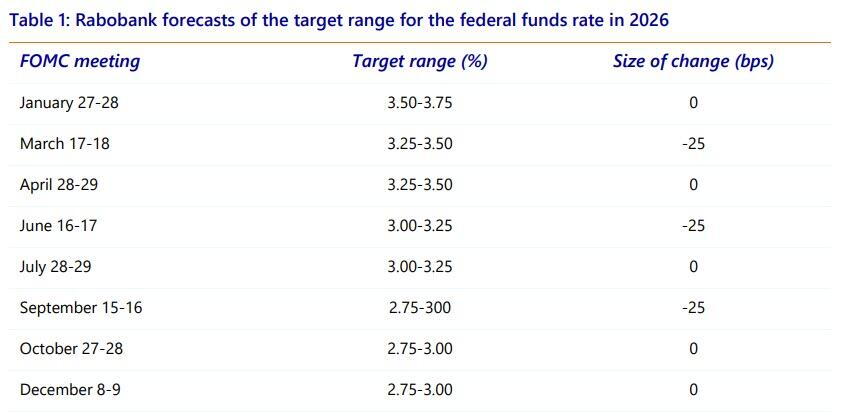

Rabobank believes that the Trump administration needs to stimulate the economy before next year's midterm elections to retain congressional seats; considering the lag in monetary policy transmission, rate cuts must be completed by October to influence the November election. The Federal Reserve may cut rates to 2.75%-3.00% by September 2026, equivalent to three 25-basis-point rate cuts. The newly appointed chair is expected to announce a rate cut at the first meeting in June to demonstrate loyalty to the White House. Trump's nominees may secure a majority of 4:3 or even 5:2 on the Federal Reserve Board.

Rabobank believes that due to political pressures from the midterm elections and changes in the Federal Reserve's personnel structure, the Fed’s interest rate cuts in 2026 may exceed market expectations.

On December 12, Philip Marey, a senior strategist at Rabobank, noted that in order to stimulate the economy ahead of the U.S. midterm elections, the Federal Reserve is expected to reduce interest rates to a neutral level or even lower by November 2026, with the federal funds rate target range reaching 2.75%-3.00% by September 2026, compared to the current range of 3.50%-3.75%.

The new chair will preside over their first FOMC meeting on June 17-18, 2026, and Rabobank predicts that an interest rate cut will be announced during this meeting to demonstrate the new chair's loyalty to the White House.

The new chair will preside over their first FOMC meeting on June 17-18, 2026, and Rabobank predicts that an interest rate cut will be announced during this meeting to demonstrate the new chair's loyalty to the White House.

Previously, Trump stated that he had made a decision, and the market considers Hassett to be the most likely candidate. However, Marey noted that the final nominee’s name may not be particularly significant.

When Trump was interviewed by the media on Tuesday and asked whether the new chair must immediately cut interest rates, he responded, “Yes.” U.S. Treasury Secretary Bessent is leading the selection process and has set clear objectives for the next chair: lowering interest rates, easing regulations, and restructuring the Federal Reserve.

Rabobank warned that if the Federal Reserve next year ignores inflation risks and forcefully cuts interest rates for political loyalty, it could lead to long-term U.S. Treasury yields rising instead of falling. Once the market perceives an imbalance between the central bank’s commitment to its 'dual mandate' and political loyalty, inflation expectations may rise, thereby increasing breakeven inflation rates and pushing up the long end of the yield curve.

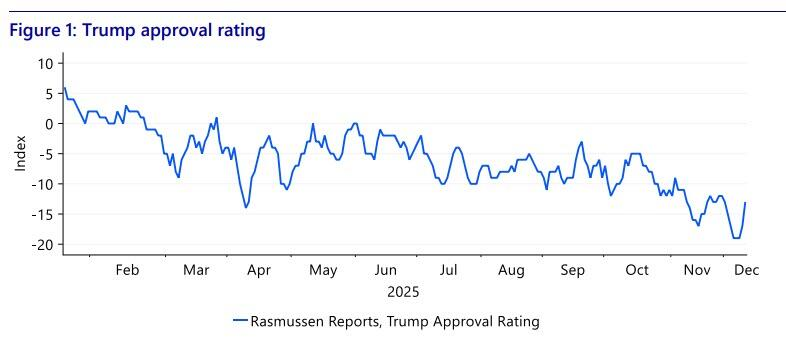

The midterm elections are not only a political milestone but also an anchor point for interest rates.

Philip Marey emphasized in his report that the 2026 midterm elections are a key temporal anchor driving the Federal Reserve’s dovish policy.

For incumbents, low interest rates help stimulate the economy, thereby increasing election odds. Although Trump is in his second term, if the Republican Party loses its majority in the Senate or House, his policy agenda will face significant constraints.

The current federal funds rate, which is above the neutral level, is considered a restrictive policy and is slowing economic growth. Therefore, in order to manifest the effects of policy before the midterm elections on November 26, 2026, the Trump administration needs the Federal Reserve to significantly cut interest rates prior to that.

Marey emphasized that, considering the lag in monetary policy transmission to the real economy, the rate cuts need to be completed by October 28, 2026; the December policy meeting would be too late for the election.

Based on this, Rabobank predicts that the FOMC will reduce rates to neutral or lower before Election Day, forecasting that the target range for the Federal Reserve’s federal funds rate will be 2.75%-3.00% by September 2026.

“Shadow Chair” and Board Restructuring Establish Influence

Philip Marey provided a detailed analysis of the potential changes in the power dynamics within the Federal Reserve.

Once Trump announces the nomination of a new chair, that individual will immediately become, in effect, Trump’s “shadow chair.” After Powell’s term ends on May 15, the statements of the “shadow chair” will have a significant impact on the market.

The new chair will preside over their first FOMC meeting on June 17-18, 2026, and Rabobank predicts that an interest rate cut will be announced during this meeting to demonstrate the new chair's loyalty to the White House.

Additionally, the composition of the Federal Reserve Board is undergoing changes favorable to the White House.

If Waller or Bowman receives the nomination for chair, they will immediately become the de facto “shadow chair” as members of the Federal Reserve Board.

If the nominee is Hassett, Warsh, or Rieder, they may fill Milan's seat on the Federal Reserve Board, which is set to expire on January 31, 2026 (three days after the conclusion of the FOMC meeting on January 27-28).

In this scenario, if the U.S. Senate confirmation process proceeds swiftly, the chair nominee could assume office as early as February in the capacity of a "regular" board member and participate in the FOMC meeting scheduled for March 17-18.

Even if Powell breaks with tradition and does not resign from his position as a board member after stepping down as chair, Trump would still have opportunities to strengthen his control through other means, such as pressuring Lisa Cook to resign. This could lead to a situation where Trump’s staunch supporters hold a majority of 4-to-3 or even 5-to-2 within the board, forming a powerful voting bloc aligned with the White House.

The Tug-of-War Between Inflation Expectations and the Yield Curve

Philip Marey pointed out that if the labor market remains weak and inflation stays under control through 2026, Trump's desire for interest rate cuts will temporarily align with the Fed’s “dual mandate,” which could push down U.S. Treasury yields.

However, if economic data proves strong and the FOMC continues cutting rates due to political motivations, markets could face risks stemming from diminished confidence in the Fed’s commitment to fighting inflation.

He emphasized that more importantly, if the Fed decides to cut rates while inflation remains persistently high, it may raise workers’ inflation expectations, leading to higher wage demands and fueling even higher inflation.

Such policy divergence could drive long-term interest rates higher, offsetting the easing effects of rate cuts.

Rabobank stressed that the Fed has decided to begin purchasing short-term Treasuries for reserve management starting December 12, primarily focusing on the short end of the curve. However, should long-term bond yields surge, the long end may also become a focal point of policy attention.

Philip Marey concluded by stating that in the future, if inflation persists, U.S. government policies, such as tariff policies, will play a greater role in controlling inflation.

Editor/melody