The year 2025 is drawing to a close, marking a tumultuous period: from Trump's return to the White House at the beginning of the year, the disruption of global markets by U.S. tariffs in April, to the Federal Reserve’s pivot towards an easing path, and the capital frenzy ignited by artificial intelligence...

As we look ahead to 2026, how can we seize new opportunities? Subscribe to our special feature."2025 Year in Review", let us reflect on the past, consolidate experiences, and together embrace the next chapter.

Looking back at 2025, the technology sector surged at the start of the year, the IPO market rebounded, and Hong Kong’s stock market experienced a strong upward trend; in April, the U.S.'s "reciprocal tariff" triggered global panic, causing a sharp decline in Hong Kong stocks, which then gradually recovered amid tariff negotiations, compounded by a wave of IPO listings that pushed the three major Hong Kong indices to new highs for the year in the third quarter.

Although the Hong Kong stock market showed weakness in the fourth quarter due to expectations of a hawkish shift in the Federal Reserve's policies and the peak of restricted stock unlocking, overall,$Hang Seng Index (800000.HK)$the year-to-date increase still exceeded 29%,$Hang Seng TECH Index (800700.HK)$surpassing 26%,$Hang Seng China Enterprises Index (800100.HK)$with cumulative gains exceeding 24% within the year.

Although the Hong Kong stock market showed weakness in the fourth quarter due to expectations of a hawkish shift in the Federal Reserve's policies and the peak of restricted stock unlocking, overall,$Hang Seng Index (800000.HK)$the year-to-date increase still exceeded 29%,$Hang Seng TECH Index (800700.HK)$surpassing 26%,$Hang Seng China Enterprises Index (800100.HK)$with cumulative gains exceeding 24% within the year.

As of December 12, the total trading volume of Southbound Stock Connect funds reached over HKD 27.8 trillion, surpassing last year's total of HKD 11.23 trillion, with an overall increase of nearly 1.5 times. The net purchase of Southbound funds exceeded HKD 1.3898 trillion, setting a new record for annual inflow size. Since the launch of Stock Connect, the cumulative net inflow has surpassed HKD 5 trillion, and this year will continue to maintain a streak of net purchases for 11 consecutive years since its inception.

In terms of the full-year flow of southbound funds, financials, non-essential consumption, and technology stocks are among the most favored targets for northbound capital.$BABA-W (09988.HK)$Starting this year, an AI infrastructure expansion plan was implemented, from Qwen3-Max to the Qwen app. Capital expenditures in the September quarter surged 80% year-on-year to RMB 32 billion. This year, Alibaba still ranks first in terms of net inflows of southbound funds. As of December 12, northbound capital has accumulated over HKD 177.6 billion worth of Alibaba shares this year, surpassing last year’s total of HKD 81.7 billion.

$MEITUAN-W (03690.HK)$、$CCB (00939.HK)$The second and third places received approximately HKD 71.4 billion and HKD 32.2 billion in additional investments, respectively, followed closely by$CHINA MOBILE (00941.HK)$and$TENCENT (00700.HK)$, which saw northbound capital buying approximately HKD 24.5 billion and HKD 23.8 billion worth of shares, respectively. Additionally,$SMIC (00981.HK)$has delivered an exceptionally remarkable performance with nearly 113% growth throughout the year.

