The three major indices closed higher, $Dow Jones Index (.DJI.US)$ initially closing up 0.14%, $S&P 500 Index (.SPX.US)$ rising 0.79%, $Nasdaq Composite Index (.IXIC.US)$ surging 1.38%. $NVIDIA (NVDA.US)$ rose nearly 2%,$Tesla (TSLA.US)$ with a rise of over 3%, $Micron Technology (MU.US)$ soaring 10%, $Trump Media & Technology (DJT.US)$ skyrocketing 41.9%. $Nasdaq China Golden Dragon Index (.HXC.US)$ climbing 0.97%, $DingDong(DDL.US)$ dropping 7%.

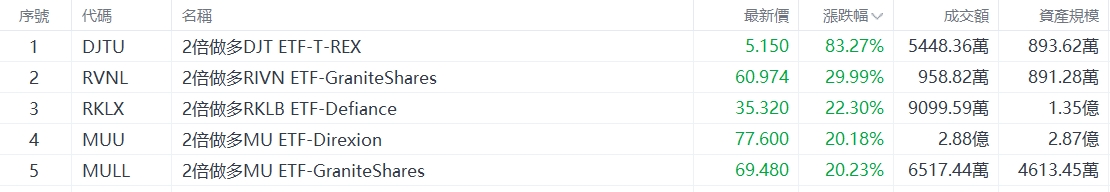

Top 5 Gainers in U.S. Equity ETFs

$2x Leverage DJT ETF-T-REX (DJTU.US)$ jumping 83.27% with a trading volume of USD 54.4836 million.

In market news, Trump Media & Technology plansMergers and acquisitionsTAE, a nuclear fusion startup, plans to begin construction of a nuclear fusion power plant next year.

$2x Leveraged RIVN ETF-GraniteShares(RVNL.US)$ Up 29.99%, with a turnover of $9.5882 million.

$2x Leverage RKLB ETF-Defiance (RKLX.US)$ Up 22.30%, with a turnover of $90.9959 million.

The White House issued an announcement on its official website stating that U.S. President Trump has signed an executive order regarding space superiority.

$2x Leveraged MU ETF-Direxion (MUU.US) Up 20.18%, with a turnover of $288 million.

$2x Leveraged MU ETF-GraniteShares (MULL.US) Up 20.23%, with a turnover of $65.1744 million.

Allay concerns about an AI bubble! Micron Technology's earnings report highlights the strongest growth momentum in the memory industry.

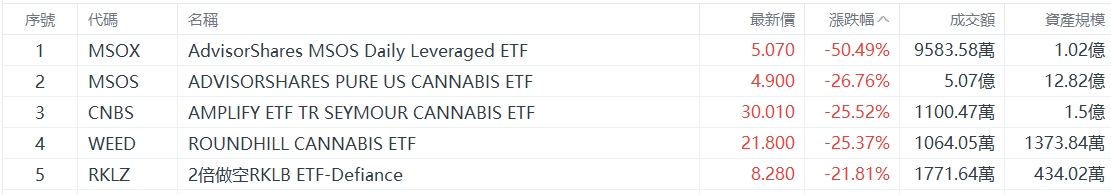

Top 5 Decliners on US Stock ETFs

$AdvisorShares MSOS Daily Leveraged ETF (MSOX.US)$ Down 50.49%, with a turnover of $95.8358 million.

$ADVISORSHARES PURE US CANNABIS ETF(MSOS.US)$ Down 26.76%, with a turnover of $507 million.

$AMPLIFY ETF TR SEYMOUR CANNABIS ETF(CNBS.US)$ Down 25.52%, with a trading volume of $11.0047 million.

$ROUNDHILL CANNABIS ETF(WEED.US)$ Down 25.37%, with a trading volume of $10.6405 million.

$2x Leverage Short RKLB ETF - Defiance (RKLZ.US) Down 21.81%, with a trading volume of $17.7164 million.

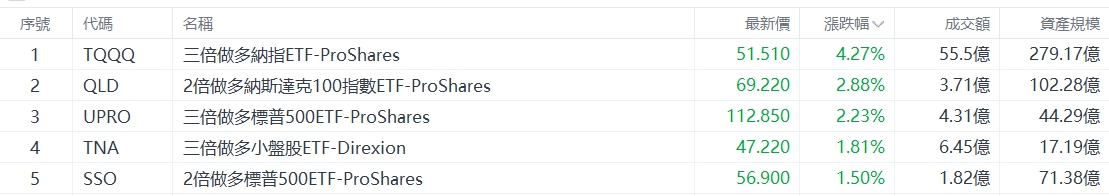

Top 5 Large-Cap U.S. Equity Index ETFs by Decline

$ProShares UltraPro QQQ (TQQQ.US)$ Up 4.27%, with a trading volume of $5.55 billion.

ProShares Ultra QQQ (QLD.US), which provides 2x daily leverage to the Nasdaq 100 Index, Up 2.88%, with a trading volume of $371 million.

$ProShares UltraPro S&P 500 (UPRO.US)$ Up 2.23%, with a trading volume of $431 million.

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Up 1.81%, with a trading volume of $6.45 billion.

$2x Leveraged S&P 500 ETF-ProShares(SSO.US)$ Up 1.50%, with a trading volume of $182 million.

US CPI cools down, showing a trend of high growth and low inflation.

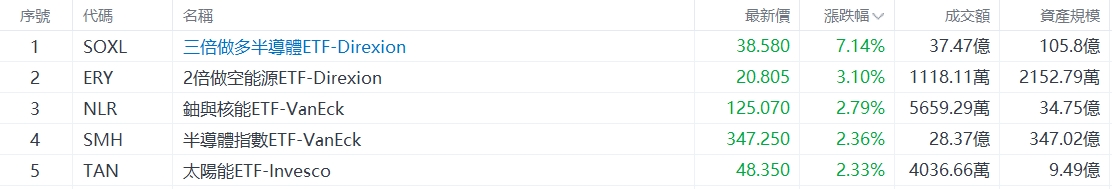

Top 5 Industry ETF Decliners

$Direxion Daily Semiconductor Bull 3X Shares (SOXL.US)$ Increased by 7.14%, with a turnover of $3.747 billion.

$2 Times Leveraged Short Energy ETF-Direxion(ERY.US) Increased by 3.10%, with a turnover of $11.1811 million.

$VanEck Uranium+Nuclear Energy ETF (NLR.US)$ Increased by 2.79%, with a turnover of $56.5929 million.

$Semiconductor Index ETF-VanEck (SMH.US)$ Increased by 2.36%, with a turnover of $2.837 billion.

$Invesco Solar Energy ETF (TAN.US)$ Increased by 2.33%, with a turnover of $40.3666 million.

Top 5 Increases in Bond ETFs

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Increased by 1.28%, with a turnover of $238 million.

ProShares Ultra 20+ Year Treasury (UBT.US) Increased by 0.95%, with a turnover of $1.3418 million.

$ProShares Ultra 7-10 Year Treasury (UST.US)$ Increased by 0.63%, with a turnover of $356,300.

Emerging Markets Sovereign Debt - PowerShares (PCY.US) Increased by 0.58%, with a turnover of $4.0368 million.

iShares 20+ Year Treasury Bond ETF (TLT.US) Up 0.48%, with a trading volume of $3.425 billion.

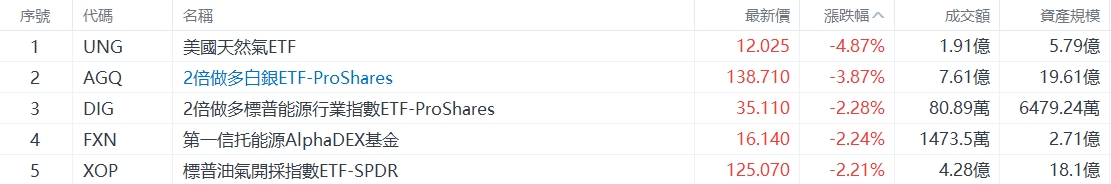

Top 5 Commodity ETF Decliners

$US Natural Gas ETF (UNG.US)$ Down 4.87%, with a trading volume of $191 million.

$ProShares Ultra Silver ETF (AGQ.US)$ Down 3.87%, with a trading volume of $761 million.

$2x Leverage S&P Energy Sector ETF-ProShares (DIG.US) Down 2.28%, with a trading volume of $808,900.

$First Trust Energy AlphaDEX Fund (FXN.US)$ Down 2.24%, with a trading volume of $14.735 million.

SPDR S&P Oil & Gas Exploration & Production ETF (XOP.US) Down 2.21%, with a trading volume of $428 million.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Liam