The Federal Reserve's independence is no longer favored, and after Powell's retirement, a close ally of Trump will take over the central bank. Bessent has proposed a policy framework that calls for lower interest rates and regulatory alignment with the White House, potentially giving the Treasury Department substantive control over monetary policy.

Like all other forms of institutional credibility, central bank independence has fallen out of favor in Washington. Its primary advocates and defenders are gradually stepping aside, replaced by staunch partisans and proponents of unorthodox monetary theories.

With Federal Reserve Chair Powell nearing retirement, this presents an opportunity for U.S. President Trump to reverse his 2018 appointment of the central banker—a decision that later drew significant criticism. Scott Bessent's tight control over the selection process means that whoever assumes the position, the U.S. Treasury Secretary will effectively dominate the Fed.

Trump has repeatedly criticized Powell in public, accusing him of being too slow to cut interest rates, calling him "stupid" and "too sluggish," and delegating the responsibility of vetting candidates to Bessent. Trump claimed to have narrowed the list of candidates to one, but did not deny to reporters that his top choice remains Kevin Hassett, the Director of the National Economic Council.

Trump has repeatedly criticized Powell in public, accusing him of being too slow to cut interest rates, calling him "stupid" and "too sluggish," and delegating the responsibility of vetting candidates to Bessent. Trump claimed to have narrowed the list of candidates to one, but did not deny to reporters that his top choice remains Kevin Hassett, the Director of the National Economic Council.

Bessent has taken the opportunity to elaborate on his institutional critique of the Fed in papers and public remarks—essentially constructing a policy framework to justify Trump’s complaints about interest rate policies. While he nominally emphasizes the importance of Fed independence, he then makes it clear that his definition of independence diverges from conventional understanding.

In a recent academic journal article, Bessent argued that the Fed has strayed from its original role. During the 2007-2009 financial crisis and the 2020 pandemic, the Fed invented various tools that significantly expanded its role in the economy, yet lacked sufficient democratic legitimacy and oversight.

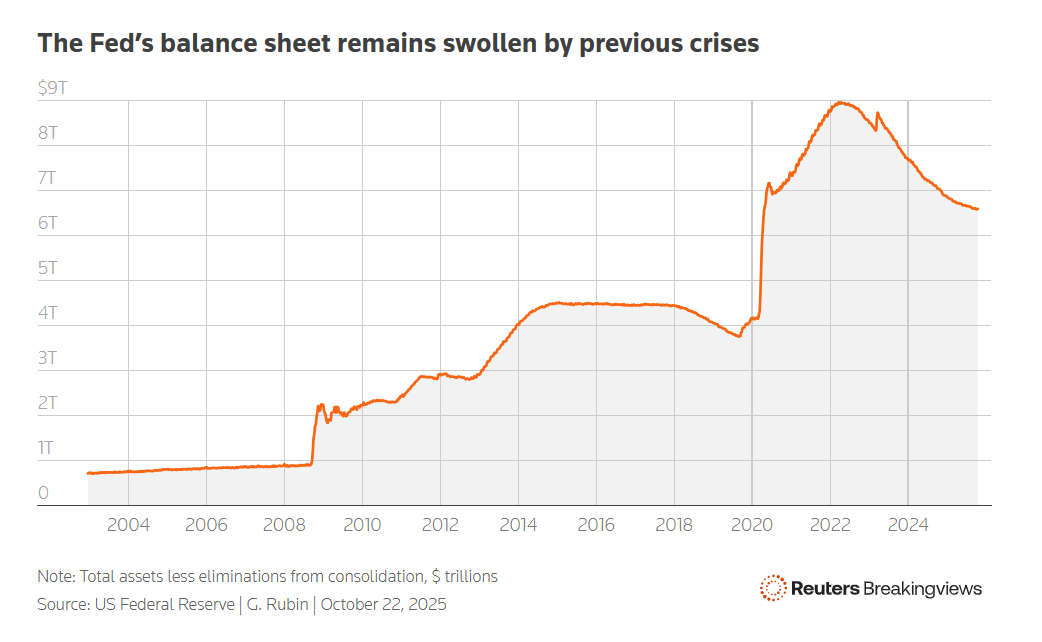

Bessent believes this is most evident in the Fed’s balance sheet, which reached $6.6 trillion in early November. The Fed repurposed its crisis-era asset purchase programs as another stimulus policy tool, benefiting asset owners such as homeowners and equity holders.

The Fed’s balance sheet expanded during previous crises.

As part of this critique, Bessent wrote that the Fed has consistently overestimated the effectiveness of fiscal stimulus while underestimating the impact of tax cuts and deregulation on economic growth. He noted that after the crisis and the passage of the 2010 Dodd-Frank Act, the Fed’s responsibilities expanded further into financial regulation and even issues like gender equality and climate change.

Although Bessent does not advocate for specific structural solutions, other critics argue for revisiting the 1951 Treasury-Fed Accord. This informal agreement allowed the Fed to take control of its own balance sheet, ending wartime arrangements that handed control to the Treasury. It marked the most significant step toward central bank independence since Andrew Mellon, then Treasury Secretary, resigned from the Federal Reserve Board in 1932—Mellon was the last official to serve simultaneously in both institutions.

Trump is challenging this arms-length relationship. Stephen Miran, Chairman of the Council of Economic Advisers, is on leave from the White House to fill a vacant seat on the Federal Reserve Board. While the Supreme Court will rule on the President’s attempt to dismiss Lisa Cook, a governor appointed by former President Joe Biden, the administration has made clear its goal is to ensure that Trump appointees hold a majority on the Board.

According to a government statement, Bessent has set clear objectives for the selection criteria for Powell’s successor: any regulatory agenda must align with the White House; interest rates should be significantly reduced as concerns about inflation driven by tariffs are exaggerated; and the issuance and management of government debt should fall under the purview of the Treasury Department rather than the Federal Reserve.

In some respects, the Federal Reserve has already begun moving toward the state preferred by Bessent. Trump recently appointed Michelle Bowman as the Vice Chair for Supervision, and she has initiated efforts to reduce bank regulatory staff by 30%. Just days before Trump's inauguration in January 2025, the Federal Reserve withdrew from a global central bank alliance on climate risk, stating that its scope exceeded the responsibilities of central banks.

Even supporters of the Federal Reserve, including former regulatory chief Daniel Tarullo, acknowledge that the Fed has overstepped its bounds in recent years. At a recent conference on central bank independence hosted by the Peterson Institute in Washington, he and other former central banking heavyweights discussed these choices as well as the crisis environment that gave rise to them. Tarullo stated that the threshold for the Fed to assume new roles should be raised, citing his opposition to granting the Fed additional consumer protection powers in post-crisis legislation.

However, to maintain financial stability and preserve its role as the lender of last resort, the Federal Reserve must employ effective tools to monitor, regulate, and manage financial and macroeconomic risks. Trump's repeated calls for interest rate cuts and demands for Powell’s resignation have continuously undermined the authority of this institution. The core elements of his trade policy shift arbitrarily on a daily basis; he fired the government’s chief statistician for releasing employment data that did not meet his expectations, and he fueled a speculative frenzy in lightly regulated cryptocurrency assets—assets in which his family holds hundreds of millions of dollars in shares.

The United States will sooner or later face another economic or financial crisis. A Federal Reserve with compromised independence means that when a crisis occurs, more power will be concentrated in the hands of the government. Central banks need to earn public trust and recognition to control inflation and ensure healthy credit conditions. These are things that the Treasury Department under the Trump administration cannot provide.

This article is contributed by market analyst Gabriel Rubin.

Editor/Rocky