Kevin Hassett, once considered almost a sure bet by the market for the position of Federal Reserve Chair, is now facing resistance from senior figures who have direct access to President Trump. There are concerns that Hassett is too closely aligned with Trump; if the bond market perceives him as being overly subservient to Trump, it might 'rebel' over time. Hassett’s likelihood in the prediction markets has dropped to 51%, significantly lower than over 80% earlier this month. Data from Polymarket even suggests that John Taylor has a higher probability than Hassett of becoming the next Fed Chair.

On Monday local time, according to media reports citing people familiar with the matter, Kevin Hassett, who was once considered almost a sure bet by the market as a candidate for Federal Reserve Chair, is facing resistance from some senior officials who can directly advise President Trump.

There are concerns that this director of the National Economic Council is too close to Trump – ironically, this was initially one of the reasons he became a leading contender to replace current Fed Chair Jerome Powell. Such resistance might explain why a candidate interview scheduled for early December was canceled, and then at least re-scheduled for Warsh last week.

Trump had previously told reporters that he already knew who he would choose as Fed Chair, but on Friday last week, during an interview with The Wall Street Journal, he surprised investors by stating that former Fed Governor Kevin Warsh had caught up with Hassett as a leading candidate on the shortlist for Fed Chair. “I think both Kevins are great.”

Trump had previously told reporters that he already knew who he would choose as Fed Chair, but on Friday last week, during an interview with The Wall Street Journal, he surprised investors by stating that former Fed Governor Kevin Warsh had caught up with Hassett as a leading candidate on the shortlist for Fed Chair. “I think both Kevins are great.”

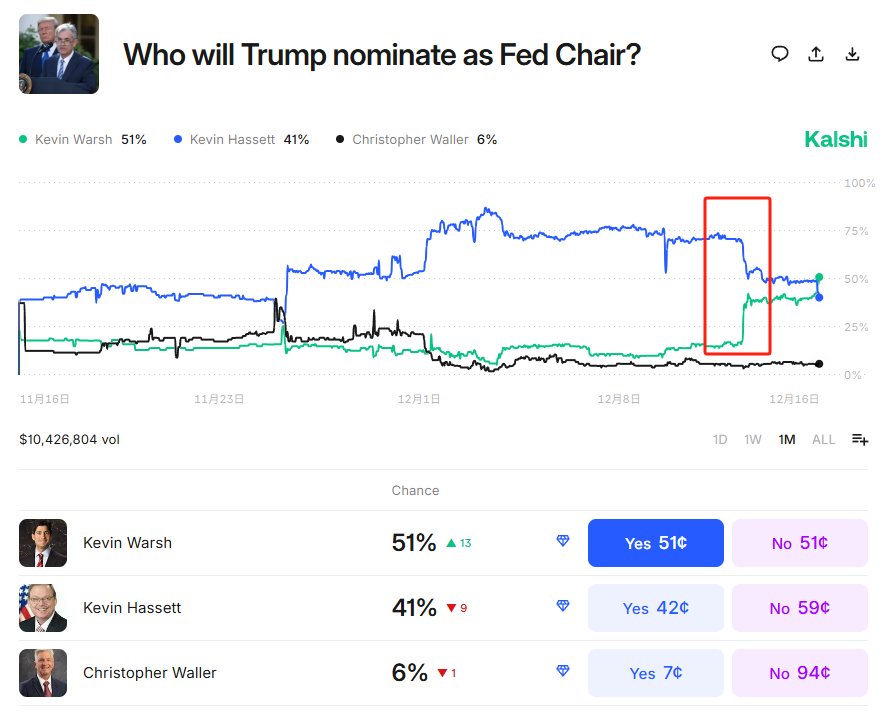

The remarks by Trump caused a sharp decline in Hassett’s chances on the Kalshi prediction market. Data from Polymarket further indicates that the prediction market views John Taylor as having a higher probability than Hassett of becoming the next Federal Reserve Chair.

Nevertheless, Hassett remained the frontrunner on Kalshi on Monday, with a 51% chance of success, but this was notably lower than the peak of over 80% earlier this month. Warsh's current odds stand at 44%, compared to about 11% in early December.

This resistance has manifested more as support for Warsh rather than direct criticism of Hassett. At an event hosted by JPMorgan on Thursday, CEO Jamie Dimon gave positive remarks about both Hassett and Warsh, but his comments left attendees feeling that he leaned more towards Warsh.

Bloomberg News reported at the end of November that with Powell's term set to expire in May next year, Hassett had emerged as the leading contender to succeed him.

However, as December progressed, multiple sources indicated that resistance to Hassett's nomination began to mount, with growing concerns: if the bond market perceives him as overly subservient to Trump, it may 'rebel' after some time. This perception could ultimately have the opposite effect of what Trump intended – if markets fear Hassett won’t be tough enough in curbing future inflation rebounds, long-term yields could rise instead.

Perhaps in response to these criticisms, Hassett appeared more resolute on the issue of the Fed’s independence during a media interview over the weekend.

According to the transcript of the interview, Hassett stated during the program: “President Trump has very strong and well-founded views on what we should do. But ultimately, the Fed's responsibility is to remain independent, collaborate with board members and the Federal Open Market Committee (FOMC), and form a collective consensus on where interest rates should go.”

When asked whether Trump's views would carry the same weight as those of Federal Reserve members with voting rights, Hassett responded: "No, no, he will not have any weight. Only if his opinions are good and data-based, then his views would be meaningful."

In an interview with The Wall Street Journal last Friday, Trump stated that the next Federal Reserve Chair should consult with him on interest rate issues, saying, “I am a smart voice and should be heard.” However, he also acknowledged that the Fed Chair should not simply follow the president’s orders.

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/Stephen