Micron's earnings and guidance have 'exploded', with revenue and gross margins significantly surpassing expectations. Morgan Stanley stated that, apart from NVIDIA, this could be the largest upward revision of revenue and net profit guidance in the history of the U.S. semiconductor industry. Despite AI-driven demand keeping supply tight until 2026, Wall Street is concerned that competitors’ capacity expansion next year may trigger a price pullback for HBM.

$Micron Technology (MU.US)$ The latest earnings report and guidance exceeded Wall Street expectations, but institutions remain slightly divided on the sustainability of the cycle moving forward: bulls view this as a historic turning point in profitability, while the cautious camp has started to worry that high-bandwidth memory (HBM) prices may retreat in 2026 as supply increases.

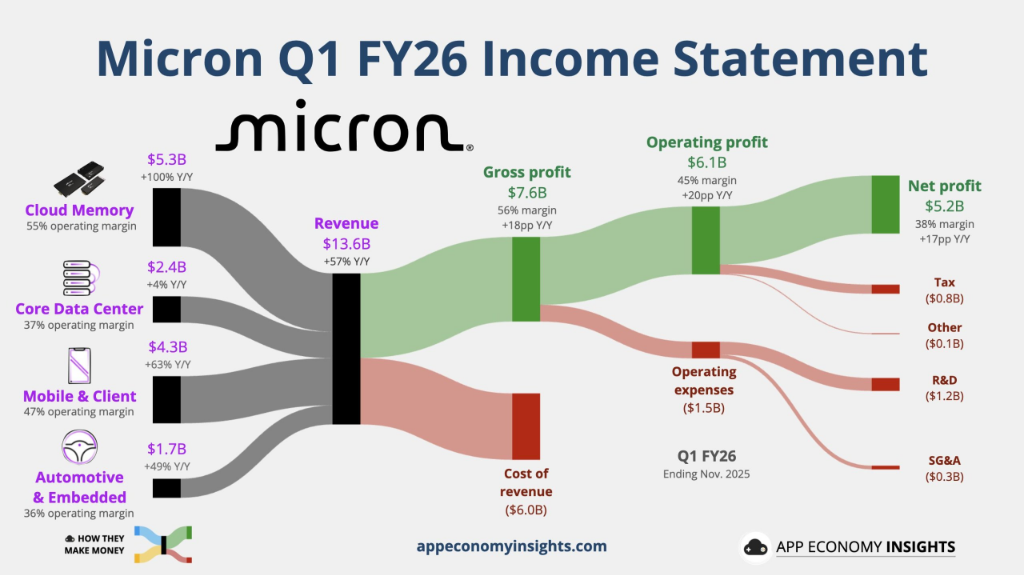

In its recently released guidance, Micron Technology forecasted revenue for the next fiscal quarter to reach $18.7 billion, significantly surpassing market consensus expectations of $14.5 billion. Additionally, the company expects its non-GAAP gross margin to surge to around 68%, which is not only substantially higher than analysts' expectations of 55%, but also marks a historic leap in profitability. In terms of quarterly performance, Micron also surpassed expectations across the board, with profitability rapidly recovering driven by significant price increases in DRAM and NAND.

This “explosive” guidance immediately triggered a strong response on Wall Street, with multiple institutions swiftly raising their price targets. Morgan Stanley noted that apart from NVIDIA, the magnitude of Micron’s upward revision in revenue and net profit is almost unprecedented in the history of U.S. semiconductors. Barclays described it as an “expected but shockingly explosive quarter,” given the improved pricing environment. Market consensus is that structural demand driven by AI is reshaping the supply-demand dynamics of the memory industry, and the tight supply situation will likely persist until at least 2026.

This “explosive” guidance immediately triggered a strong response on Wall Street, with multiple institutions swiftly raising their price targets. Morgan Stanley noted that apart from NVIDIA, the magnitude of Micron’s upward revision in revenue and net profit is almost unprecedented in the history of U.S. semiconductors. Barclays described it as an “expected but shockingly explosive quarter,” given the improved pricing environment. Market consensus is that structural demand driven by AI is reshaping the supply-demand dynamics of the memory industry, and the tight supply situation will likely persist until at least 2026.

However, amid widespread optimism, concerns about mid-term price trends remain. While Goldman Sachs significantly raised its earnings forecast, it maintained a “neutral” rating, primarily due to concerns that with capacity releases from competitors like Samsung, the HBM market could face downward pricing pressure by 2026.

Guidance far exceeds expectations, with gross margin moving towards 68%

The core highlight of this earnings report lies in the forward-looking guidance provided by management, which significantly surpassed Wall Street's conservative models. In a research note on the 18th, Morgan Stanley’s Joseph Moore analysis team pointed out that Micron’s earnings per share (EPS) guidance for the next quarter was approximately 75% higher than market consensus, with the midpoint of the non-GAAP EPS guidance reaching $8.42, compared to the previous market expectation of just $4.78. The firm’s analysts stated outright that aside from NVIDIA, this might be the largest upward revision in revenue and net profit guidance in the history of the U.S. semiconductor industry.

Barclays’ Tom O'Malley team emphasized in their report that this was a “breakout quarter.” Although the market had anticipated some level of outperformance due to recent price dynamics, the extent of the beat was still astonishing. The guidance indicates that gross margins will reach 68%, with further room for improvement in the coming quarters. This suggests that underpinned by long-term agreements (LTAs), the pricing environment will continue to improve.

Additionally, the average selling prices (ASPs) for DRAM and NAND continued to rise due to tight supply. Barclays’ model shows that Micron’s DRAM ASP will grow 30% quarter-over-quarter in the next quarter, with NAND growing 40% quarter-over-quarter.

Capital expenditure raised to $20 billion; capacity shortages to persist

In response to highly anticipated capital expenditure (Capex) plans, Micron announced that its net Capex for fiscal year 2026 would be increased from the previous $18 billion to approximately $20 billion.

Morgan Stanley offered a relatively positive interpretation, stating that this figure is actually "below market concern levels." Analysts noted that the increased spending is primarily aimed at constructing cleanroom facilities and supporting capacity for HBM and 1-gamma process technologies, but this does not imply a surge of mature wafer supply entering the market in the short term. Management revealed that the Fab 1 facility in Idaho will not begin wafer production until the first half of 2027, indicating that the supply shortage throughout 2026 will remain challenging to alleviate.

Barclays further noted that management anticipates the Total Addressable Market (TAM) for HBM to grow at a Compound Annual Growth Rate (CAGR) of approximately 40%, reaching USD 100 billion by 2028. Micron Technology is working to enhance its supply capabilities, but this tight supply situation will negatively impact consumer markets such as PCs, as capacity is being prioritized for high-margin AI and data center sectors.

Goldman Sachs maintains a 'Neutral' rating, expressing concerns over potential HBM price pullbacks next year.

Despite such robust earnings results, Goldman Sachs opted to maintain a 'Neutral' rating and did not adopt an aggressively bullish stance like other institutions. Analyst James Schneider’s team raised the target price from USD 205 to USD 235, acknowledging Micron’s strong execution in HBM products, with expectations of capturing approximately 20% of this high-growth market.

However, Goldman Sachs’ primary concern lies in the pricing environment for 2026. Analysts believe that the current risk-reward ratio is relatively balanced. While the DRAM market remains healthy and NAND supply is tight, the entry of more suppliers (such as Samsung) passing validation and ramping up capacity could lead to downside risks in HBM pricing by 2026. The firm stated it would only consider a more constructive stance on the stock if evidence emerges of disciplined supply growth across the industry continuing into 2027.

Nevertheless, based on significantly higher-than-expected revenue and gross margin assumptions, Goldman Sachs raised its non-GAAP EPS forecast by an average of 97%.

Morgan Stanley reiterated its 'Top Pick' designation, raising the target price to USD 350.

In contrast, Morgan Stanley maintained an extremely optimistic stance, increasing the target price from USD 338 to USD 350 and reaffirming Micron Technology as its 'Top Pick' in the U.S. semiconductor sector.

Morgan Stanley believes that the memory chip industry is entering "uncharted territory," where pricing shows no signs of weakness but instead becomes more predictable due to multiple long-term contracts. Analysts pointed out that as long as the wave of AI continues, Micron will benefit over the next 12 months, with profitability potentially surpassing the USD 40 mark. Addressing valuation concerns, Morgan Stanley countered that despite the stock's rise, considering the company may generate USD 30 billion to USD 35 billion in free cash flow over the next year and double its book value, the current valuation is actually undervalued.

Barclays also assigned an 'Overweight' rating, raising its target price from USD 240 to USD 275. Its optimistic view is based on structural changes in the memory industry, asserting that Micron will continue to benefit from improved operational models until supply shortages ease. Barclays set an optimistic scenario target price as high as USD 325, contingent upon faster HBM growth and a better-than-expected pricing environment.

Editor/KOKO