①The board of Warner Bros. Discovery rejected Paramount Skydance’s $108.4 billion all-cash offer, hostile takeoverdeeming Netflix’s acquisition proposal more attractive; ②Warner questioned the credibility of Paramount’s equity financing and raised concerns about the structure of the Ellison family’s funding, pointing out that Paramount’s offer was undervalued and carried high risks.

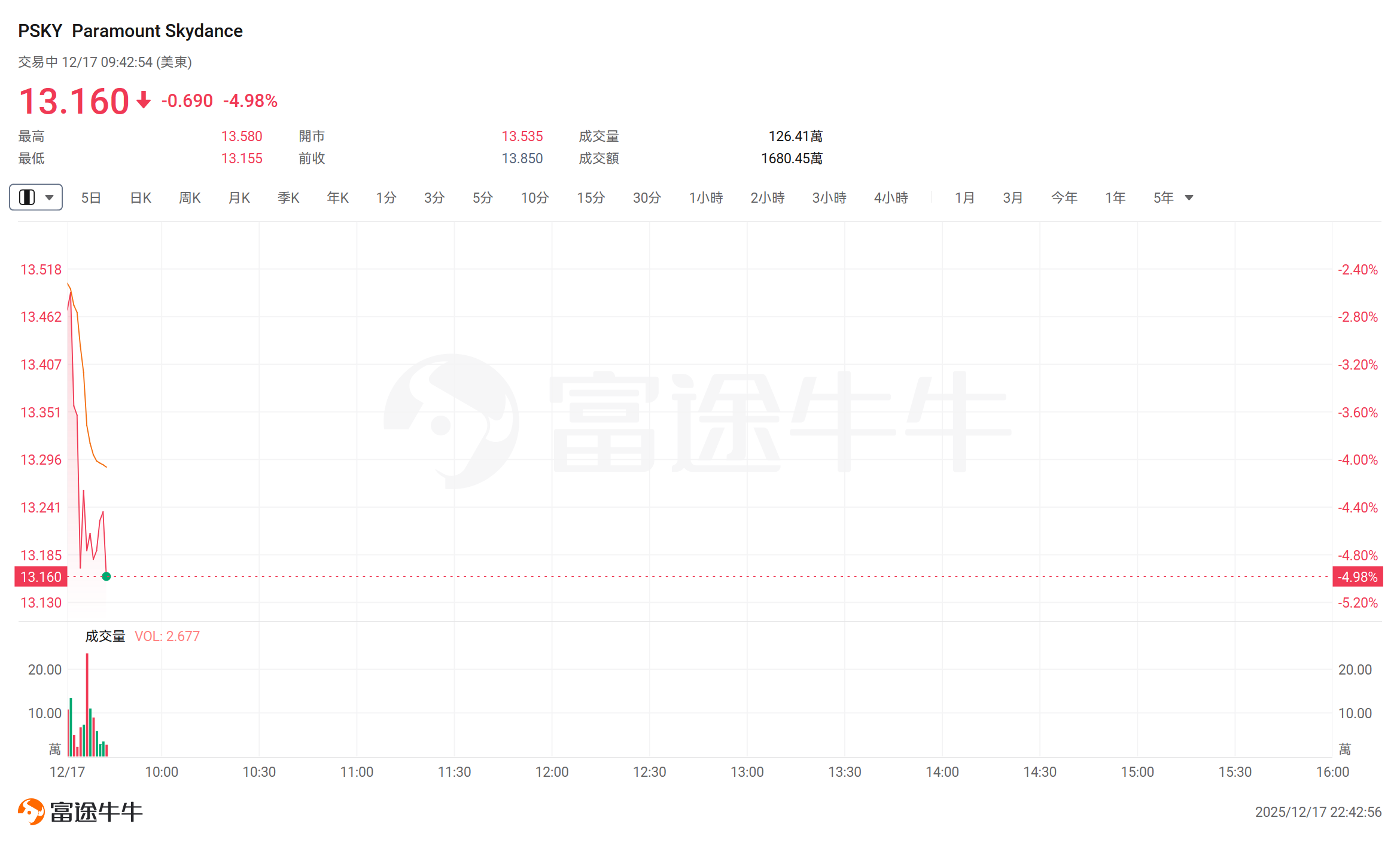

Today, $Paramount Skydance (PSKY.US)$ Dropped nearly 5%, currently trading at $13.16, with a turnover of $16.8045 million.

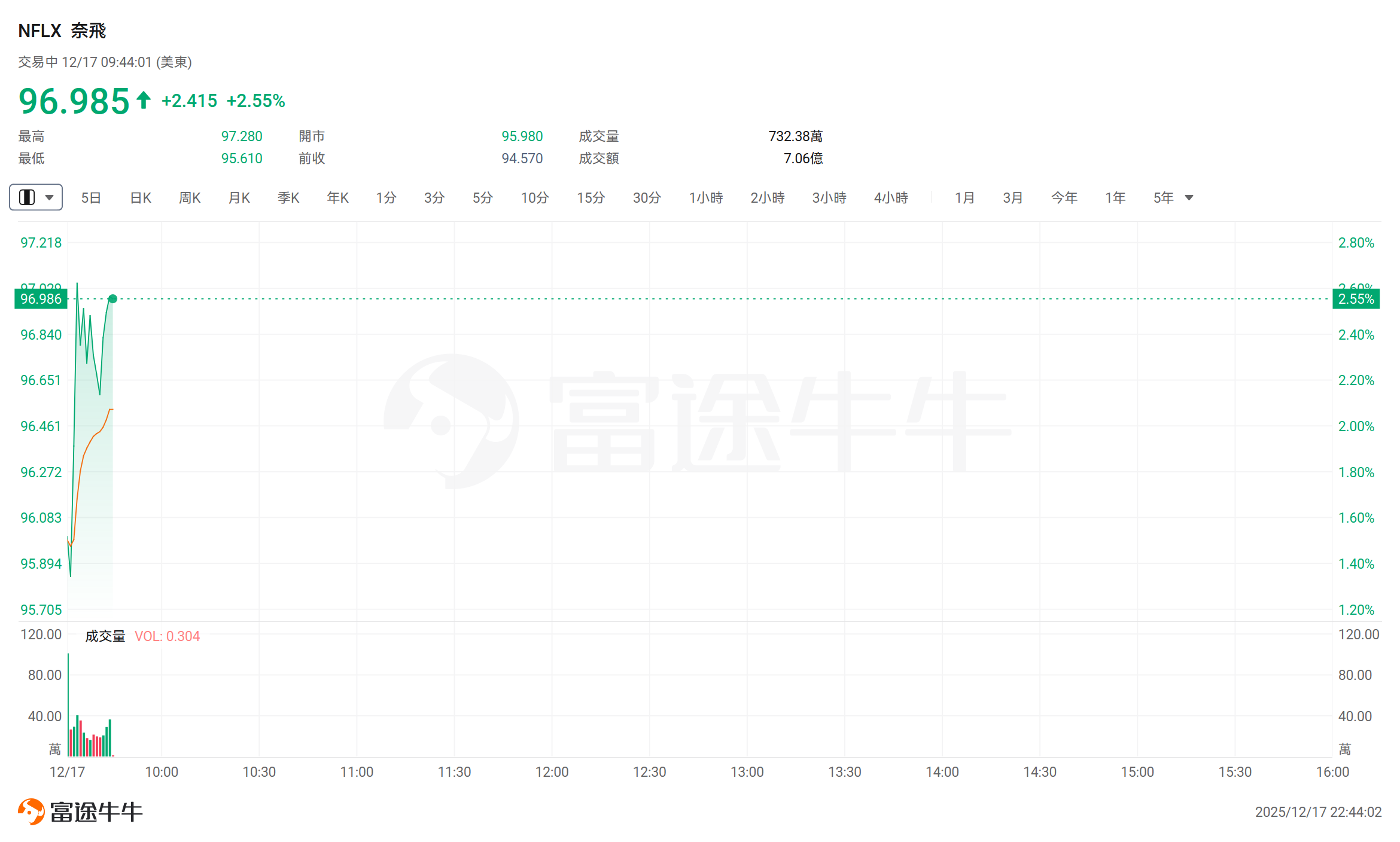

$Netflix (NFLX.US)$ Rose over 2%, last trading at $96.985.

On Wednesday, the board of Warner Bros. Discovery rejected Paramount Skydance's $108.4 billion all-cash hostile takeover bid, stating that it still considered Netflix's acquisition proposal for its film studio assets and HBO streaming business to be more attractive.

On Wednesday, the board of Warner Bros. Discovery rejected Paramount Skydance's $108.4 billion all-cash hostile takeover bid, stating that it still considered Netflix's acquisition proposal for its film studio assets and HBO streaming business to be more attractive.

In a letter to shareholders, Warner described Paramount's offer as "illusory" and again questioned the credibility of Paramount's equity financing, while pointing out significant issues with the structure of the Ellison family's funding for the deal.

Samuel Di Piazza, Chairman of Warner's Board, stated: "After a thorough evaluation of Paramount's recent tender offer, the Board has determined that the offer is undervalued and would impose significant risks and costs on shareholders."

Paramount CEO David Ellison, along with his father, billionaire Larry Ellison, and Redbird Capital, are the controlling shareholders of Paramount.

Earlier this month, Netflix agreed to acquire Warner's legendary film studio and HBO streaming business, retained after being split into two companies, for $72 billion in cash and stock, valuing each share at $27.75.

Subsequently, Paramount initiated a 'hostile takeover' approach, proposing an all-cash offer to acquire all outstanding shares of Warner Bros. Discovery at $30 per share, corresponding to a corporate valuation of $108.4 billion. Paramount has consistently claimed that its proposal offers greater value to shareholders and is more likely to pass antitrust scrutiny.

In its letter to shareholders, Warner stated that the Ellison family plans to fund the transaction through a revocable trust, and the documents submitted by Paramount regarding this funding commitment contain "gaps, loopholes, and multiple restrictions," potentially exposing Warner and its shareholders to significant risks.

Despite the Ellison family's substantial wealth and Paramount's repeated assurances during the strategic review process that such commitments would be provided, the family ultimately chose not to provide a backstop for Paramount Skydance’s offer.

By contrast, Warner noted that Netflix’s deal is fully backed by a publicly traded company with a market value exceeding $400 billion and an investment-grade balance sheet, offering a clearer and more certain source of funding.

In its letter, Warner stated: 'The terms of the Netflix transaction are clearly superior; Paramount’s offer not only undervalues the company but also introduces multiple significant risks and additional costs.'

Paramount’s hostile takeover bid stands at $30 per share, but the company simultaneously indicated to Warner that this is not its “final and best offer,” suggesting room for an increase.

Paramount’s initial acquisition proposal also included funding from three Gulf state sovereign wealth funds and Affinity Partners, led by Jared Kushner, a former senior White House advisor. However, as of Tuesday, Affinity was no longer involved in the deal.

A spokesperson for Affinity stated: 'Since our initial involvement in October, there have been significant changes in the dynamics of the related investment arrangements.' He added, however, that the firm still believes Paramount’s proposal demonstrates 'strong strategic logic.'

Paramount’s tender offer is set to expire on January 8 but can be extended at its discretion. Paramount has repeatedly claimed that Warner’s lack of adequate communication has prevented it from further refining its bid.

In response, Warner stated on Wednesday that its board had engaged extensively with all relevant parties, holding dozens of teleconferences and face-to-face meetings with Paramount’s management and the Ellison family. It raised explicit concerns about the financing structure and provided multiple opportunities for them to revise their proposal.

Warner also noted that its board considers there to be “no material difference” between Paramount’s proposal and the Netflix transaction regarding regulatory approval risks.

Netflix welcomed Warner’s board recommendation on Wednesday. Ted Sarandos, Netflix’s co-CEO, stated: 'Netflix and Warner Bros. Discovery are highly complementary. We are thrilled to combine our strengths with their theatrical film division, world-class television studio, and the iconic HBO brand, which will continue to focus on premium scripted series.'

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio?For all your investment-related questions, just ask Futubull AI!

Editor/KOKO