In 2025, the Hong Kong stock market demonstrated resilience amid fluctuations, ushering in a slow bull market with a tortuous upward trend. As of December 16, the three major indices have all recorded solid gains for the year, $Hang Seng Index (800000.HK)$ with cumulative increases nearing 26%. $Hang Seng TECH Index (800700.HK)$ 、$Hang Seng China Enterprises Index (800100.HK)$ all rising over 20%.

In retrospect, Hong Kong stocks had a strong start at the beginning of the year, steadily advancing for two consecutive months. However, from mid-to-late March to mid-April, the market was significantly impacted by the 'black swan' event of unexpected tariff policies introduced by the Trump administration, causing a sharp decline in Hong Kong stocks alongside global markets.

Subsequently, through multiple rounds of negotiations, China and the U.S. gradually resolved their differences. Coupled with the sustained large-scale inflow of southbound funds providing robust support, market confidence gradually recovered, and Hong Kong stocks resumed their upward trajectory.

Entering the fourth quarter, Hong Kong stocks turned volatile again, starting to correct in mid-October. Market fluctuations noticeably intensified, with November presenting an overall oscillating trend. Since December, the adjustment has deepened further.

Entering the fourth quarter, Hong Kong stocks turned volatile again, starting to correct in mid-October. Market fluctuations noticeably intensified, with November presenting an overall oscillating trend. Since December, the adjustment has deepened further.

Hong Kong stocks once again welcomed a 'bumper year,' largely supported by a group of standout performers. Next, let's take a look at the top ten gainers and leading stock performance rankings for the year.

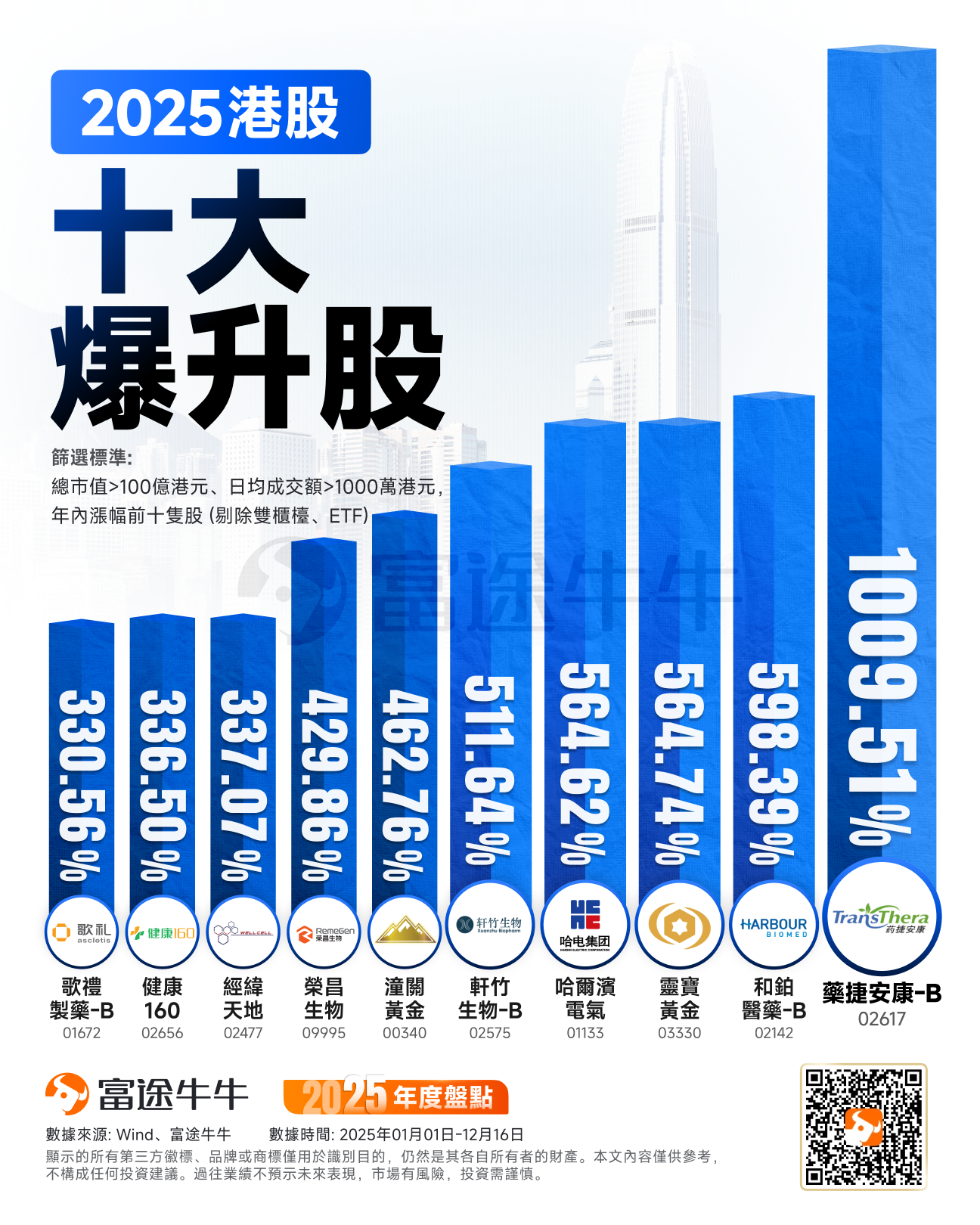

Top 10 Gainers in Hong Kong Stock Market

An overview of the top ten gainers in Hong Kong stocks this year reveals that biomedicine and gold constituted the two core themes driving the market.

This year, after a three-year adjustment period, biopharmaceutical stocks have rebounded significantly, benefiting from the triple tailwinds of 'R&D breakthroughs, policy support, and capital recovery.' Among the ten biggest gainers, pharmaceutical-related companies accounted for six spots, emerging as the biggest winners of the year.

Among them, newly-listed stocks $TRANSTHERA-B (02617.HK)$ topped the list with an astounding increase of 1009%. Since its listing in June, the company’s share price surged from HKD 13.15 to HKD 679.5 and then plummeted to HKD 143.2, experiencing a staggering rise of over 10 times within seven trading days, followed by a sharp decline of 79% in just four days. This extreme performance of Pharmaron reflects certain risks associated with the passive investment mechanism of index funds. Multiple ETFs tracking the Hang Seng Stock Connect Innovative Drug Index were forced to purchase shares at high prices due to adjustments in constituent stocks, sparking deeper discussions among investors about the operational mechanisms of ETFs.

$HBM HOLDINGS-B (02142.HK)$ 、 $XUANZHUBIO-B (02575.HK)$ 、 $REMEGEN (09995.HK)$ 、 $ASCLETIS-B (01672.HK)$ followed closely behind, with year-to-date increases of 598%, 511%, 429%, and 330%, respectively. In addition, the internet healthcare platform $160 HEALTH (02656.HK)$ also recorded an impressive gain of 336%.

On the other hand, amid the intertwined concerns of geopolitical instability and global inflationary pressures, gold has become increasingly attractive as safe-haven assets, with relevant individual stocks $LINGBAO GOLD (03330.HK)$ 、 $TONGGUAN GOLD (00340.HK)$ rising over 564% and 462% year-to-date, respectively.

Beyond the two main themes mentioned above, some individual stocks achieved notable gains due to favorable conditions in niche sectors. A long-established central state-owned enterprise $HARBIN ELECTRIC (01133.HK)$ recorded a 564% increase year-to-date driven by its overseas expansion in power equipment, while a telecommunications network service provider $WELLCELL HOLD (02477.HK)$ also surged by over 337%.

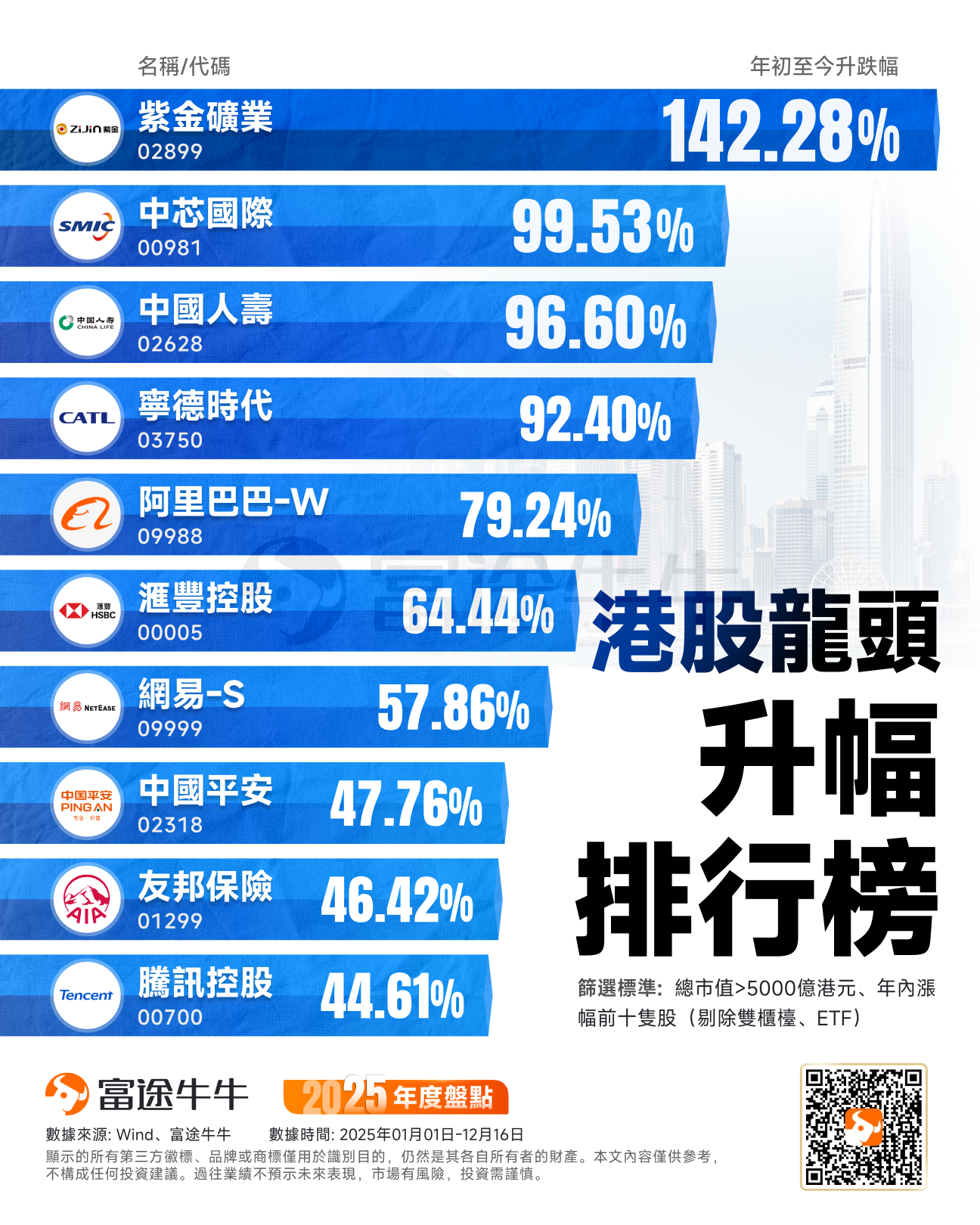

Ranking of Gainers Among Hong Kong Stock Leaders

In 2025, leading enterprises in the Hong Kong stock market performed strongly overall, serving as a key driver propelling index growth.

Leading gold stocks $ZIJIN MINING (02899.HK)$ ranked first with a 142% increase. The company’s global resource allocation and consistent performance breakthroughs, combined with the continuous strengthening of commodity prices such as copper and gold, pushed its market capitalization close to HKD 1 trillion. Following closely was the semiconductor company $SMIC (00981.HK)$ , which benefited from the domestic substitution trend, nearly doubling its share price within the year.

Meanwhile, amid heightened market volatility, investors increasingly favored dividend stocks offering stable profitability and attractive payouts. Insurers and banks stood out, with $CHINA LIFE (02628.HK)$ 、 $PING AN (02318.HK)$ 、 $AIA (01299.HK)$ posting year-to-date gains of 96%, 47%, and 46%, respectively, while international bank $HSBC HOLDINGS (00005.HK)$ also rose over 64% during the same period.

Since the beginning of this year, a large number of A-share listed companies have gone public on the Hong Kong stock market, contributing to the continued boom in Hong Kong IPOs. Representative “A+H” share companies $CATL (03750.HK)$ have also recorded a 92% increase year-to-date, with H-shares currently trading at a premium of more than 20% over A-shares, which is extremely rare among “A+H” listed companies.dual listingThis phenomenon is quite uncommon among “A+H” share firms.

In addition, driven by both a stabilized policy environment and recovering financial performance, internet giants have also demonstrated strong rebound momentum. $BABA-W (09988.HK)$ One such company has risen 79% year-to-date, $NTES-S (09999.HK)$ 、 $TENCENT (00700.HK)$ while others have recorded gains of 57% and 44%, respectively.

Looking ahead to the future direction of Hong Kong stocks, CICC believes that the Hong Kong market is influenced by both foreign capital and southbound flows but requires spillover, meaning funds from both regions must perceive limited opportunities locally. In terms of allocation, CICC recommends using dividends and AI as core holdings; short-term performance will require industrial catalysts or improved liquidity. In the first quarter, focus should be placed on strong cyclical trading catalysts, while the consumer sector overall lacks fundamental support.

![]() Looking back at 2025, how did your investment returns fare?

Looking back at 2025, how did your investment returns fare?

![]() Did you reap substantial gains by making the right decisions?

Did you reap substantial gains by making the right decisions?

![]() Which stocks or industries do you believe hold opportunities?

Which stocks or industries do you believe hold opportunities?

![]() Come share your annual summary!

Come share your annual summary!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/KOKO