If 2024 was a market revelry dominated by speculative trading, 2025 will undoubtedly be remembered for its "thirst for substance." The global asset landscape has shown a striking divergence: century-old tangible assets are highly sought after, digital assets face growth bottlenecks, and the U.S. stock market successfully transitions its driving forces, while the Asia-Pacific market experiences robust recovery. This structural transformation not only reshapes the market dynamics of 2025 but also lays the groundwork for investment trends in 2026.

As December 31, 2025, has not yet arrived, this statistical period covers January 1, 2025, to December 16, 2025.

Core Landscape of 2025 Market: Asset Divergence and Driving Force Restructuring

U.S. Stocks: Profit-Driven Steady Growth with Broadening Rally Participation

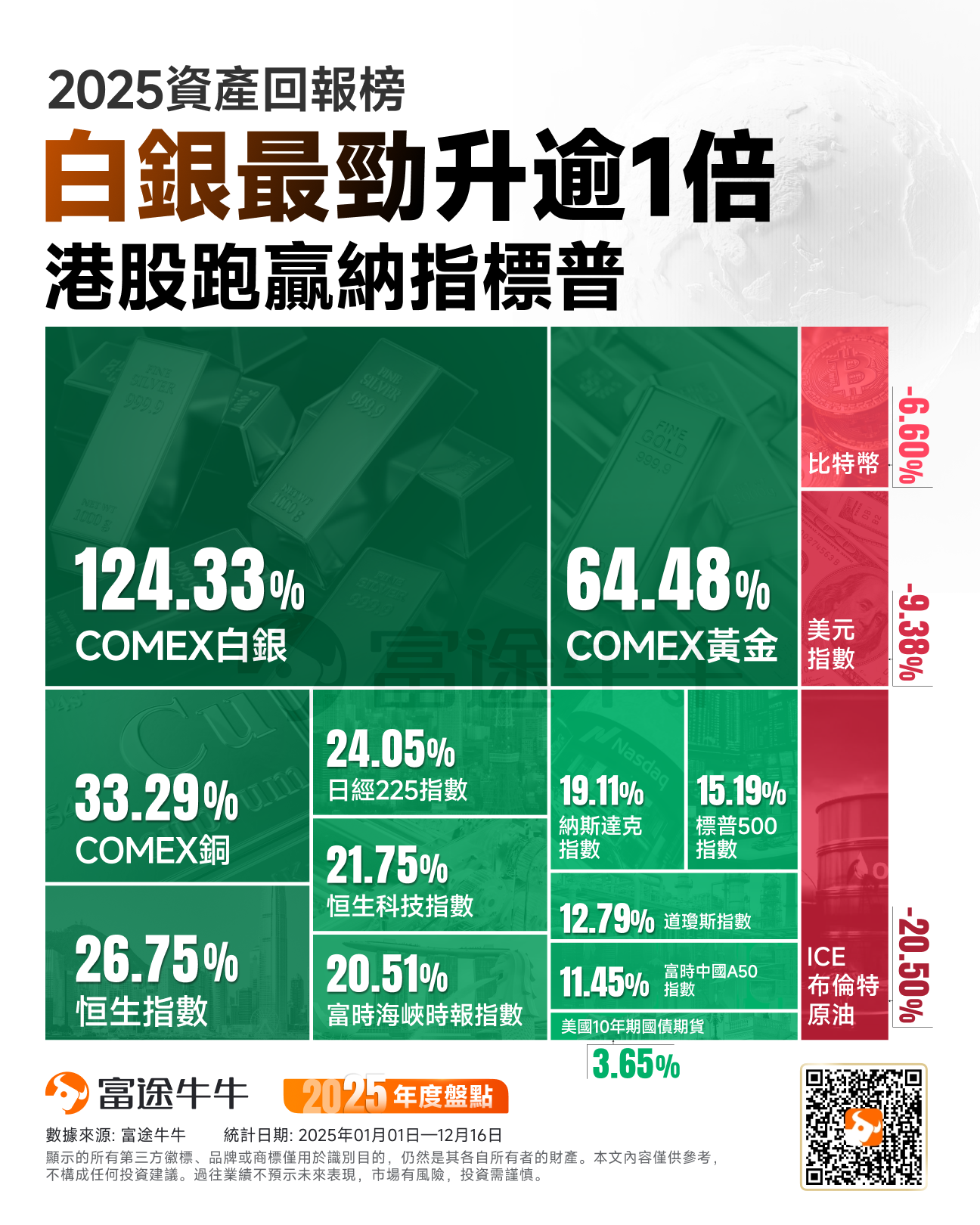

The "Buy American" strategy remains robust in 2025, serving as a cornerstone for global investment portfolios. The Nasdaq index leads with a 19.1% return, while the S&P 500 and Dow Jones Industrial Average achieve notable gains of 15.2% and 12.8%, respectively. Notably, there is a structural shift in market drivers—79% of the S&P 500's return stems from actual earnings growth, with only 21% attributable to valuation increases. Compared to the valuation expansion model seen between 2023 and 2024, this transition provides more solid support for stock prices.

Although the overall market valuation stands at the 91st percentile historically, the "Magnificent Seven"—contributing approximately 43% of returns—have a relative valuation at just the 15th percentile, creating an unexpected margin of safety. The rally has extended beyond the technology sector to financials, industrials, and utilities, all of which achieved double-digit profit growth in the third quarter. Despite a weakening dollar, U.S. equities maintain their global leadership position due to higher profitability and upward revisions to 2026 earnings forecasts.

Although the overall market valuation stands at the 91st percentile historically, the "Magnificent Seven"—contributing approximately 43% of returns—have a relative valuation at just the 15th percentile, creating an unexpected margin of safety. The rally has extended beyond the technology sector to financials, industrials, and utilities, all of which achieved double-digit profit growth in the third quarter. Despite a weakening dollar, U.S. equities maintain their global leadership position due to higher profitability and upward revisions to 2026 earnings forecasts.

Macroeconomic Currency: Dollar Decline Triggers Global Asset Repricing

Fed rate cuts have led to yield declines, driving a 3.7% increase in U.S. 10-year Treasury futures and delivering positive returns to bondholders. The key variable in global asset allocation for 2025 is the sharp decline in the U.S. dollar, with the dollar index falling 9.4% for the year. This decline results from a "triple threat": a convergence in growth as U.S. economic growth slows and Eurasian economies stabilize, eroding the "American exceptionalism" trade narrative; concerns among foreign investors over high U.S. federal deficits prompting demands for higher risk premiums and shifts to reserve assets like gold; and the Fed’s interest rate cuts in the second half of the year, eliminating the yield advantage that had supported the dollar since 2022. This monetary restructuring triggers a global asset repricing, acting as a core catalyst for the "hard asset" supercycle.

Digital Assets: Bitcoin Fades as the Industry Moves Toward Practical Applications

In 2025, when gold prices repeatedly hit new highs, Bitcoin delivered a negative return of -6.6%, significantly deviating from the narrative of "digital gold." Bitcoin failed to function as expected,safe-haven assetsinstead becoming a high-beta instrument highly sensitive to liquidity withdrawal. Coupled with speculative capital flowing into the silver market, causing an "attention drain," it experienced a rare annual decline.

However, 2025 is also seen as the year of industry "reshuffling," with purely speculative leverage being thoroughly eliminated. The market generally expects that by 2026, the cryptocurrency industry will transition from a "volatility phase" to a "utility phase," with the core development direction being the establishment of an integrated foundational financial layer rather than merely serving as a speculative tool.

Commodities: Polarization Between Precious Metals and Energy

The most prominent feature of the 2025 market is the sharp shift of capital towards tangible assets, driven by both physical scarcity and currency depreciation, making precious metals the biggest winners. Silver/USD (XAGUSD.FX) surged 124.3%, while Gold/USD (XAUUSD.CFD) rose by 64.5%, with gold prices climbing from $2,624 per ounce to approximately $4,200. Continuous purchases by sovereign wealth funds and interest rate cuts were the main drivers. Silver led the gains due to its dual advantages as a monetary substitute and industrial shortage, particularly benefiting from the recovery of the solar/PV industry, which consumed significant global inventories. Copper prices also increased by 33.3%, underscoring the long-term structural shortages under the electrification trend.

In stark contrast, the energy sector saw crude oil prices fall by 20.5% for the year. A surge in non-OPEC crude supply combined with cooling global demand led to the collapse in oil prices, effectively providing a tax cut for consumers while supporting the stock market.

Asia-Pacific Markets: Liquidity Injections Spur Recovery Rally

The sharp decline of the US dollar brought ample liquidity to Asia-Pacific markets, driving capital away from crowded US trades into undervalued regional assets and fostering a robust recovery rally. The Hang Seng Index rose by 26.75%, outperforming the S&P 500 for the first time, confirming the formation of a "policy pivot" bottom. The upward momentum stemmed from valuation mean reversion, proactive stimulus measures, and institutional interest in oversold tech giants; the Hang Seng Tech Index concurrently gained 21.75%, reflecting a clear trend of valuation repair in the technology sector.

The Nikkei 225 Index rose by 24.05%, with its bull market foundation rooted in structural factors rather than purely exchange-rate driven dynamics. Regulatory pressure from the Tokyo Stock Exchange on price-to-book ratios and fiscal optimism brought by "high price-to-earnings trading" have decoupled corporate earnings from foreign exchange fluctuations, showcasing "governance alpha." The FTSE Straits Times Index in Singapore rose by 20.51%, making Singapore the "safe haven" of the year. High-dividend banks andReal Estate Investment Trustfunds (REITs) attracted a surge of global funds, serving as a quality alternative to defensive bonds amid the U.S. interest rate normalization cycle.

2026 Investment Insights: Moving Beyond Passive Gains, Focusing on Value and Diversification

Looking ahead to 2026, the era of easy gains through passive index tracking (beta) may come to an end. JPMorgan noted that double-digit index returns are unlikely to persist, but the environment for stock selection is improving. Investors should focus on three key areas: reducing concentration risk through diversified investments, prioritizing the expanding US industrial base; maintaining allocations in structural commodities like silver and copper to capitalize on long-term opportunities arising from physical scarcity and industrial demand; and closely monitoring the digital asset space for investment opportunities driven by practical applications.

The market divergence in 2025 has clearly revealed that value restoration and substantive growth have become the core logic of investment. In 2026, only by accurately capturing structural change trends and focusing on assets supported by real demand and profit growth potential can investors achieve stable returns in a complex and evolving market environment.

![]() Stay ahead with the latest financial updates and discover investment opportunities early! Open Futubull > Market > US Stocks >Economic Calendar/Selected macroeconomic data, seize the investment opportunity!

Stay ahead with the latest financial updates and discover investment opportunities early! Open Futubull > Market > US Stocks >Economic Calendar/Selected macroeconomic data, seize the investment opportunity!

Editor/Lee