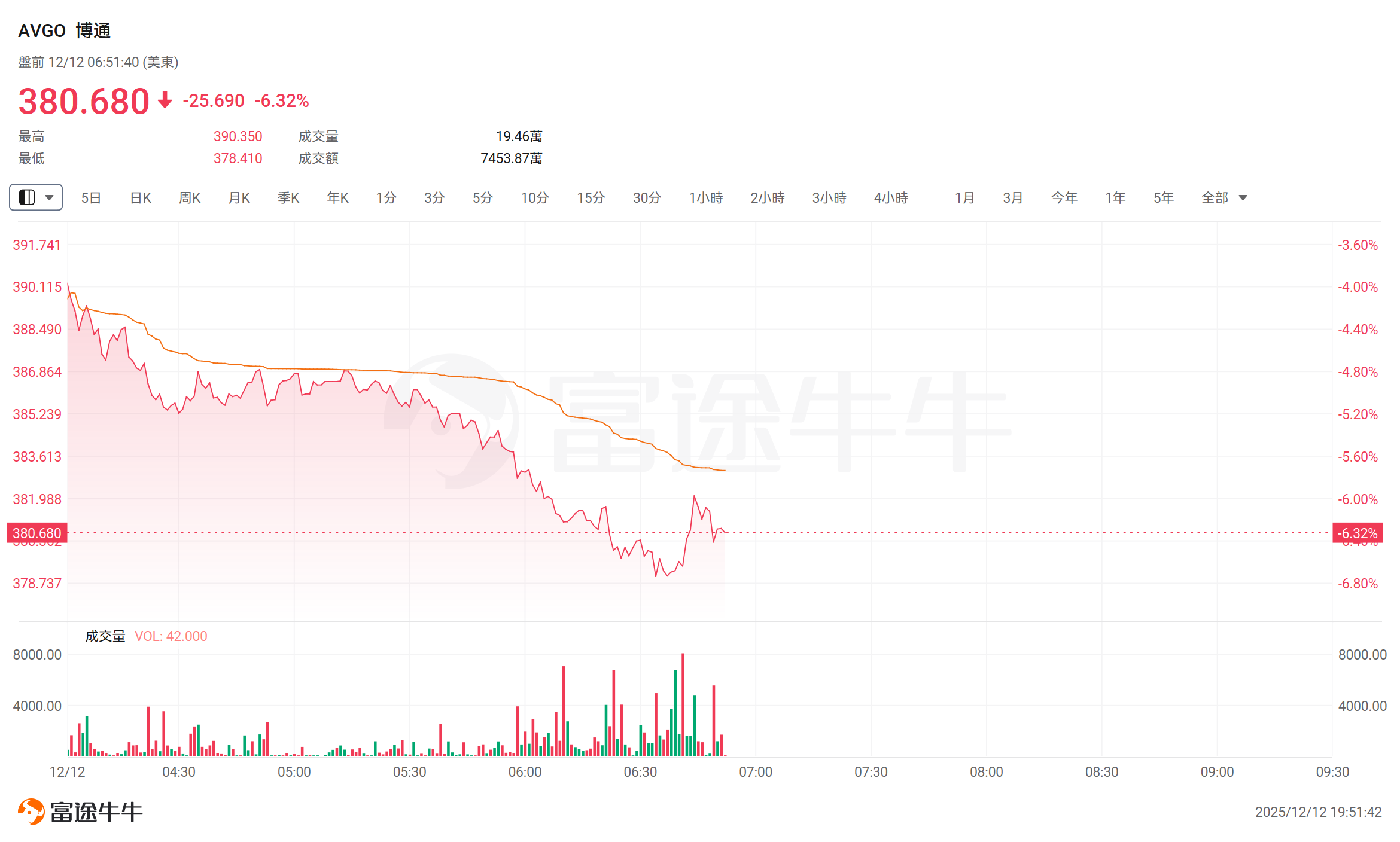

$Star Tech Companies (LIST2518.US)$ Most stocks traded lower in pre-market activity. $Broadcom (AVGO.US)$ Dropped over 6%, $Micron Technology (MU.US)$ 、 $Advanced Micro Devices (AMD.US)$ Down more than 1%.

$China Concept Stocks (LIST2517.US)$ Most stocks rose before the market opened, $NetEase (NTES.US)$ with a rise of over 3%, $Baidu (BIDU.US)$ 、 $Li Auto (LI.US)$ Surged over 1%.

$Gold (LIST2110.US)$ Pre-market trading higher, $Coeur Mining (CDE.US)$ surging over 4%, $Pan American Silver (PAAS.US)$ with a rise of over 3%, $Newmont (NEM.US)$ 、 $Barrick Mining (B.US)$、 $Harmony Gold Mining (HMY.US)$ Rose more than 2%.

$Gold (LIST2110.US)$ Pre-market trading higher, $Coeur Mining (CDE.US)$ surging over 4%, $Pan American Silver (PAAS.US)$ with a rise of over 3%, $Newmont (NEM.US)$ 、 $Barrick Mining (B.US)$、 $Harmony Gold Mining (HMY.US)$ Rose more than 2%.

The U.S. government is reportedly set to significantly ease restrictions on marijuana.$Cannabis & Hemp (LIST2997.US)$Pre-market trading saw significant gains in$Tilray Brands (TLRY.US)$ with some surging over 25%, $Canopy Growth (CGC.US)$, which surged over 19%, while$SNDL Inc (SNDL.US)$ Increased by more than 14%.

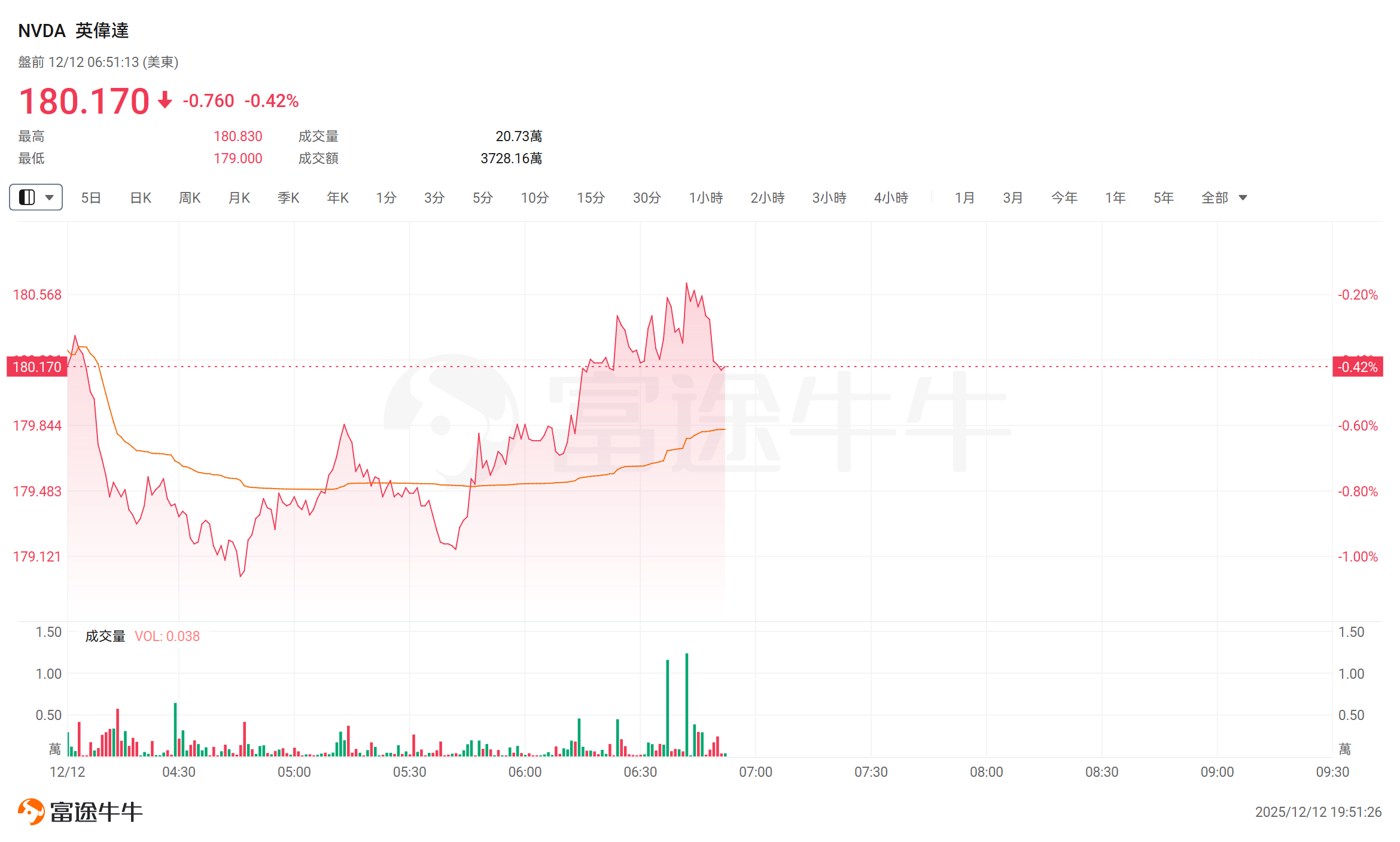

NVIDIA to Host Summit Next Week Amid Power Shortages for AI Development

According to The Information, NVIDIA will host a closed-door summit next week to address power shortages hindering AI development. The meeting will convene startups from the power and electrical engineering sectors, including some NVIDIA has already invested in, to explore solutions. This move sends a clear signal to the market: energy has become a critical component of the AI race, with NVIDIA taking steps to ensure its future growth by building an ecosystem.

Broadcom fell in pre-market trading. Goldman Sachs: No change to its long-term bullish logic.

$Broadcom (AVGO.US)$The stock dropped over 6%. In a recently published research report, Goldman Sachs analyst James Schneider’s team noted that despite robust earnings and an optimistic first-quarter outlook, management did not update or raise its previously issued full-year AI revenue growth guidance for fiscal year 2026. Given that investors had already taken bullish positions ahead of the earnings release, and the AI business itself is showing signs of acceleration, the lack of a formal upward revision to the full-year guidance may be perceived as a disappointment, leading to a short-term pullback in the stock price.

However, Goldman Sachs emphasized that this does not alter its long-term bullish thesis and raised Broadcom's 12-month target price from $435 to $450. Goldman Sachs stated that any weakness in the stock should be viewed as a buying opportunity. The firm is confident that Broadcom’s strengths in custom chips (XPUs) are establishing it as a core player in the low-cost inference market for hyperscale computing enterprises. Continued demand from major clients like Google is expected to drive its AI business to outperform peers over the medium to long term.

Earnings beat expectations and guidance was raised; Lululemon announces CEO will step down.

$Lululemon Athletica (LULU.US)$ Shares rose 9% in pre-market trading. The company’s third-quarter revenue and earnings per share exceeded expectations, and it raised its full-year 2025 revenue guidance. Amid intensifying competition and pressure from the founder, the company announced that CEO Calvin McDonald will step down on January 31.

Costco reported an 8.2% revenue increase last quarter, surpassing expectations, with online sales surging 20%.

$Costco (COST.US)$ Shares edged lower in pre-market trading. Revenue for the last quarter grew 8.2% year-over-year to $67.31 billion, with EPS at $4.50, both exceeding Wall Street expectations. Net income increased by 11.1% from $1.8 billion in the same period last year to $2 billion. The transition to e-commerce has been promising, with website traffic up 24% and app traffic surging 48%.

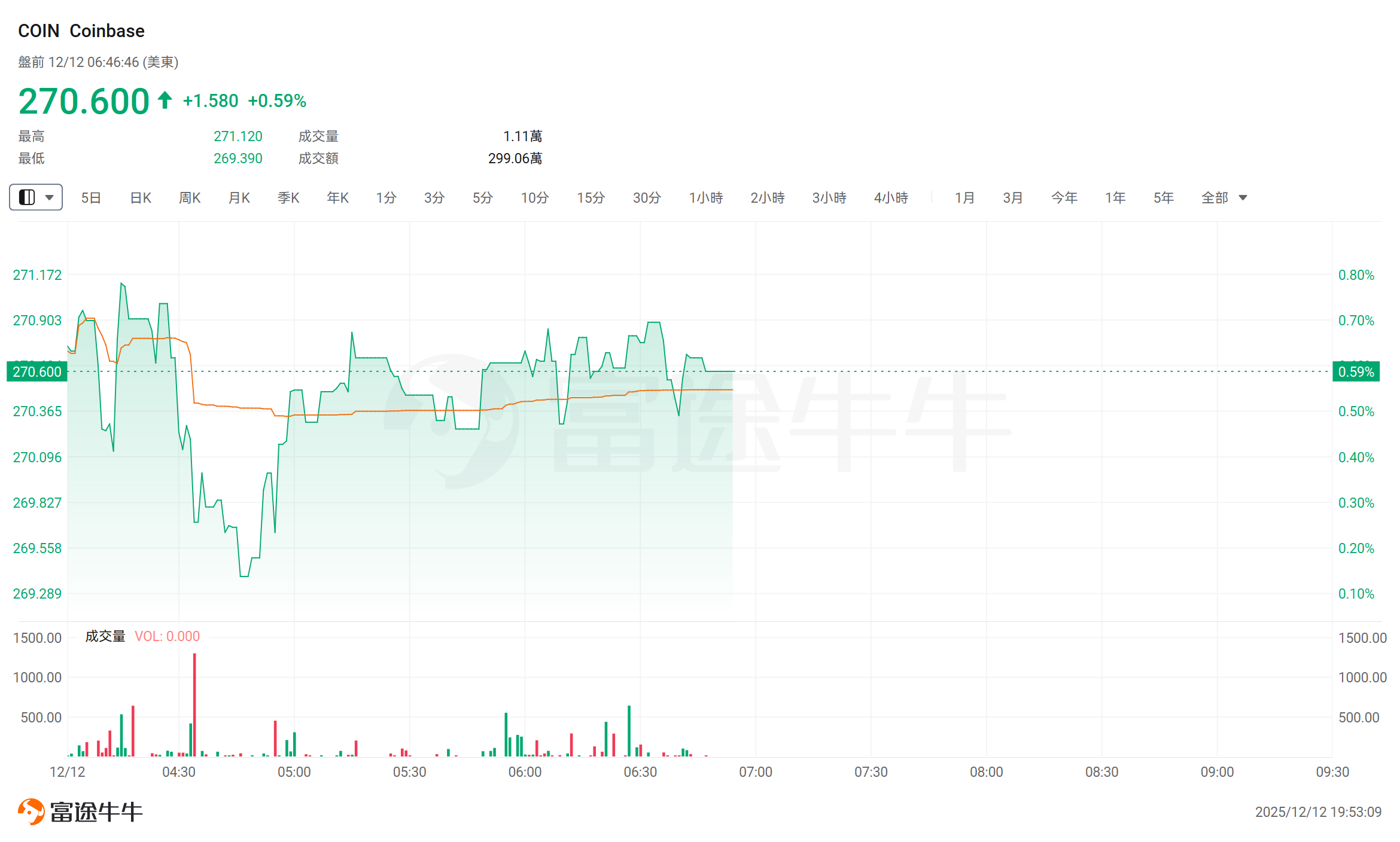

Catch the new trend! Coinbase’s tokenized stocks and prediction market features may launch as early as next week.

According to a person familiar with the matter, $Coinbase (COIN.US)$ Plans to announce the launch of prediction markets and tokenized stocks next week, two of the hottest products in financial markets. According to sources familiar with the matter, Coinbase, the largest U.S. cryptocurrency exchange, will officially unveil these products on December 17 during a showcase event. They indicated that its tokenized stocks will be launched internally rather than through partnerships. Coinbase executives have previously expressed interest in entering these business areas but have yet to formally announce their plans.

Kunlun Chip Gains Momentum! Wall Street Bullish on Baidu: Poised to Replicate Google’s AI Comeback

$Baidu (BIDU.US)$ Wall Street is reassessing Baidu's value amid expectations that Kunlun Chip, its chip subsidiary, will spin off and go public, shifting valuation logic from traditional businesses to hard-tech assets centered around chips. Macquarie Securities estimates that Baidu’s 59% stake in Kunlun Chip is worth approximately $16.5 billion, accounting for about 30% of its target valuation for Baidu. Kunlun Chip’s revenue is projected to double next year to around $1.4 billion, placing it in the same tier as Cambricon Technologies.

December 22nd Marks the Final Showdown for Warner's Acquisition! Paramount Demonstrates Strong Financial Power; Netflix May Exit with a $2.8 Billion Breakup Fee.

$Paramount Skydance (PSKY.US)$ It has made clear that the offer of $30 per share is not the 'best and final' bid. Analysts predict that if negotiations resume, Paramount may raise its offer to $32 per share, a level that would test $Netflix (NFLX.US)$ Netflix's willingness to counterattack. Since the news of Netflix’s interest in acquiring $Warner Bros Discovery (WBD.US)$ broke out in September, its market value has evaporated by 20%. However, it may now have a decent exit opportunity—collecting a $2.8 billion termination fee while avoiding regulatory scrutiny risks. Warner Bros Discovery’s board must respond to Paramount’s proposal by December 22, which will determine the final outcome of this Hollywood acquisition battle.

Global macro

Trump signed an executive order aimed at removing state legislative obstacles to AI.

On Thursday, U.S. President Trump signed an executive order allowing the U.S. Department of Justice to establish a legal task force to review AI laws across U.S. states, potentially withholding federal funding from states that do not comply. Speaking in the White House office, Trump emphasized that the United States must act in unison. However, the order has sparked divisions within the Republican Party, with some conservatives arguing that it undermines states’ ability to regulate AI and protect consumers.

Fed Predicts 'Negative Job Growth,' Market Expectations for Easing Intensify

Goldman Sachs noted that the biggest highlight of this week's Fed meeting is Powell acknowledging that the official employment growth data may be subject to 'serious systemic overestimation,' with the actual situation possibly already in negative growth territory. Current official figures may overstate job numbers by 60,000 per month, while the real labor market might already be mired in a 'monthly loss of 20,000 jobs' scenario. This grim situation is tilting the Fed's balance towards 'job protection.' Institutions predict that rising unemployment will force rate cuts, and markets are betting on more aggressive easing measures.

Is Silver Becoming the New Gold? Silver Prices Hit New Record Highs

On Friday, $XAG/USD (XAGUSD.FX)$ Prices continued to rise over 1%, setting a new historical high. In an article published by the Financial Times, columnist Gillian Tett delved into the underlying reasons behind the surge in silver prices: severe supply-demand imbalances underpinning robust fundamentals, heightened geopolitical risks exacerbating market volatility, retail enthusiasm and 'fear of missing out' psychology further driving demand, while expectations of dollar depreciation triggered by the Fed's rate-cutting cycle enhance its financial appeal. As analysts have said, 'Silver is becoming the new gold.'

The Bank of Japan May Reaffirm Rate Hike Commitment Next Week but Will Take It 'Step by Step,' Refusing to Set a Specific Endpoint

On the 12th, according to Reuters citing sources, the Bank of Japan (BoJ) may maintain its commitment to raising interest rates next week, with the pace of hikes depending on how the economy reacts to each rate increase. The latest survey shows that nine out of ten economists predict the BoJ will raise rates by 25 basis points at its December 18-19 meeting, with market pricing indicating a roughly 90% probability of a rate hike to 0.75% in December. However, informed sources noted that the BoJ will avoid using the 'neutral rate' estimate as a primary communication tool to guide future rate hike paths. Instead, the central bank will explain that future rate hike decisions will depend on observing how past rate increases have affected bank lending, corporate financing conditions, and broader economic activities to determine the timing of the next move.

Expectations for ECB Rate Hikes in 2024 Rekindled, Next Week’s Meeting to Focus on Five Key Signals

As the Federal Reserve shifts towards easing, the European Central Bank, amid sticky inflation and economic recovery, is being bet by the market to potentially restart rate hikes in 2026. The core of next week's meeting lies in verifying this policy reversal logic, with five key uncertainties surrounding the interest rate decision, future trajectory, inflation forecasts, external shocks, and personnel reshuffle. The latest survey shows that most economists have already adopted 'the next move will be a rate hike' as the new consensus.

Top 20 pre-market trading volume stocks in the U.S. stock market

U.S. Stock Market Macroeconomic Calendar Reminder

(The following times are in Beijing Time)

21:30 Canada October wholesale sales month-over-month rate

21:30 2026 FOMC voter, Cleveland Fed President Loretta Mester, delivers a speech

23:35 Chicago Fed President Austan Goolsbee participates in a moderated discussion prior to the 39th Annual Economic Outlook Symposium hosted by the Chicago Fed

Early next morning

02:00 U.S. weekly oil rig count as of December 12 (number of rigs)

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO