Top News

Could a weak nonfarm payroll report save the U.S. stock market on Tuesday? Morgan Stanley's chief strategist suggests that softer employment data may help drive equity markets higher.

U.S. stocks failed to rebound on Monday, with the three major indices collectively closing lower for two consecutive trading days. Investors turned their attention to the delayed non-farm payroll report, postponed due to the U.S. federal government shutdown, seeking opportunities for a market rebound. This belated yet pivotal report, released on Tuesday, could provide key insights into the Federal Reserve's interest rate trajectory for next year.

Economists predict that non-farm payrolls may have contracted in October, with an increase of 50,000 expected in November and the unemployment rate rising to a four-year high. Michael Wilson, Chief U.S. Equity Strategist at Morgan Stanley, believes that if the report shows moderately weak employment data, it could instead boost stock market gains. He notes that the market has returned to a state where good economic news is bad news for stocks, and conversely, bad news is good news for the market. He explained that while a robust labor market benefits the economy, it reduces the likelihood of the Federal Reserve cutting interest rates next year.

Nasdaq to formally apply for 5X23-hour trading

Nasdaq to formally apply for 5X23-hour trading

According to foreign media reports, Nasdaq is planning to file a submission with the U.S. Securities and Exchange Commission on Monday to launch around-the-clock stock trading services. Nasdaq plans to extend the trading hours for stocks and exchange-traded products (ETPs) from the current five days a week, 16 hours a day, to 23 hours.

Nasdaq’s new “5X23” model will be divided into two main trading sessions: ① Day Session: Starting at 4:00 AM Eastern Time and ending at 8:00 PM. This session will continue to include pre-market, regular, and after-hours trading periods, with the opening bell (9:30 AM) and closing bell (4:00 PM) retained during regular trading hours. ② Night Session: Starting at 9:00 PM Eastern Time and ending at 4:00 AM the following morning. Trades executed between 9:00 PM and midnight will be considered part of the next calendar day’s trading. Under the new plan, the trading week will start at 9:00 PM on Sunday and end at 8:00 PM on Friday after the conclusion of the day session.

Intensifying Contest for Fed Chair Nomination: Hassett Faces Opposition from Trump's Close Associates

According to sources familiar with the matter, Kevin Hassett, Director of the White House National Economic Council, was once seen by the market as almost a sure bet to become the next Federal Reserve Chair, but now faces opposition from some high-level individuals closely tied to Trump. Sources say there are concerns that Hassett’s close relationship with the President—ironically, the very factor that initially made him a frontrunner to succeed Powell—is now working against him. As of Monday, Hassett remained the leading contender on the prediction market Kalshi, with odds of 51%, though this marks a decline from over 80% earlier this month.

Kevin Warsh’s odds currently stand at 44%, a significant increase from approximately 11% at the beginning of December. Sources indicate that growing resistance to Hassett’s candidacy reflects mounting concerns that if the bond market perceives him as being too aligned with Trump, it could trigger market volatility. This perception might ultimately produce results contrary to Trump’s expectations, with long-term yields potentially rising. Perhaps in response to these criticisms, Hassett expressed stronger support for the Fed’s independence during an interview last week.

Fed's Williams: Slower Job Growth and Easing Inflation Risks Support Rate Cut

On December 15, Federal Reserve’s John Williams stated that a cooling labor market and easing inflation risks provided justification for the Fed’s decision to cut interest rates last week. This marked Williams’ first public commentary on the rate cut decision. He said he is increasingly confident that price increases will continue to slow. Williams noted that inflation is “temporarily lingering” above the Fed’s target, but he expects it to continue declining as the effects of tariffs are absorbed more broadly across the economy next year.

At the same time, he said that although the employment situation has not deteriorated sharply, it is gradually cooling, as reflected in official data as well as consumer and business surveys. Williams stated that, taken together, these shifts in pressures on the Fed’s dual economic goals supported last week’s decision to cut interest rates.

Federal Reserve Governor Michelle Bowman: May continue serving beyond her term expiration at the end of January until a successor is confirmed.

Federal Reserve Governor Michelle Bowman indicated that she is likely to remain on the Board of Governors after her term expires at the end of January next year, until a new governor is confirmed to fill her vacancy. Bowman’s intention to stay coincides with Trump’s consideration of candidates to replace Jerome Powell, who is stepping down as Fed Chair in May. Since Powell has not indicated whether he will step down from his role as a governor after his chairmanship ends, Trump is expected to use Bowman’s seat to place his nominee for chair onto the board.

Trump hinted that a decision on the chair nominee might be made before early next year, explicitly stating he would only select someone who supports his push for aggressive interest rate cuts. On Monday, Bowman stated, “I expect to continue serving in this capacity until someone else is confirmed to take over my seat.” However, Bowman added that whether she will continue dissenting on interest rate decisions will depend on officials’ subsequent policy actions.

Forbes: Musk's Net Worth Surges to $677 Billion

According to Forbes data, Musk's net worth has reached $677 billion. The significant increase in Musk's wealth is primarily attributed to the rising valuation of his space exploration company, SpaceX. Earlier this month, media reports indicated that SpaceX initiated a share buyback offer internally, which valued the company at $800 billion, doubling its August valuation of $400 billion. Based on Musk's approximately 42% stake in SpaceX, as of noon Eastern Time on Monday, his personal wealth increased by $168 billion, reaching about $677 billion.

SEC Chair: Cryptocurrency Could Become the Ultimate Financial Surveillance Tool; Calls for Regulatory Balance Between Privacy and Security

Paul Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), stated on December 15 that cryptocurrencies might evolve into "the most powerful financial surveillance architecture ever created," while emphasizing that regulation should avoid excessive intervention to strike a balance between security and individual privacy. At the sixth roundtable meeting of the SEC's Crypto Working Group, Atkins noted that blockchain technology can efficiently track the association between transactions and senders. If regulatory direction goes awry, governments could treat every wallet as a broker and every software as an exchange, turning the crypto ecosystem into a "panopticon of finance." However, he also believed it was still possible to construct a regulatory framework that does not sacrifice individual privacy.

Trump: Closer to a 'peace agreement' now than ever before

U.S. President Trump stated on December 15 that he had "very good conversations" with European leaders that day, many of which focused on the Russia-Ukraine conflict, and they discussed it at length, noting that things "seem to be going well."

Trump noted that he held very long and productive discussions with Ukrainian President Zelenskyy, as well as leaders from Germany, Italy, Finland, France, the UK, Poland, Norway, Denmark, the Netherlands, and NATO. Trump believes that progress toward achieving a "peace agreement" to resolve the Russia-Ukraine conflict is closer now than ever before.

Trump also stated that he has had multiple conversations with Russian President Putin and received significant support from European leaders, with all parties hoping to bring the conflict to an end. Trump emphasized that it is essential for Ukraine and Russia to reach an agreement, noting that progress is currently smooth and discussions have been effective.

Trump: Investigating Whether Israeli Military Killing of Hamas Leader Violated Ceasefire Agreement

U.S. President Trump stated on the 15th that an investigation is underway regarding whether the killing of a leader of the Palestinian Islamic Resistance Movement (Hamas) by the Israeli military violated the ceasefire agreement.

On the 13th, the Israel Defense Forces and the Israel Security Agency (Shin Bet) issued a joint statement saying that during a strike operation carried out by the Israeli military in Gaza City that day, a senior Hamas commander, Saad, was killed.

On the 14th, the armed wing of Hamas, the Qassam Brigades, released a statement confirming that Saad had died in an Israeli attack earlier. The statement also pointed out that this attack seriously violated the ceasefire agreement, resulting in the deaths of several Hamas members.

European and EU leaders issue joint statement: commitment to provide security guarantees for Ukraine

European leaders held talks with Ukrainian President Volodymyr Zelenskyy, reaching a consensus that territorial concessions by Ukraine should only be made after robust security guarantees are in place, including a European-led multinational force. The joint statement emphasized that Ukraine should maintain an armed force of approximately 800,000 personnel, with Europe coordinating the formation of a multinational force supported by the United States to assist in rebuilding Ukraine’s military, defending its airspace, and securing its maritime zones.

U.S. Stock Market Recap

AI-related stocks remain under pressure as the three major indices closed lower; Tesla surged over 3%.

On Monday Eastern Time, U.S. stocks opened higher but ended lower, with all three major indices closing in negative territory. Artificial intelligence (AI)-related stocks continued to face downward pressure.

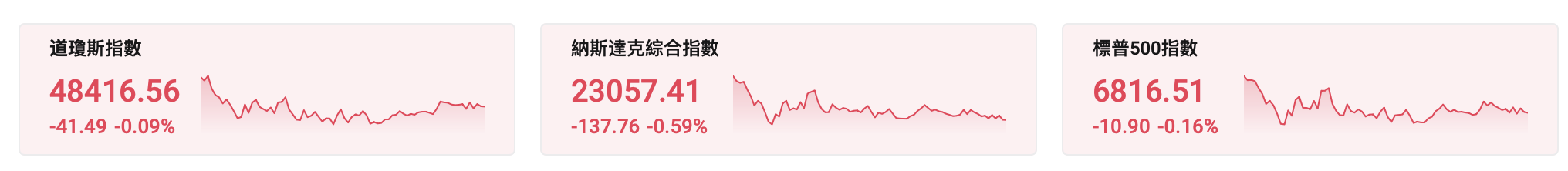

At the close, the Dow Jones Industrial Average fell 0.09% to 48,416.56 points; the S&P 500 Index declined 0.16% to 6,816.51 points; and the Nasdaq Composite Index dropped 0.59% to 23,057.41 points.

Blue-chip tech stocks showed mixed performance, $Tesla (TSLA.US)$ with one rising over 3% to hit a new yearly high, $NVIDIA (NVDA.US)$ another slightly up, $Apple(AAPL.US)$ with declines exceeding 1%. $Google-C (GOOG.US)$ 、 $Microsoft(MSFT.US)$ and another marginally down. $Amazon(AMZN.US)$ with declines exceeding 1%. $Broadcom (AVGO.US)$ dropped over 5%, $Oracle (ORCL.US)$ Dropped more than 2%.

Popular Chinese ADRs generally declined, with the Nasdaq Golden Dragon China Index falling 2.17%. $Baidu(BIDU.US)$ fell nearly 5%. $Kingsoft Cloud (KC.US)$ dropping over 4%, $Alibaba(BABA.US)$ 、 $XPeng Motors (XPEV.US)$ Dropped more than 3%.

Bitcoin once fell below $86,000, with cryptocurrency-related stocks leading declines. $CleanSpark(CLSK.US)$ Down over 15%, $Cipher Mining(CIFR.US)$ Down over 13%, $Bitmine Immersion Technologies(BMNR.US)$ 、 $IREN Ltd(IREN.US)$ Down over 11%.

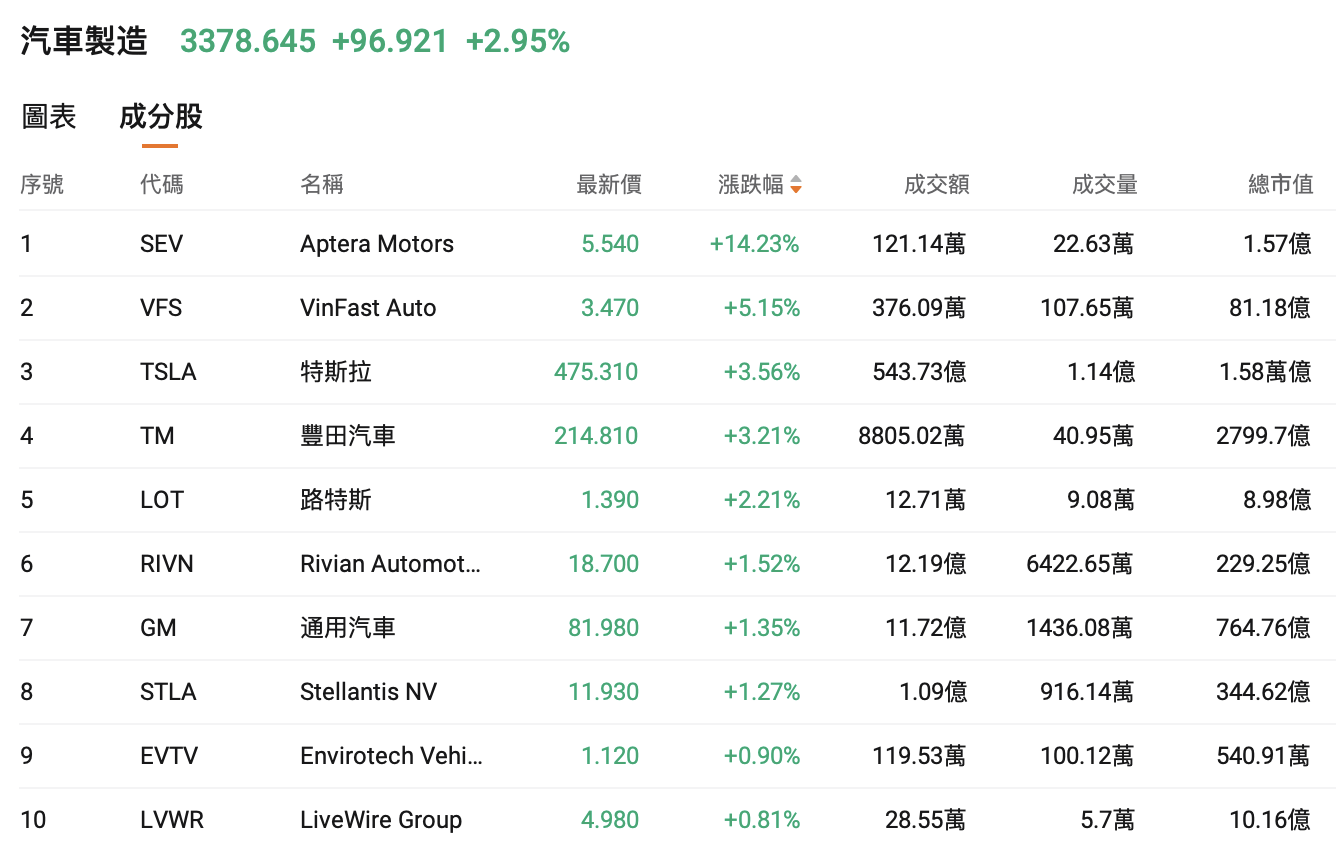

Tesla drove gains in the automobile manufacturing sector. $Aptera Motors(SEV.US)$ Surging over 14%, $VinFast Auto(VFS.US)$ up over 5%, $Toyota Motor(TM.US)$ with a rise of over 3%, $Lotus Cars(LOT.US)$ Rose more than 2%.

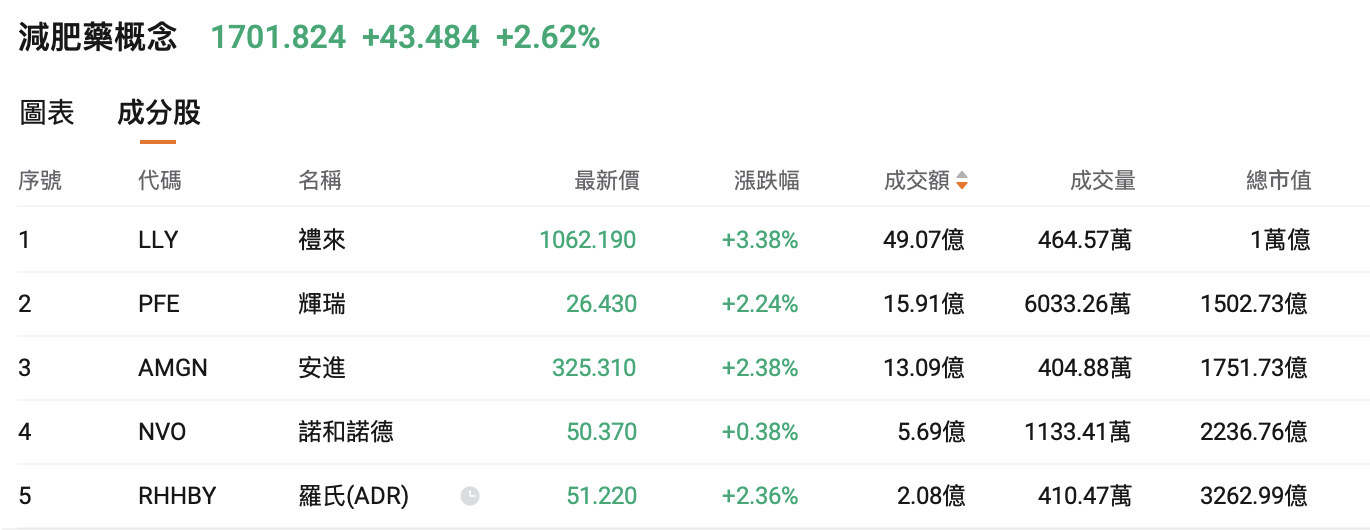

Eli Lilly and Co boosted weight-loss drug-related stocks. $Eli Lilly and Co (LLY.US)$ with a rise of over 3%, $Pfizer (PFE.US)$ 、 $Amgen(AMGN.US)$ Rose more than 2%.

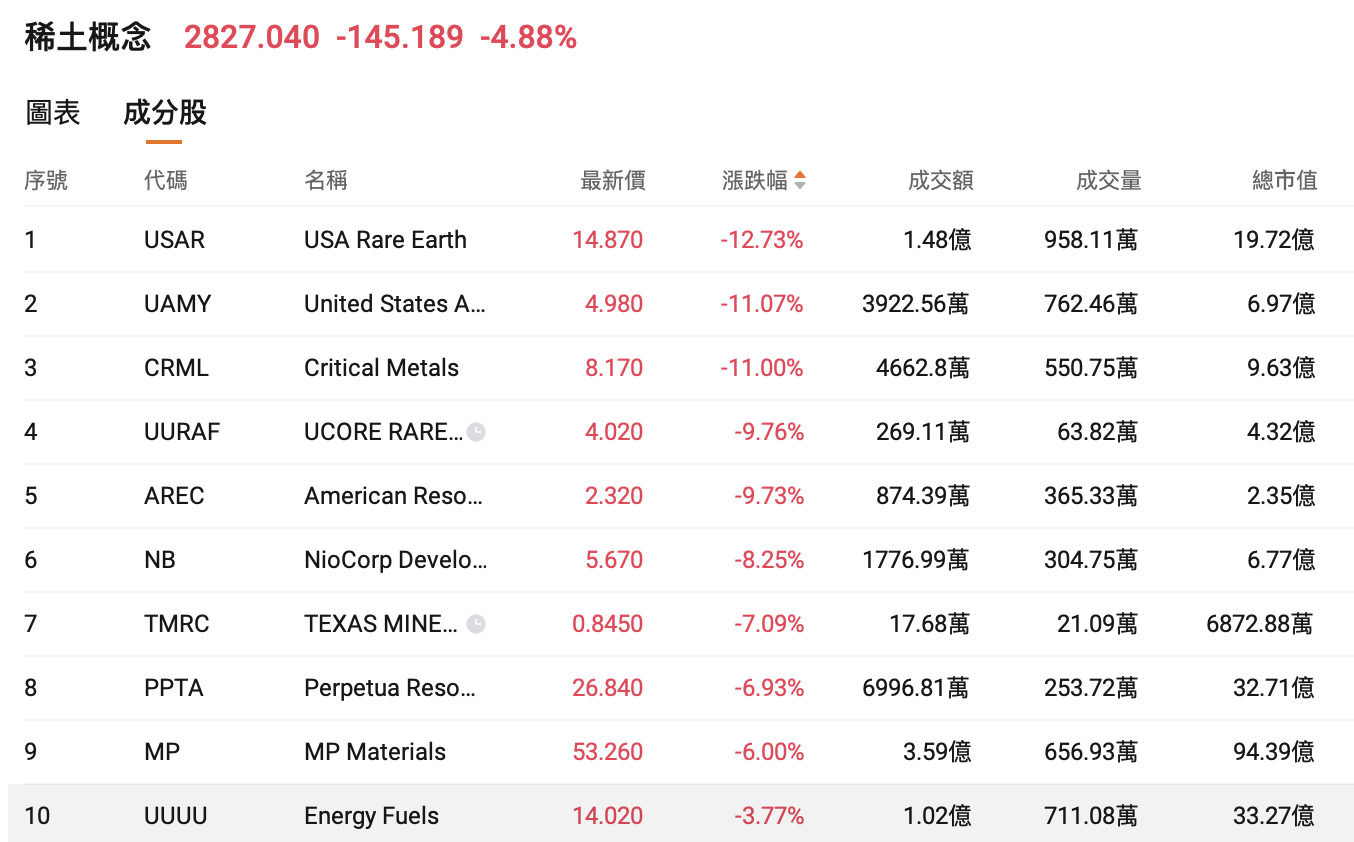

Rare earth-related stocks broadly declined. $USA Rare Earth(USAR.US)$ Down nearly 13%, $United States Antimony(UAMY.US)$ 、 $Critical Metals(CRML.US)$ Down over 11%.

Travel service concept stocks rose collectively. $Royal Caribbean (RCL.US)$ 、 $Expedia(EXPE.US)$ with a rise of over 3%, $Airbnb (ABNB.US)$ Rose more than 2%.

Individual stock news

The character licensing agreement between OpenAI and Disney for the settlement of Sora will be conducted entirely in stock.

Reports indicate that OpenAI and $Disney (DIS.US)$ have reached a character licensing agreement for its Sora video application entirely in the form of stock warrants, rather than cash. The agreement grants Disney the option to purchase additional shares beyond the already announced $1 billion stake, ensuring alignment of interests should Sora succeed. Disney will authorize OpenAI to use more than 200 characters, including Mickey Mouse and Cinderella. As Sora competes with rivals such as Runway AI and Google, this collaboration further solidifies OpenAI’s position in Hollywood while also making Disney one of OpenAI's most important clients.

JPMorgan: Oracle’s aggressive AI spending raises bond market concerns, Oracle down nearly 3%

$Oracle (ORCL.US)$ Oracle’s aggressive artificial intelligence expenditure plan has drawn significant attention in Wall Street’s search for cracks in the AI boom. JPMorgan credit analyst Erica Spear expects the pressure on the company’s bonds to persist into next year. Last week, Oracle shares recorded their largest drop in nearly 11 months, while its credit risk indicators climbed to a 16-year high. Company earnings reports showed revenue falling short of market expectations, with the annual capital expenditure target raised by $15 billion and future lease commitments more than doubling.

Co-CEO Clay Magouyrk stated that the company is committed to maintaining its investment-grade debt rating, and the actual borrowing scale may be lower than analysts’ forecast of over $100 billion. Spear noted: “The challenge for investors lies precisely here: management continues to finance investments almost entirely through debt, which, while unsurprising, remains frustrating given the lack of clarity around investment timelines and caps.”

Tesla rose over 3%. Wedbush’s latest report optimistically forecasts Tesla’s market value to reach $3 trillion by the end of 2026, with FSD penetration potentially exceeding 50%.

Wedbush analyst Dan Ives released $Tesla (TSLA.US)$ the latest research report: Tesla is expected to capture approximately 70% of the global autonomous driving market share over the next decade, as no company worldwide can match Tesla in terms of scale and business scope, with its artificial intelligence capabilities continuing to expand. As autonomous driving and robotics business roadmaps enter full-scale mass production, we believe Tesla's market value could exceed $2 trillion within the next year, reaching $3 trillion by the end of 2026 under an optimistic scenario... Over the next 12 to 18 months, our optimistic target price for Tesla is $800.

Eli Lilly and Co’s orforglipron approval process is expected to accelerate significantly, with shares rising over 3%

$Eli Lilly and Co (LLY.US)$ The approval process for the company’s experimental oral weight-loss drug orforglipron is expected to accelerate significantly, potentially receiving a regulatory decision from the U.S. Food and Drug Administration (FDA) as early as the end of March 2026. The expedited timeline suggests that orforglipron’s potential approval date may be moved up from the originally planned mid-May 2026 to the end of March. This holds significant implications for Eli Lilly’s competitive position in the rapidly growing weight-loss drug market.

NVIDIA Releases Nemotron 3 Open-Source Model Series: Hybrid MoE Architecture + 1 Million Token Context

$NVIDIA (NVDA.US)$ On Monday, the company released the latest version of its series of open-source artificial intelligence models, 'Nemotron,' along with accompanying data and libraries, aiming to provide transparent, efficient, and customizable agentic AI development capabilities for various industries. The company stated that this new family of models will outperform previous products in speed, cost, and intelligence levels. The Nemotron 3 model series includes Nano, Super, and Ultra versions, introducing a groundbreaking hybrid latent Mixture-of-Experts (MoE) architecture, enabling developers to build and deploy reliable multi-agent systems at scale.

The company stated that the Nemotron 3 Nano, which went online on Monday, is more efficient than the previous generation, meaning lower operating costs, while also performing better when handling long tasks involving multiple steps. The other two larger versions are expected to be launched in the first half of 2026.

Immunome, a biopharmaceutical company, announced positive results from the late-stage clinical trial of its experimental drug, with shares rising over 15%

Biopharmaceutical company $Immunome(IMNM.US)$ On Monday, the company announced that its experimental drug had met the primary endpoint in a late-stage clinical trial targeting patients with a rare tumor. The oral medication, named varegacestat, is currently undergoing clinical trials for patients with desmoid tumors. Desmoid tumors, also known as aggressive fibromatosis or desmoid-type fibromatosis, are a type of aggressive, non-metastatic soft tissue tumor prone to recurrence.

Trial results showed that, compared to placebo, varegacestat significantly improved progression-free survival in patients, reducing the risk of disease progression or death by 84%.

OpenAI has once again 'poached' talent, hiring Albert Lee from Google to lead corporate development.

On Monday, according to media reports, OpenAI has hired $Google-C (GOOG.US)$ Albert Lee from has been appointed as the head of Corporate Development. Previously, Albert Lee was responsible for corporate development affairs at Google Cloud and Google DeepMind, participating in several high-profile acquisitions by Google, including the $32 billion acquisition of cloud security startup Wiz, announced in March this year. In his new role, Albert Lee will have a broad oversight of OpenAI’s overall business, focusing on advancing strategic investments and mergers and acquisitions (M&A) as the company enters its next phase of growth. His appointment signals that OpenAI will continue to seek acquisition targets that can help it gain an edge over competitors such as Google and Anthropic.

Ford Motor makes an abrupt shift in its electrification strategy, canceling production of multiple electric vehicle models

$Ford Motor(F.US)$ Ford Motor announced on Monday that it would write down $19.5 billion in assets and cancel several electric vehicle models. The company stated that it would cease production of the all-electric version of the F-150 Lightning and shift to producing extended-range electric vehicles. Ford is also scrapping its next-generation electric truck, code-named T3, as well as a planned electric commercial van. The company emphasized its commitment to internal combustion engine and hybrid models, although it will lay off some workers at a joint-venture battery plant in Tennessee in the short term, while eventually hiring thousands more.

The company expects that by 2030, the share of its global hybrid, extended-range electric, and fully electric vehicles will increase from the current 17% to 50%. Ford has also raised its guidance for adjusted EBIT in 2025 to approximately $7 billion, up from the previous range of $6 billion to $6.5 billion.

Strategy invested $980 million last week to increase its Bitcoin holdings, which now exceed 670,000 coins.

Bitcoin major holder as of December 15, $Strategy(MSTR.US)$ announced that it purchased 10,645 Bitcoins between December 8 and December 14, 2025, at a total cost of $980.3 million, with an average purchase price of $92,098 per coin. As of December 14, 2025, Strategy’s total Bitcoin holdings amounted to 671,268 coins, with an average purchase price of $74,972 per coin.

ServiceNow shares fell sharply, dropping over 11% as of this writing. News emerged that the company is in advanced talks to acquire cybersecurity startup Armis in a deal valued at up to $7 billion. If finalized, this transaction would mark the largest acquisition in ServiceNow's history since its founding.

$ServiceNow(NOW.US)$ The stock declined significantly, falling over 11%. Reports indicate that the company is in deep negotiations to acquire cybersecurity startup Armis, with the deal potentially valued at up to $7 billion. If completed, this acquisition would be the largest in ServiceNow’s history since its establishment.

According to sources familiar with the matter, the transaction is expected to be announced within the coming days. However, as discussions remain private, uncertainties persist, and there is still a possibility of the negotiations falling through or other bidders emerging.

Riding the wave of regulatory easing, PayPal applies for a banking license, reversing post-market losses to gain positive momentum.

$PayPal(PYPL.US)$ PayPal has applied to establish a Utah-chartered industrial loan company, PayPal Bank, with the primary goal of enhancing its small business lending capabilities. The digital payments giant also plans to offer savings accounts to its customers. Since 2013, PayPal has provided over $30 billion in loans and working capital to more than 420,000 business accounts globally.

Plummeting over 70%! iRobot, the pioneer of robotic vacuums, declares bankruptcy as Chinese creditors may take over.

$iRobot(IRBT.US)$ iRobot will complete its restructuring through bankruptcy protection procedures, with Shenzhen Yinxing Intelligent Technology acquiring 100% of the equity while writing off $190 million in corporate debt. In recent years, iRobot has faced challenges from competition with Chinese rivals, tariffs imposed during the Trump administration, and the failure of Amazon’s acquisition attempt. Its market value has plummeted from a peak of $3.56 billion in 2021 to less than $38 million during Monday’s intraday trading.

