On December 16, 2025, Eastern Time, Circle, known as the "first stablecoin stock," $Circle (CRCL.US)$ closed with a share price increase of approximately 10%.

The direct factor behind the rise was $Visa (V.US)$ Circle's announcement of the launch of $USDCoin (USDC.CC)$ settlement services. Visa announced that it would allow U.S. banks and institutions to use USDC for faster and lower-cost settlements. This directly benefits Circle’s payment network and promotes the integration of USDC into traditional finance.

In addition to this positive development, the company has recently achieved historic breakthroughs in key regulatory compliance areas.

$Circle (CRCL.US)$ The drivers of Circle’s share price are transitioning from a singular reliance on cryptocurrency market beta to alpha growth driven by regulatory clarity, accelerated institutional adoption, and the expansion of its own ecosystem.

$Circle (CRCL.US)$ The drivers of Circle’s share price are transitioning from a singular reliance on cryptocurrency market beta to alpha growth driven by regulatory clarity, accelerated institutional adoption, and the expansion of its own ecosystem.

Recent Positive Developments: Compliance Builds a Solid Path for Upside

$Circle (CRCL.US)$ At the end of 2025, Circle experienced a series of significant positive developments. These events not only strengthened USDC’s compliance advantages but also promoted its expansion in institutional-grade applications. The two most impactful developments were receiving conditional approval from the U.S. Office of the Comptroller of the Currency to establish a national trust bank and Visa’s launch of USDC settlement services.

On December 9, Circle obtained a full financial services license in the Abu Dhabi Global Market, allowing it to operate as a money service provider, further expanding its presence in the Middle Eastern market.

On December 10, Circle partnered with privacy blockchain Aleo to launch the privacy coin USDCx. The introduction of USDCx can be regarded as a differentiated competitive strategy by Circle.

On December 13, the U.S. Office of the Comptroller of the Currency (OCC) conditionally approved trust bank charters for five institutions: Ripple, BitGo, DigitalAssets, Paxos, and Circle. Circle is one of the five institutions that received conditional approval from the OCC to establish a national trust bank.

On December 15, Circle announced an agreement to acquire Interop Labs (the development team behind the Axelar cross-chain network) and related proprietary technologies, marking a key step in Circle's efforts to accelerate cross-chain interoperability.

On December 16, Visa announced the launch of USDC settlement services in the United States, allowing U.S. banks and institutions to use USDC for faster and lower-cost settlements.

Background: Regulation of crypto assets by U.S. banks has entered a new phase.

As the year-end approaches, U.S. crypto asset regulation has seen several favorable policy developments.

On November 19, 2025, the U.S. Office of the Comptroller of the Currency (OCC) issued Interpretive Letter 1186, confirming that banks may hold specific cryptocurrencies (such as ETH) on their balance sheets for payment of blockchain network gas fees, addressing practical bottlenecks for banks participating in on-chain operations.

On December 10, the U.S. Office of the Comptroller of the Currency (OCC) released an interpretive memorandum clarifying that banks may act as intermediaries in cryptocurrency transactions, allowing them to purchase crypto assets from one party and simultaneously sell them to another without holding these assets on their balance sheets. This move clears legal obstacles for banks engaging in crypto brokerage activities.

The GENIUS Act provides a national legal framework for stablecoins, while the aforementioned OCC policies indicate regulatory intent to integrate crypto activities into the existing financial regulatory system, making them more transparent and compliant.

Analysis: Circle’s approval to establish a national trust bank represents a milestone at the regulatory level.

Circle has received conditional approval from the U.S. Office of the Comptroller of the Currency (OCC) to establish a national trust bank. This charter holds strategic value for the company.

It addresses two core pain points: first, the national trust bank charter provides a unified operational license across the country, significantly reducing operational costs. Second, it provides a trust endorsement. A 'bank' charter carries substantial credibility in the traditional financial world, which will help Circle attract institutional clients who were previously hesitant due to regulatory uncertainties, such as hedge funds, family offices, and even publicly traded companies.

Although the OCC’s approval is currently conditional and not the final permit, Circle must meet specific conditions within a set timeframe to transition to full operational status. Once the OCC issues the final, unconditional national trust bank charter, the company can immediately exercise its trust banking powers.

Analysis: Adoption by mainstream financial institutions like Visa directly enhances the utility of USDC.

$Visa (V.US)$ Opening USDC settlement services based on the Solana blockchain to U.S. institutions marks a significant milestone in the integration of traditional financial infrastructure with blockchain technology.

Visa’s choice of USDC reflects recognition of Circle’s compliant stablecoin. By deeply integrating the stablecoin into one of the largest traditional payment networks globally, USDC transitions from the 'proof-of-concept' phase to the 'commercial deployment' phase in mainstream finance.

Currently, a significant portion of Circle’s revenue relies on interest generated from reserves backing USDC, a model highly sensitive to interest rate cycles. Collaboration with Visa opens doors to non-interest income streams such as 'transaction fees' and 'technical service fees.' When USDC is used for settlements on Visa’s network, its velocity and frequency of circulation will grow exponentially. More importantly, Visa provides Circle’s payment ecosystem with heavyweight 'early adopters' and credit endorsements.

Visa’s adoption sets a powerful precedent. The first wave of partner banks, Cross River Bank and Lead Bank, settled with Visa using USDC via the Solana blockchain. As this service rolls out across the U.S. by 2026, more financial institutions will be compelled—either voluntarily or otherwise—to consider integrating USDC settlement systems. This will directly drive the adoption and market capitalization growth of USDC, while greater scale and liquidity will, in turn, attract more partners and use cases, forming a robust network effect moat.

In the short term, Circle’s stock price is under pressure due to fluctuations in the cryptocurrency market. However, Cathie Wood is taking advantage of the dip to increase her position, with long-term focus on the realization of positive catalysts.

As a crypto-related stock, $Circle (CRCL.US)$ In the short term, it will still be influenced by Bitcoin prices and overall risk sentiment in the cryptocurrency market. Recently, $Bitcoin (BTC.CC)$ the price has been fluctuating between $85,000 and $90,000. Currently, funding rates on mainstream CEXs and DEXs indicate that the market remains bearish.

On a macro level, the Bank of Japan is expected to raise short-term interest rates from 0.5% to 0.75% on Friday. As the BOJ approaches its rate hike, cryptocurrencies remain under pressure in the short term, but this may provide investors with a window of opportunity for low-cost positioning.

Cathie Wood's ARK Fund has recently adopted a 'be greedy when others are fearful' approach, increasing its holdings in cryptocurrency-related stocks, including $Circle (CRCL.US)$ a net purchase of 143,600 shares.

With the dual synergistic effects of Visa providing adoption channels and OCC offering regulatory moats, $Circle (CRCL.US)$ demonstrates long-term investment value. Investors can focus on the following stock price drivers:

Adoption metrics: Focus on the growth of USDC’s market capitalization, settlement volumes on the Visa network, and updates regarding Arc testnet and mainnet launches.

Regulatory developments: Final operating licenses after OCC conditional approval, as well as the regulatory stance toward stablecoins in other jurisdictions.

Financial data validation: Monitor whether the proportion of non-interest income (e.g., transaction-related service revenues) in corporate earnings reports rises as expected.

Options Strategy: How to Capture the Value of Narrative Revaluation?

Mid-term Bullish Options Setup:

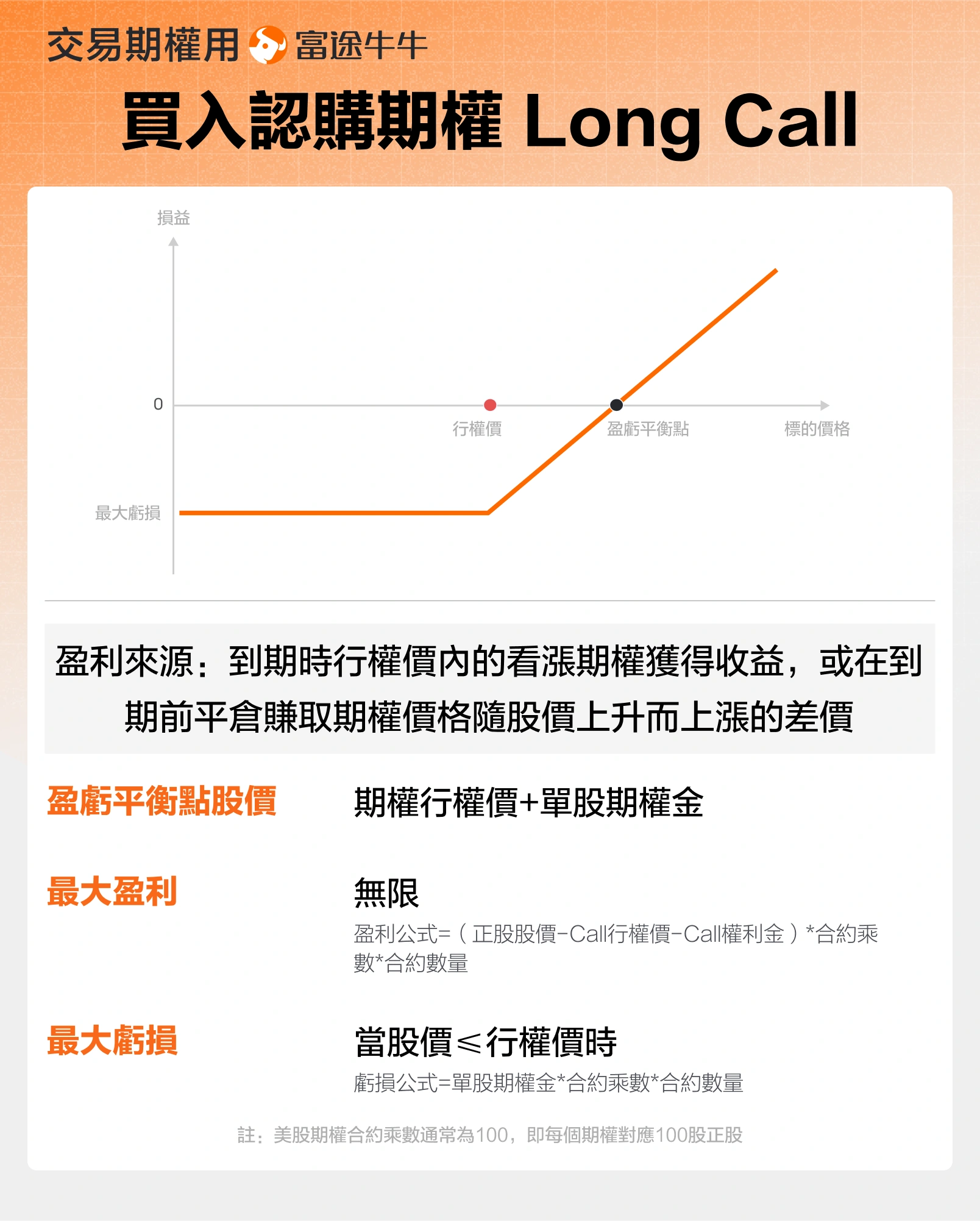

For long-term investors who are optimistic about $Circle (CRCL.US)$ the increase in market share driven by compliance, they can purchase Call options with an expiration period of more than three months and a strike price slightly higher than the current level to capture further price appreciation.

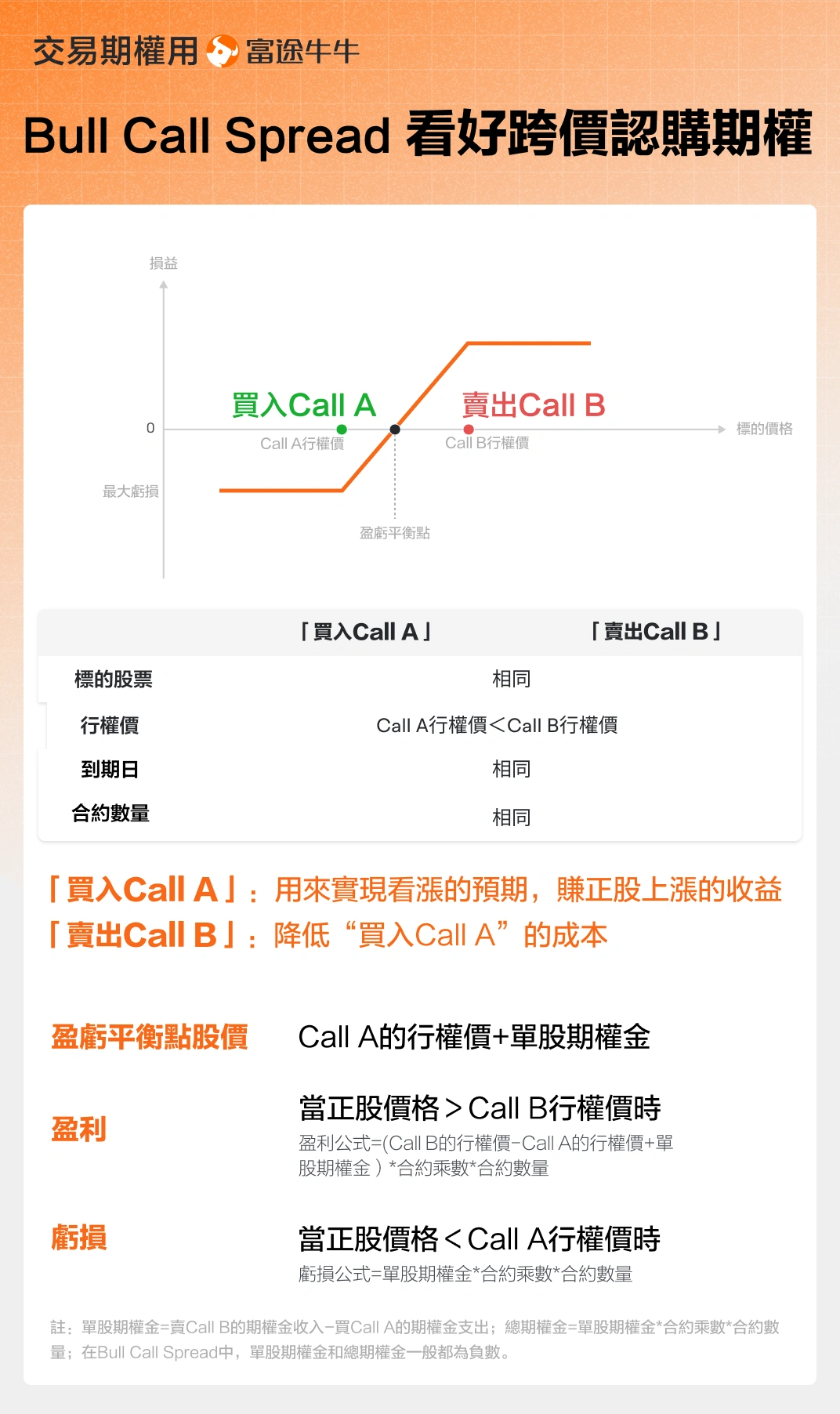

When short-term implied volatility is high, selling Calls at higher strike prices to construct a bull spread can reduce costs.

Protective Strategies:

For long-term investors who are optimistic about $Circle (CRCL.US)$ but consider this news as a long-term positive that may not immediately translate into profits in the short term, while being concerned about potential declines due to cryptocurrency market conditions, combining holding the stock with purchasing corresponding at-the-money Put options can hedge downside risks. If the price falls further, it also allows for buying at a lower cost.

![]() Market conditions are complex and volatile,Options Strategyare numerous, and you don't know how to choose? Futubull helps you build an options strategy in three steps, making investing simple and efficient from now on!

Market conditions are complex and volatile,Options Strategyare numerous, and you don't know how to choose? Futubull helps you build an options strategy in three steps, making investing simple and efficient from now on!

Risk Factors

An option is a contract that grants the holder the right, but not the obligation, to buy or sell an asset at a fixed price on a specific date or at any time before that date. The price of an option is influenced by various factors, including the current price of the underlying asset, the strike price, the time to expiration, andImplied Volatility。

Implied VolatilityIt reflects the market's expectation of volatility in options over a certain period. This data is derived inversely from the BS option pricing model and is generally regarded as an indicator of market sentiment. When investors anticipate greater volatility, they may be more willing to pay higher prices for options to hedge risks, thereby leading to a higherImplied Volatility。

Traders and investors useImplied Volatilityto evaluateoption pricethe attractiveness, identify potential mispricing, and manage risk exposure.

Disclaimer

This content does not constitute any offer, solicitation, recommendation, opinion, or guarantee regarding securities, financial products, or tools. The risk of loss in trading options can be substantial. Under certain circumstances, the losses you incur may exceed the initial margin amount deposited. Even if you set contingency orders, such as “stop-loss” or “limit” orders, they may not prevent losses. Market conditions may make it impossible to execute such orders. You may be required to deposit additional margin within a short period. If you fail to provide the required amount within the specified time, your open positions may be liquidated. Nevertheless, you will remain responsible for any shortfall in your account resulting from such liquidation. Therefore, before engaging in trading, you should thoroughly study and understand options and carefully consider whether such trading is suitable for you based on your financial situation and investment objectives. If you trade options, you should be familiar with the procedures for exercising options and the rights and obligations associated with exercising options and their expiration.

Editor/Doris