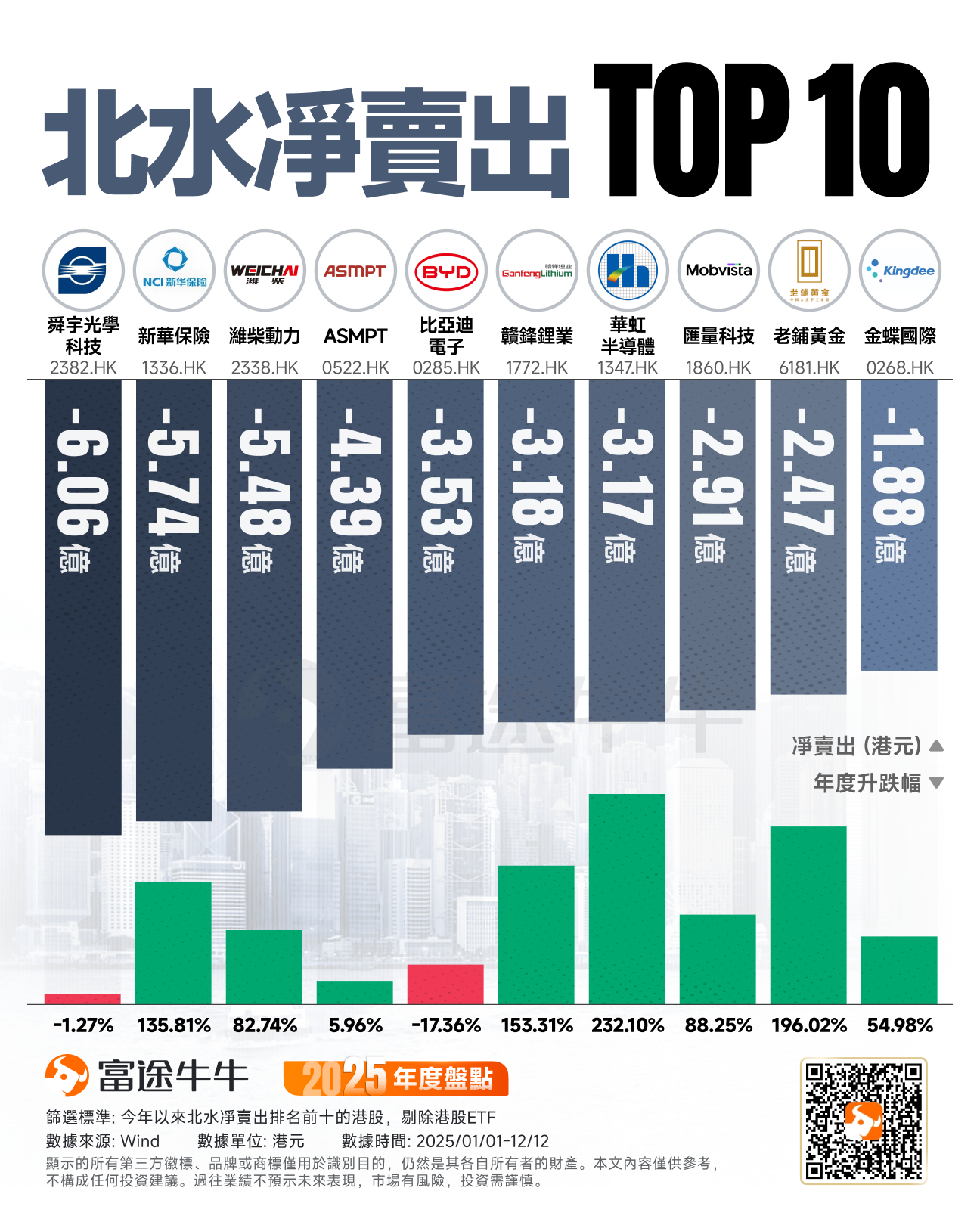

On the net selling side, Sunny Optical and China Life Insurance were heavily sold off, with$SUNNY OPTICAL (02382.HK)$ranking at the top of the selling list with HKD 606 million worth of shares sold, though its annual decline is not significant. In contrast, the stock ranked second in sales,$NCI (01336.HK)$experienced a nearly 136% increase in value over the year. For positions 3 to 5,$WEICHAI POWER (02338.HK)$、$ASMPT (00522.HK)$、$BYD ELECTRONIC (00285.HK)$、$LI NING (02331.HK)$were sold for HKD 548 million, HKD 439 million, and HKD 353 million, respectively.$GANFENGLITHIUM (01772.HK)$、$LAOPU GOLD (06181.HK)$Despite being on the net selling list, they have achieved cumulative annual gains of over 153% and 196%, respectively, demonstrating outstanding performance.

Looking ahead to 2026, CITIC Securities believes that the Hong Kong stock market will benefit from internal catalysts tied to the '15th Five-Year Plan,' as well as dual easing policies ('fiscal + monetary') in major external economies, particularly the United States and Japan.

On its own merits, Hong Kong's stock market not only encompasses a full range of high-quality AI industry chain companies (including infrastructure, software and hardware, and applications) but also benefits from an increasing number of leading A-share enterprises listing in Hong Kong. It is expected that Hong Kong stocks will benefit from liquidity spillover across domestic and overseas markets, as well as continued momentum from AI-driven narratives.

Given the bottoming out and rebound of fundamentals in the Hong Kong stock market, coupled with its still significant valuation discount, it is anticipated that the Hong Kong stock market will experience a second round of valuation recovery alongside further earnings improvement in 2026.

In terms of sector allocation, attention can be focused on:

1) The technology sector, including AI-related sub-sectors and consumer electronics;

2) The broader healthcare sector, particularly biotechnology;

3) Resource sectors benefiting from rising overseas inflation expectations coupled with de-dollarization, including non-ferrous metals and rare earth elements;

4) As the domestic economy continues to recover, relatively lagging and undervalued essential consumption sectors are also expected to see valuation recovery;

5) The paper and aviation sectors, which stand to benefit from the appreciation of the Renminbi.

![]() Looking back at 2025, how did your investment returns fare?

Looking back at 2025, how did your investment returns fare?

![]() Did you reap substantial gains by making the right decisions?

Did you reap substantial gains by making the right decisions?

![]() Which stocks or industries do you believe hold opportunities?

Which stocks or industries do you believe hold opportunities?

![]() Come share your annual summary!

Come share your annual summary!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/melody