Top News

Former 'dove' unexpectedly casts dissenting vote: Fed's Goolsbee says more inflation data should be awaited before rate cuts.

Chicago Fed President Austan Goolsbee said that the reason he opposed the Federal Reserve's rate cut decision this week was that he preferred to wait for more inflation data before further cuts. Three officials dissented at this week’s interest rate meeting: Goolsbee, Kansas City Fed President Esther George, and Federal Reserve Governor Christopher Waller.

Fed's Paulson: Labor market concerns outweigh inflation risks; central bank still has room to cut rates

Philadelphia Fed President Anna Paulson recently stated that she expects U.S. inflation to cool next year and warned of the risk of further weakening in the labor market. Next year, Paulson will become a voting member of the Federal Open Market Committee and could emerge as a key dovish force.

Fed's Hammock: Prefers a more restrictive policy stance.

Fed's Hammock: Prefers a more restrictive policy stance.

Cleveland Fed President Beth Hammack favors keeping rates at a slightly more restrictive level to continue exerting downward pressure on inflation. Hammack noted that inflation has remained above the Fed's 2% target for several consecutive years and recently stayed close to 3%. She warned that easing rates prematurely could allow inflation to linger above target for longer.

Powell's Successor Gradually Clear? Trump: Kevin Warsh is Currently the Top Choice; Interest Rate Decisions Should Be Discussed With Me!

As current Federal Reserve Chair Jerome Powell’s term nears its end, Trump has increasingly spoken about his preferred successor. On Friday local time, he explicitly stated for the first time that Kevin Warsh had risen to the top of his list of candidates for the next Fed chair, although others remain in contention.

Powell’s term as Federal Reserve Chair ends on May 15, 2026, and his term as a governor ends on January 31, 2028. Warsh previously served as a Fed governor and, although he was on Trump’s candidate list earlier, he was not the most favored choice. However, after meeting with Trump on Wednesday, he clearly gained more favor from the president.

Trump pointed out that Warsh generally aligns with his views on monetary policy. 'He believes interest rates must be lowered, and everyone else I’ve spoken with agrees as well,' he added.

Consistently Asserting 'Independence'! Hassett: If Chosen to Lead the Fed, Trump Can Offer Opinions, But They Will Carry No Weight in Decision-Making

Trump's chief economic advisor, Kevin Hassett, said Sunday that if chosen to lead the Federal Reserve, he would consider the president’s policy input, but the central bank’s interest rate decisions would remain independent. This statement attempts to acknowledge Trump’s influence while emphasizing the independence of the Fed’s decision-making mechanism.

US SEC Commissioner Warns Against 'Deregulation' Wave: Turning Markets Into Casinos Where Only the House Always Wins

As the only dissenting voice on the US Securities and Exchange Commission (SEC), outgoing commissioner Caroline Crenshaw delivered sharp criticism this week against the nearly year-long 'deregulation' wave sweeping through the US securities industry.

On Thursday, Crenshaw delivered a speech at the Brookings Institution titled “Rubble and Reconstruction,” stating outright that the SEC was moving in the opposite direction of protecting markets and investor safety—making the market increasingly resemble a casino.

She remarked: "We should be protecting markets so investors can accumulate retirement funds through safe and sustainable means, but now we are moving toward making markets look like casinos. Of course, the problem with casinos is that, in the long run, the house always wins."

SpaceX Confirms IPO Plan for 2026, Valuation Doubles to USD 800 Billion in Six Months

SpaceX has officially informed its employees that the company is preparing for a potential initial public offering (IPO) next year, confirming recent market rumors.

SpaceX Chief Financial Officer Bret Johnsen stated in an internal memo that the company is preparing for a potential IPO in 2026 to raise substantial funds. Johnsen emphasized the high uncertainty surrounding the IPO timeline but revealed that the internal stock pricing stands at $421 per share, valuing SpaceX at approximately $800 billion.

The United States to Lift Sanctions on Belarus Potash, Advancing Bilateral Normalization

According to reports by Xinhua and other media outlets, on Saturday local time, Belarusian President Lukashenko pardoned 123 prisoners from various countries under an agreement reached with the Trump administration. In exchange, the US will lift sanctions imposed on Belarus's potash sector.

It is reported that prior to this, Lukashenko held a two-day closed-door meeting with John Kerr, the US Special Envoy for Belarus appointed by President Trump. On Saturday, Kerr stated that both sides discussed how to normalize relations between the two countries, describing the dialogue as 'excellent' and the meeting as 'productive.'

EU Agrees to Indefinitely Freeze Russian Central Bank Assets, Paving Way for Loans to Ukraine

The European Union has agreed to indefinitely freeze the assets of the Russian Central Bank held in Europe, ensuring that Hungary and Slovakia cannot block the EU from using these assets to support Ukraine. The European Commission is advancing plans to provide 'reparations loans' to Ukraine backed by frozen Russian assets, while the Russian Central Bank has filed a lawsuit against the depository institution Euroclear with the Moscow Arbitration Court.

U.S. envoy states 'significant progress' made in U.S.-Ukraine talks in Berlin

On December 14 local time, US Presidential Envoy Witkowski released minutes from talks held between the US and Ukraine in Berlin, Germany. The minutes show that representatives from both sides engaged in in-depth discussions on topics including the 'peace plan' and economic agendas. Significant progress was achieved during the talks, and both parties will reconvene on the morning of the 15th. Core issues of discussion included territorial integrity, security guarantees, and the frozen assets of the Russian Central Bank held by the EU.

Zelenskyy: Neither the US nor the EU Supports Ukraine's NATO Membership

On December 14 local time, Ukrainian President Volodymyr Zelenskyy revealed in an interview that, amid negotiations surrounding the U.S.-proposed 'peace plan,' neither the United States nor some European countries supported making Ukraine's accession to NATO a core component of its security guarantees.

Zelenskyy emphasized that joining NATO remains a core demand for Ukraine and is seen as a practical and effective security guarantee, yet it has not garnered support from relevant U.S. and European parties. Currently, efforts are underway to construct an alternative bilateral security guarantee framework for Ukraine. Zelenskyy explicitly stated that accepting these bilateral security guarantees instead of direct NATO membership represents a compromise by Ukraine, with the central aim being the establishment of an effective mechanism to prevent Russia from initiating conflicts in the future.

U.S. Stock Market Recap

AI-related trading faced consecutive setbacks, leading to collective declines in the three major indices, with Broadcom plummeting over 11%.

On Friday Eastern Time, the three major indices closed lower collectively. As Broadcom and Oracle successively fueled market concerns about an AI bubble, coupled with some Fed officials opposing monetary policy easing, Treasury yields were pushed higher, prompting investors to pull out of the tech sector.

The Dow Jones Industrial Average fell 0.51%, but rose 1.05% cumulatively last week; the Nasdaq Composite Index dropped 1.69%, with a cumulative decline of 1.62% last week; and the S&P 500 Index fell 1.07%, with a cumulative decline of 0.63% last week.

$明星科技股(LIST2518.US)$ A broad decline, $Broadcom (AVGO.US)$ Plummeted over 11%, $NVIDIA (NVDA.US)$ Dropped over 3%, $Google-C (GOOG.US)$ 、 $Microsoft(MSFT.US)$ 、 $Meta Platforms(META.US)$ 、 $Amazon(AMZN.US)$ Both fell more than 1%.

$热门中概股(LIST2517.US)$Most have declined.$Taiwan Semiconductor (TSM.US)$ dropping over 4%, $Advanced Semiconductor Engineering (ASX.US)$ Dropped nearly 4%, $Baidu(BIDU.US)$ Dropped more than 2%.

