Against the backdrop of surging demand for AI data centers and a continued tightening of memory chip supply, Micron delivered a significantly stronger-than-expected earnings report for the first fiscal quarter after market close on Wednesday. The company provided second-quarter revenue, gross margin, and earnings-per-share guidance that far exceeded market expectations, stating that the memory/storage chip supply shortage would persist through 2026 and likely extend further. Micron also raised its capital expenditure forecast for fiscal year 2026 from $18 billion to $20 billion. Analysts believe this indicates that Micron is well-positioned to increase product prices amid rapidly rising demand and ongoing supply constraints.

Benefiting from tightening supply and significant price increases in memory chips, as well as rapid growth in demand for artificial intelligence data centers, $Micron Technology (MU.US)$ Micron Technology’s first-quarter earnings report released after Wednesday's market close showed not only better-than-expected performance in the previous quarter but also significantly exceeded forecasts for revenue, gross margin, and earnings per share guidance for the second quarter. Additionally, the company raised its capital expenditure forecast for fiscal year 2026 from $18 billion to $20 billion. The company’s stock surged over 9% in after-hours trading.

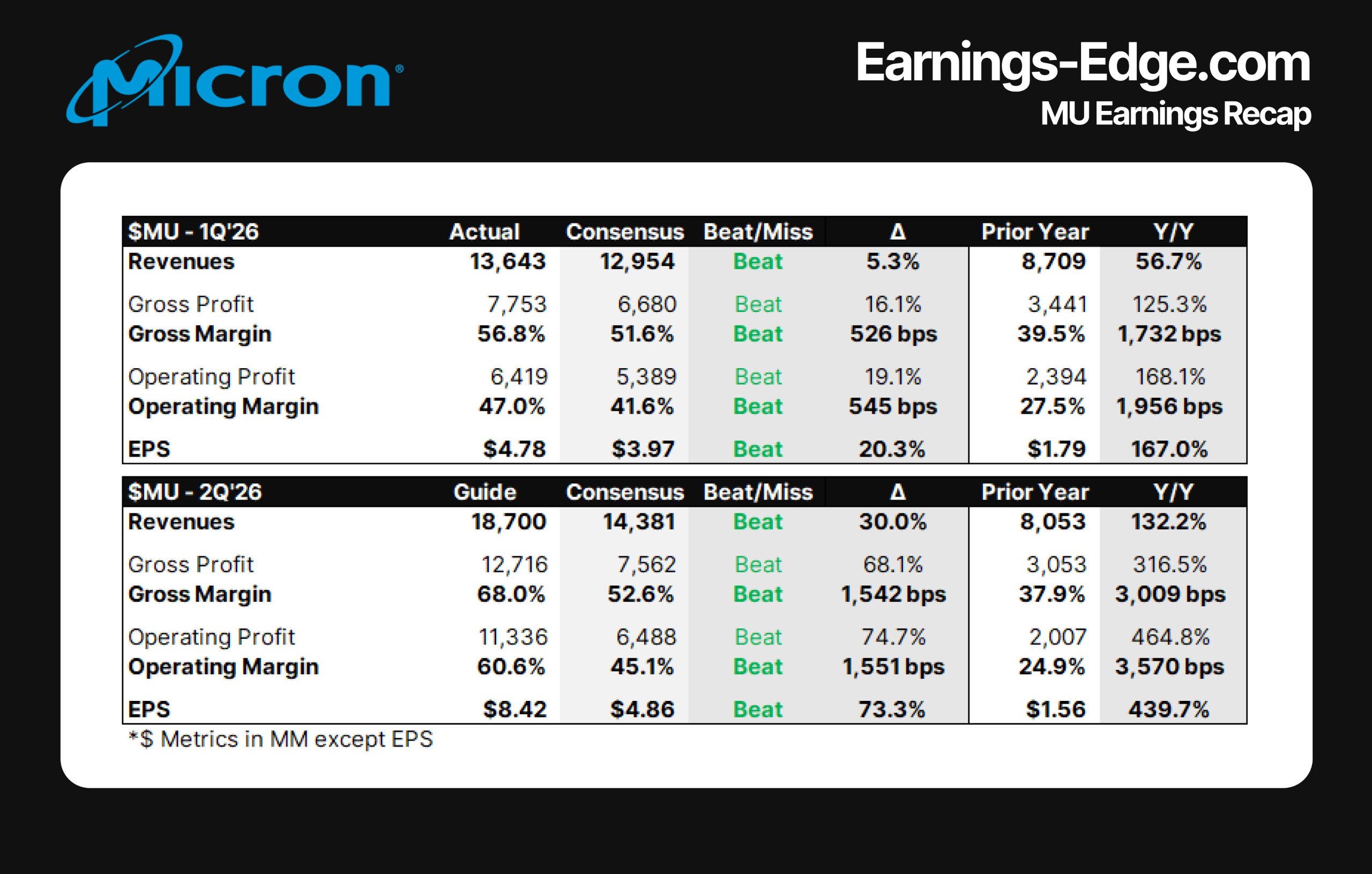

Below are the key highlights of Micron Technology's first-quarter earnings report:

Key Financial Data:

Key Financial Data:

Revenue: Micron Technology reported adjusted revenue of $13.64 billion in the first quarter, a year-over-year increase of 57%, surpassing analyst expectations of $12.95 billion.

Capital Expenditure: Net capital expenditure for Micron Technology in the first quarter was $4.5 billion.

Operating Expenses: Operating expenses under GAAP were $1.51 billion, compared to $1.40 billion in the previous quarter and $1.174 billion in the same period last year. On a non-GAAP basis, operating expenses were $1.334 billion, compared to $1.214 billion in the previous quarter and $1.047 billion in the same period last year.

Operating Profit: Under GAAP, operating profit was $6.136 billion, accounting for 45.0% of revenue; on a non-GAAP basis, operating profit was $6.419 billion, representing 47.0% of revenue, exceeding analyst expectations of $5.37 billion.

Gross Profit: According to GAAP, gross profit was $7.646 billion with a gross margin of 56.0%; on a non-GAAP basis, gross profit was $7.753 billion with a gross margin of 56.8%.

Net Profit: Under GAAP, net profit was $5.24 billion with diluted earnings per share of $4.60; on a non-GAAP basis, net profit was $5.48 billion with diluted earnings per share of $4.78, surpassing analyst expectations of $3.95.

Cash Flow: Cash flow from operating activities was $8.41 billion, higher than analyst expectations of $5.94 billion, surpassing the $5.73 billion in the previous quarter, and significantly exceeding $3.24 billion in the same period last year.

Segment-wise performance data:

Cloud storage: Revenue in the first fiscal quarter was USD 5.284 billion, compared to USD 4.543 billion in the previous quarter and USD 2.648 billion in the same period last year, representing a year-over-year doubling. The segment’s gross margin was 66%, compared to 59% in the previous quarter and 51% in the same period last year; the operating profit margin was 55%, compared to 48% in the previous quarter and 40% in the same period last year.

Data center business: Revenue in the first fiscal quarter was USD 2.379 billion, compared to USD 1.577 billion in the previous quarter and USD 2.292 billion in the same period last year. Gross margin was 51%, compared to 41% in the previous quarter and 50% in the same period last year; operating profit margin was 37%, compared to 25% in the previous quarter and 38% in the same period last year.

Mobile and client business: Revenue in the first fiscal quarter was USD 4.255 billion, compared to USD 3.760 billion in the previous quarter and USD 2.608 billion in the same period last year. Gross margin was 54%, compared to 36% in the previous quarter and 27% in the same period last year; operating profit margin was 47%, compared to 29% in the previous quarter and 15% in the same period last year.

Automotive and embedded business: Revenue in the first fiscal quarter was USD 1.720 billion, compared to USD 1.434 billion in the previous quarter and USD 1.158 billion in the same period last year. Gross margin was 45%, compared to 31% in the previous quarter and 20% in the same period last year; operating profit margin was 36%, compared to 20% in the previous quarter and 7% in the same period last year.

Second fiscal quarter guidance:

Revenue: Second fiscal quarter revenue is expected to be USD 18.7 billion, with a fluctuation of USD 400 million, significantly surpassing analysts' expectations of USD 14.38 billion.

Gross profit: Under GAAP standards, the gross margin is projected at 67.0%, with a fluctuation of 1 percentage point; under non-GAAP standards, the gross margin is projected at 68.0%, with a fluctuation of 1 percentage point, exceeding analysts' expectations of 55.7%.

Operating expenses: Under GAAP standards, operating expenses are forecasted at USD 1.56 billion, with a fluctuation of USD 20 million; under non-GAAP standards, operating expenses are forecasted at USD 1.38 billion, with a fluctuation of USD 20 million.

Earnings per share: Under GAAP standards, diluted earnings per share are expected to be USD 8.19, with a fluctuation of USD 0.20; under non-GAAP standards, diluted earnings per share are expected to be USD 8.42, with a fluctuation of USD 0.20, far exceeding analysts' expectations of USD 4.71.

Strong earnings, coupled with guidance that significantly exceeded expectations and optimistic remarks from executives during the earnings call, drove Micron Technology's shares up more than 9% in after-hours trading on Wednesday, currently nearing an 8% gain. Prior to this, the stock had already surged 168% year-to-date, closing at $225.71 on Wednesday.

Sanjay Mehrotra, Chairman, President, and Chief Executive Officer of Micron Technology, stated:

"In the first quarter of fiscal 2026, Micron achieved record revenue and significant margin expansion across the entire company and all business units. Our outlook for the second fiscal quarter indicates that revenue, gross margin, earnings per share, and free cash flow will reach important new highs, and we expect the company’s performance to continue strengthening throughout fiscal 2026. With leading technological capabilities, a differentiated product portfolio, and robust operational execution, Micron has become an indispensable key enabler within the AI ecosystem, and we are continuing to invest to meet growing customer demand for memory and storage."

Shortages of AI-related components and memory chips

Micron's chips are critical components in a wide range of devices, including data center servers, personal computers, smartphones, and automobiles. Micron is also one of the three major suppliers of high-bandwidth memory (HBM), alongside SK Hynix and Samsung Electronics of South Korea. HBM is a core component required for training and deploying generative artificial intelligence models. For example, AMD’s latest generation of AI chips heavily utilizes Micron's memory products.

Media analysis suggests that demand for AI computing-related components is extremely strong, surpassing supply capacity, a situation that is benefiting companies like Micron.

At the same time, there is also a shortage of more basic memory chips used in personal computers. This is partly due to the memory chip industry shifting production capacity toward more advanced technologies to serve AI data centers.

PC manufacturers, including Dell Technologies and HP Inc, have warned investors that a memory chip shortage is expected over the next year, which will drive up component prices.

Wedbush analysts predict that by the end of the year, DRAM (Dynamic Random Access Memory) prices will rise by at least 30%, while NAND flash memory prices will increase by at least 20%.

Micron reported cloud storage business sales of $5.28 billion in the first fiscal quarter, doubling year-over-year, while core data center business sales were $2.38 billion, a modest 4% year-over-year increase. The company attributed the growth in both segments primarily to higher product pricing.

Analysts believe this also places Micron in a more advantageous position when negotiating with customers in an industry known for its significant fluctuations. Amid constrained supply, Micron’s profit margins are expected to benefit further.

Bloomberg Intelligence analyst Jake Silverman noted in a report:

“Memory chip prices are unlikely to stop rising in the short term.”

Addressing growing demand, capital expenditure increases

During a conference call with analysts, Mehrotra stated that the shortage of memory chips is expected to persist for some time. He said:

“Strong and sustained industry demand, coupled with constrained supply, is creating ongoing market tightness. We expect this situation to continue beyond 2026.”

He also expressed disappointment at not being able to fulfill all orders. He said:

“For several key customers, we are currently only able to meet approximately 50% to two-thirds of their demand. Therefore, we remain highly focused on expanding supply and making the necessary investments.”

Micron had previously warned investors that expenditures would continue to rise as the company worked to meet growing demand. The company's spending on new facilities and equipment for fiscal year 2025 amounted to USD 13.8 billion, and it indicated that related investment levels would exceed this amount in the current fiscal year. On Wednesday, the company announced it was raising its capital expenditure forecast for fiscal year 2026 to USD 20 billion, up from the previous estimate of USD 18 billion.

Micron stated that it is witnessing robust demand from data centers, driven primarily by large cloud service providers continuing to increase spending. These cloud providers deliver hardware and cloud computing capabilities to their clients while continuously expanding related infrastructure.

Mehrotra stated during the earnings call:

"The expansion of AI data center capacity is driving a significant increase in demand for high-performance, high-capacity storage and memory. Server shipment demand has clearly strengthened."

He further added that the company anticipates server shipment growth rates to remain at the higher end of the 10%-20% range in 2025.

In order to more effectively address the surge in demand brought by AI, Micron Technology is undergoing a major strategic shift. On December 3rd, the company announced its plan to exit the Crucial consumer business. Micron will continue shipping Crucial consumer products through distribution channels until the second fiscal quarter ending in February, after which it will fully focus on enterprise and commercial businesses to reserve more supply capacity for AI chips and data center-related demands.

Rosenblatt analyst Kevin Cassidy believes this move highlights management’s focus on 'high-value end markets.' Investors will closely monitor management’s comments on the progress of capacity ramp-up, particularly regarding how existing capacity can be converted into 'sellable output' for high-margin cloud and data center products.

![]() Earnings updates have been fully upgraded, giving you a head start in discovering investment opportunities! Navigation: Open Futubull > Individual Stock Page > Click on the [Company] Tab >Earnings Express

Earnings updates have been fully upgraded, giving you a head start in discovering investment opportunities! Navigation: Open Futubull > Individual Stock Page > Click on the [Company] Tab >Earnings Express

Editor/jayden