Top 20 US stock index turnover

Market Outlook

Northbound funds increased holdings in Hong Kong stocks by over HKD 3.6 billion, purchasing nearly HKD 1.4 billion worth of Xiaomi and selling over HKD 700 million worth of Tencent.

On December 15 (Monday), southbound funds net purchased HKD 3.654 billion worth of Hong Kong stocks today.

$Xiaomi Group-W(01810.HK)$、$Ping An (02318.HK)$、$Meituan-W(03690.HK)$Net purchases amounted to HKD 1.382 billion, HKD 1.19 billion, and HKD 548 million respectively;

$Tencent (00700.HK)$、$Hua Hong Semiconductor (01347.HK)$、$China Mobile (00941.HK)$Net sales amounted to HKD 774 million, HKD 555 million, and HKD 550 million respectively.

CNGR Advanced Material: Company’s H shares added to the list of eligible securities for Stock Connect

$Zhongwei New Materials (02579.HK)$ The company announced that its H shares will be added to the list of eligible securities for Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect (collectively referred to as “Stock Connect”) starting from December 15, 2025.

Wuxi Apptec: Completion of asset sale transaction, expected to generate post-tax net profit of approximately RMB 960 million

$Wuxi Apptec (02359.HK)$ The company announced that its wholly-owned subsidiary, Shanghai Wuxi Apptec New Drug Development Co., Ltd., has received the first installment of the equity transfer payment amounting to RMB 1.54 billion from the transferee. The preconditions for the completion of the transaction stipulated in the Equity Transfer Agreement have been met, and the transaction has been completed. The target company will no longer be included in the consolidated financial statements of the company. It is expected that this transaction will generate a post-tax net profit of approximately RMB 960 million, exceeding 10% of the audited net profit attributable to shareholders for the most recent period (fiscal year 2024). The target company and relevant parties will proceed with the change registration procedures at the Administration for Market Regulation as per the agreement, with the change registration expected to be completed by December 31, 2025.

Guoxia Technology's grey market price closed up 88%

A provider of renewable energy solutions and products in China's energy storage industry $Guoxia Technology (02655.HK)$ Began trading today, with the grey market price on Futu closing 88.46% higher yesterday at HKD 37.88. With a board lot of 100 shares, investors gained HKD 1,778 on paper.

In terms of market news, Guoxia Technology’s public offering reportedly garnered an oversubscription of over 1,800 times, amounting to more than HKD 130 billion, making it the top oversubscribed AI robotics safety sector IPO in Hong Kong this year. Guoxia's IPO included three cornerstone investors: Huikai Hong Kong, Dream’ee HK Fund, and Wusong Capital, collectively subscribing for a total of HKD 74.25 million.

Guoxia Technology, as a provider of renewable energy solutions and products in China's energy storage industry, focuses on research and development while delivering energy storage system solutions and products to customers and end-users. Its energy storage solutions and products serve a wide range of application scenarios including large-scale power generation, major grid systems, industrial and commercial sectors, and residential settings, suitable for both the Chinese domestic market and international markets.

Today's Focus

Keywords: US Novembernonfarm payroll data

In terms of economic data, key attention can be paid to the US November non-farm payroll data.

15:00 UK November unemployment rate, UK November number of unemployment benefit claimants (in ten thousand people)

16:15 France December Manufacturing PMI Preliminary

16:30 Germany December Manufacturing PMI Preliminary

17:00 Eurozone December Manufacturing PMI Preliminary

17:30 UK December Manufacturing PMI Preliminary, UK December Services PMI Preliminary

18:00 Germany December ZEW Economic Sentiment Index, Eurozone December ZEW Economic Sentiment Index, Eurozone October Seasonally Adjusted Trade Balance (€ billion)

21:30 US November Unemployment Rate, US November Seasonally Adjusted Nonfarm Payrolls (10,000 people), US October Retail Sales Month-over-Month Rate

22:45 US December S&P Global Manufacturing PMI Preliminary, US December S&P Global Services PMI Preliminary

23:00 US September Business Inventories Month-over-Month Rate

![]()

Morning Reading by Niuniu:

When buying a stock, you should not purchase it simply because it is cheap; instead, you should consider whether you truly understand it!

— Peter Lynch

![]() AI Portfolio Strategist goes live!One-click insight into holdings, fully grasp opportunities and risks.

AI Portfolio Strategist goes live!One-click insight into holdings, fully grasp opportunities and risks.

Editor/Doris