Top News

Before the market opened on Monday, following last Friday's decline, the three major futures indices rebounded collectively, with Dow Jones futures up 0.51%, Nasdaq futures up 0.56%, and S&P 500 futures up 0.51%.

$明星科技股(LIST2518.US)$ Most stocks rose before the market opened, $Tesla (TSLA.US)$ 、 $NVIDIA (NVDA.US)$ 、 $Micron Technology (MU.US)$ Surged over 1%.

$热门中概股(LIST2517.US)$ Pre-market trading showed mixed performance, $Baidu(BIDU.US)$Down nearly 2%, $Alibaba(BABA.US)$ Down more than 1%; $Nio (NIO.US)$ 、 $XPeng Motors (XPEV.US)$ Slight increase.

$黄金/美元(XAUUSD.CFD)$ Up for five consecutive days, surpassing $4,340, $Silver/USD (XAGUSD.FX)$ with a rise of over 3%, $黄金(LIST2110.US)$ Pre-market trading higher, $AngloGold Ashanti(AU.US)$ 、 $Golden Fields Industrial (GFI.US)$ 、 $Coeur Mining, Inc. (CDE.US)$ with a rise of over 3%, $Harmony Gold Mining Company (HMY.US)$ Rose more than 2%.

$黄金/美元(XAUUSD.CFD)$ Up for five consecutive days, surpassing $4,340, $Silver/USD (XAGUSD.FX)$ with a rise of over 3%, $黄金(LIST2110.US)$ Pre-market trading higher, $AngloGold Ashanti(AU.US)$ 、 $Golden Fields Industrial (GFI.US)$ 、 $Coeur Mining, Inc. (CDE.US)$ with a rise of over 3%, $Harmony Gold Mining Company (HMY.US)$ Rose more than 2%.

$大麻股(LIST2997.US)$ Pre-market extended gains,$cbdMD(YCBD.US)$Surging over 14%, $Tilray Brands(TLRY.US)$, 、$Canopy Growth(CGC.US)$Up over 6%. In related news, Trump will sign an executive order to reclassify marijuana as a less restricted drug.

True driverless is here! Musk: Tesla initiates Robotaxi road tests without safety drivers.

$Tesla (TSLA.US)$ Up over 1% pre-market. On Sunday, an X user captured footage of a $Tesla (TSLA.US)$ Tesla Model Y cruising through the streets of Austin, seemingly unoccupied, without even a safety supervisor onboard. Since Tesla launched its autonomous taxi (Robotaxi) service in Austin this June, a safety supervisor had always been seated in the passenger seat. Elon Musk, CEO of Tesla, later responded, stating that the company is currently testing autonomous taxis without human safety supervisors, though these are not yet available to paying passengers.

The Nasdaq 100 annual component adjustment results have been announced, with Western Digital and Seagate Technology successfully included. Strategy retains its position in the index.

According to a release by Nasdaq, Inc., this adjustment involves six additions and six removals, with the six newly added companies set to be included in the index before the market opens on Monday, December 22, 2025. The new components include:$Alnylam Pharmaceuticals (ALNY.US)$ 、 $Ferrovial SE(FER.US)$ 、 $Insmed(INSM.US)$ 、 $Monolithic Power Systems(MPWR.US)$ 、 $Seagate Technology (STX.US)$ 、 $Western Digital (WDC.US)$ 。

Meanwhile, the following six companies will be removed from the index:$Biogen Inc (BIIB.US)$ 、 $CDW Corp(CDW.US)$ 、 $GlobalFoundries(GFS.US)$ 、 $Lululemon Athletica(LULU.US)$ 、 $ON Semiconductor(ON.US)$ 、 $The Trade Desk(TTD.US)$ . In addition, $Strategy(MSTR.US)$ was not removed as a component, retaining its position in the Nasdaq 100 Index.

Further Reading:Nasdaq 100 Major Shake-Up! Western Digital and Seagate Technology Successfully Included—Is the Storage Industry's Super Cycle Just Beginning?

Rocket Lab Executes First Dedicated Launch for JAXA, Shares Rise Pre-Market

$Rocket Lab(RKLB.US)$ Shares rose over 2% pre-market after the company announced last Saturday that it had completed its first dedicated launch mission for the Japan Aerospace Exploration Agency (JAXA). This marks a new milestone for its Electron rocket in providing reliable space launch services globally. The successful launch for JAXA reflects the growing trend of commercial companies integrating into domestic and international national space programs. Additionally, a dedicated Electron launch for the European Space Agency (ESA) is scheduled for early next year, further highlighting the demand for the Electron rocket in the international market.

STMicroelectronics: Up to 10 Billion Chips May Be Delivered to SpaceX by 2027

European chip manufacturing giant $STMicroelectronics (STM.US)$ Shares rose more than 2% in pre-market trading after delivering over 5 billion RF antenna chips to Elon Musk’s SpaceX for the company’s Starlink satellite network. According to a senior executive at STMicroelectronics, the number of chips delivered through this partnership could double within the next two years (by 2027).

Filing for Bankruptcy! U.S. Consumer Robotics Giant iRobot Plummets Over 80% in Pre-Market Trading

Once hailed as the pioneer of robotic vacuum cleaners with its Roomba model $iRobot(IRBT.US)$ Shares plunged over 80% in pre-market trading. On December 14, iRobot filed for bankruptcy protection with a U.S. court and will be privatized after being acquired by its main manufacturer, Shenzhen-based Picea Robotics. Founded in 1990, the consumer robotics company launched its first robotic vacuum cleaner in 2002 and went public on Nasdaq in 2005. However, the company reported a net loss in 2022, reversing from a profit to a deficit of $286.3 million. Earlier in March, iRobot expressed concerns about its ability to continue operations, citing fierce competition from low-cost rivals and the impact of U.S. tariff increases.