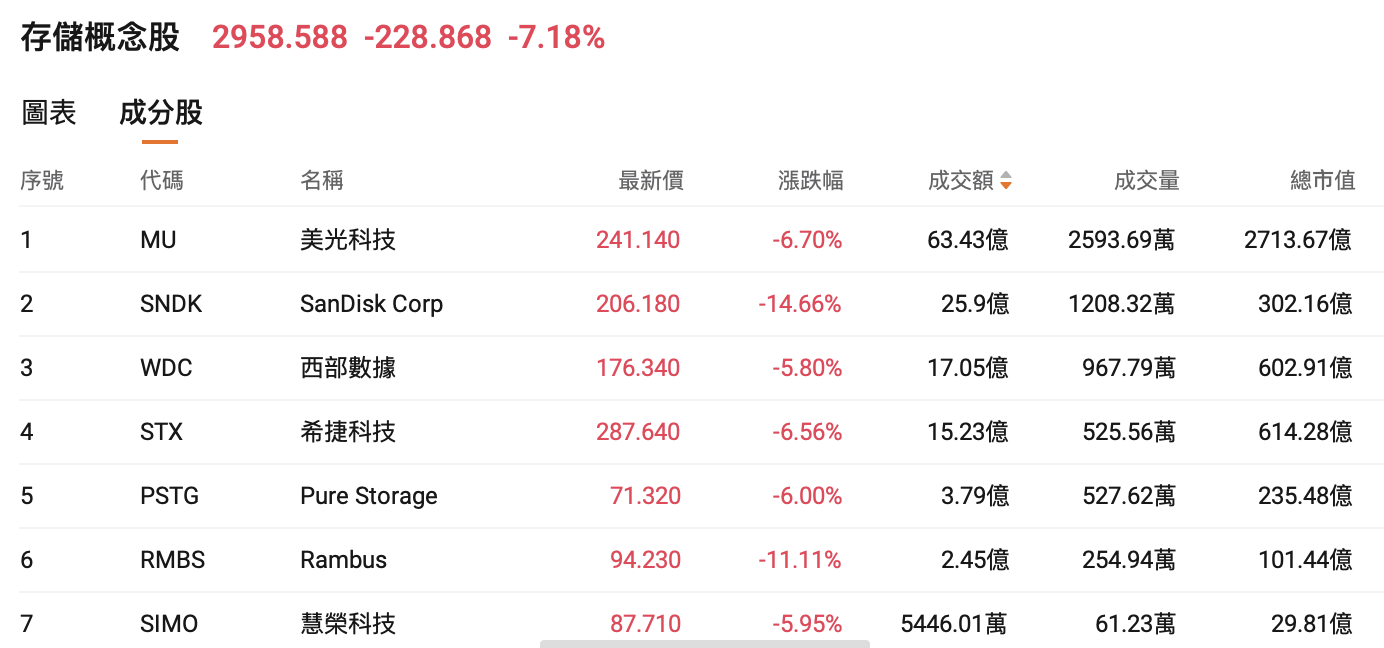

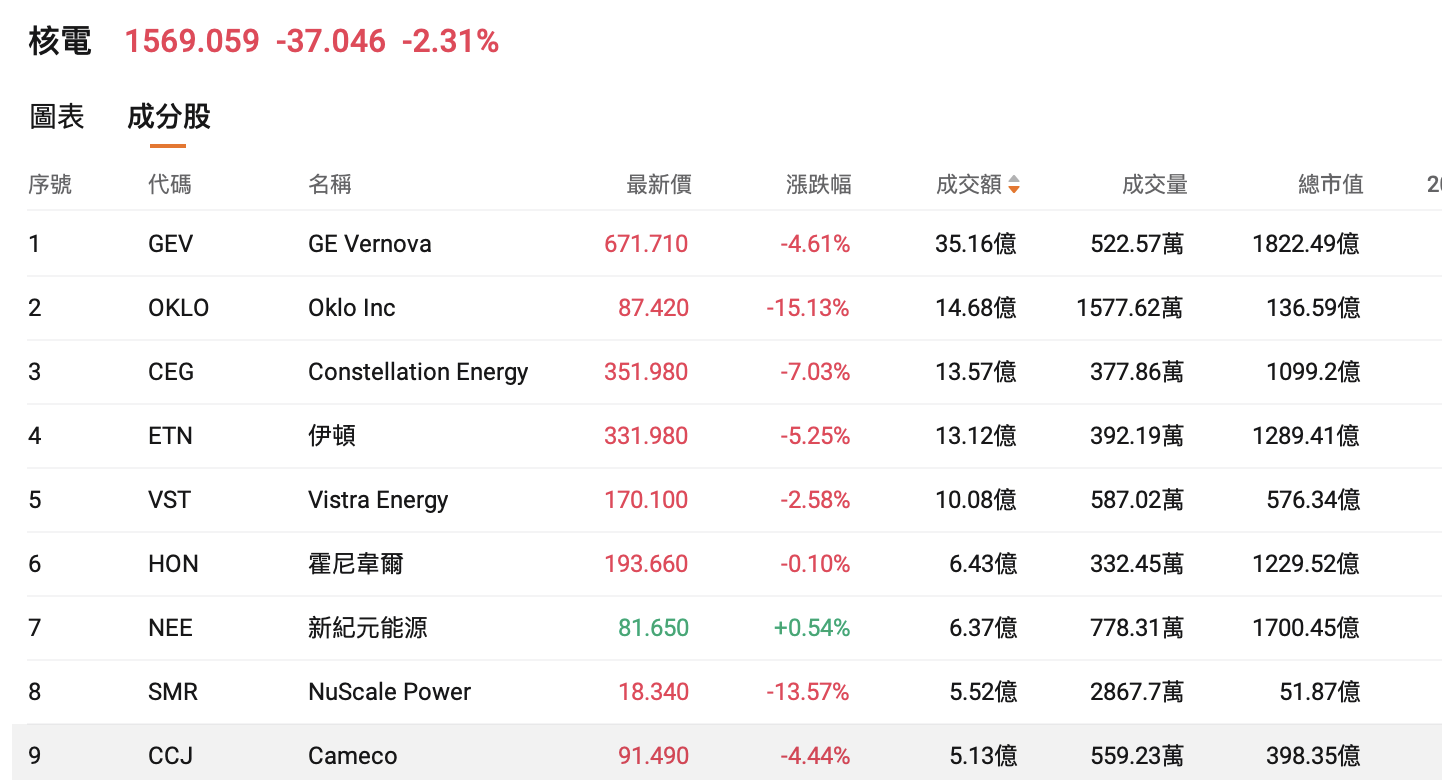

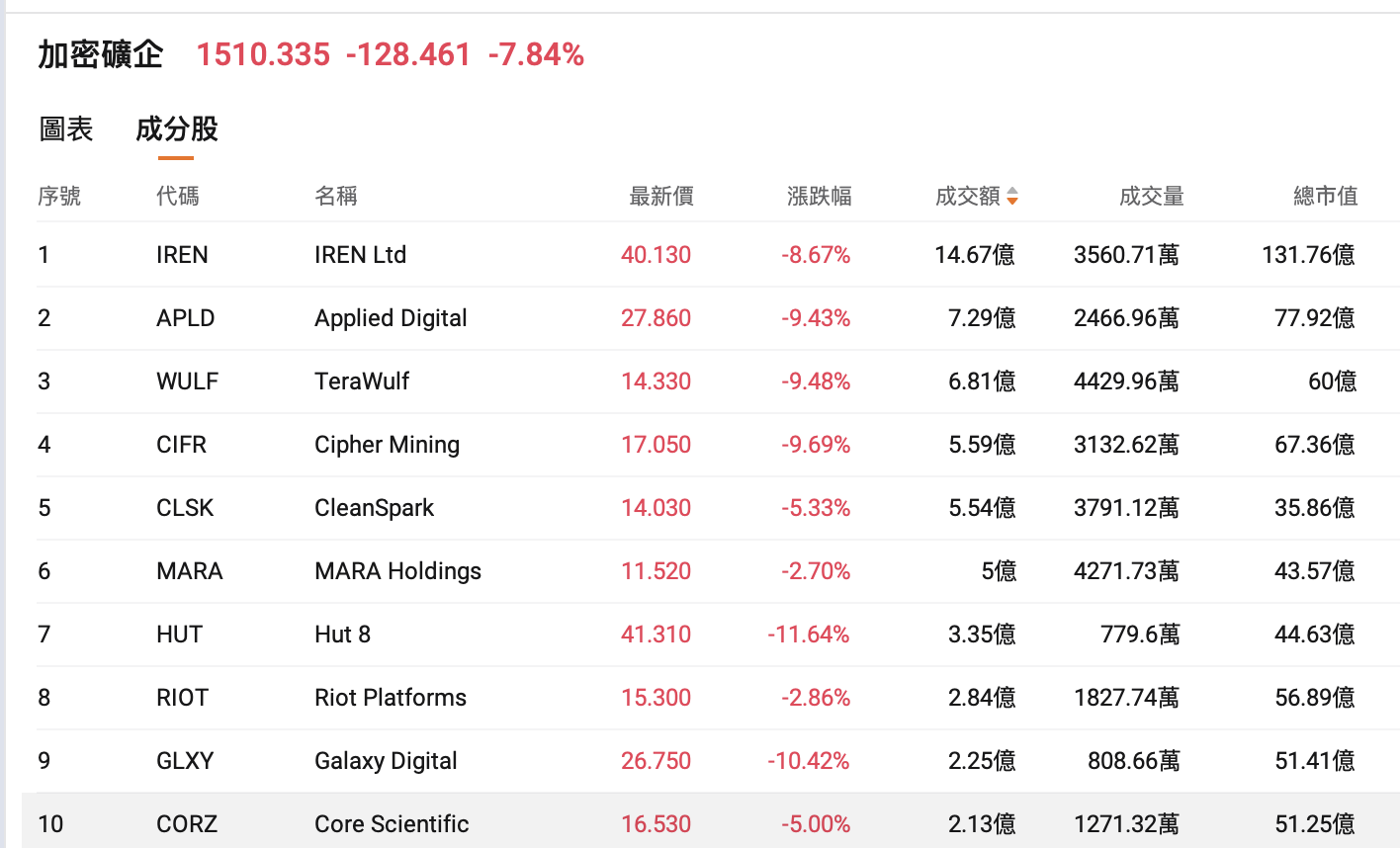

$存储概念股(LIST23925.US)$ 、 $核电(LIST2583.US)$ 、 $加密矿企(LIST23921.US)$ 、 $Semiconductor(LIST2015.US)$ Led the declines, $SanDisk Corp (SNDK.US)$Down nearly 15%; $Oklo Inc (OKLO.US)$Down over 15%; $Hut 8(HUT.US)$Down nearly 12%, $Galaxy Digital(GLXY.US)$Down over 10%; $Corning (GLW.US)$ Down nearly 8%, $Quantum (QMCO.US)$ Down over 7%, $Micron Technology (MU.US)$ 、 $Dell Technologies (DELL.US)$ 、 $Logitech(LOGI.US)$ Down over 6%.

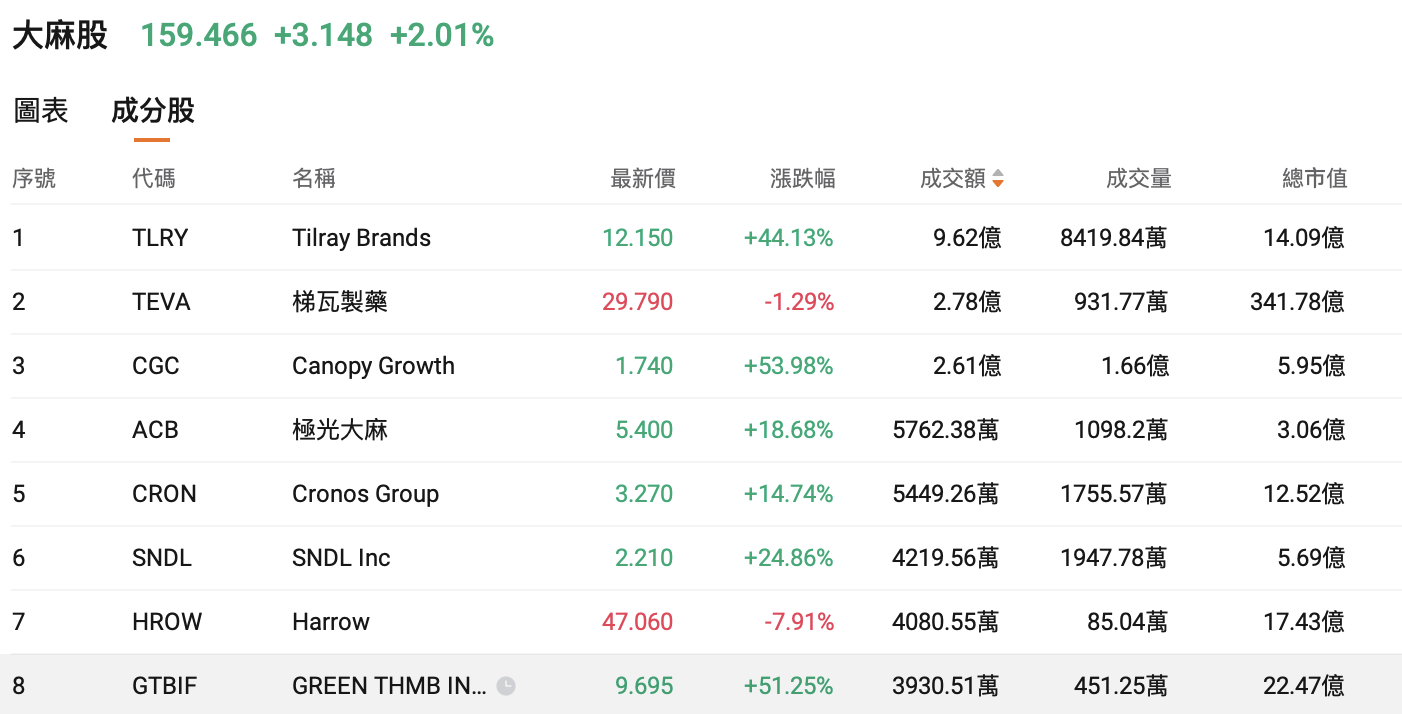

U.S. stocks $大麻股(LIST2997.US)$ Soaring, $Tilray Brands(TLRY.US)$, Surged 44%, $Canopy Growth(CGC.US)$ Rose nearly 54%, $SNDL Inc(SNDL.US)$ Increased by nearly 25%.

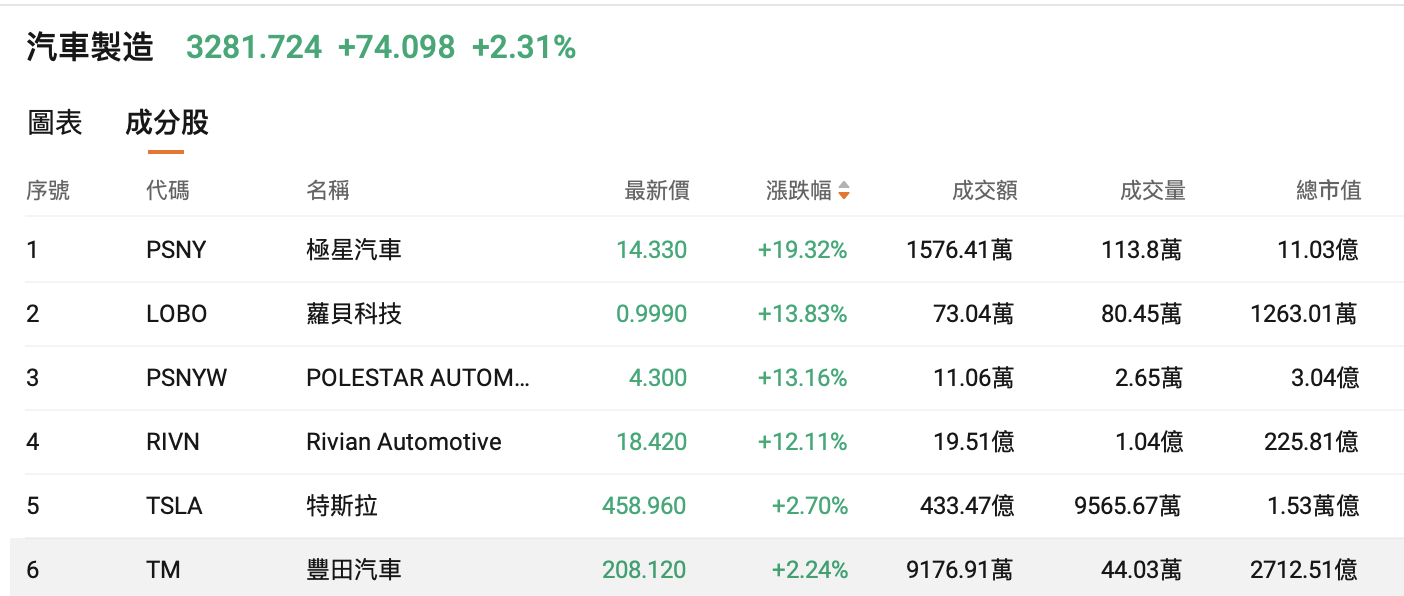

$Automotive Manufacturing (LIST2054.US)$ The sector rose, $Polestar Automotive (PSNY.US)$ Rose over 19%, $Rivian Automotive(RIVN.US)$ Increased over 12%, $Lobo Technology (LOBO.US)$ Surging over 13%,, $Tesla (TSLA.US)$ Rose over 2%.

Individual stock news

Google has launched an AI-powered real-time voice translation feature, enabling communication even when the nationality of the other party is unknown.

$Google-C (GOOG.US)$ The most advanced Gemini translation capabilities have been integrated into the beta version of the translation app, enabling 'AI simultaneous/consecutive interpretation' for earphones and covering more than 70 languages and over 2,000 language combinations. The hardware requirements are significantly lower than Apple's solution. While enhancing the 'authenticity' of web and text translations, Google has also directly incorporated language learning features, posing a challenge to $Duolingo(DUOL.US)$ the 'livelihood' of language learning software such as Duolingo.

As the AI boom enters its fourth year, how to capitalize on it? JPMorgan: these two tech giants are the top picks!

JPMorgan forecasts that AI spending will continue to break records in 2026; the bank highlights that Google (GOOGL.US) and $Amazon(AMZN.US)$ stocks will be the best picks for the next wave of AI trading, with these two companies expected to spend over $400 billion on artificial intelligence.

Oracle, Broadcom Earnings Reports: The Higher the Market Expectations, the Sharper the Selloff

Chip designer $Broadcom (AVGO.US)$ released its earnings report after hours on Thursday. Despite record-high sales, its revenue forecast for the AI business fell short of Wall Street’s lofty expectations. $Oracle (ORCL.US)$ Shortly after reporting disappointing earnings, it was revealed that some data centers being built for ChatGPT owner OpenAI may face delays, with completion now potentially pushed back from 2027 to 2028. This directly raised concerns about the pace of AI infrastructure development.

$Broadcom (AVGO.US)$ The company’s shares plummeted 11%, dragging both the S&P 500 Index and Nasdaq Composite Index down and completely reversing the record highs set earlier this week due to rate cut expectations. $Oracle (ORCL.US)$ It continued to drop by over 4%.

Up over 200% year-to-date! AI ignites storage boom, Seagate Technology and Western Digital both join Nasdaq 100

Last Friday (December 12th, local time), Nasdaq, Inc. announced the annual reconstitution results of the Nasdaq 100 Index, stating that six companies would be added to the index. The changes will take effect before the market opens on Monday, December 22, 2025.

The six companies to be included in the Nasdaq 100 Index are: $Alnylam Pharmaceuticals (ALNY.US)$ 、$Ferrovial SE(FER.US)$ 、 $Insmed(INSM.US)$ 、$Monolithic Power Systems(MPWR.US)$ 、$Seagate Technology (STX.US)$ and$Western Digital (WDC.US)$ 。

Among them, Seagate Technology and Western Digital are both global leaders in storage solutions. The inclusion of these two companies in the Nasdaq 100 index reflects the strong momentum in the storage industry; year-to-date, the share prices of Seagate Technology and Western Digital have surged by over 200%, primarily driven by the AI-induced supercycle in storage demand.

Meanwhile, the Nasdaq 100 Index will also remove six constituent companies, namely,$Biogen Inc (BIIB.US)$ 、 $CDW Corp(CDW.US)$ 、 $GlobalFoundries(GFS.US)$ 、$Lululemon Athletica(LULU.US)$ 、 $ON Semiconductor(ON.US)$ and $The Trade Desk(TTD.US)$。

Report: Intel to acquire chip company for approximately $1.6 billion,

According to sources familiar with the matter, $Intel (INTC.US)$Intel is in advanced negotiations to acquire SambaNova Systems Inc. for approximately $1.6 billion (including debt). The deal involving SambaNova could be finalized as early as next month. Acquiring SambaNova will provide Intel with a platform to expand its artificial intelligence product offerings. SambaNova was valued at $5 billion in 2021.

The Trump administration approved the first batch of cryptocurrency banks, with Circle receiving OCC approval to establish a national trust bank.

On Friday local time, the Trump administration approved plans to launch five new cryptocurrency-focused national banks, part of its broader effort to integrate the industry into the traditional financial system. Cryptocurrency startups that received approval from the Office of the Comptroller of the Currency include,$Circle(CRCL.US)$and Ripple. Paxos, BitGo, and Fidelity Investments also received approvals on Friday.

On December 12 EST, Circle announced on its official website that it had received conditional approval from the Office of the Comptroller of the Currency (OCC) to establish a national trust bank – First National Digital Currency Bank (First National Digital Currency Bank, NA). Once fully approved, the First National Digital Currency Bank will operate as a federally regulated trust bank supervised by the OCC and will oversee the management of USDC reserves issued under Circle's U.S. entity. This conditional approval represents a significant milestone in Circle’s efforts to strengthen the infrastructure supporting USDC (the world’s largest regulated stablecoin) and comply with the requirements of the U.S. GENIUS Act, which takes effect in July 2025.

Oracle Responds: No Delay in Data Center Construction Related to OpenAI

A media report on Friday stated that due to labor and material shortages, $Oracle (ORCL.US)$ Oracle will delay the construction of data centers related to OpenAI, postponing from 2027 to 2028. However, Oracle later denied the report.

Oracle spokesperson Michael Ebert stated in an email declaration: 'After signing the agreement, we closely coordinated with OpenAI to determine the construction and delivery schedule and reached a consensus. There is no delay at any site required to fulfill contractual commitments, and all milestones are on track.' He added, 'We remain fully aligned with OpenAI and are confident in our ability to fulfill our contractual commitments and future expansion plans.' Following this response, Oracle's stock price partially recovered its losses.

Pressure from Rising Memory Prices Begins to Trickle Down; Dell Reportedly to Increase Commercial PC Pricing Across the Board Next Week

Facing pressure from the rapid surge in memory chip prices, American computer hardware manufacturer $Dell Technologies (DELL.US)$ plans to comprehensively raise prices for its commercial product line starting December 17. The price increase will range between 10% and 30%, depending on the storage configuration of the computers.

It was reported that Dell’s management sent an internal letter to sales personnel on November 25, outlining the 'key next steps' they should take before the price hike. The letter also mentioned that 'global memory and storage supplies are tightening rapidly,' and contract prices for DRAM and NAND chips 'have risen significantly this quarter.' Suppliers have also hinted at further price increases and rationing restrictions driven by AI demand.

An anonymous Dell salesperson revealed that there was initially a wave of panic buying that helped customers purchase remaining inventory, but the current situation is now considered 'out of control.' The employee stated that Dell is also absorbing some costs internally by compressing profit margins and limiting the discounts salespeople can offer.

Bitcoin ‘Hoarding Whale’ Strategy Secures Nasdaq 100 Position, MSCI Still Warns of Possible Exclusion in January Ruling

On Friday, Bitcoin hoarding giant $Strategy(MSTR.US)$ has retained its position in the Nasdaq 100 Index, extending its status as a component of the benchmark index for a year. Meanwhile, analysts remain skeptical about its business model.

Some market observers have noted that Strategy’s pioneering "buy-and-hold" Bitcoin business model more closely resembles the operation of an investment fund, which has now spawned dozens of imitators. MSCI is expected to decide in January whether to exclude Strategy and similar companies.

Stablecoin giant Tether explores equity tokenization after aiming to raise $20 billion

Stablecoin giant Tether is exploring whether to tokenize its shares following a planned fundraising round targeting up to $20 billion at a targeted valuation of approximately $500 billion. The company reportedly does not plan to allow existing shareholders to sell their stakes in this primary financing round, meaning these investors may need alternative means to achieve liquidity before a potential IPO. Tether has not yet provided a timeline for going public.

Rivian bets big on self-driving with in-house chip, claims four times the computing power of NVIDIA’s system, surging over 12%

U.S. electric vehicle maker $Rivian Automotive(RIVN.US)$ unveiled its self-developed artificial intelligence chip, 'RAP1,' and plans to deploy it in the R2 SUV to replace NVIDIA’s technology; the RAP1 chip can process 5 billion pixels per second, achieving a computational speed of 1.6 quadrillion operations per second—four times faster than systems currently reliant on NVIDIA chips.

Asset management firm $Corebridge Financial(CRBG.US)$ replaces $Allete (ALE.US)$ will be included in the S&P MidCap 400 Index, rising more than 3% in after-hours trading.

Top 20 by Trading Value

Market Outlook

Northbound funds bought nearly HKD 2.5 billion worth of Meituan and added nearly HKD 2.4 billion in Xiaomi Group, while selling nearly HKD 3.4 billion worth of Alibaba.

On December 12 (Friday), southbound funds recorded a net sell of HKD 5.287 billion worth of Hong Kong stocks today.

$Meituan-W(03690.HK)$、$Xiaomi Group-W(01810.HK)$、$KE Holdings-W (02423.HK)$They received net inflows of HKD 2.482 billion, HKD 2.361 billion, and HKD 997 million, respectively;

$Alibaba-W (09988.HK)$、$Tencent (00700.HK)$、$Hua Hong Semiconductor (01347.HK)$They were subject to net outflows of HKD 3.368 billion, HKD 996 million, and HKD 735 million, respectively.

Hsbc Holdings: The proposed consideration for the privatization plan of Hang Seng Bank is HKD 155 per share.

$Hsbc Holdings (00005.HK)$ The proposed consideration for the privatization plan of Hsbc Holdings (0011.HK) is HKD 155 per share. The planned consideration is the final price and will not be increased under any circumstances.

Jack Ma and Jerry Yang appeared in Rwanda and were received by the President.

According to media reports, $Alibaba-W (09988.HK)$ Jack Ma, founder of Alibaba, appeared yesterday in Kigali, the capital of Rwanda, along with Jerry Yang, co-founder of Yahoo. They were received by Rwandan President Paul Kagame. It is reported that Jack Ma’s visit to Africa this time is mainly to participate in the 'Africa's Business Heroes' event. Initiated by the Jack Ma Foundation, the event is part of Alibaba's flagship project to support African entrepreneurs. The event will provide USD 1.5 million in grant investments to the top 10 finalists to assist with local employment and economic development.

It is reported that this is not Jack Ma’s first visit to Africa, as he and Kagame have a long-standing connection. Between 2017 and September this year, they met multiple times at events such as the African Youth Summit and the United Nations General Assembly in New York. Under the promotion of Jack Ma and Alibaba, Rwandan agricultural products such as coffee and chili peppers have entered the Chinese market through e-commerce platforms.

51WORLD has passed the Hong Kong Stock Exchange listing hearing, aiming to become the first stock in the Physical AI sector.

Recently, Beijing 51WORLD Digital Twin Technology Co., Ltd. ( $51WORLD (Temporary Code) (810653.HK)$ ) has passed the listing hearing and will pursue an IPO under Chapter 18C to become the first stock in the Physical AI sector. CICC and Huatai International will act as joint sponsors.

51WORLD has made significant investments and developed core competencies in three key technological domains: 3D graphics, simulation, and artificial intelligence. The company has launched three core businesses: 51Aes (Digital Twin Platform), 51Sim (Synthetic Data and Simulation Platform), and 51Earth (Digital Earth Platform).

Physical AI is becoming a new direction for the global technology industry, representing the next wave of AI development with a potential market value of trillions of dollars. Since its establishment, 51WORLD has consistently moved towards Physical AI, starting from digital twin technology. After years of technological accumulation and strategic planning, the company has built comprehensive capabilities in the three key components of Physical AI (data fuel, spatial models, and training platforms) and established an end-to-end Physical AI closed-loop ecosystem comprising 'synthetic data - spatial intelligence models - simulation training platforms.' This has created a unique technical and ecological barrier that is difficult to replicate, making it one of the few companies globally that truly possesses the three essential elements of Physical AI.

Industry insiders believe that if 51WORLD successfully goes public, it will fill the gap in Physical AI investment targets in Hong Kong's stock market, becoming a highly promising and scarce asset for investors.

‘DouBao Phone’ summoned by regulators? Insiders: The report is inaccurate.

According to The Paper, DouBao smartphone continues to attract attention. On December 1, DouBao, ByteDance’s large-scale AI model, announced the launch of a mobile assistant and a collaboration with $ZTE Corporation (00763.HK)$ to introduce the 'DouBao Phone'—Nubia M153. As a mobile assistant with system-level permissions, it can operate smartphones like a human being, attempting to reshape human-computer interaction logic. This groundbreaking product in the AI era quickly became a focal point of discussion. However, concerns about the security of AI phone assistants also sparked rapid external debate. Recently, reports indicated that regulators had summoned relevant ByteDance executives due to concerns over cybersecurity, data security, and potential competitive issues. On December 13, informed sources responded to reporters, stating that the aforementioned report was inaccurate.

Industry insiders: A price war for semaglutide in the domestic market is expected to commence soon.

According to Yicai, as the year-end approaches, multinational pharmaceutical giants are showing no signs of slowing down their efforts to develop the next generation of weight-loss drugs. Recently, $Eli Lilly and Co (LLY.US)$ released the latest data on a new type of weight-loss drug; meanwhile, $Pfizer (PFE.US)$ made another acquisition of a Chinese company’s next-generation GLP-1 class drug. On the other hand, with Eli Lilly’s tirzepatide expected to be included in China’s medical insurance by 2026, and $诺和诺德(NVO.US)$ The core patent for semaglutide in China is about to expire, and the overall landscape of the domestic GLP-1 metabolic drug market will undergo significant changes.

Industry insiders predict that the future supply of GLP-1 drugs will far exceed the previous wave of PD-1 targeted drugs. With the launch of numerous generic drugs, a price war for GLP-1 drugs is expected to begin by 2026. According to incomplete statistics, eight domestically produced versions of semaglutide have been accepted for market approval so far, from companies such as Huisheng Biopharmaceuticals, Chengdu Better, $CSPC Pharma (01093.HK)$ , Hangzhou Zhongmei Huadong, Zhuhai United Laboratories, Qilu, $Livzon Pharmaceutical (01513.HK)$ 、 $Jiu Yuan Gene (02566.HK)$ 。

Today's Focus

Monday (December 15)

Keywords: China's key economic data for November, housing prices in 70 cities, remarks by Federal Reserve officials

In terms of economic data, attention should be paid to a series of critical economic indicators released by China for November.

10:00 Year-on-year growth rates of China's retail sales of consumer goods and industrial value-added output for November.

18:00 Monthly change rate of industrial production in the Eurozone for October.

21:30 Monthly change rate of Canada's CPI and the New York Fed Manufacturing Index for the U.S. in December.

23:00 US December NAHB Housing Market Index

In terms of financial events, the monthly data for housing prices in 70 cities will be released, and Fed officials Milan and Williams will deliver speeches.

09:30 National Bureau of Statistics releases the monthly report on residential sales prices in 70 large and medium-sized cities

10:00 State Council Information Office holds a press conference on the status of national economic operations

22:30 Fed Governor Milan delivers a speech

23:30 Permanent FOMC voter and New York Fed President Williams speaks on the economic outlook

![]()

Morning Reading by Niuniu:

The financial market is a place where experienced individuals gain more wealth, and those with wealth gain more experience!

—[US] Jules

![]() AI Portfolio Strategist goes live!One-click insight into holdings, fully grasp opportunities and risks.

AI Portfolio Strategist goes live!One-click insight into holdings, fully grasp opportunities and risks.

Editor/Doris