①Kevin Hassett, Director of the White House National Economic Council and a top candidate for Federal Reserve Chair, stated that the U.S. has room to cut interest rates and believes that interest rates are out of sync with the rest of the world; ②Hassett noted he is confident that the economy can return to 3% growth with 1% inflation due to improved productivity, particularly AI-driven productivity gains.

As the year-end approaches, the competition for 'Powell's successor' is intensifying, with Trump expected to announce the final nominee early next year. The selection process is still in full swing, and U.S. Treasury Secretary Bessent recently stated that one or two more interviews will take place this week.

As one of the leading candidates, Kevin Hassett, Director of the White House National Economic Council, recently stated that the U.S. still has significant room to cut interest rates. He argued that U.S. interest rates are out of alignment with other parts of the world and pointed out that underlying employment trends remain solid, although recent data has been distorted by the 'episode' of the government shutdown.

He also noted that President Trump believes interest rates could be lower, a view shared by many. However, he emphasized that any actions taken by the Federal Reserve must be based on consensus derived from facts and data. Hassett remarked, "If he were in their position, he would engage in discussions and consultations with Fed officials."

He also noted that President Trump believes interest rates could be lower, a view shared by many. However, he emphasized that any actions taken by the Federal Reserve must be based on consensus derived from facts and data. Hassett remarked, "If he were in their position, he would engage in discussions and consultations with Fed officials."

Hassett also stated that Trump will soon announce his nominee for Federal Reserve Chair and expressed confidence that the government will not shut down again.

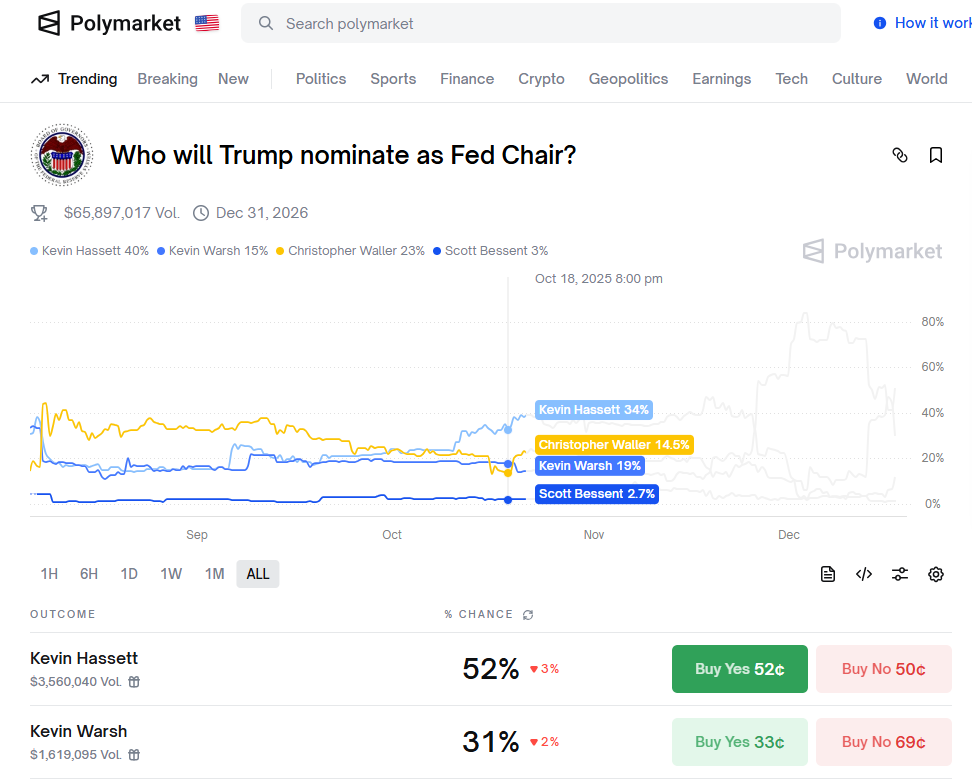

Despite a surge in the likelihood of Kevin Warsh, a former Federal Reserve governor and another top contender, being nominated as Fed Chair following Trump’s remarks over the weekend, Kevin Hassett remains at the top on Polymarket, the world’s largest 'prediction market' platform.

In a recent interview, Hassett also stated that reducing the deficit is crucial to lowering interest rates and expressed confidence that the economy can achieve 3% growth with 1% inflation, citing significant productivity improvements, particularly AI-driven productivity gains that are boosting worker productivity and wages.

Notably, the last time the Consumer Price Index (CPI) increased by less than 1% over a 12-month period was before the pandemic shock to the global economy. However, in Hassett’s view, this may very well represent the future of the U.S. economy. He believes the U.S. economy can 'return to its glory days,' characterized by rapid economic growth and low inflation, with the Federal Reserve maintaining interest rates near historically low levels.

"After a severe supply-side shock, we achieved 3% economic growth and 1% inflation," Hassett said in an interview on Tuesday. "I think it could happen again."

However, achieving this goal will not be easy. Since 2021, U.S. inflation has consistently exceeded the Federal Reserve's official target of 2%, and most forecasters predict that inflation will not return to that level for several years. Nevertheless, Hassett remains adamant that Trump’s economic policies will ultimately lead to a decline in inflation.

Finally, on trade issues, Hassett stated that the administration is confident that the Supreme Court will rule in favor of the government on the tariff issue. However, he noted that Sections 232 and 301 could still serve as safeguards if necessary. Section 232 originates from the Trade Expansion Act of 1962, while Section 301 stems from the Trade Act of 1974.

Editor/Lambor