The US stock market in 2025 maintained robust momentum amidst volatility and enthusiasm, with the three major indices repeatedly hitting new historical highs. As of December 15, $Dow Jones Industrial Average (.DJI.US)$ the year-to-date increase has been nearly 14%, $Nasdaq Composite Index (.IXIC.US)$ surging over 19%, $S&P 500 Index (.SPX.US)$ while also recording an approximate 16% gain.

At the macro level, “tariffs” and “rate cuts” became the key themes for capital throughout the year. After Trump returned to the White House, fluctuations in tariff policies once caused market jitters, leading to the prevalence of “TACO trades.” However, as multiple rounds of negotiations between China and the US thawed, both parties officially reached a consensus on November 10, 2025, announcing a one-year suspension of new tariffs. This milestone ceasefire marks a temporary stabilization period for global trade conflicts.

At the September, October, and December Federal Open Market Committee meetings, the Federal Reserve cut interest rates consecutively three times, bringing the current monetary easing cycle into its later stages. However, with Chairman Powell nearing the end of his term, internal divisions among officials regarding inflation and growth have intensified. In the “post-Powell era,” who will take the helm? And where will monetary policy head next? These questions have become the biggest uncertainties looming over the market.

Meanwhile, the narrative around artificial intelligence continues to dominate market trends. From Sora’s stunning debut at the beginning of the year to the phenomenal rise of “Nano Banana” at year-end, the market focus is shifting from the “OpenAI chain” to the “Google chain,” from $NVIDIA (NVDA.US)$ GPU-based solutions $Alphabet-A (GOOGL.US)$ to TPU-driven systems, and from pure computational power accumulation to concerns about shortages in electricity and storage capacity.

Meanwhile, the narrative around artificial intelligence continues to dominate market trends. From Sora’s stunning debut at the beginning of the year to the phenomenal rise of “Nano Banana” at year-end, the market focus is shifting from the “OpenAI chain” to the “Google chain,” from $NVIDIA (NVDA.US)$ GPU-based solutions $Alphabet-A (GOOGL.US)$ to TPU-driven systems, and from pure computational power accumulation to concerns about shortages in electricity and storage capacity.

Beneath the surface of this prosperity, underlying concerns are gradually emerging. NVIDIA and Broadcom reported disappointing earnings consecutively. The market has raised continuous doubts about issues such as “circular trading” among companies like OpenAI and GPU depreciation. Discussions surrounding an “AI bubble” are heating up. These signs indicate that capital is no longer blindly buying into the capex narratives of tech giants but is instead starting to focus on the actual implementation and commercial returns of AI applications.

As we approach the end of 2025, looking back at this tumultuous year, which assets have managed to weather the cycles? Which individual stocks have emerged as winners amidst the transition between old and new AI technologies? Let’s take a look at the top ten best-performing stocks in the US market this year, along with the performance of industry giants.

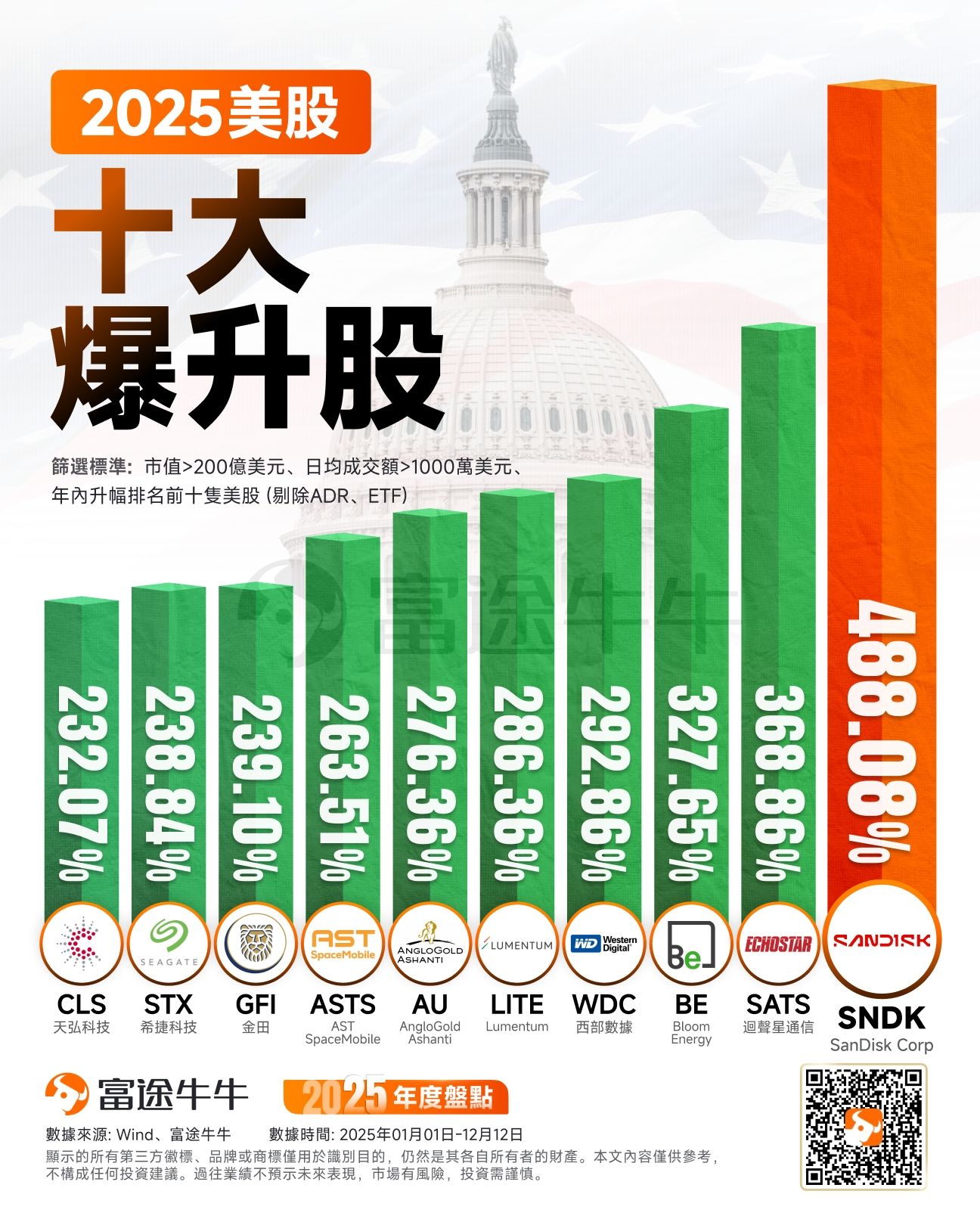

Top Ten Surging Stocks in the US Market

As large AI models drive exponential growth in data generation and processing speed, shortages in memory chips have emerged, leading to continuously rising product prices, and ushering in a “super cycle” for the industry. Against this backdrop, a “rising star in storage,” $SanDisk Corp (SNDK.US)$ has topped the list of the ten best-performing stocks in the US market in 2025 with a staggering 488% increase. The company is the fifth-largest player in the global NAND market and only went public on the US stock exchange this February. Close behind are $Western Digital (WDC.US)$ and $Seagate Technology (STX.US)$ , with annual gains reaching 292% and 238%, respectively, having just been added to the Nasdaq 100 Index components.

In response, JPMorgan anticipates that the memory chip sector is entering its longest-ever boom cycle, with leading companies’ market caps approaching one trillion dollars this year, expected to surge to 1.5 trillion by 2027, representing a rise of over 50%. High Bandwidth Memory (HBM) demand continues to encroach upon traditional DRAM capacity, with AI inference consuming three times more memory than training, and supply-demand gaps persisting until 2027. DRAM prices are projected to soar by 53% in fiscal 2026, with strong enterprise-level demand fully offsetting consumer-side pressures.

Electricity remains another key bottleneck in the construction of AI data centers, leading to a surge in related concept stocks. Bloom Energy ($Bloom Energy(BE.US)$), a leader in fuel cells, $Bloom Energy (BE.US)$ has skyrocketed by 327% this year. In response to the explosive growth in AI computing demands and terrestrial power bottlenecks, major American tech firms have collectively turned towards the concept of “space-based data centers.” Space-related concept stocks like $EchoStar (SATS.US)$ 、 $AST SpaceMobile (ASTS.US)$ have performed exceptionally well, recording respective increases of 368% and 263%.

Benefiting from the demand for optical interconnects in computing clusters, the leading company in optical communications $Lumentum (LITE.US)$ has surged over 286% year-to-date, while AI infrastructure hardware supplier $Celestica (CLS.US)$ has also risen by more than 232%.

In addition, driven by geopolitical uncertainties and concerns over global fiscal easing, gold stocks have delivered notable performance this year, with $AngloGold Ashanti (AU.US)$ and $Gold Fields (GFI.US)$ recording gains of 276% and 239%, respectively.

Ranking of Top Gainers in U.S. Stocks

Among the leading U.S. stocks, AI-related stocks have also shown strong performance, demonstrating a robust upward trend across both software and hardware sectors.

Among them, the leader in memory chips $Micron Technology (MU.US)$ , as well as the semiconductor equipment giant $Lam Research (LRCX.US)$ , “NVIDIA’s strongest challenger” $Advanced Micro Devices (AMD.US)$ with year-to-date gains of 187%, 124%, and 74%, respectively.

On the software front, continuous breakthroughs in large-model technology from both China and the US have allowed Tongyi Qianwen and Gemini to win market favor with their outstanding performance, boosting $Alibaba (BABA.US)$ 、 $Alphabet-A (GOOGL.US)$ with respective gains exceeding 86% and 64%.

Meanwhile, the acceleration of AI commercialization in the US has led to surging share prices of star companies, $Palantir (PLTR.US)$ 、 $Applovin (APP.US)$ with their stock prices soaring by 142% and 107%, respectively.

Additionally, the trend of “US manufacturing reshoring” has revitalized traditional industrial giants, $GE Aerospace (GE.US)$ 、 $Caterpillar (CAT.US)$ with year-to-date increases of over 80% and 67%. Financial giant $Citigroup (C.US)$ also recorded a 63% gain, adding diversity to this tech-dominated ranking.

Looking ahead to 2026, Wall Street generally believes that the US stock market rally may not be over yet, but it might no longer be a one-sided dominance by tech giants; sector rotation is expected to become the new investment theme. Goldman Sachs forecasts that the acceleration of US economic growth in 2026 will most significantly drive earnings-per-share growth for cyclical industries, including industrials, materials, and consumer discretionary sectors.

Goldman Sachs forecasts that earnings per share (EPS) growth for real estate companies will increase from 5% this year to 15% next year, while EPS growth for non-essential consumer goods companies is expected to rise from 3% to 7%. Industrial stocks are also anticipated to rebound significantly, with EPS growth accelerating from 4% to 15%. In contrast, the growth rate for information technology companies is projected to slow from 26% in 2025 to 24% in 2026.

![]() Looking back at 2025, how did your investment returns fare?

Looking back at 2025, how did your investment returns fare?

![]() Did you reap substantial gains by making the right decisions?

Did you reap substantial gains by making the right decisions?

![]() Which stocks or industries do you believe hold opportunities?

Which stocks or industries do you believe hold opportunities?

![]() Come share your annual summary!

Come share your annual summary!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/KOKO