Top News

On Tuesday before the market opened, ahead of the release of the U.S. November employment data, the three major futures indexes weakened slightly, with Dow futures down 0.09%, Nasdaq futures down 0.25%, and S&P 500 futures down 0.15%.

$明星科技股(LIST2518.US)$Slight fluctuations before the market opens,$Tesla (TSLA.US)$ 、 $Micron Technology (MU.US)$ 、 $Advanced Micro Devices (AMD.US)$fell nearly 1%.

$热门中概股(LIST2517.US)$ Most stocks fell before the market opened. $Alibaba(BABA.US)$ 、 $JD.com (JD.US)$ 、 $Nio (NIO.US)$ 、 $Hesai (HSAI.US)$ Down more than 1%.

$加密货币概念股(LIST20010.US)$There was a rebound before the market opened.$Circle(CRCL.US)$has risen more than 3%. $Bitmine Immersion Technologies(BMNR.US)$up more than 2%, $Strategy(MSTR.US)$Up nearly 2%,$Coinbase(COIN.US)$、 $MARA Holdings(MARA.US)$ Surged over 1%.

$加密货币概念股(LIST20010.US)$There was a rebound before the market opened.$Circle(CRCL.US)$has risen more than 3%. $Bitmine Immersion Technologies(BMNR.US)$up more than 2%, $Strategy(MSTR.US)$Up nearly 2%,$Coinbase(COIN.US)$、 $MARA Holdings(MARA.US)$ Surged over 1%.

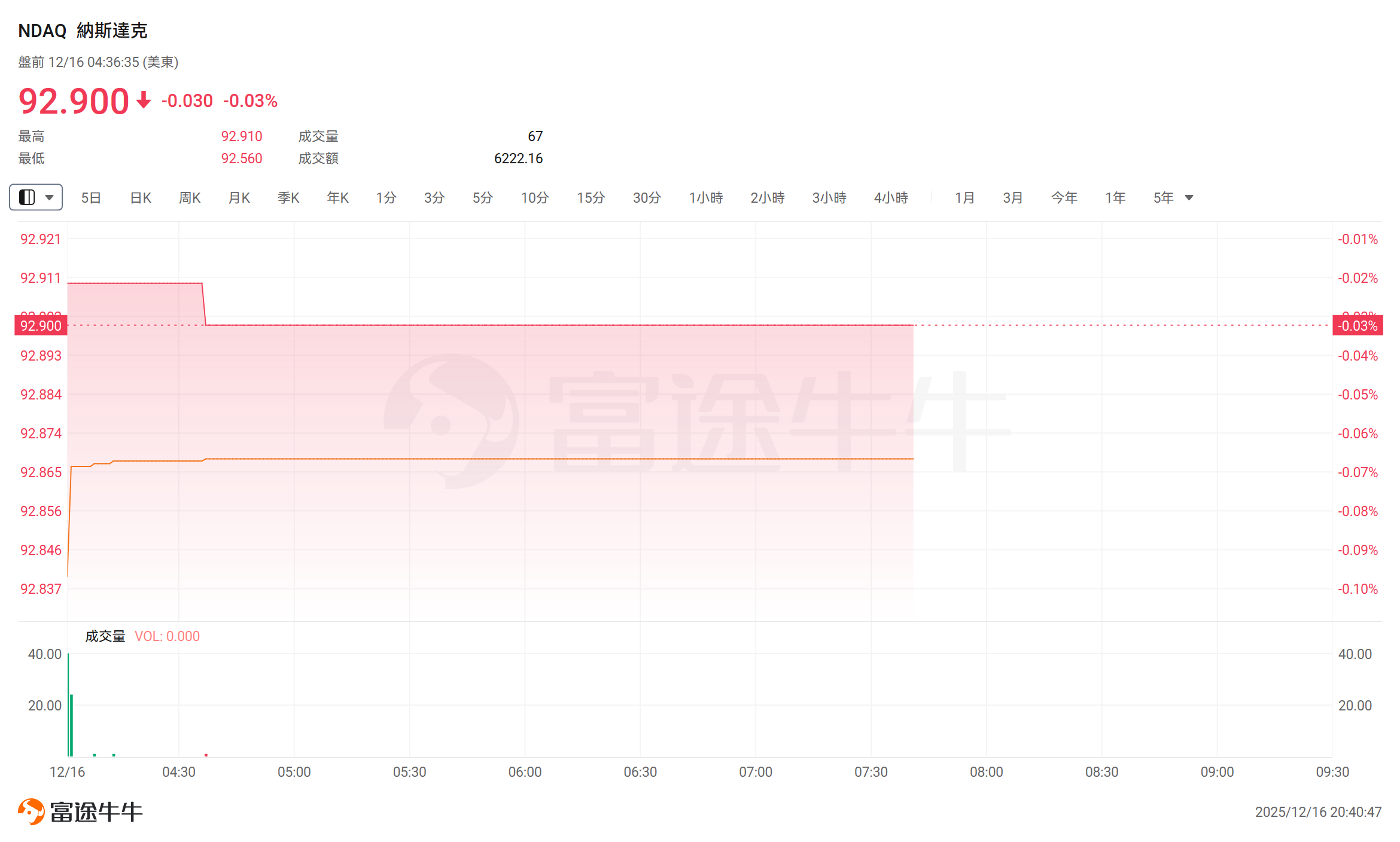

Nasdaq applies for "23-hour trading," U.S. stocks may be heading towards an era of sleeplessness.

According to the documents submitted on Monday,$Nasdaq(NDAQ.US)$The Nasdaq Stock Market has applied to the U.S. Securities and Exchange Commission (SEC) for an additional trading session—from 9 PM to 4 AM Eastern Time the next day. Currently, the Nasdaq offers three trading sessions on each business day: the pre-market session (4 AM to 9:30 AM), the regular session (9:30 AM to 4 PM), and the after-hours session (4 PM to 8 PM). It is important to note that some brokers offer "U.S. stock night trading" (8 PM to 4 AM the next day) as over-the-counter trading, which generally has lower liquidity and only supports a limited number of stocks and ETFs for night trading. According to the documents, Nasdaq is applying to cover the "night trading session" from "9 PM to 4 AM the next day," and will reserve one hour before this session for system maintenance, testing, and clearing transactions such as stock mergers, splits, and dividends. If implemented, the trading hours of the Nasdaq will evolve to a "23/5" model—five days a week, 23 hours a day.

Morgan Stanley: Tesla's "Robotaxi story" enters a critical validation phase.

$Tesla (TSLA.US)$U.S. stock futures fell slightly before the market opened, following the official launch of fully autonomous Robotaxi testing in Austin, where there are no safety supervisors or passengers in the vehicle, marking a critical validation phase for the commercialization of its autonomous driving. Morgan Stanley believes this breakthrough will be the most important catalyst for validating Tesla's Robotaxi strategy. The firm expects Tesla to significantly increase its Robotaxi fleet size to 1,000 vehicles by 2026 and reach a scale of 1 million by 2035. With a cost advantage of $0.59 per mile, Tesla not only gains a head start in the autonomous ride-hailing market but also accumulates key data and regulatory basis for the comprehensive promotion of its Full Self-Driving (FSD) technology.

AMD's Lisa Su visits China

$Advanced Micro Devices (AMD.US)$Chairman of the Board and CEO Dr. Lisa Su led an executive team to visit Lenovo Group's global headquarters in Beijing. Accompanied by several senior executives from Lenovo Group, the AMD delegation toured various latest products and technological achievements from Lenovo, including humanoid robots.

U.S. healthcare giant Medline is set to price its IPO, potentially surpassing CATL to become the largest IPO of 2025.

As part of this year’s 'A+H' listing wave, the world's largest electric vehicle battery manufacturer $CATL (03750.HK)$ listed on the Hong Kong Stock Exchange in May, raising HKD 41 billion (approximately USD 5.27 billion), making it the largest IPO of 2025 so far. CATL’s challenger is a company called $Medline(MDLN.US)$ . According to schedule, the company will finalize its IPO pricing on Tuesday evening and debut on the Nasdaq Global Select Market on Wednesday.

According to Medline's prospectus filed with the U.S. Securities and Exchange Commission, the company plans to issue 179 million shares, with a pricing range of USD 26 to USD 30 per share. If priced at the upper end of the range, Medline will raise USD 5.37 billion, slightly exceeding CATL. However, according to insiders, Medline is guiding potential investors to anticipate that its IPO will be priced in the 'upper half of the price range.' Simple calculations show that unless Medline’s IPO is priced below USD 30, it cannot surpass CATL. Insiders also revealed that Medline’s IPO has attracted orders approximately ten times the number of shares available for subscription.

$Pfizer (PFE.US)$ The pre-market saw a slight increase, with the company expecting revenue of approximately USD 62 billion in 2025, compared to the previous forecast of USD 61 billion to USD 64 billion; adjusted R&D expenses for 2026 are expected to be between USD 10.5 billion and USD 11.5 billion.

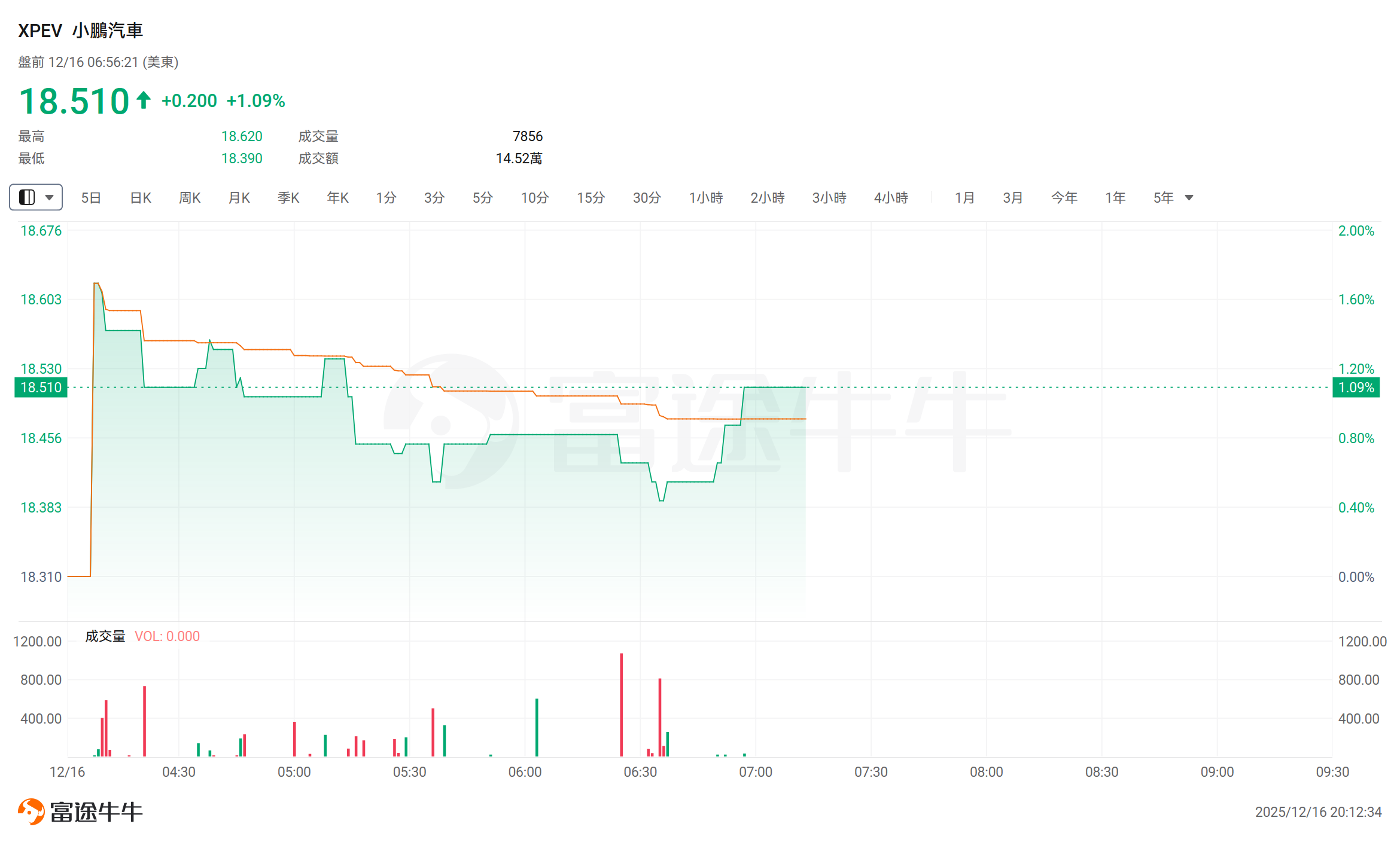

XPeng Motors rose in pre-market trading after reports surfaced that it had obtained an L3 autonomous driving road test license.

$XPeng Motors (XPEV.US)$ The stock rose more than 1% in pre-market trading. Reports indicate that XPeng Motors has obtained an L3 autonomous driving road test license in Guangzhou and has initiated routine L3 road testing. The license is primarily used for conditional autonomous driving tests on high-speed intelligent connected vehicle test roads in Guangzhou. Additionally, XPeng Motors Vice President @ThomasElectricTrain posted on Weibo today: “Looking forward to a surprise in the first quarter of next year, full deployment. In fact, some users can officially experience this version earlier.”

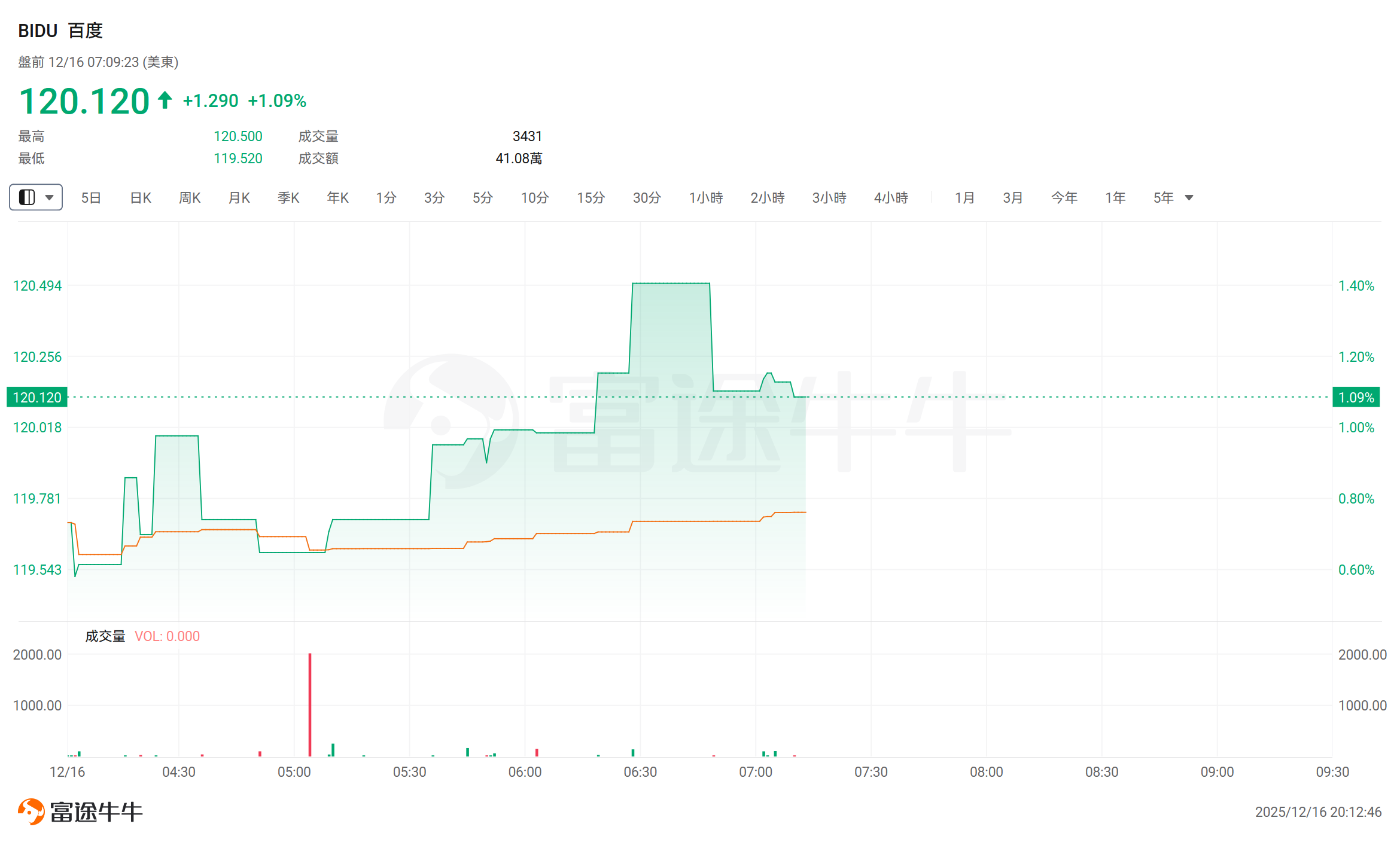

Kunlun Chip is about to complete its shareholding reform: accelerating the push for an IPO, with revenue projected to exceed 2 billion yuan by 2025.

$Baidu(BIDU.US)$ Kunlun Chip, under Baidu, is about to complete its shareholding reform, accelerating its push for an IPO. An insider revealed, “Everyone is paying attention, and it can no longer be kept under wraps, but the timeline still needs confirmation.” Before this round of shareholding reform, Kunlun Chip decided to shift to a Hong Kong listing after discussions with multiple brokers. Subsequently, Baidu, as the majority shareholder, announced that it is currently evaluating the proposed spin-off and listing. Baidu emphasized that if the spin-off and listing proceed, they must undergo relevant regulatory approval processes, and the company does not guarantee that the spin-off and listing will occur. According to IDC data, in 2024, Kunlun Chip ranked second in industry shipments. Regarding Kunlun Chip’s full-year performance, prior research notes indicated that its annual revenue is expected to reach approximately CNY 5 billion, a significant increase from CNY 2 billion in 2024.

Oracle’s stock price is nearing a '50% drop' from its historical peak, and JPMorgan expects its bonds to remain under pressure into next year.

$Oracle (ORCL.US)$ The stock fell more than 1% during pre-market trading but later trimmed losses to 0.11%. As of Monday’s close, the stock had declined 46% from its historical high of USD 345.121 reached in September. On the news front, JPMorgan credit analyst Erica Spear expects Oracle’s bonds to remain under pressure as the new year begins. Last week, Oracle recorded its largest single-day drop in nearly 11 months, and indicators measuring its credit risk rose to a 16-year high. The company’s latest quarterly earnings report showed cloud revenue falling short of analysts’ expectations, while it raised its annual capital expenditure target by USD 15 billion and doubled its future lease commitments. These moves have heightened investor concerns about a potential AI bubble.

Amazon is set to cut 370 jobs at its European headquarters in Luxembourg, marking the largest workforce reduction in the Grand Duchy in at least two decades.

$Amazon(AMZN.US)$ An earlier decision this year to lay off 14,000 employees globally has significantly impacted Amazon's European headquarters in Luxembourg. In the coming weeks, the company is expected to eliminate 370 local positions, representing approximately 8.5% of its total workforce of 4,370 employees. This marks the largest staff reduction in the small nation in at least two decades and poses a challenge to the mutually beneficial relationship between Amazon and Luxembourg. Like many multinational corporations, Amazon has continuously expanded its operations in Luxembourg since 2003, benefiting from favorable local tax incentives. Even after the layoffs, Amazon will remain the fifth-largest employer in Luxembourg.

Ford Motor makes an abrupt shift in its electrification strategy, canceling production of multiple electric vehicle models

$Ford Motor(F.US)$Shares rose more than 1% in pre-market trading as the company announced it would record a $19.5 billion asset write-down and discontinue several electric vehicle models. Ford stated it would cease production of its all-electric F-150 Lightning and shift focus to extended-range electric vehicles. The company also canceled its next-generation electric truck, code-named T3, along with a planned electric commercial van.

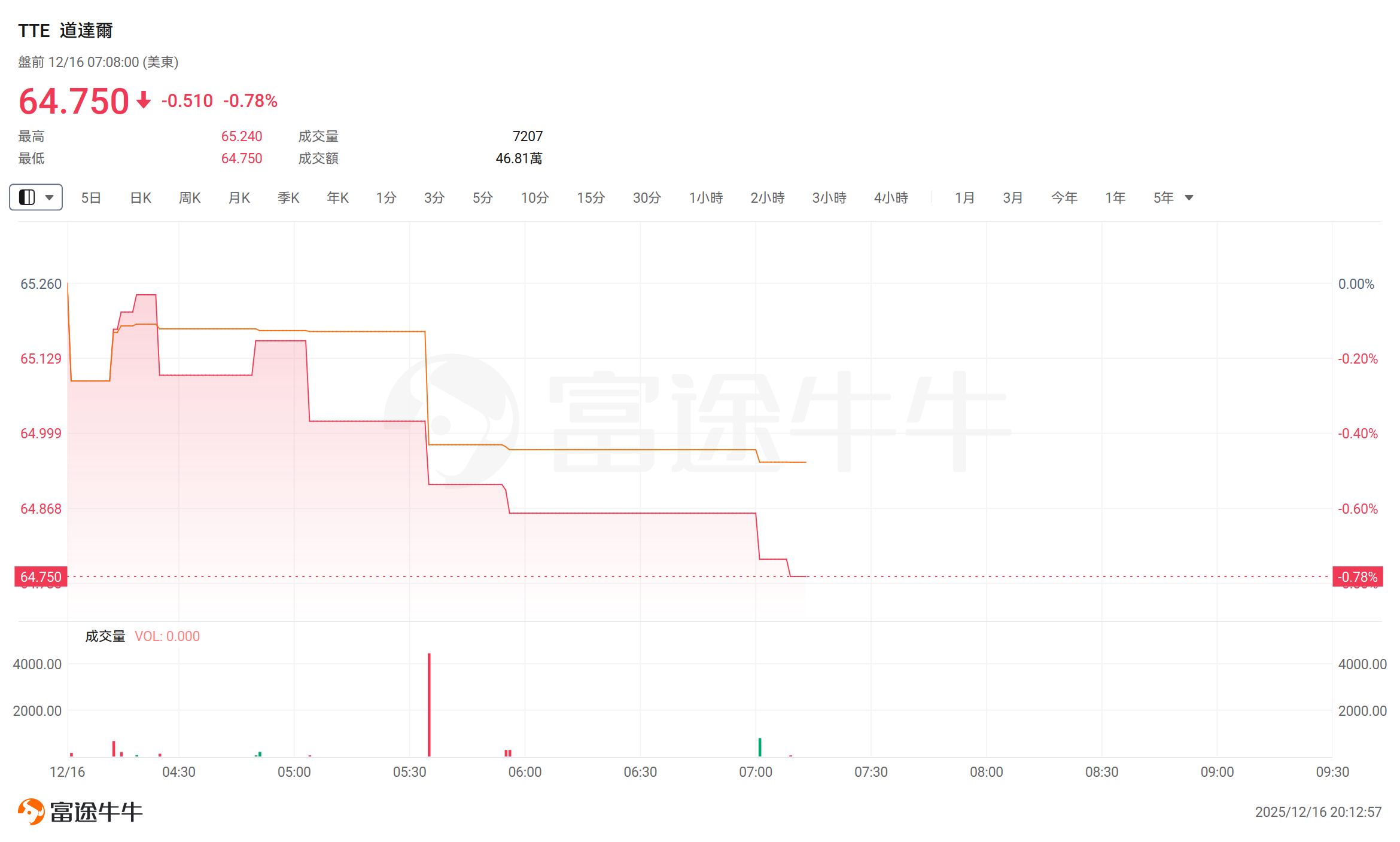

Google and TotalEnergies have reached another green electricity supply agreement, lasting 21 years.

French energy giant $TotalEnergies (TTE.US)$ announced on Tuesday that it had signed a 21-year power supply agreement with Google, under Alphabet, committing to provide 1 terawatt-hour (TWh) of renewable energy to Google’s data center in Malaysia. This power supply contract is expected to take effect in the first quarter of next year.

Global macro

Tonight at 9:30 PM! Rare 'two-in-one' release of non-farm payroll report, Morgan Stanley: Mild employment weakness = higher probability of rate cuts.

This week, a flurry of U.S. economic data is being released. At 9:30 PM Beijing time tonight, the non-farm payroll report will be published. Alongside the November non-farm data release, an additional portion of data — October’s non-farm payroll figures — will also be disclosed.

Economists predict that the U.S. economy added 50,000 non-farm jobs in November, with the unemployment rate at 4.5%. This combination of figures suggests a labor market showing signs of softness but without rapid deterioration. Ahead of the non-farm report release, Morgan Stanley strategist Michael Wilson noted that mild weakness in U.S. employment data could boost U.S. stock markets, as it increases the likelihood of further interest rate cuts by the Federal Reserve.

Deutsche Bank analyzes policy stance of Kevin Warsh, candidate for the next Fed Chair: Rate cuts + Balance sheet reduction.

Most recently, Matthew Luzzetti's team at Deutsche Bank published a research report providing an in-depth analysis of Wash’s policy proposals. The report analyzes that if Wash is elected, he would support interest rate cuts but simultaneously advocate for a reduction in the balance sheet. The report notes that the feasibility of "concurrent rate cuts and balance sheet reduction" hinges on regulatory reforms that lower banks' reserve requirements, which appears questionable in the short term. Deutsche Bank believes that the market needs to closely monitor whether the new chair can maintain independence under pressure from Trump for significant rate cuts and observe the process of establishing policy credibility.

Goldman Sachs raised its 2026 copper price forecast, citing 'delayed U.S. copper tariffs leading to a larger non-U.S. supply gap.'

Goldman Sachs has revised its 2026 copper price forecast upward to $11,400 per ton. The core rationale is the expectation that U.S. copper tariffs will be postponed until 2027, meaning the U.S. will continue to stockpile copper at a premium in 2026, thereby exacerbating supply shortages in non-U.S. markets and dominating pricing. However, the current copper price already reflects extremely crowded speculative long positions and excessive optimism regarding AI data center concepts. Should tariffs be implemented earlier or market sentiment reverse, prices could face significant downside risks.

The EU may abandon the 'full ban' on fuel-powered vehicles by 2035, reduce emission reduction targets to 90%, and permit the sale of plug-in hybrid vehicles.

On Tuesday local time, Bloomberg reported, citing informed sources, that the European Commission plans to relax the originally scheduled 2035 zero-emission requirements, abandoning the approach of mandating a '100% reduction in exhaust emissions, effectively banning the sale of internal combustion engine vehicles.' Instead, the target will be adjusted to a 90% reduction. Under the new framework, certain plug-in hybrid electric vehicles (PHEVs) and electric vehicles equipped with fuel extenders will be allowed to remain on sale beyond 2035. This adjusted proposal is expected to be officially announced on Tuesday and subsequently enter the review process in the European Parliament and the Council of Member States. If ultimately approved, this would be seen as a key concession by the EU on its 'full electrification' roadmap.

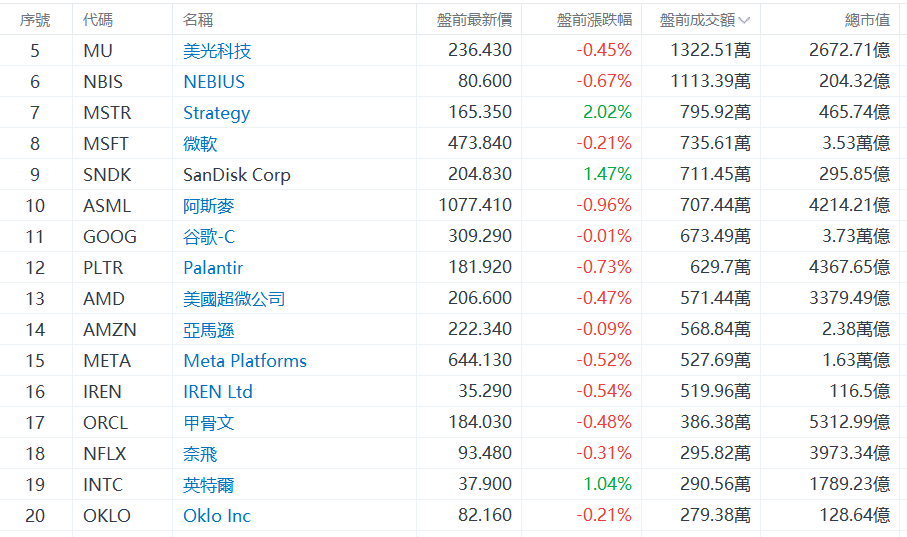

Top 20 pre-market trading volume stocks in the U.S. stock market

U.S. Stock Market Macroeconomic Calendar Reminder

(The following times are in Beijing Time)

21:30 US November Unemployment Rate, US November Seasonally Adjusted Nonfarm Payrolls (10,000 people), US October Retail Sales Month-over-Month Rate

Early next morning

01:45 Bank of Canada Governor Macklem delivers a speech

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO