$Micron Technology (MU.US)$ Revenue for Q1 2026 is projected to reach USD 12.801 billion, representing a year-over-year increase of 46.98%; expected earnings per share are USD 3.76, reflecting a year-over-year surge of 124.91%.

The accounting standard used for the above data is US-GAAP.

The key highlight of this earnings report is the progress of the HBM business.

As a critical hardware component for AI servers, the HBM market is experiencing explosive growth, and Micron Technology's positioning in this field has drawn significant attention. The company has already confirmed that its supply of HBM3E and HBM4 products for the entirety of 2026 has been fully sold out, with deliveries currently made to six clients. The goal is to maintain a market share of 20%-25%. Notably, Micron's proprietary CMOS substrate + 1þ process DRAM has achieved the 11Gbps performance specification for HBM4, and the upcoming upgrade to HBM4E is even more anticipated. Additionally, the company’s new wafer fabrication plant in Hiroshima, Japan, which involves an investment of USD 9.6 billion, is scheduled to commence the first phase of HBM production in 2028. Meanwhile, its advanced packaging facility for HBM in Singapore is set to begin operations in 2027. These long-term capacity plans will directly impact its competitive position in the HBM market, and the market expects management to disclose further details in the earnings report.

The dynamics of supply, demand, and pricing in the memory market remain another focal point.

Micron’s management has repeatedly emphasized that the supply-demand tension in the DRAM market continues to intensify, with both HBM and non-HBM sectors facing shortages. Meanwhile, demand in the NAND market is strengthening, and inventory levels continue to decline, with expectations of entering a shortage phase in the first half of 2026. On the supply side, the expansion cycle for cleanroom capacity, migration to advanced nodes, and the high consumption of wafer capacity by HBM have created structural supply constraints, providing support for product pricing. Additionally, the company’s production capacities in Taiwan and Hiroshima offer certain flexibility. The current capital expenditure guidance of USD 18 billion for fiscal year 2026 is under upward pressure, and the market is curious whether it will be raised to the USD 20-25 billion range and whether there will be additional capacity plans for the second half of 2027.

Micron’s management has repeatedly emphasized that the supply-demand tension in the DRAM market continues to intensify, with both HBM and non-HBM sectors facing shortages. Meanwhile, demand in the NAND market is strengthening, and inventory levels continue to decline, with expectations of entering a shortage phase in the first half of 2026. On the supply side, the expansion cycle for cleanroom capacity, migration to advanced nodes, and the high consumption of wafer capacity by HBM have created structural supply constraints, providing support for product pricing. Additionally, the company’s production capacities in Taiwan and Hiroshima offer certain flexibility. The current capital expenditure guidance of USD 18 billion for fiscal year 2026 is under upward pressure, and the market is curious whether it will be raised to the USD 20-25 billion range and whether there will be additional capacity plans for the second half of 2027.

In terms of demand across various application scenarios, the trend of multi-sector coordinated growth is expected to continue.

The proliferation of AI training and inference applications is driving sustained growth in demand for HBM and high-density DDR5 modules. Data centers, as the core battleground, are seeing continued increases in spending. Both traditional servers and AI servers are witnessing synchronized improvements in demand, driving up average selling prices and sales volumes of enterprise SSDs, which are crucial for profit recovery in the NAND business. On the intelligent device front, the penetration of AI PCs and the end of the Windows 10 lifecycle are driving PC replacement cycles, while AI functionalities in smartphones are extending to mid-range platforms. The clear trend of increased DRAM and NAND capacities per device is supporting recovery in the mobile and client segments. Furthermore, the undersupply of hard disk drives, coupled with AI-driven demand for vector databases and key-value caching, is further boosting enterprise SSD demand, creating multidimensional demand support.

The release of profitability upside is another key highlight of this earnings report.

In the previous quarter, Micron achieved better-than-expected profit growth driven by optimized product mix and improved pricing conditions. In this quarter, factors such as rising DRAM prices, recovery in the NAND business, and an increasing proportion of high-value HBM products are expected to further boost gross margin and net margin on a quarter-over-quarter basis. Wells Fargo & Co has raised its earnings forecast for Micron, adjusting revenue and earnings per share expectations for this quarter to USD 12.8 billion and USD 3.87, respectively, at the upper end of the company’s guidance range. It also revised upward its revenue and earnings per share forecasts for fiscal years 2026 and 2027 to USD 54.7 billion/USD 17.85 and USD 65.2 billion/USD 22.41, respectively, while issuing its first forecast for fiscal year 2028 at USD 71.2 billion in revenue and USD 22.80 in earnings per share. The price target was further raised to USD 300.

Overall, under the structural tailwinds of the AI-driven memory industry, Micron Technology is in a critical growth and profitability improvement cycle. In this earnings report, updates on HBM capacity and customer progress, pricing strategies for memory products, adjustments to capital expenditures, and feedback on demand across core businesses will directly influence the market’s assessment of the company’s long-term valuation. Behind the widespread bullish sentiment among institutions lies recognition of the industry’s supply-demand dynamics and Micron’s competitive standing. Whether this earnings report can meet or even exceed expectations in delivering profitability upside deserves close attention from investors.

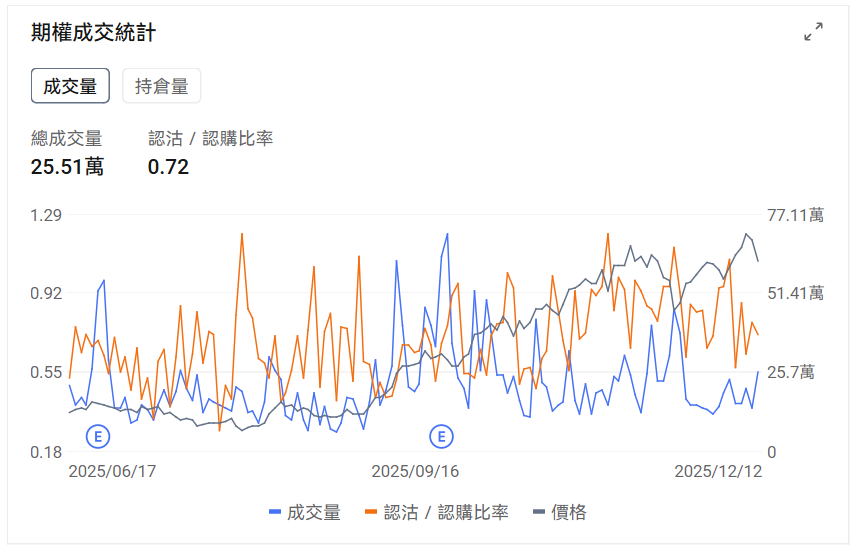

Option Signals

The put/call ratio declined, while trading volume increased.

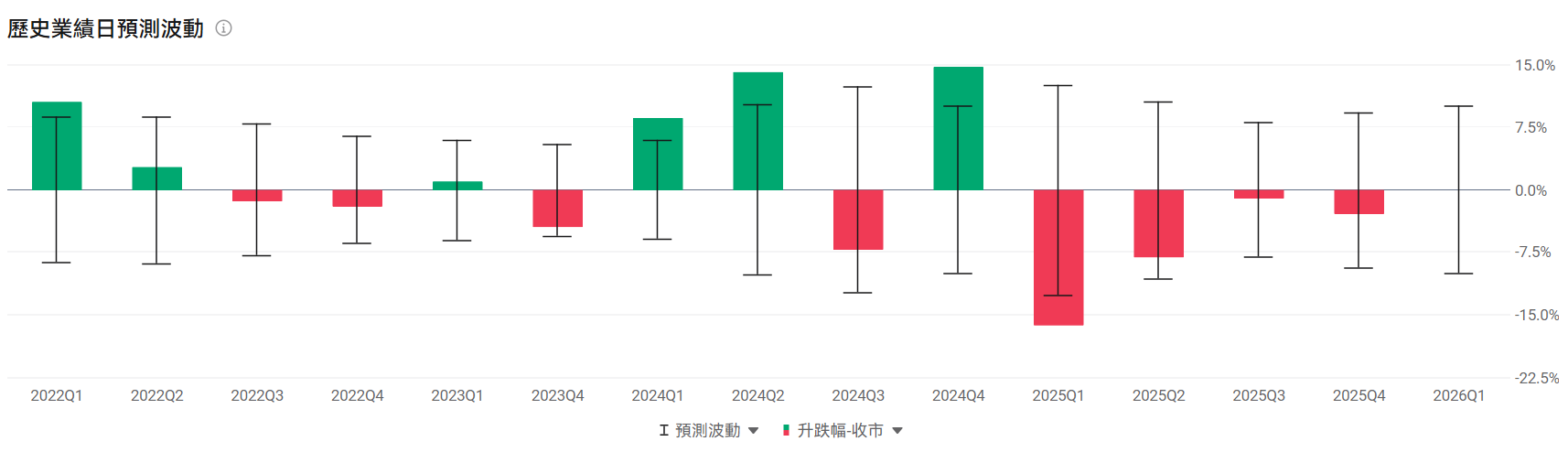

Observing post-earnings options forecasts, estimated historical performance volatility is ±4.31%.

As a structured product with fixed dividends, FCN offers the following advantages:

1. Stable monthly dividend: Receive agreed coupon payments monthly during the holding period, ensuring stable and predictable cash flow.

2. Downside protection: As long as the price does not fall below the safety line at maturity, investors can recover 100% of the principal even if the stock price declines.

3. Flexible underlying stocks: Investors can choose single or multiple stocks (underlying assets), making it easier to align with different risk preferences and investment objectives.

Editor/Lee