Top News

Before the opening on Thursday, ahead of the release of the U.S. November CPI, $Micron Technology (MU.US)$ Earnings reports boosted optimism in tech stocks, with the three major futures continuing to rise. Dow futures were up 0.24%, Nasdaq futures surged 0.79%, and S&P 500 futures increased by 0.46%.

$明星科技股(LIST2518.US)$ Most rebounded pre-market. Micron Technology's earnings report showed strong demand for memory chips, alleviating investor concerns about a potential slowdown in data center construction. $Tesla (TSLA.US)$ 、 $NVIDIA (NVDA.US)$ 、 Google (GOOGL.US) 、 $Broadcom (AVGO.US)$ 、 $Oracle (ORCL.US)$ 、 $Advanced Micro Devices (AMD.US)$ Surged over 1%.

$热门中概股(LIST2517.US)$ Gains were widespread in pre-market trading. $Pony AI (PONY.US)$up more than 2%, $Baidu(BIDU.US)$、 $Nio (NIO.US)$ Surged over 1%.

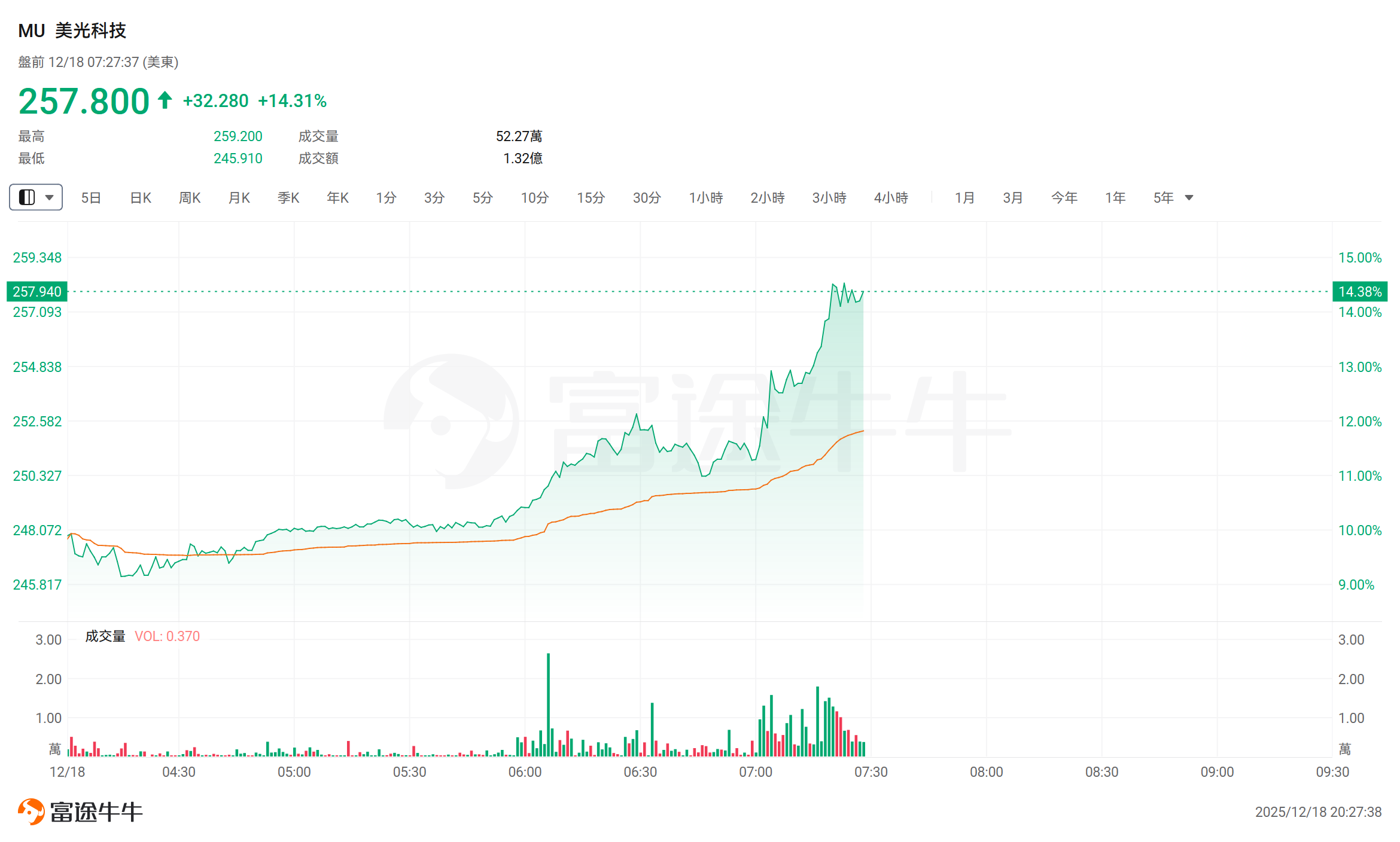

$存储概念股(LIST23925.US)$ Active performance in pre-market trading, $Micron Technology (MU.US)$ Surging over 14%, $SanDisk Corp (SNDK.US)$ rising more than 8%, $Western Digital (WDC.US)$ up over 5%, $Seagate Technology (STX.US)$ rising over 3%.

$存储概念股(LIST23925.US)$ Active performance in pre-market trading, $Micron Technology (MU.US)$ Surging over 14%, $SanDisk Corp (SNDK.US)$ rising more than 8%, $Western Digital (WDC.US)$ up over 5%, $Seagate Technology (STX.US)$ rising over 3%.

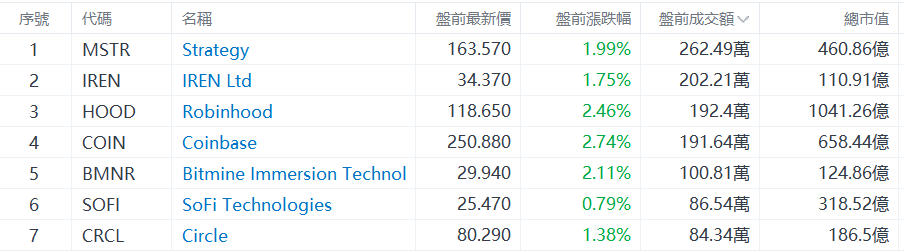

$加密货币概念股(LIST20010.US)$ Pre-market trading higher, $Robinhood(HOOD.US)$ 、 $Coinbase(COIN.US)$ 、 $Bitmine Immersion Technologies(BMNR.US)$ Up more than 2%, $Strategy(MSTR.US)$ 、 $IREN Ltd(IREN.US)$ Surged over 1%.

$Quantum Computing Concept(LIST2594.US)$ Rising pre-market, $D-Wave Quantum(QBTS.US)$、 $IonQ Inc(IONQ.US)$up more than 2%, $Rigetti Computing(RGTI.US)$ 、 $Quantum Computing(QUBT.US)$ Surged over 1%.

$大麻股(LIST2997.US)$Continued strength was seen pre-market, $Canopy Growth(CGC.US)$rising more than 11%, $cbdMD(YCBD.US)$ Surging over 6%, $Tilray Brands(TLRY.US)$, Rose more than 2%.

Earnings beat expectations, with Micron Technology soaring pre-market.

$Micron Technology (MU.US)$ Shares surged over 14% pre-market after the company announced Q1 revenue of $13.64 billion, surpassing analyst expectations of $12.84 billion. Net profit reached $5.24 billion, and adjusted earnings per share hit $4.78, exceeding forecasts of $3.95. Micron stated that second-quarter revenue is projected to reach $18.7 billion, above analyst estimates of $14.2 billion, with earnings per share expected to grow significantly to $8.42, outpacing expectations of $4.78.

This “explosive” guidance immediately triggered a strong response on Wall Street, with multiple institutions swiftly raising their price targets. Morgan Stanley noted that apart from NVIDIA, the magnitude of Micron’s upward revision in revenue and net profit is almost unprecedented in the history of U.S. semiconductors. Barclays described it as an “expected but shockingly explosive quarter,” given the improved pricing environment. Market consensus is that structural demand driven by AI is reshaping the supply-demand dynamics of the memory industry, and the tight supply situation will likely persist until at least 2026.

Lululemon Athletica shares rose nearly 6% pre-market after activist investor Elliott reportedly acquired more than $1 billion worth of the company’s shares.

$Lululemon Athletica(LULU.US)$ Shares climbed nearly 6% pre-market. According to sources, activist investor Elliott has acquired over $1 billion in Lululemon shares. Elliott is recommending potential CEO candidates to the athletic apparel retailer, suggesting Jane Nielsen, a retail executive who previously served as CFO and COO of Ralph Lauren, as a suitable candidate.

Sales heading towards a three-year low: Has Tesla also 'stalled' in the U.S.?

According to estimates from industry research firm Cox Automotive, $Tesla (TSLA.US)$ Tesla is expected to sell 125,937 electric vehicles in the U.S. between October and December, marking a decline of more than 22% compared to 162,388 units sold in the same period last year. This will also bring Tesla's total EV deliveries in the U.S. for this year down to 577,097 vehicles, an 8.9% decrease from 2024. According to estimates by Cox, Tesla’s market share across the entire U.S. automotive sector is projected to fall by 0.5 percentage points to 3.5%. Tesla's challenges are not limited to its domestic market; it faces headwinds in China and Europe as well.

JPMorgan upgrades RXRX to 'Overweight' rating, with core pipeline asset REC-4881 poised to become a blockbuster drug.

$Recursion Pharmaceuticals (RXRX.US)$ Shares rose nearly 4% pre-market after JPMorgan upgraded its rating from 'Neutral' to 'Overweight,' citing the sales potential of the company’s core asset, REC-4881, which has the potential to become a 'blockbuster' product. Additionally, the bank raised its price target from $10 to $11.

Trump Media & Technology shares surged pre-market on plans toMergers and acquisitionsFusion startup TAE

$Trump Media & Technology (DJT.US)$ Shares soared as much as 35% pre-market after the company announced an all-stock merger agreement with fusion energy company TAE Technologies, valuing the deal at over $6 billion. Shareholders of both companies will each hold approximately 50% of the newly merged entity. The combined company aims to develop utility-scale fusion power plants, with plans to begin site selection and construction of a fusion power station by 2026, targeting the growing energy demands driven by AI computing.

$Accenture (ACN.US)$ Shares fell over 2% pre-market despite reporting adjusted earnings per share of $3.94 for Q1, surpassing estimates of $3.72. Q1 revenue reached $18.7 billion, beating expectations of $18.52 billion.

Birkenstock shares plunged pre-market after issuing weaker-than-expected revenue and profit guidance for the new fiscal year.

$Birkenstock (BIRK.US)$ Shares dropped over 9% pre-market after the company reported that strong demand for its premium sandals and clogs drove growth in sales and profits but forecasted a slowdown in growth for the coming year. Birkenstock stated that revenue grew 20% year-on-year to €526 million ($616 million) for the three months ending September, slightly above analysts’ consensus estimate. However, the company expects fiscal year 2026 revenue growth of up to 15%, implying annual revenue of no more than €2.35 billion, which is slightly below expectations.

Global macro

Can it return to the 2% range? US November CPI to be released tonight

At 21:30 tonight, the US Bureau of Labor Statistics (BLS) will release the November CPI data. Since the October CPI has been canceled, the BLS has clarified that this report will not provide the month-on-month data for November. Analysts generally expect the year-on-year increase in November CPI to expand to 3.1% (slightly higher than 3.0% in September), with core CPI annualized expected to remain unchanged at 3.0%.

José Torres, senior economist at Interactive Brokers, stated that whether the inflation reading falls within the "2% range or the 3% range will be crucial." This psychological threshold may influence market expectations regarding the Federal Reserve's policy path. In short, if inflation returns to the 2% range, it will significantly boost risk appetite and could create room for a year-end “Santa Claus rally” in US stocks; conversely, if it remains above 3%, it would reinforce the narrative of "higher rates for longer."

Trump stated that the next Fed Chair must be a "super dove" and will announce the nominee soon.

On Wednesday local time, President Trump made clear in a national address that the next Federal Reserve chair must be someone who believes in "significant interest rate cuts," and promised to soon announce this key appointment decision. Trump said in his speech: "I will soon announce our next Federal Reserve chair, a person who believes in drastically lowering interest rates, which will further reduce mortgage rates." The current Federal Reserve benchmark interest rate range is 3.5%-3.75%, while Trump had previously demanded that rates be cut to 1%, a "crisis level."

"Trump Account" plan to give $1,000 to newborns to buy stocks

The "Trump Account" proposal plans to provide $1,000 for newborns to invest in U.S. stocks for wealth accumulation. Based on the S&P Index's average annual growth rate of 10.5%, this fund could grow to approximately $5,800 by the time the child turns 18 and potentially reach about $600,000 by retirement. If families contribute additional investments annually, the account value could exceed $300,000 by age 18. The plan faces questions regarding equity due to insufficient tax incentives and the potential exclusion of low-income households.

ECB likely to stay on hold tonight, potentially marking the end of the easing cycle

At 21:15 tonight, the European Central Bank will announce its interest rate decision. Markets widely expect the ECB to keep policy rates unchanged and signal a lack of near-term willingness to cut rates, as despite global trade headwinds, the Eurozone economy has remained resilient, and inflation has stayed stable. Driven by rising prices in the services sector, inflation has hovered near the ECB’s 2% target and is projected to remain at that level in the foreseeable future. This may imply that the ECB will revise up some growth and inflation forecasts at Thursday’s meeting, effectively (though possibly not explicitly) bringing the easing cycle to an end.

Silver Market Cap Surpasses Google, Becomes Fourth Largest Asset Globally

Strong investment demand, inclusion in the U.S. critical minerals list, and a new round of momentum buying are collectively driving silver prices to historic highs, with expectations that prices will double by the end of 2025 compared to the beginning of the year. Wednesday$Silver/USD (XAGUSD.FX)$ The price has first broken through the $66 per ounce mark, with an increase of over 120% this year. According to data from LSEG dating back to 1982, its annual performance is expected to set a historical record. In terms of market capitalization, with a new round of surge exceeding 4% on Wednesday, the market value of silver has now surpassed that of the recently popular AI "darling."Google (GOOGL.US)It has become the fourth largest asset in the world, with a current market value only lower than$黄金/美元(XAUUSD.CFD)$ 、 $NVIDIA (NVDA.US)$ and $Apple(AAPL.US)$ 。

Top 20 pre-market trading volume stocks in the U.S. stock market

U.S. Stock Market Macroeconomic Calendar Reminder

(The following times are in Beijing Time)

21:15 The European Central Bank announces its interest rate decision.

21:30 US November unadjusted CPI year-on-year, number of initial jobless claims in the US for the week ending December 13 (in ten thousand)

21:45 ECB President Lagarde holds press conference on monetary policy

![]() Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Looking to pick stocks or analyze them? Want to know the opportunities and risks in your portfolio? For all investment-related questions,just ask Futubull AI!

Editor/KOKO