The three major U.S. stock indexes closed collectively lower, $Dow Jones Index (.DJI.US)$ Dropped by 0.09%, $Nasdaq Composite Index (.IXIC.US)$ Dropped by 0.59%, $S&P 500 Index (.SPX.US)$down 0.16%,$Broadcom (AVGO.US)$Dropped more than 5%, $Apple(AAPL.US)$ 、$Amazon(AMZN.US)$up more than 1%,$Tesla (TSLA.US)$Increased by more than 3%.

Top 5 Gainers in U.S. Equity ETFs

$2x Inverse BMNR ETF-Defiance (BMNZ.US)$ Rose by 22.21%, with a trading volume of $107 million.

$2x Leverage Short RKLB ETF - Defiance (RKLZ.US) Rose by 19.77%, with a trading volume of $10.31 million.

$2 Leverage Short QBTS ETF - Defiance (QBTZ.US) Rose by 18.31%, with a trading volume of $3,463.61.

$2 Leverage Short QBTS ETF - Defiance (QBTZ.US) Rose by 18.31%, with a trading volume of $3,463.61.

$2x Short CRCL ETF-T-REX (CRCD.US)$ Rose by 18.27%, with a trading volume of $10.55 million.

In terms of news,$Bitcoin (BTC.CC)$Fell below the $86,000 mark; cryptocurrency-related stocks generally declined, with BMNR dropping over 11% and CRCL falling nearly 10%.

$2x Inverse RGTI ETF - Defiance (RGTZ.US) Rose by 17.74%, with a trading volume of $105 million.

In terms of market news, quantum computing-related stocks collectively declined, with QBTS and RGTI both falling by 9%.

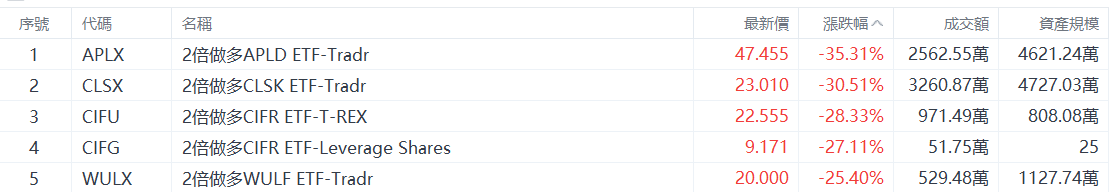

Top 5 Decliners on US Stock ETFs

$2x Leverage APLD ETF-Tradr (APLX.US)$ Fell by 35.31%, with a trading volume of $25.6255 million.

$2x Long CLSK ETF-Tradr (CLSX.US)$ Fell by 30.51%, with a trading volume of $32.6087 million.

$2x Leverage CIFR ETF-T-REX (CIFU.US) Fell by 28.33%, with a trading volume of $9.7149 million.

$2x Leverage CIFR ETF-Leverage Shares(CIFG.US) Fell by 27.11%, with a trading volume of $517,500.

$2x Leverage WULF ETF-Tradr (WULX.US)$ Fell by 25.40%, with a trading volume of $5.2948 million.

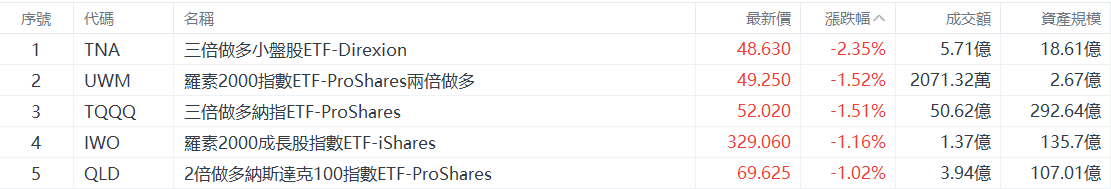

Top 5 Decliners in Major US Equity Index ETFs

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Fell by 2.35%, with a trading volume of $571 million.

$ProShares Ultra Russell 2000 (UWM.US)$ Fell by 1.52%, with a trading volume of $20.7132 million.

