①Based on the interpretations by investment banks following the release of data on Tuesday, industry insiders have expressed a wide range of opinions;

②The relatively mainstream view is that this nonfarm payroll report, which was somewhat "distorted" due to the longest government shutdown in U.S. history, has limited overall reference value and may not necessarily determine the Federal Reserve's next policy decision.

The U.S. November nonfarm payroll report once again confirms the weakening of the U.S. labor market, but in the short term, it is unlikely to alter the Federal Reserve’s policy outlook…

Data released by the U.S. Bureau of Labor Statistics on Tuesday showed that the U.S. economy added 64,000 jobs in November, while 105,000 jobs were lost in October. In terms of unemployment, the November unemployment rate rose to 4.6%, hitting its highest level since September 2021.

Data released by the U.S. Bureau of Labor Statistics on Tuesday showed that the U.S. economy added 64,000 jobs in November, while 105,000 jobs were lost in October. In terms of unemployment, the November unemployment rate rose to 4.6%, hitting its highest level since September 2021.

Following the release of this non-farm payroll report, investors initially seemed uncertain about how to respond. Goldman Sachs strategist Chris Hussey noted this during last night’s trading session.

Hussey pointed out, “Today’s price action suggests that investors appear unsure how to react to this morning’s non-farm payroll data. On one hand, the yield on the 10-year U.S. Treasury bond fell by 3 basis points as investors turned to bonds—a traditionally defensive signal. However, a quick glance at the S&P 500’s performance on Tuesday reveals that the worst-performing sectors of the day—healthcare, utilities, and real estate—are also traditionally defensive industries, while the technology sector of the S&P 500 actually saw the most significant gains.”

What exactly is going on?

Hussey suggested that this might simply reflect the market digesting the data, or it could reflect intense debates about the Federal Reserve’s future trajectory: How many rate cuts will there be, and when will they occur?

In fact, based on interpretations by investment banks after Tuesday’s data release, industry insiders’ views vary significantly.

However, the relatively mainstream view remains that this non-farm payroll report, somewhat ‘distorted’ due to the longest government shutdown in U.S. history, has limited overall reference value and may not dictate the Federal Reserve’s next policy decision. Moreover, the state of the U.S. labor market presented in the data does not yet indicate sufficient weakness to lock in expectations for rate cuts.

Krishna Guha, Head of Global Policy at Evercore ISI, stated, “We believe the data was not weak enough to prompt the Federal Reserve to cut rates again in the near term. Rate cuts would only be triggered if the data significantly undershoots expectations. Although the Fed will remain vigilant and closely monitor the December data, we do not think the October-November data met the threshold to trigger a rate cut.”

Stephen Brown, an economist at Capital Economics, also expressed that he doubts this report is 'sufficient to prompt thethe Federal Open Market Committee(FOMC) to consider resuming interest rate cuts in upcoming meetings.'

Typically, such data might trigger renewed concerns among Fed officials about the health of the labor market, prompting further interest rate cuts. However, economists and Fed watchers pointed out that given the government shutdown persisted throughout October and extended into November, which could lead to data distortions, these figures should be interpreted with caution.

The U.S. Department of Labor had previously warned that due to multiple factors such as a decline in survey response rates, adjustments to composite weights, and the adoption of a two-month analysis period instead of one month, the data contains a higher-than-usual standard error.

Moreover, although the unemployment rate surged to 4.6%—a figure typically indicative of concern—the rise in unemployment may have been driven by reductions in government jobs. As federal employees who chose to resign earlier in the year were finally removed from payrolls on October 1, there was an expected spike in federal government job cuts in October. Affected by delayed resignations, government positions decreased by 162,000 in October and another 6,000 in November. Since peaking in January, federal government jobs have cumulatively declined by 271,000.

When asked about the increase in the unemployment rate, Kevin Hassett, Director of the White House National Economic Council, noted that the labor force participation rate also rose in November. “The coexistence of these two phenomena is likely because the 250,000 federal employees who accepted buyout packages are still looking for work within the labor market,” he said.

Of course, not all overnight views from Wall Street institutions lean toward the notion that the data will support the Fed maintaining its current stance.

Joe Brusuelas, Chief Economist at RSM, stated, “The nonfarm payroll data likely strengthened the position of those advocating for rate cuts at the December meeting. In the later stages of the economic cycle, the Bureau of Labor Statistics tends to overestimate employment figures, subsequently revising down initial estimates during benchmark revisions. If this holds true, it opens the door for near-term rate cuts, especially if January’s employment data shows weakness.”

Ellen Zentner, Chief Economic Strategist at Morgan Stanley Wealth Management, also believed that this data represents a 'godsend' for those anticipating further rate cuts. She pointed out, “There indeed appears to be some softness in the labor market, but there is no indication that the overall economy has derailed.”

Fed Chair Powell warned at the press conference following last week’s interest rate decision meeting that the Fed needs to carefully evaluate employment data. “Technical issues in the way data is collected for certain indicators of inflation and the labor market could result in distorted figures—not only making them more volatile but also prone to distortion,” he said. “We must scrutinize this data with prudence.”

Powell noted at the time that he believed monthly job growth figures were likely overestimated by an average of 60,000, with actual job growth closer to a net loss of 20,000 per month.

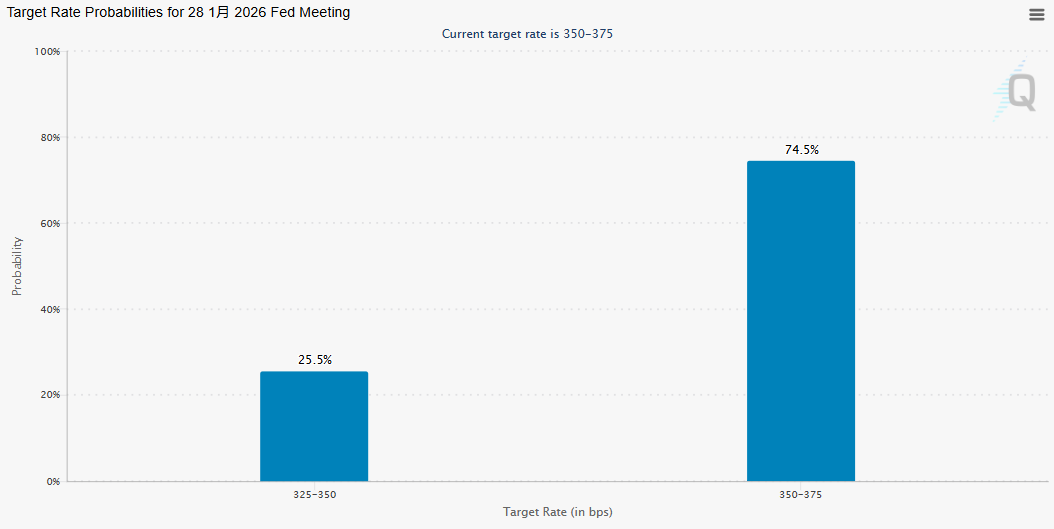

The CME FedWatch Tool shows that, following the release of Tuesday’s non-farm payroll data, traders currently anticipate a roughly 25% probability of the Federal Reserve cutting interest rates in January next year, with a 75% likelihood of maintaining the current policy stance—a figure largely unchanged from the previous day.

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/melody