Source: Qile Club

In fact, the key to trading success is quite simple. If you can truly gain insight and conduct thorough research into either of the following two systems—"the Laws of Heaven" system or "the Ways of Humanity" system—then trading success will not be far away!

01 “The Laws of Heaven System”: Adhering to Universal Principles

What is “the Laws of Heaven”? Fundamentally, it encompasses all the principles governing the operation of everything in the universe. Laozi stated, "The way of heaven reduces what is excessive and supplements what is insufficient." The *I Ching* mentions, "When the sun reaches its zenith, it begins to decline; when the moon is full, it starts to wane." These ancient wisdoms reveal immutable universal laws.

All things in the world reach their peak only to decline, and extremes lead to reversals. The changing of the seasons is the most vivid manifestation: spring for growth, summer for flourishing, autumn for harvest, and winter for storage. This is the rhythm of nature, which human efforts can hardly alter.

All things in the world reach their peak only to decline, and extremes lead to reversals. The changing of the seasons is the most vivid manifestation: spring for growth, summer for flourishing, autumn for harvest, and winter for storage. This is the rhythm of nature, which human efforts can hardly alter.

So, what exactly is the “Laws of Heaven System”?

In the trading market, market principles are omnipresent.

Take agricultural products as an example. Climate directly affects the growth and yield of crops. If a region suffers from severe drought or flooding, crop production may drastically decline, leading to a rise in futures prices. This reflects the manifestation of natural laws within the futures market. This is an example of how market principles operate.

Another example is commodity futures, where changes in supply and demand directly determine the price trends of commodities. When the supply of a particular product exceeds demand, prices typically fall; conversely, when demand surpasses supply, prices tend to rise.

All we need to do is establish long positions promptly during upward trends and hold them to benefit from price increases; while in downward trends, decisively take short positions or maintain a neutral position to avoid losses.

Fu Haitang, a legendary figure in the futures world, has profound insights into the application of the Laws of Heaven in agricultural products.Futures Exchange,is a model of application.

Fu Hai-tang firmly believes that the price fluctuations of agricultural products follow the laws of nature and changes in supply and demand. He conducts in-depth research on the planting cycles, climatic conditions, and market supply and demand of agricultural products, predicting price trends through an analysis of these factors.

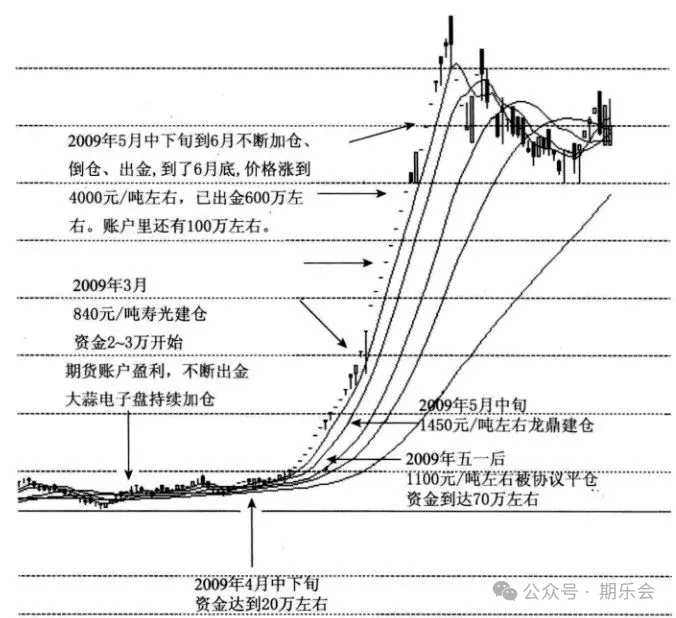

In the battle over garlic, he noticed that due to several consecutive years of significant increases in garlic planting areas, market supply was seriously excessive, leading to persistently low prices. Meanwhile, he discovered that garlic farmers, suffering from poor planting returns, began reducing their planting areas, and abnormal climatic changes could potentially affect garlic production.

Based on an accurate assessment of these natural laws and market supply-demand relationships, Fu Hai-tang decisively established long positions at low price levels. As time passed, garlic production declined, and market demand gradually rebounded, causing prices to rise sharply. This allowed him to complete one of the major campaigns of his life, multiplying his funds 300-fold, from 20,000 to 6 million yuan.

02 'Human Nature System': Insight into the Laws of Human Behavior

The 'Human Nature System' focuses on the core principles of human behavior. Within human nature exist the 'five characteristics'—greed, anger, ignorance, arrogance, and doubt—which continuously influence our decisions and actions during the trading process.

Greed can drive traders to seek additional profits when they are already profitable, making them reluctant to take profits in a timely manner, which ultimately leads to profit reversals or even losses;

Anger may cause traders to experience feelings of rage when facing losses, lose rationality, and make incorrect decisions;

Ignorance can trap traders in certain trading patterns or ideologies, preventing them from adapting to changing market conditions;

Arrogance may lead traders to overestimate their abilities and underestimate market risks, resulting in trading failures;

Hesitation can cause traders to be indecisive during transactions, causing them to miss the best trading opportunities.

However, if we are able to adapt to others' human nature while managing our own, we can achieve the desired results in the trading market. In competition with others, understanding the weaknesses of human nature and leveraging their greed and fear allows us to make correct trading decisions.

When the majority in the market are in a state of greed, blindly chasing rising prices, we can remain calm and sell at the appropriate time; when the market falls into panic and people rush to sell, we can boldly buy.

At the same time, we must strictly manage our own human weaknesses. Before trading, clearly set stop-loss and take-profit points, and once the target is reached, execute decisively without being swayed by emotions. Through continuous self-reflection and discipline, improve our psychological resilience to remain calm, rational, and decisive in trading.

A paragon of applying insights into human nature in trading is the legendary Wall Street trader Jesse Livermore, who once said, 'The market is never wrong—only human nature makes mistakes.' He believed that market fluctuations are fundamentally driven by human emotions, including greed, fear, hope, and despair. He observed that these emotions repeatedly play out in the market, creating volatility and trends.

In market competition, he was adept at observing the emotions and behaviors of the majority. When the market was in a bull phase and investors were generally greedy, blindly chasing gains, Livermore would remain calm, carefully analyzing the true state of the market to identify price bubbles caused by excessive speculation.

Once he detected overheating in the market, he would decisively sell his stocks to avoid losses during a market crash. Conversely, when the market fell into a bear phase and investors were selling out of fear, he would conduct in-depth research to find high-quality stocks that were undervalued by the market and boldly buy them.

At the same time, Livermore placed great emphasis on managing his own human weaknesses. He established strict trading rules and always clearly defined stop-loss and take-profit levels before each trade. Regardless of market fluctuations, he adhered firmly to these rules, avoiding being influenced by emotions.

He also continuously improved his psychological resilience and trading skills through self-reflection and learning from experience, achieving tremendous success in the complex and volatile stock market.

But similarly, he also fell victim to human nature. Livermore attempted to trade by predicting market trends, but his forecasts were often overly optimistic, leading to premature entry into the market and ultimately suffering significant losses due to market uncertainty.

The root cause of forecasting markets lies in the greed inherent in human nature. Every speculator wants to enter the trend as early as possible, hoping to maximize profits. Once there are slight indications in the market that align with their predictions—even if these signs have not been fully validated by the market—speculators often rush to take positions.

Livermore himself detested such behavior. Early in his career, he recognized this weakness within himself and understood both the importance and methods of waiting for the right moment. Throughout his long trading career, he constantly reminded himself to try to overcome this flaw. However, regrettably, despite spending his entire life battling this issue, he was unable to completely eradicate it until his death.

Ultimately, studying the laws of nature and human behavior is, at its core, a process of reflection. Once one stops thinking, it becomes easy to fall into mediocrity, drift along with the tide, and lose independent awareness.

However, whether you deeply study the operating principles of everything in the world to act in accordance with trends, or gain insight into human weaknesses to manage yourself while accommodating others’ tendencies, either approach can provide you with significant advantages in the market.

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/KOKO