$ProShares UltraPro QQQ (TQQQ.US)$ Fell by 1.51%, with a trading volume of $5.062 billion.

$iShares Russell 2000 Growth ETF (IWO.US)$ Fell by 1.16%, with a trading volume of $137 million.

ProShares Ultra QQQ (QLD.US), which provides 2x daily leverage to the Nasdaq 100 Index, Dropped by 1.02%, with a trading volume of $394 million.

Top 5 Industry-Specific ETFs by Decline

$VanEck Uranium+Nuclear Energy ETF (NLR.US)$ Dropped by 2.40%, with a trading volume of $8,102.28.

$US Natural Gas ETF (UNG.US)$ Dropped by 2.20%, with a trading volume of $200 million.

$2x Leveraged Energy ETF-Direxion (ERX.US)$ Dropped by 1.34%, with a trading volume of $12.13 million.

$SPDR S&P Metals and Mining ETF (XME.US)$ Dropped by 1.33%, with a trading volume of $180 million.

$Direxion Daily Semiconductor Bull 3X Shares (SOXL.US)$ Dropped by 1.28%, with a trading volume of $3.22 billion.

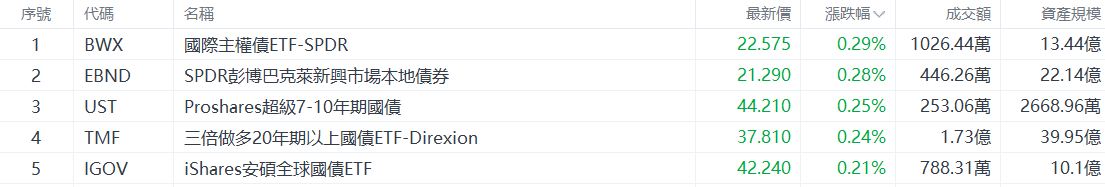

Top 5 Increases in Bond ETFs

$International Sovereign Bond ETF-SPDR(BWX.US)$ Rose by 0.29%, with a trading volume of $10.26 million.

$SPDR Bloomberg Barclays Emerging Markets Local Bond(EBND.US)$ Rose by 0.28%, with a trading volume of $4.46 million.

$ProShares Ultra 7-10 Year Treasury (UST.US)$ Rose by 0.25%, with a trading volume of $2.53 million.

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Rose by 0.24%, with a trading volume of $173 million.

$iShares Global Treasury Bond ETF (IGOV.US)$ Up 0.21%, with a trading volume of $7.8831 million.

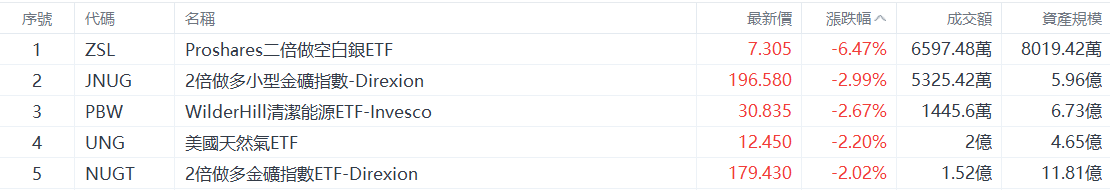

Top 5 Commodity ETF Decliners

$Proshares UltraShort Silver ETF (ZSL.US)$ Down 6.47%, with a trading volume of $65.9748 million.

$2x Leveraged Junior Gold Miners ETF - Direxion (JNUG.US) Down 2.99%, with a trading volume of $53.2542 million.

$WilderHill Clean Energy ETF - Invesco (PBW.US) Down 2.67%, with a trading volume of $14.456 million.

$US Natural Gas ETF (UNG.US)$ Down 2.20%, with a trading volume of $200 million.

$2x Leveraged Gold Miners ETF - Direxion (NUGT.US) Down 2.02%, with a trading volume of $152 million.

In market news, spot silver once again approached its historical high, surging over 3% within 24 hours. $ProShares Ultra Silver ETF (AGQ.US)$ rose over 6%.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen