The three major U.S. stock indexes closed mixed. $Dow Jones Index (.DJI.US)$ Dropped by 0.62%, $Nasdaq Composite Index (.IXIC.US)$ Rose by 0.23%, $S&P 500 Index (.SPX.US)$fell by 0.24%,$Tesla (TSLA.US)$Surged over 3% to hit a new high since its listing, $Meta Platforms(META.US)$ Surged over 1%.

Top 5 Gainers in U.S. Equity ETFs

$AdvisorShares MSOS Daily Leveraged ETF (MSOX.US)$ Increased by 35.89%, with a trading volume of USD 44.6852 million.

$T-Rex 2X Long AFRM Daily Target ETF (AFRU.US) Rose by 23.52%, with a trading volume of USD 467,300.

$ADVISORSHARES PURE US CANNABIS ETF(MSOS.US)$ Gained 20.93%, with a trading volume of USD 250 million.

$ADVISORSHARES PURE US CANNABIS ETF(MSOS.US)$ Gained 20.93%, with a trading volume of USD 250 million.

On the news front, the cannabis concept regained momentum, with several component stocks rising over 10%. This follows Trump's indication that he is considering reclassifying marijuana through an executive order.

$ROUNDHILL CANNABIS ETF(WEED.US)$ Increased by 19.17%, with a trading volume of USD 5.1657 million.

$2x Long CRCL ETF-Leverage Shares (CRCG.US)$ Rose by 19.09%, with a trading volume of USD 23.815 million.

Top 5 Decliners on US Stock ETFs

$2x Short CRCL ETF-T-REX (CRCD.US)$ Dropped by 19.66%, with a trading volume of USD 21.0238 million.

In terms of market news, Visa announced the launch of USDC settlement services in the United States, marking a significant step forward in the integration of stablecoins into mainstream financial services. U.S.-based issuing and acquiring partners can now use Circle’s USDC for settlements with Visa. CRCL surged by 10%, $2x Leverage CRCL ETF-ProShares (CRCA.US) rising nearly 19%.

$2x Inverse IONQ ETF - Defiance (IONZ.US)$ dropping 15.75%, with a trading volume of $47.5091 million.

$2 Leverage Short QBTS ETF - Defiance (QBTZ.US) falling 14.95%, with a trading volume of $30.074 million.

Market news indicates that the quantum computing sector experienced a collective rebound, with IONQ and QBTS both rising over 7%, $2x Long IONQ ETF-Defiance (IONX.US)$ 、 $2x Leverage QBTS ETF-Tradr(QBTX.US)$ the share price rose by more than 15%.

$2x Long CORZ ETF-Tradr (COZX.US)$ dropping 9.93%, with a trading volume of $218,400.

$MicroSectors US Big Oil Index 3X Leveraged ETN (NRGU.US)$ declining 9.69%, with a trading volume of $3.7294 million.

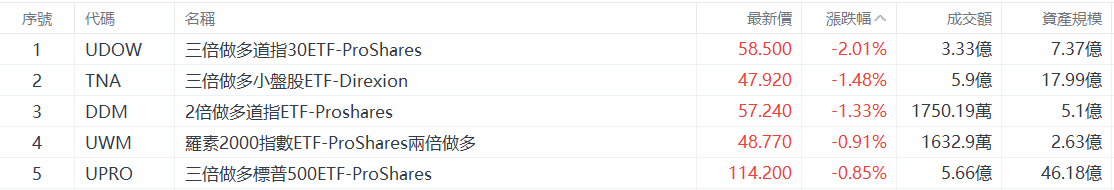

Top 5 Large-Cap U.S. Equity Index ETFs by Decline

ProShares UltraPro Dow30 (UDOW.US) Down 2.01%, with a trading volume of $333 million.

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Down 1.48%, with a trading volume of $590 million.

ProShares Ultra Dow30 (DDM.US) Down 1.33%, with a trading volume of $17.5019 million.

$ProShares Ultra Russell 2000 (UWM.US)$ Down 0.91%, with a trading volume of $16.329 million.

$ProShares UltraPro S&P 500 (UPRO.US)$ Down 0.85%, with a trading volume of $566 million.

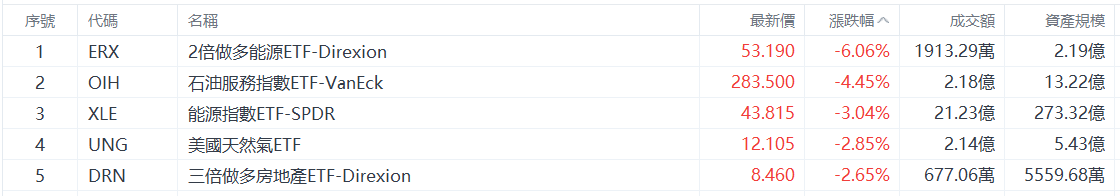

Top 5 Industry-Specific ETFs by Decline

$2x Leveraged Energy ETF-Direxion (ERX.US)$ Down 6.06%, with a trading volume of $19.1329 million.

$Oil Services ETF-VanEck (OIH.US)$ Down 4.45%, with a trading volume of $218 million.

$Energy Index ETF-SPDR (XLE.US)$ Down 3.04%, with a trading volume of $2.123 billion.

$US Natural Gas ETF (UNG.US)$ Down 2.85%, with a trading volume of $214 million.

$Direxion Daily Real Estate Bull 3X Shares (DRN.US)$ Dropped by 2.65%, with a trading volume of $6.7706 million.

Top 5 Increases in Bond ETFs

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Rose by 1.69%, with a trading volume of $266 million.

ProShares Ultra 20+ Year Treasury (UBT.US) Rose by 1.13%, with a trading volume of $852,200.

iShares 20+ Year Treasury Bond ETF (TLT.US) Rose by 0.55%, with a trading volume of $3.312 billion.

$ProShares Ultra 7-10 Year Treasury (UST.US)$ Rose by 0.54%, with a trading volume of $248,300.

$SPDR Citi International Government Inflation-Protected Bond ETF (WIP.US)$ Rose by 0.48%, with a trading volume of $1.6103 million.

Top 5 Commodity ETF Decliners

$2x Leverage S&P Energy Sector ETF-ProShares (DIG.US) Dropped by 5.95%, with a trading volume of $1.6655 million.

$2x Long Bloomberg Crude Oil ETF-ProShares (UCO.US) Dropped by 4.57%, with a trading volume of $63.1242 million.

$Oil Services ETF-VanEck (OIH.US)$ Down 4.45%, with a trading volume of $218 million.

$Invesco S&P Small Cap Energy ETF(PSCE.US)$ Dropped by 4.13%, with a trading volume of $2.0297 million.

SPDR S&P Oil & Gas Exploration & Production ETF (XOP.US) fell 3.79% with a trading volume of $678 million.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen