After the market closed on December 16 Eastern Time, $Lennar Corp (LEN.US)$ Lennar released its Q4 2025 financial results and full-year 2025 performance as of November 30, 2025.

Highlights of Q4 2025 Performance

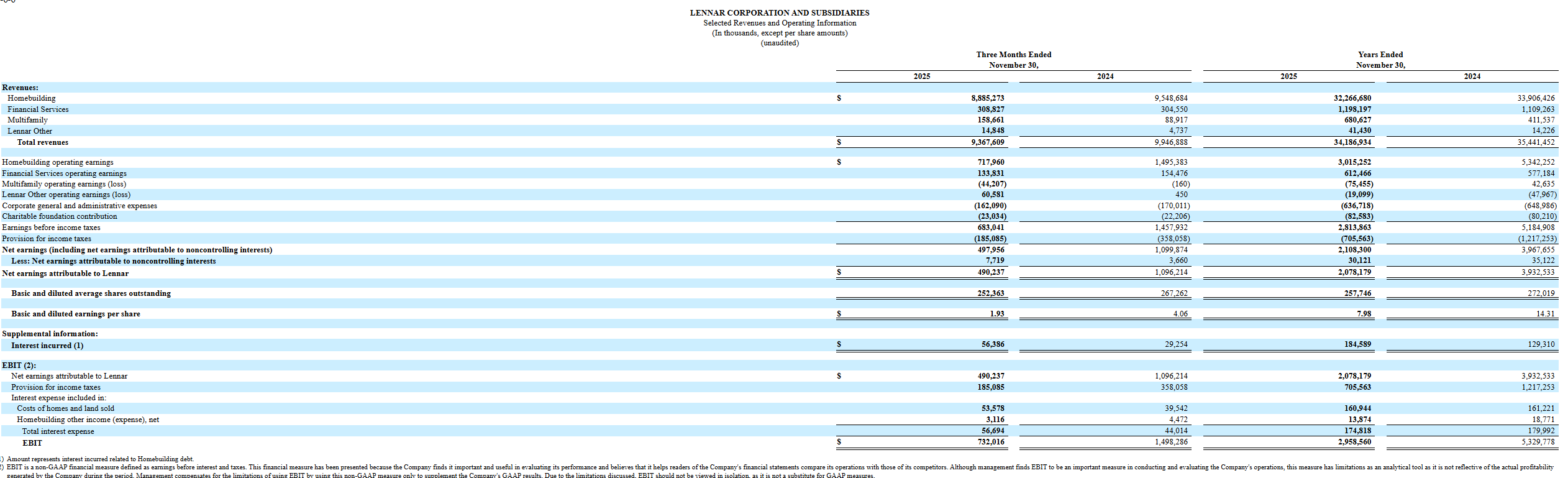

In Q4 2025, Lennar reported a net income attributable to the company of $490 million, or $1.93 per diluted share, compared to $1.1 billion, or $4.06 per diluted share, in Q4 2024.

Excluding $123 million in mark-to-market gains from technology investments and a one-time loss of $156 million resulting from the previously announced Milrose exchange offer, Lennar’s net income attributable to the company for Q4 2025 was $514 million, or $2.03 per diluted share; by comparison, excluding $13 million in mark-to-market gains from technology investments, Lennar’s net income attributable to the company for Q4 2024 was $1.1 billion, or $4.03 per diluted share.

For the fiscal year ended November 30, 2025, Lennar reported net income attributable to the company of $2.1 billion, or $7.98 per diluted share, compared to $3.9 billion, or $14.31 per diluted share, for the fiscal year ended November 30, 2024. Excluding $130 million in mark-to-market gains from technology investments and the one-time loss of $156 million from the Milrose exchange offer, Lennar’s net income attributable to the company for the fiscal year ended November 30, 2025, was $2.1 billion, or $8.06 per diluted share; by comparison, excluding $25 million in mark-to-market gains from technology investments and other one-time items, Lennar’s net income attributable to the company for the fiscal year ended November 30, 2024, was $3.8 billion, or $13.86 per diluted share.

For the fiscal year ended November 30, 2025, Lennar reported net income attributable to the company of $2.1 billion, or $7.98 per diluted share, compared to $3.9 billion, or $14.31 per diluted share, for the fiscal year ended November 30, 2024. Excluding $130 million in mark-to-market gains from technology investments and the one-time loss of $156 million from the Milrose exchange offer, Lennar’s net income attributable to the company for the fiscal year ended November 30, 2025, was $2.1 billion, or $8.06 per diluted share; by comparison, excluding $25 million in mark-to-market gains from technology investments and other one-time items, Lennar’s net income attributable to the company for the fiscal year ended November 30, 2024, was $3.8 billion, or $13.86 per diluted share.

Stuart Miller, Executive Chairman and Co-Chief Executive Officer of Lennar, stated: 'Despite a slight decline in interest rates during the company's fourth quarter, the overall market remains challenging. As such, the company’s Q4 2025 and full-year results reflect its prudent commitment to increasing housing supply amid affordability challenges and weak consumer confidence that constrained the market. Despite additional pressure from a six-week government shutdown, the company continued to build and sell homes while making necessary adjustments to adapt to the evolving market environment.'

'This quarter, the company delivered 23,034 homes and secured 20,018 new orders. The average selling price was $386,000, with a gross margin of 17%, sales, general, and administrative expenses (SG&A) accounting for 7.9%, and a final net profit margin of 9.1%.'

'In response to the ongoing market downturn, the company maintained approximately 14% in incentives and price adjustments while continuing to focus on volume. Deliveries in 2025 increased by more than 2,300 units, or about 3%, compared to 2024, reaching a total of 82,583 units.'

'Even in a weak market environment, the company prioritized providing supply for a healthier housing market while reducing costs to support affordability. The company’s strategy has remained consistent and clear: maintain volume, adapt to changing conditions, reduce costs, and support housing affordability.'

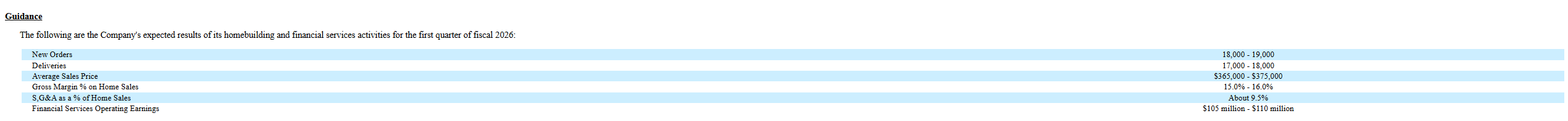

Guidance