Author: Rick, Research Analyst at Messari

2026 is just around the corner, at this time$Ethereum (ETH.CC)$The relationship between price and fundamentals is clearer now than at any time since the NFT frenzy.

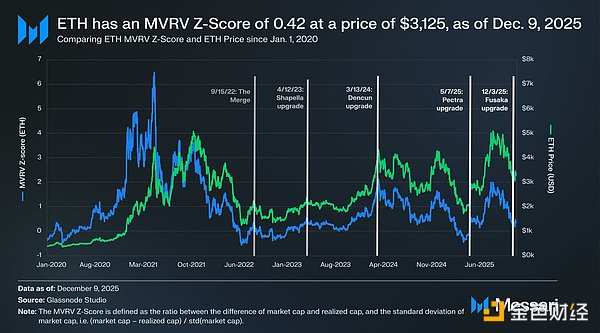

As of December 16, 2025, the price of Ethereum has fallen below $3,000. Based on the MVRV indicator and its dominant position in tokenized assets, ETH appears to offer investors a constructive long-term investment target.

The MVRV Z-score is used to assess whether ETH is overvalued or undervalued relative to its fair value. This indicator compares the market capitalization (i.e., the spot price multiplied by the circulating supply) with the realized value (i.e., the total capital that has flowed into ETH). Its formal definition is: the MVRV Z-score equals the difference between market capitalization and realized market capitalization, divided by the standard deviation of market capitalization (cumulatively calculated from the earliest available data point).

The MVRV Z-score is used to assess whether ETH is overvalued or undervalued relative to its fair value. This indicator compares the market capitalization (i.e., the spot price multiplied by the circulating supply) with the realized value (i.e., the total capital that has flowed into ETH). Its formal definition is: the MVRV Z-score equals the difference between market capitalization and realized market capitalization, divided by the standard deviation of market capitalization (cumulatively calculated from the earliest available data point).

During the NFT boom from 2021 to 2022, the MVRV Z score of ETH soared to nearly 6, indicating extreme market enthusiasm. Since the Ethereum Merge, this metric has reverted to the mean, currently fluctuating mainly between 0 and 2—0 represents undervaluation, 1 is close to fair value, and 2 leans towards overvaluation. On May 7, 2025, when the important Ethereum upgrade Pectra went live, the price of ETH was around $1,800, with an MVRV Z score of approximately -0.1. As the price subsequently reached new historical highs, the MVRV gradually climbed close to 2. After the Fusaka upgrade on December 3, 2025, the trading price of ETH was about $3,189, with an MVRV Z score of 0.47, indicating that it still showed signs of undervaluation at significantly higher price levels, suggesting a similar post-upgrade market structure but with a more robust fundamental positioning.

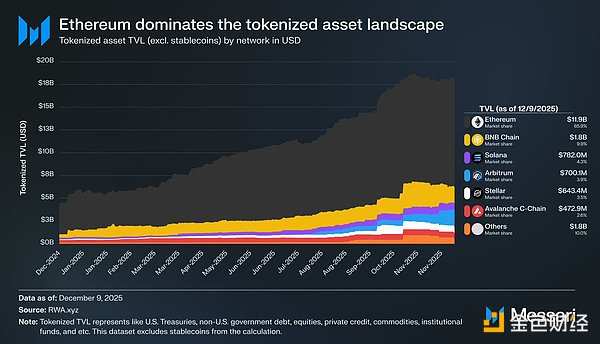

On-chain data further strengthens the bullish logic for Ethereum. In the field of asset tokenization, Ethereum is the core settlement layer. According to data from RWA.xyz (excluding stablecoins in the statistics), Ethereum carries a total locked value of $11.9 billion in tokenization, accounting for 65.9% of the market share. Other base layers and Rollups have seen development, but their scale is far from comparable. As institutions migrate government bonds, credit, and other real-world assets to crypto channels to improve capital efficiency and reduce operational costs, Ethereum's liquidity, tool ecosystem, and compliance-oriented infrastructure are continuously deepening its moat.

The MVRV Z-score shows signals of undervaluation, the upgraded positive price performance, and the increasingly dominant position in tokenized assets all point in the same direction. However, this still only reveals a small part of the bullish narrative for Ethereum. As spot ETFs bring regulated funds into ETH, and digital asset treasury companies (DATs) continue to accumulate ETH supply, the market's free circulation is gradually tightening, and the price's sensitivity to marginal demand is increasing. For allocators seeking exposure to real economic throughput and scalable smart contracts, the current price level of ETH appears more as an opportunity to build a core position for 2026 rather than a risk at the end of the cycle.

Editor/Doris