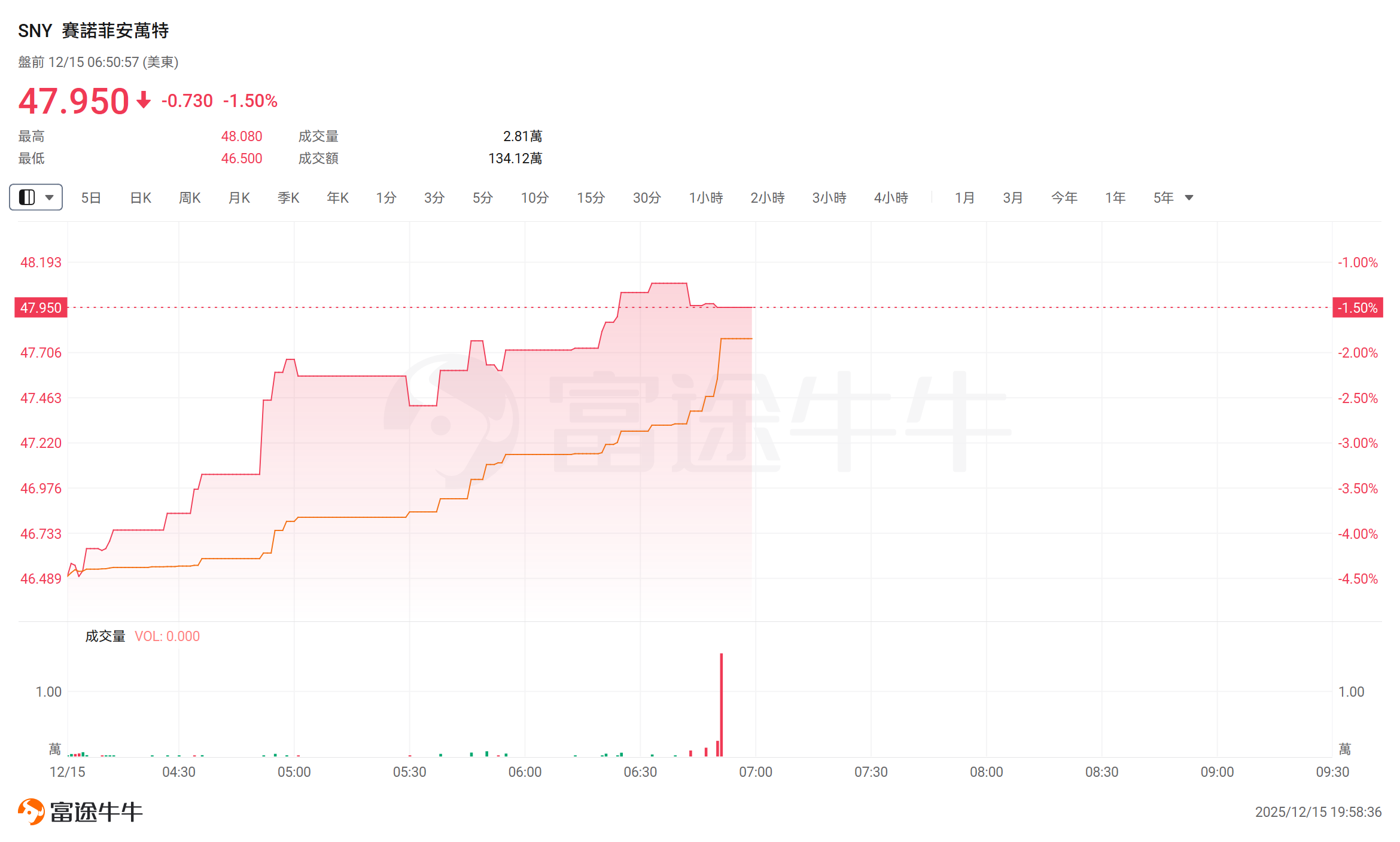

Sanofi’s New Multiple Sclerosis Drug Faces Setbacks; Shares Drop Over 4% in Pre-Market Trading

Shares of the French multinational pharmaceutical company $Sanofi(SNY.US)$ fell more than 4% in pre-market trading after its experimental drug for treating multiple sclerosis encountered dual setbacks: a late-stage clinical trial failed to meet key primary endpoints, and U.S. regulators signaled that the approval decision for the drug would be delayed again. Sanofi announced that its candidate drug, tolebrutinib, failed to achieve the primary endpoint in a late-stage clinical trial targeting multiple sclerosis. Additionally, the company stated that communications with the U.S. Food and Drug Administration (FDA) indicated that the regulatory review timeline for another indication of the drug would be longer than previously expected.

Biopharmaceutical company $Immunome(IMNM.US)$ Shares surged over 30% pre-market after the company announced positive results from its trial for treating cancer patients.

Global macro

Is the market underestimating the probability of a January interest rate cut? This week's employment and CPI data will be key variables.

UBS Group's Jonathan Pingle team recently released a report stating that Powell’s cautious stance on certain data primarily addresses quality issues with household survey data affected by the government shutdown, rather than a rejection of all economic data. Previously, Powell clearly stated during a press conference that the Federal Open Market Committee (FOMC) had not made any decisions regarding the January meeting and emphasized that policymaking would depend on forthcoming data.

This Tuesday, both October and November non-farm payroll reports will be released simultaneously—a rare arrangement that will provide the FOMC with a more comprehensive assessment of the labor market. UBS Group forecasts that, influenced by the federal government’s Delayed Retirement Plan (DRP), non-farm employment will decline by 20,000 in October and increase by 45,000 in November. More importantly, the unemployment rate in November may rise to 4.5%, continuing the trend of a slowing labor market. The November CPI data will be released on Thursday. However, due to data collection interruptions caused by the government shutdown, the CPI report may contain significant noise.

Bank of America: RMP combined with the Treasury’s debt issuance strategy forms a standard 'QE-like combination punch.'

In its latest research report, Bank of America stated that an RMP alone does not equate to QE; however, when viewed in conjunction with the U.S. Treasury's debt issuance strategy, it constitutes a standard 'QE-like combination punch.' The report noted that the Fed began implementing RMPs this month, which, though not traditional QE, indirectly allows the Treasury to increase short-term bill issuance while reducing medium- to long-term bond supply. Bank of America expects that by 2026, the Fed will purchase $560 billion in Treasury bills through RMPs and MBS reinvestments, while the Treasury plans to issue an additional $500 billion in Treasury bills and reduce medium- to long-term bond issuance by $600 billion. This combination is projected to exert downward pressure of 20-30 basis points on the 10-year U.S. Treasury yield in 2026.

Hassett: If chosen to lead the Fed, Trump can offer opinions, but they will carry 'no weight' in Fed decision-making.

On Sunday, Federal Reserve Chair candidate Kevin Hassett firmly refuted the notion that the President’s opinions carry equal weight with FOMC voting members. He stated that policymakers are free to reject the President’s input and 'vote differently.' Hassett remarked, 'No, no, he won’t have any weight. It’s just that if his opinion is good and data-driven, then it matters.'

Forget AI and tech giants in 2026! Goldman Sachs and Bank of America predict a rotation in U.S. stocks.

Investors have been focusing on artificial intelligence (AI) and large tech giants driving stock market gains throughout the year. However, nearing the end of the year, Goldman Sachs indicated that greater opportunities next year may come from other sectors. In their latest report, analysts wrote, 'At the sector level, we expect the acceleration of economic growth in 2026 to most significantly boost earnings-per-share growth in cyclical industries, including industrials, materials, and consumer discretionary.' Goldman Sachs analysts anticipate that real estate companies’ earnings-per-share growth will rise from 5% this year to 15% next year, while consumer discretionary companies’ earnings-per-share growth is expected to increase from 3% to 7%. Industrial stocks are also set for a substantial rebound, with earnings-per-share growth accelerating from 4% to 15%. Meanwhile, information technology companies’ growth is projected to slow from 26% in 2025 to 24% in 2026. Additionally, Savita Subramanian, head of U.S. equity and quantitative strategy at Bank of America, believes that AI-related stocks will encounter a 'downturn' next year as investors continue to sell off.

Morgan Stanley: As AI becomes physical, robotics enters a Cambrian explosion, with China holding a clear leading advantage.

Morgan Stanley's global embodied AI team, in the latest release of 'The Robotics Compendium,' forecasts that under a baseline scenario, global sales of robotics hardware will surge from approximately USD 100 billion in 2025 to USD 500 billion in 2030, reaching USD 9 trillion by 2040 and climbing to USD 25 trillion by 2050. This forecast covers only hardware sales; if software services, maintenance, and supply chain-related revenues are included, the market size could multiply.

In this transformation, China has demonstrated clear leadership advantages, particularly in terms of manufacturing capabilities, control over rare earth materials, and policy support across multiple dimensions. As Chinese companies accelerate the mass production and application of robots, the global market landscape is undergoing profound changes. Morgan Stanley believes that China’s leading position is expected to continue expanding over the next decade.

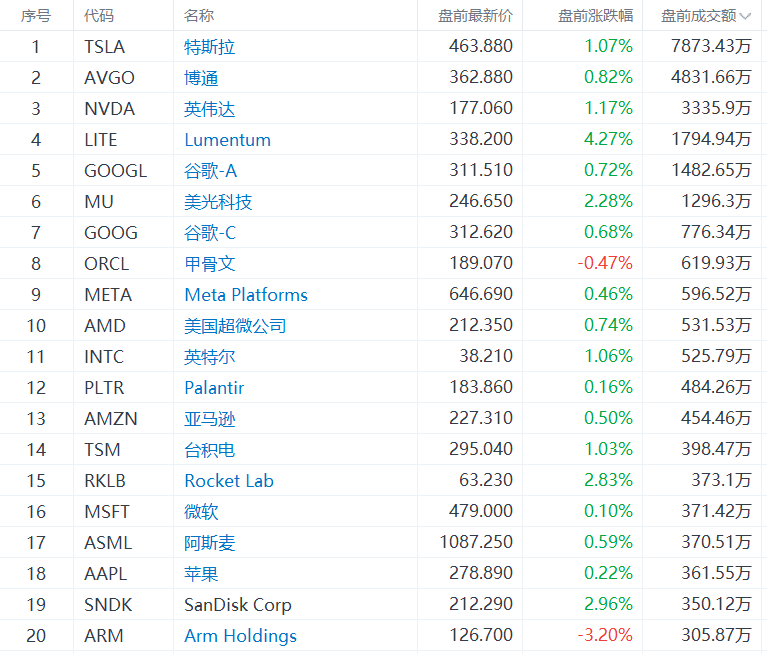

Top 20 pre-market trading volume stocks in the U.S. stock market

U.S. Stock Market Macroeconomic Calendar Reminder

(The following times are in Beijing Time)

21:30 Monthly change rate of Canada's CPI and the New York Fed Manufacturing Index for the U.S. in December.

22:30 Fed Governor Milan delivers a speech

23:00 US December NAHB Housing Market Index

23:30 Permanent FOMC voter and New York Fed President Williams speaks on the economic outlook

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO