The probability of former Federal Reserve Governor Kevin Warsh becoming the next Fed Chair has surged, with his chances in predictive markets jumping by 24 percentage points at one point. Previously, JPMorgan CEO Jamie Dimon expressed support for Warsh as the next Fed Chair, calling him a 'great chair.' Meanwhile, Trump may be choosing between 'two Kevins' — Kevin Warsh and Kevin Hassett — as Powell's successor.

Following JPMorgan CEO Jamie Dimon's public endorsement of Kevin Warsh as a 'great chair,' the former Federal Reserve governor is quickly emerging as a strong contender for the next Fed chair, with his odds of success surging significantly in predictive markets.

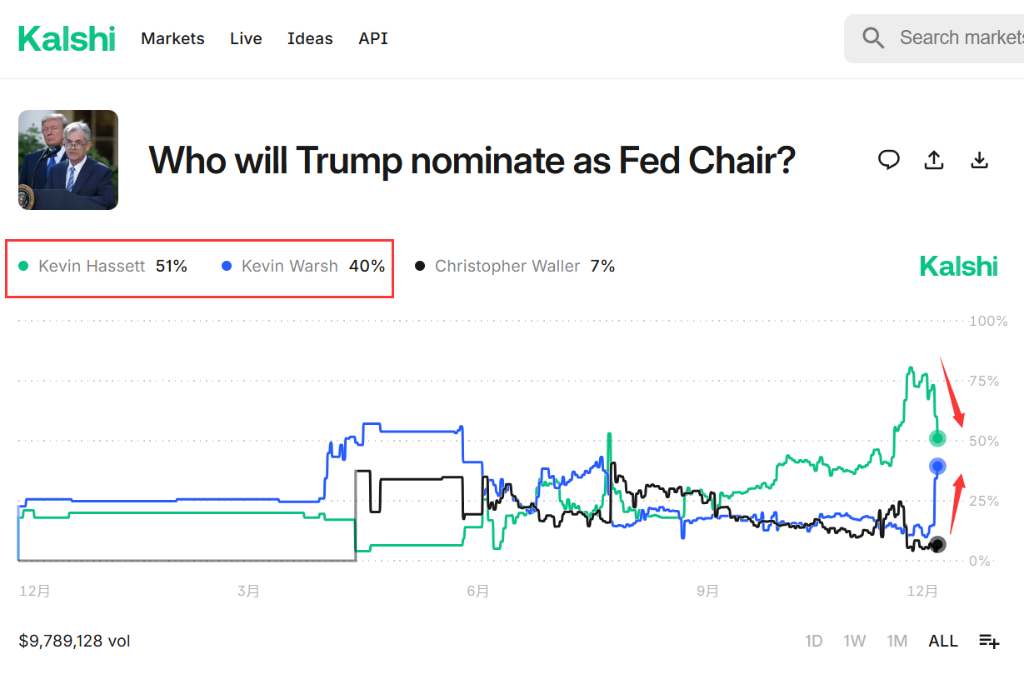

The latest data as of Saturday shows that the probability of Warsh being nominated has surged by 17 and 24 percentage points on the Kalshi and Polymarket predictive platforms, respectively. This notable shift indicates that market expectations regarding the composition of the Fed’s future leadership are undergoing a significant change.

Data from the Kalshi prediction market presents a more vivid picture: the probabilities of victory for Warsh and another leading candidate, Hassett, are inversely correlated. Warsh's likelihood of winning is skyrocketing, nearly catching up to Hassett's; meanwhile, the latter’s chances are declining sharply, though his 50% probability still keeps him in the lead.

Data from the Kalshi prediction market presents a more vivid picture: the probabilities of victory for Warsh and another leading candidate, Hassett, are inversely correlated. Warsh's likelihood of winning is skyrocketing, nearly catching up to Hassett's; meanwhile, the latter’s chances are declining sharply, though his 50% probability still keeps him in the lead.

This suggests that although Warsh’s chances have improved significantly, Hassett’s lead remains relatively secure for now.

The immediate catalyst for this shift came from two fronts. First, President Trump stated on Friday that he was leaning toward choosing between 'the two Kevins'—Kevin Warsh and Kevin Hassett, Director of the White House National Economic Council—as Powell’s successor. Second, Jamie Dimon, CEO of JPMorgan and one of Wall Street's most powerful bankers, explicitly endorsed Warsh to lead the Fed during a private CEO meeting of asset managers in New York on Thursday.

Trump narrows down to 'the two Kevins'

In an interview with the media on Friday, Trump clearly indicated that he had narrowed the search for Powell’s successor to two candidates. He revealed that after a 45-minute meeting with Warsh at the White House on Wednesday, Warsh had joined Hassett as one of his top considerations.

Trump’s criteria for selecting candidates are also clear. “(Warsh) believes you must lower interest rates, and everyone else I’ve spoken to agrees,” Trump said. He has consistently criticized the Fed under Powell for its reluctance to cut rates aggressively amid inflation concerns. After the Fed announced a 25-basis-point rate cut for the third consecutive meeting on Wednesday, Trump remarked that the reduction should have been at least twice as large.

Furthermore, Trump believes the next Fed chair should consult with him on interest rate policy. He told the media: “I don’t think he should do exactly what we say, but... I’m a wise voice that should be heard.” He noted that he believes interest rates should fall to “1% within a year, or even lower.”

JPMorgan CEO voices support

Adding significant weight to Warsh's candidacy is the indirect support from JPMorgan CEO Jamie Dimon. According to Wall Street Wisdom, Dimon told Wall Street executives at a private meeting on Thursday that he agrees with Warsh's views on the Federal Reserve.

Notably, it was reported that Dimon also stated his belief that if Kevin Hassett were to become the Fed Chair, the latter would be more likely to cut interest rates in line with Trump’s wishes. This comment adds further complexity to market interpretations.

Earlier this year, Dimon publicly emphasized that the independence of the Federal Reserve is “absolutely crucial” and warned that presidential interference in central bank decisions typically leads to unintended negative consequences.

Different Policy Prospects of the Two Kevins

For the markets, the focus is on the potential policy differences among candidates. Some bond investors have expressed concerns that a Federal Reserve led by Hassett might prioritize economic growth over price stability in pursuing aggressive rate cuts.

Such a policy inclination could disrupt the Treasury market and pose challenges to bond portfolios. Therefore, as the final selection approaches, the market will scrutinize the candidates' past statements and policy stances more rigorously, and any fluctuations may trigger volatility in asset prices.

Kevin Hassett: As a former White House insider, he is seen as a candidate more aligned with Trump’s expectations. He has publicly supported aggressive interest rate cuts and is viewed by some on Wall Street as having a strong “enforcer” label.

Kevin Warsh: A former Federal Reserve governor, he has gained recognition from Wall Street leaders like Jamie Dimon. However, his frequent criticisms of the Fed after leaving office have made him unpopular within the central bank, with some opinions holding that his stance before the 2008 financial crisis was “excessively hawkish.”

As Trump continues to publicly pressure the Federal Reserve to adopt more aggressive interest rate cuts, the race for the next Fed Chair is intensifying.

Currently, the selection process led by U.S. Treasury Secretary Bessent is still underway, and Trump is expected to interview more candidates next week. Whether he will choose an “independent” figure trusted by Wall Street or a “loyalist” favored by the White House will be revealed in the coming weeks.

Editor/KOKO