Author: Matt Hougan, Chief Investment Officer of Bitwise; Compiled by Jinse Finance

Bitwise released its annual 'Top Ten Predictions' report, forecasting trends for 2026.

The report includes some interesting and surprising insights.

Prediction One: Bitcoin will break its four-year cycle and reach a new all-time high.

$Bitcoin (BTC.CC)$ Historically, Bitcoin's price movement has followed a four-year cycle, with significant gains over the first three years followed by a sharp correction in the fourth year. Based on this cycle, 2026 should be a year of correction.

$Bitcoin (BTC.CC)$ Historically, Bitcoin's price movement has followed a four-year cycle, with significant gains over the first three years followed by a sharp correction in the fourth year. Based on this cycle, 2026 should be a year of correction.

We believe this scenario will not occur.

We believe that factors which previously drove the four-year cycle – Bitcoin halving, interest rate cycles, and crypto leverage-driven booms and busts – have significantly weakened compared to previous cycles.

Halving: By definition, each Bitcoin halving is half as significant as the previous one.

Interest Rates: The sharp rise in interest rates in 2018 and 2022 had an impact on prices; we expect interest rates to decline in 2026.

Crisis Outbreak: A relative decline in leverage (following record liquidations in October 2025) and improved regulation have reduced the likelihood of a major crisis outbreak.

More importantly, we believe that as platforms such as Morgan Stanley, Wells Fargo & Co, and Merrill Lynch begin to allocate Bitcoin, the wave of institutional capital flowing into the cryptocurrency space since the approval of the spot Bitcoin ETF in 2024 will accelerate by 2026. Meanwhile, we anticipate that cryptocurrencies will also benefit from a favorable shift in regulatory policies following the 2024 elections, as Wall Street and fintech companies start adopting cryptocurrencies more seriously.

We expect the combined effect of these factors to drive Bitcoin to new all-time highs, rendering its four-year cycle obsolete.

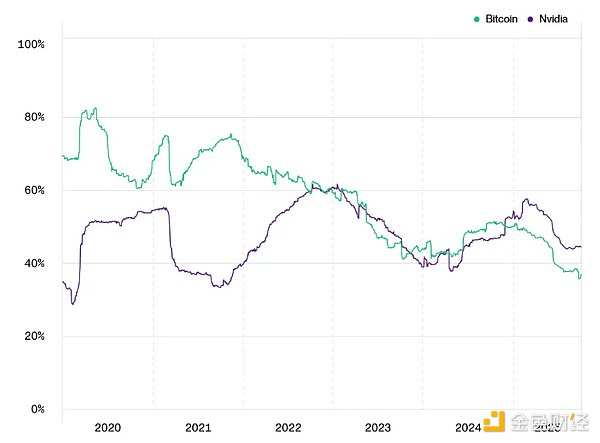

Prediction Two: Bitcoin’s Volatility Will Be Lower Than NVIDIA’s

If you've worked in the cryptocurrency space long enough, you may have heard someone say, "I would never invest in something as volatile as Bitcoin." We've heard this countless times. It is one of the most common criticisms from Bitcoin skeptics.

Is Bitcoin volatile? Of course. We do not deny this.

But is Bitcoin really more volatile than other assets that investors flock to? Not recently.

Throughout 2025, Bitcoin's volatility has been lower than that of one of the most popular stocks in the market: $NVIDIA (NVDA.US)$ . A closer look reveals that Bitcoin's volatility has been steadily declining over the past decade. This shift reflects a fundamental reduction in Bitcoin's investment risk, along with the diversification of its investor base brought about by traditional investment vehicles like ETFs.

We expect this trend to continue into 2026.

Volatility: Bitcoin vs. NVIDIA

1-Year Rolling Annualized Volatility

Data Source: Bitwise Asset Management, data from Bloomberg. Time range of the data is from December 31, 2019, to December 5, 2025.

Note: Gold also underwent a similar transformation after the U.S. abandoned the gold standard and subsequently launched gold ETFs in 2004. We explore these trend similarities in depth in our recent paper 'Bitcoin Long-Term Capital Market Assumptions'.

Prediction Three: The correlation between Bitcoin and equities will decline

Many people—especially those in the media—are fond of saying that Bitcoin is highly correlated with the stock market.

The data suggests otherwise. Using a rolling 90-day correlation, the correlation between Bitcoin and the S&P 500 Index rarely exceeds 0.50, which is typically the statistical threshold distinguishing between 'low' and 'moderate' correlation.

In any case, we believe that the correlation between Bitcoin and equities will be lower in 2026 than it was in 2025. Why? We anticipate that cryptocurrency-specific factors such as regulatory developments and institutional adoption will drive up cryptocurrency prices, even as equity markets struggle due to concerns over valuations and short-term economic growth.

Conclusion

Taken together, these three predictions amount to a triple benefit for investors:

Strong returns

Reduced volatility

Correlation decreases

Sounds like a fairly good portfolio asset, doesn't it? I estimate that as these events unfold, we will see institutional investors pour tens of billions of dollars in new capital.

Finally, I believe 2026 will be an excellent year.

Editor/Doris