The three major U.S. stock indexes closed collectively lower, $Dow Jones Index (.DJI.US)$ Down 0.51%, $Nasdaq Composite Index (.IXIC.US)$ Down 1.69%,$S&P 500 Index (.SPX.US)$Down 1.07%.

Popular technology stocks fell broadly,$Broadcom (AVGO.US)$Fell more than 11%,$NVIDIA (NVDA.US)$Fell more than 3%. $Google-C (GOOG.US)$ 、$Microsoft(MSFT.US)$、 $Meta Platforms(META.US)$ 、$Amazon(AMZN.US)$All fell more than 1%,$Tesla (TSLA.US)$and rising more than 2%.

Top 5 Gainers in U.S. Equity ETFs

$AdvisorShares MSOS Daily Leveraged ETF (MSOX.US)$ Rose 107.85%, with a trading volume of $80.8269 million.

$ROUNDHILL CANNABIS ETF(WEED.US)$ Rose 55.65%, with a trading volume of $5.1264 million.

$ROUNDHILL CANNABIS ETF(WEED.US)$ Rose 55.65%, with a trading volume of $5.1264 million.

$ADVISORSHARES PURE US CANNABIS ETF(MSOS.US)$ Up 54.78%, with a trading volume of $469 million.

On the news front, the U.S. government is reportedly set to significantly relax restrictions on marijuana, causing cannabis stocks to soar collectively.

$AMPLIFY ETF TR SEYMOUR CANNABIS ETF(CNBS.US)$ Up 54.57%, with a trading volume of $6.94 million.

$ETFMG Alternative Harvest ETF(MJ.US)$ Up 42.77%, with a trading volume of $25.52 million.

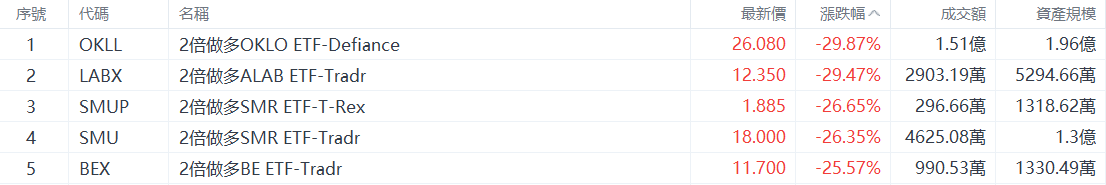

Top 5 Decliners on US Stock ETFs

$2x Long OKLO ETF - Defiance (OKLL.US) Down 29.87%, with a trading volume of $151 million.

$2x Leverage ALAB ETF-Tradr (LABX.US)$ Down 29.47%, with a trading volume of $29.03 million.

$2x Leveraged SMR ETF-T-Rex (SMUP.US)$ Down 26.65%, with a trading volume of $2.97 million.

$2x Long SMR ETN-Tradr(SMU.US)$ Dropped by 26.35%, with a trading volume of $46.2508 million.

In terms of news, nuclear power concept stocks plummeted significantly, with OKLO dropping over 15%. $2x Leveraged Short OKLO ETF-Defiance (OKLS.US)$ Surged over 30%.

$2x Leveraged BE ETF-Tradr (BEX.US)$ Dropped by 25.57%, with a trading volume of $9.9053 million.

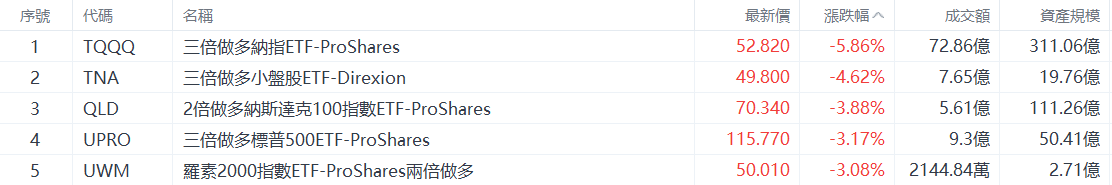

Top 5 Decliners in Major US Equity Index ETFs

$ProShares UltraPro QQQ (TQQQ.US)$ Dropped by 5.86%, with a trading volume of $7.286 billion.

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Dropped by 4.62%, with a trading volume of $765 million.

ProShares Ultra QQQ (QLD.US), which provides 2x daily leverage to the Nasdaq 100 Index, Dropped by 3.88%, with a trading volume of $561 million.

$ProShares UltraPro S&P 500 (UPRO.US)$ Dropped by 3.17%, with a trading volume of $930 million.

$ProShares Ultra Russell 2000 (UWM.US)$ Dropped by 3.08%, with a trading volume of $21.4484 million.

In terms of news, the three major U.S. stock indexes closed collectively lower, with technology stocks weighing on the Nasdaq, which fell by 1.69%. $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ rose nearly 6%.

Top 5 Industry-Specific ETFs by Decline

$Direxion Daily Semiconductor Bull 3X Shares (SOXL.US)$ Fell 14.51%, with a trading volume of $5.924 billion.

$VanEck Uranium+Nuclear Energy ETF (NLR.US)$ Fell 6.04%, with a trading volume of $67.1011 million.

$Semiconductor Index ETF-VanEck (SMH.US)$ Fell 4.53%, with a trading volume of $4.392 billion.

$Oil Services ETF-VanEck (OIH.US)$ Fell 2.93%, with a trading volume of $105 million.

$The Technology Select Sector SPDR® Fund (XLK.US)$ Fell 2.89%, with a trading volume of $2.095 billion.

Top 5 Decliners in Bond ETFs

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Fell 2.98%, with a trading volume of $260 million.

ProShares Ultra 20+ Year Treasury (UBT.US) Fell 1.94%, with a trading volume of $1.0424 million.

$Vanguard Long-Term Corporate Bond ETF (VCLT.US)$ Fell 0.99%, with a trading volume of $368 million.

iShares 20+ Year Treasury Bond ETF (TLT.US) Fell 0.96%, with a trading volume of $4.043 billion.

$iShares 10-20 Year Treasury Bond ETF (TLH.US)$ Down 0.72%, with a trading volume of $94.516 million.

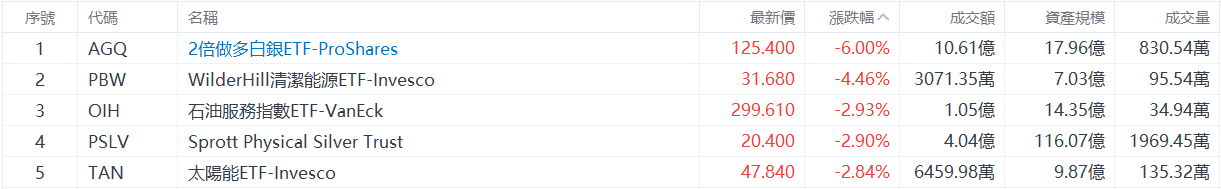

Top 5 Commodity ETF Decliners

$ProShares Ultra Silver ETF (AGQ.US)$ Down 6.00%, with a trading volume of $1.061 billion.

$WilderHill Clean Energy ETF - Invesco (PBW.US) Down 4.46%, with a trading volume of $30.7135 million.

$Oil Services ETF-VanEck (OIH.US)$ Down 2.93%, with a trading volume of $105 million.

$Sprott Physical Silver Trust(PSLV.US)$ Down 2.90%, with a trading volume of $404 million.

$Invesco Solar Energy ETF (TAN.US)$ Down 2.84%, with a trading volume of $64.5998 million.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen