The three major U.S. stock indexes closed collectively lower, $Dow Jones Index (.DJI.US)$ dropped 0.47%, $Nasdaq Composite Index (.IXIC.US)$ Dropped by 1.81%,$S&P 500 Index (.SPX.US)$Dropped by 1.16%, with large-cap technology stocks generally declining,$Tesla (TSLA.US)$、$Broadcom (AVGO.US)$Dropped more than 4%,$NVIDIA (NVDA.US)$、 $Google-C (GOOG.US)$ Dropped more than 3%. $Meta Platforms(META.US)$ 、 $Apple(AAPL.US)$ Down more than 1%.

Top 5 Gainers in U.S. Equity ETFs

$2x Leveraged Short OKLO ETF-Defiance (OKLS.US)$ Rose by 18.02%, with a trading volume of $15.98 million.

$2x Inverse IONQ ETF - Defiance (IONZ.US)$ Rose by 14.93%, with a trading volume of $55.33 million.

$2x Inverse CRWV ETF-T-REX(CORD.US)$ Rose by 13.97%, with a trading volume of $21.45 million.

$2x Inverse CRWV ETF-T-REX(CORD.US)$ Rose by 13.97%, with a trading volume of $21.45 million.

$2 Leverage Short QBTS ETF - Defiance (QBTZ.US) Rose by 13.34%, with a trading volume of $38.57 million.

$2x Inverse BMNR ETF-Defiance (BMNZ.US)$ Rose by 12.96%, with a trading volume of $100 million.

In terms of news, AI technology stocks were generally under pressure, with Bitcoin falling below $86,000. Affected by this, sectors such as nuclear power, quantum computing concepts, and cryptocurrency-related concepts declined across the board. OKLO fell more than 9%, while QBTS and BMNR dropped over 6%.

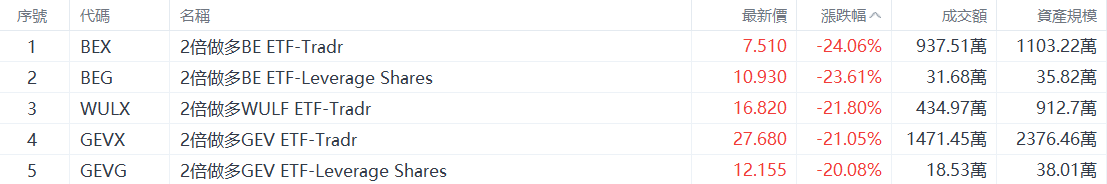

Top 5 Decliners on US Stock ETFs

$2x Leveraged BE ETF-Tradr (BEX.US)$ Dropped by 24.06%, with a trading volume of $9.38 million.

$2x Leverage BE ETF-Leverage Shares (BEG.US)$ Down 23.61%, with a trading volume of $316,800.

$2x Leverage WULF ETF-Tradr (WULX.US)$ Down 21.80%, with a trading volume of $4,349,700.

$2x Leverage GEV ETF-Tradr (GEVX.US)$ Down 21.05%, with a trading volume of $14,714,500.

$2x Leveraged GEV ETF-Leverage Shares(GEVG.US)$ Down 20.08%, with a trading volume of $185,300.

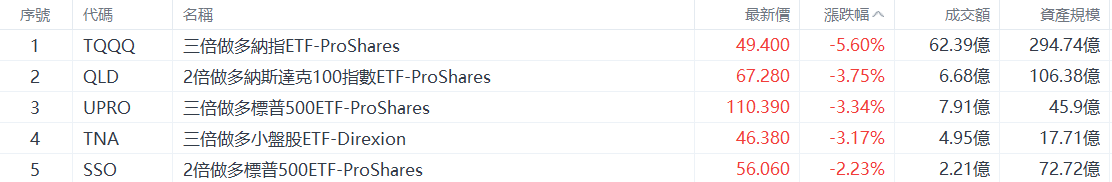

Top 5 Large-Cap U.S. Equity Index ETFs by Decline

$ProShares UltraPro QQQ (TQQQ.US)$ Down 5.60%, with a trading volume of $6.239 billion.

ProShares Ultra QQQ (QLD.US), which provides 2x daily leverage to the Nasdaq 100 Index, Down 3.75%, with a trading volume of $668 million.

$ProShares UltraPro S&P 500 (UPRO.US)$ Down 3.34%, with a trading volume of $791 million.

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Down 3.17%, with a trading volume of $495 million.

$2x Leveraged S&P 500 ETF-ProShares(SSO.US)$ Down 2.23%, with a trading volume of $221 million.

In terms of market news, the three major U.S. stock indices collectively closed lower, with AI technology stocks dragging down the Nasdaq Composite Index, which fell by 1.81%. $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ Up more than 5%.

Top 5 Industry-Specific ETFs by Decline

$Direxion Daily Semiconductor Bull 3X Shares (SOXL.US)$ Down 11.06%, with a trading volume of $4.593 billion.

$2 Times Leveraged Short Energy ETF-Direxion(ERY.US) Down 4.45%, with a trading volume of $13.7003 million.

$Semiconductor Index ETF-VanEck (SMH.US)$ Down 3.61%, with a trading volume of $3.365 billion.

$VanEck Uranium+Nuclear Energy ETF (NLR.US)$ Down 3.54%, with a trading volume of $48.2671 million.

$The Technology Select Sector SPDR® Fund (XLK.US)$ Down 2.22%, with a trading volume of $2.536 billion.

Top 5 Decliners in Bond ETFs

$International Sovereign Bond ETF-SPDR(BWX.US)$ Down 0.49%, with a trading volume of $78.8948 million.

Emerging Markets Sovereign Debt - PowerShares (PCY.US) Down 0.46%, with a trading volume of $5.1795 million.

$iShares Emerging Markets USD Bond ETF (EMB.US)$ Down 0.38%, with a trading volume of $647 million.

$iShares Global Treasury Bond ETF (IGOV.US)$ Dropped 0.32%, with a trading volume of 5.51 million US dollars.

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Dropped 0.29%, with a trading volume of 151 million US dollars.

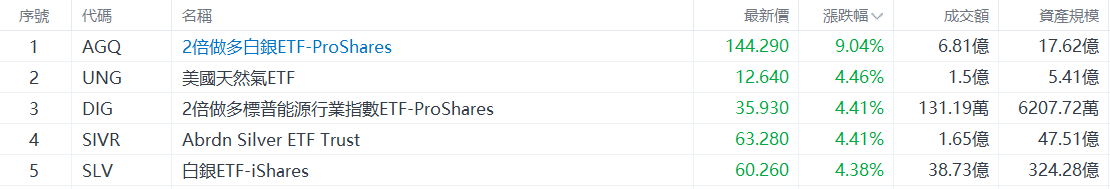

Top 5 Gainers in Commodity ETFs

$ProShares Ultra Silver ETF (AGQ.US)$ Surged 9.04%, with a trading volume of 681 million US dollars.

$US Natural Gas ETF (UNG.US)$ Rose 4.46%, with a trading volume of 150 million US dollars.

$2x Leverage S&P Energy Sector ETF-ProShares (DIG.US) Rose 4.41%, with a trading volume of 1.3119 million US dollars.

$Abrdn Silver ETF Trust(SIVR.US)$ Rose 4.41%, with a trading volume of 165 million US dollars.

$iShares Silver Trust (SLV.US)$ Increased 4.38%, with a trading volume of 3.873 billion US dollars.

In terms of news, silver prices continued their surge, with spot silver rising over 4% in 24 hours, approaching $67 at one point and setting another record high.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen