Top News

Before the market opened on Wednesday, the three major futures indexes continued to rise, with Dow futures up 0.23%, Nasdaq futures up 0.47%, and S&P 500 futures up 0.37%.

$明星科技股(LIST2518.US)$ Gains were widespread in pre-market trading. $Micron Technology (MU.US)$ Up nearly 3%,$Amazon(AMZN.US)$ 、 $Advanced Micro Devices (AMD.US)$ 、 $Oracle (ORCL.US)$ Surged over 1%.

$热门中概股(LIST2517.US)$ Most stocks rose before the market opened, $Baidu(BIDU.US)$ 、 $Pony AI (PONY.US)$ Up more than 2%, $Alibaba(BABA.US)$ Surged over 1%.

$光通信(LIST23979.US)$ Strengthens before the market opens, $Lumentum(LITE.US)$ up over 5%, $Astera Labs(ALAB.US)$ 、 $Credo Technology(CRDO.US)$ 、 $Coherent(COHR.US)$ up more than 4%.

$光通信(LIST23979.US)$ Strengthens before the market opens, $Lumentum(LITE.US)$ up over 5%, $Astera Labs(ALAB.US)$ 、 $Credo Technology(CRDO.US)$ 、 $Coherent(COHR.US)$ up more than 4%.

$大麻股(LIST2997.US)$ Rose again in pre-market trading, $cbdMD(YCBD.US)$ Surged nearly 43%, $Canopy Growth(CGC.US)$ Surged over 7%, $Tilray Brands(TLRY.US)$, Up nearly 2%. According to sources, U.S. President Trump is expected to sign an executive order as early as this week to ease the classification control on marijuana and recognize its medical use at the federal level for the first time.

Oil stocks generally rose in pre-market trading, $BP PLC (BP.US)$ 、 $Shell (SHEL.US)$ 、 $Cenovus Energy (CVE.US)$ Up more than 2%, $Equinor(EQNR.US)$ Surged over 1%.

Amazon reportedly plans to invest at least $10 billion in OpenAI and provide its self-developed chips.

$Amazon(AMZN.US)$ Up more than 1% in pre-market trading. According to media citing sources, OpenAI is in talks with Amazon to secure at least $10 billion in funding from Amazon Web Services (AWS) and utilize AWS’s self-developed AI chip Trainium. One insider mentioned that this investment could push OpenAI’s valuation above $500 billion. It would also help Amazon expand its influence in the AI chip sector, challenging NVIDIA and Google.

Micron Technology rose in pre-market trading, with earnings due to be released at midnight tomorrow. JPMorgan listed it as a top semiconductor stock pick for next year.

$Micron Technology (MU.US)$ Shares rose nearly 3% pre-market. The company is set to announce its Q1 2026 fiscal year results early tomorrow morning. The market expects revenue of $12.801 billion, representing a 47% year-over-year increase, and earnings per share of $3.76, reflecting a 125% year-over-year growth. As a key hardware component for AI servers, the HBM market is experiencing explosive growth, with Micron Technology's positioning in this sector drawing significant attention. The company has already confirmed that its supply of HBM3E and HBM4 products for all of 2026 has been fully sold out. JPMorgan analyst Harlan Sur issued a report naming Micron Technology as one of the top semiconductor investment picks for 2026. Despite the stock surging 173% this year, there remains upside potential for next year, supported by rising product prices, continued gross margin expansion, and potentially upwardly revised financial forecasts.

Li Lecheng Meets with Lisa Su, Chairperson and CEO of Advanced Micro Devices

$Advanced Micro Devices (AMD.US)$Shares rose more than 1% pre-market. Minister of Industry and Information Technology, Licheng Li, met with Lisa Su, Chairperson of the Board and CEO of Advanced Micro Devices (AMD), in Beijing on December 17th. Both parties exchanged views on strengthening cooperation in the digital economy and artificial intelligence fields. Li stated that China possesses abundant data resources and application scenarios, with digital technology and artificial intelligence rapidly developing and empowering various industries. China will steadfastly advance new industrialization, continuously expand high-level opening up, and provide more collaboration opportunities for foreign enterprises, including AMD. He expressed hope that AMD would continue to deepen its presence in the Chinese market, innovate alongside upstream and downstream companies in China’s industrial chain, and achieve mutually beneficial development. Lisa Su thanked China’s Ministry of Industry and Information Technology for its support of AMD’s development in China and stated that AMD would continue to deepen its investments in China, further strengthen cooperation with China, and jointly promote industrial innovation.

Apple is considering packaging iPhone chips in India for the first time and has begun negotiations.

According to foreign media reports, $Apple(AAPL.US)$ Apple is in preliminary discussions with Indian chipmakers regarding plans to assemble and package components for its iPhone production. Previously, Apple’s industrial collaboration in India primarily focused on the final assembly stages of end products such as the iPhone and AirPods. The latest progress in negotiations suggests that Apple’s operations in India may extend beyond the current terminal product assembly into more complex semiconductor packaging areas upstream.

Hut 8 shares surged pre-market following an AI infrastructure partnership agreement with Anthropic and FluidStack.

Cryptocurrency miner $Hut 8(HUT.US)$ Shares rose more than 21% pre-market after the company announced an artificial intelligence infrastructure partnership with Anthropic and Fluidstack. Under the deal, Hut 8 will develop and provide AI data center infrastructure for Anthropic, delivering at least 245 megawatts (MW) and up to 2,295 MW of capacity under a contract valued at $7 billion.

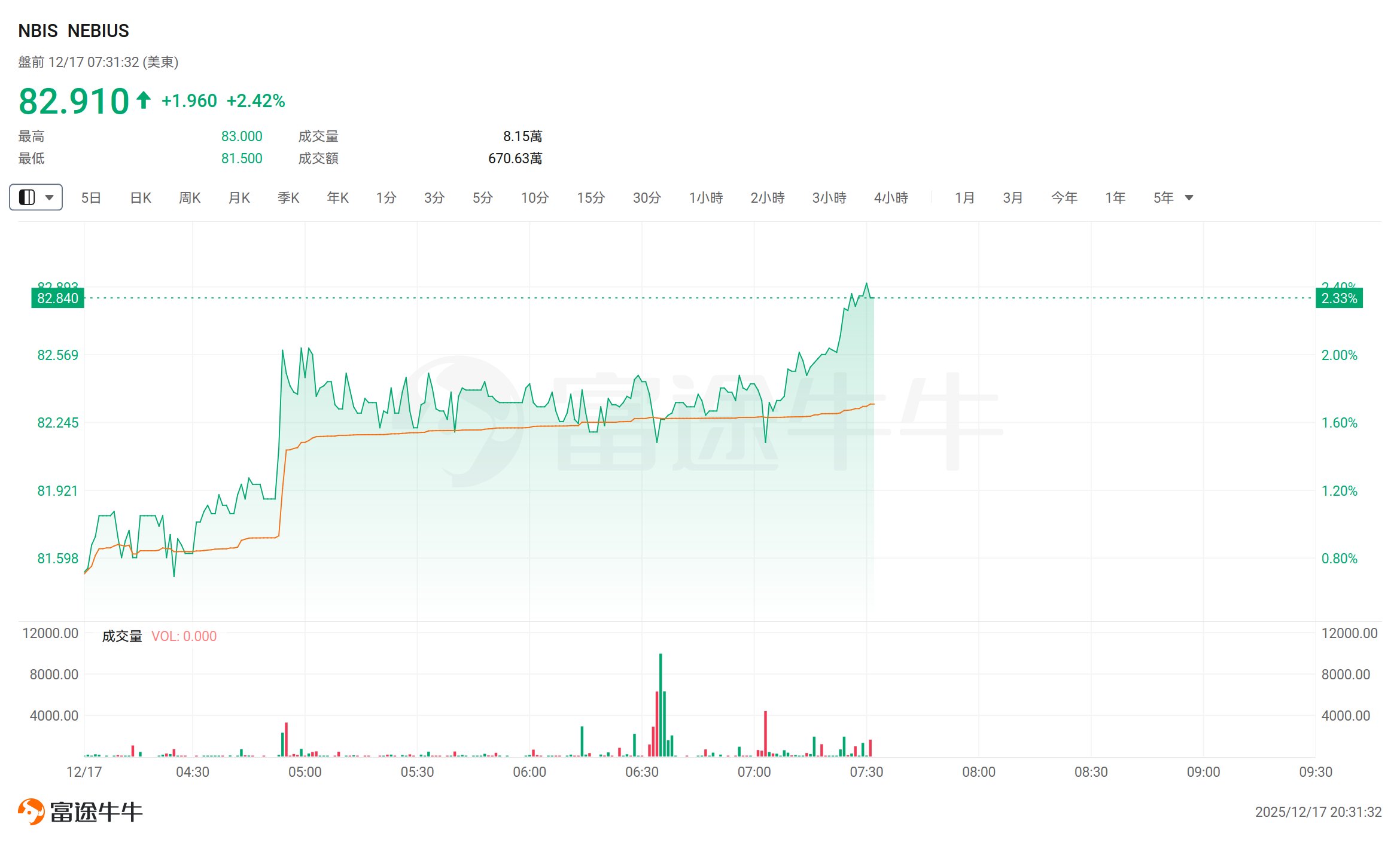

$NEBIUS(NBIS.US)$ Shares rose over 2% pre-market after announcing the launch of NEBIUS AI Cloud 3.1, incorporating the next-generation NVIDIA Blackwell Ultra computing power and enhanced operational features into the latest version of its full-stack AI cloud platform.

The largest IPO in the US this year is here! Medline to debut on Nasdaq tonight, raising $6.26 billion.

The largest IPO in the United States this year has been completed — $Medline(MDLN.US)$ Raised $6.26 billion in its IPO. After increasing the offering size, the final pricing was set at the high end of the indicative range, issuing 216 million shares at $29 per share. This expanded issuance plan is set to officially list on the Nasdaq exchange later on December 17, 2025, under the ticker symbol “MDLN.” Based on the number of shares submitted to the U.S. Securities and Exchange Commission, the pricing implies a company valuation of approximately $39 billion.

Warner Bros Discovery’s board rejects Paramount’s acquisition offer.

According to market reports, $Warner Bros Discovery(WBD.US)$ The board on Wednesday rejected a hostile takeover bid from Paramount Pictures worth $108.4 billion, stating that the offer failed to provide adequate financing assurances. The board wrote that Paramount had “repeatedly misled” Warner Bros shareholders by claiming its $30-per-share cash offer was fully backed by the Ellison family, led by billionaire and $Oracle (ORCL.US)$ CEO Larry Ellison. Paramount’s offer “currently does not, nor has it ever had,” such backing, pointing out that the offer carries “several significant risks.” The Warner Bros board also said they believe Paramount’s offer is “inferior” to the merger agreement with $Netflix (NFLX.US)$ . The chairman of the board further noted that acquisition offers from both Netflix and Paramount pose antitrust risks. We are confident that any deal will be reached.

SpaceX Officially Enters IPO 'Quiet Period,' Valuation May Exceed $1.5 Trillion

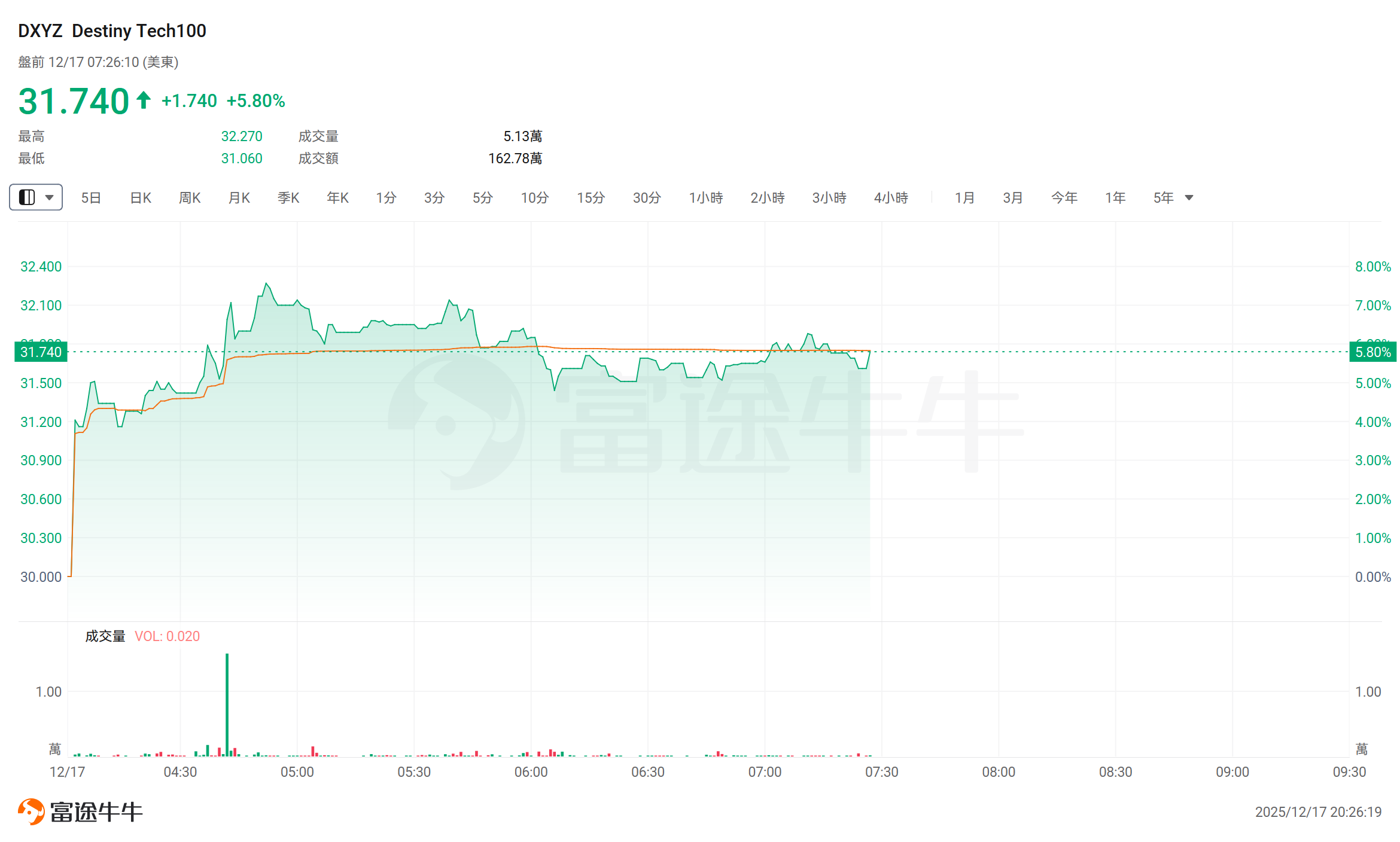

Closed-end fund holding SpaceX shares $Destiny Tech100(DXYZ.US)$ rose nearly 6% in pre-market trading. According to Bloomberg, insiders revealed that SpaceX has notified employees that the company is entering a regulatory “quiet period.” An internal email shows that SpaceX has instructed employees to strictly adhere to U.S. Securities and Exchange Commission (SEC) regulations, refraining from commenting, discussing, or otherwise speculating about the company’s IPO plans. The company plans to conduct an IPO in 2026, aiming to raise over $30 billion with a target valuation of approximately $1.5 trillion, which could make it the largest IPO in history. The proceeds will be used for high-frequency flight testing of the Starship rocket, space-based AI data centers, and lunar base construction. However, the company emphasized that the timing and valuation of the IPO remain uncertain.

Global macro

Traders bet Thursday's CPI 'irrelevant,' U.S. stock volatility expectations plummet

For nearly three years, the U.S. monthly consumer price report has been one of the most closely watched federal data points for equity traders. Now, as investors await the November inflation report due Thursday, the prevailing sentiment is one of indifference rather than the usual anxiety. According to data compiled by Barclays, options traders are betting that the S&P 500 index will move by only 0.7% in either direction. This range is significantly lower than the average actual volatility of 1% triggered by the previous 12 reports through September.

Trump Plans New Sanctions Against Russia, Brent Crude Returns Above $60

International oil prices jumped sharply during the European session on Wednesday, with U.S. WTI crude oil and Brent crude oil rising rapidly. $Brent Crude Oil (Cash) Main Contract (2602)(BZmain.US)$ Prices rose as much as 2.4%, climbing above $60 per barrel. Reports indicate that the U.S. is preparing to impose a new round of sanctions on Russia, with measures potentially launching as early as this week if Russia refuses to accept a peace proposal to end the Ukraine war. Insiders say the U.S. is considering sanction options targeting the so-called “shadow fleet” of tankers used to transport Russian oil, as well as traders facilitating those transactions. Analysts note that overlapping geopolitical risks have refocused market attention on supply-side disruptions, with expectations of escalating sanctions from Venezuela to Russia driving a rebound in crude prices.

Trump is expected to interview Fed Governor Waller on Wednesday

According to insiders, Trump will interview another Federal Reserve Chair candidate—Fed Governor Christopher Waller—on Wednesday. Officials stated that the process is moving quickly, but as Trump is still weighing his options, the meeting could be postponed or canceled at any time. Last week, Trump interviewed former Fed Governor Kevin Warsh. Trump indicated that Warsh, along with National Economic Council Director Kevin Hassett, is among his top choices for the position.

Ahead of the policy decision, member of the Gao municipal government's policy group: The Bank of Japan should avoid raising interest rates prematurely.

Ahead of the Bank of Japan's policy decision, a divergence in stance between the government and the central bank has surfaced. Former Deputy Governor Masazumi Wakatabe warned against premature interest rate hikes, advocating for fiscal and growth policies to first elevate the neutral interest rate. His remarks have been interpreted as a constraint on the central bank’s pace of rate increases. Nonetheless, markets remain highly confident in a 25-basis-point rate hike this week.

U.S. Lawmakers Send Accountability Letters to Seven Data Center Companies

This week, three Democratic U.S. Senators jointly sent letters to seven companies developing data centers, requesting an explanation regarding the electricity cost implications of large-scale construction. In their letter, the senators warned that as demand for AI computing power grows explosively, tech companies are transferring the substantial electricity consumption costs of data centers and grid construction expenses to ordinary American households through existing electricity pricing mechanisms, becoming a significant driver of rising electricity costs in the U.S. in recent years.

The letters were sent to four of the 'Big Seven' — $Amazon(AMZN.US)$ 、 Google (GOOGL.US) 、 $Meta Platforms(META.US)$ and $Microsoft(MSFT.US)$ , as well as $NVIDIA (NVDA.US)$ , which is closely associated with $CoreWeave(CRWV.US)$ , the digital infrastructure giant Equinix Inc (EQIX.US) , and the technology-focused real estate management company Digital Realty Trust Inc (DLR.US). 。

Goldman Sachs: Risks of AI Financing Overstated; Oracle Volatility Not Indicative of Industry Decline

Regarding discussions on the AI bubble, Sung Cho, Co-Head of Public Tech Investing and U.S. Fundamental Equity at Goldman Sachs Asset Management, recently stated that the majority of funding for current artificial intelligence investments does not rely on speculative debt but rather stems from the robust and internally generated cash flows of established technology giants. This distinction is crucial for understanding the long-term resilience of the AI market. Sung Cho believes that $Oracle (ORCL.US)$ the conditions faced by certain companies like Oracle do not indicate a weakening of overall AI demand. Instead, they often reflect operational challenges or supply chain bottlenecks. Sung Cho also pointed out that while the competitive landscape among leading AI model developers will remain highly volatile, these changes are natural outcomes of intense innovation rather than signs of systemic financial weakness. From the perspective of underlying financial health and demand, these concerns, though evident, appear to be overstated.

Top 20 pre-market trading volume stocks in the U.S. stock market

U.S. Stock Market Macroeconomic Calendar Reminder

(The following times are in Beijing Time)

21:15 Fed Governor Waller delivers remarks

22:05 FOMC Permanent Voting Member and New York Fed President Williams delivers the opening remarks at the 2025 Foreign Exchange Market Structure Conference hosted by the New York Fed.

23:30 U.S. EIA Crude Oil Inventory (in million barrels) for the week ending December 12

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO