Nike released its fiscal 2026 second-quarter earnings report after the market closed on Thursday.

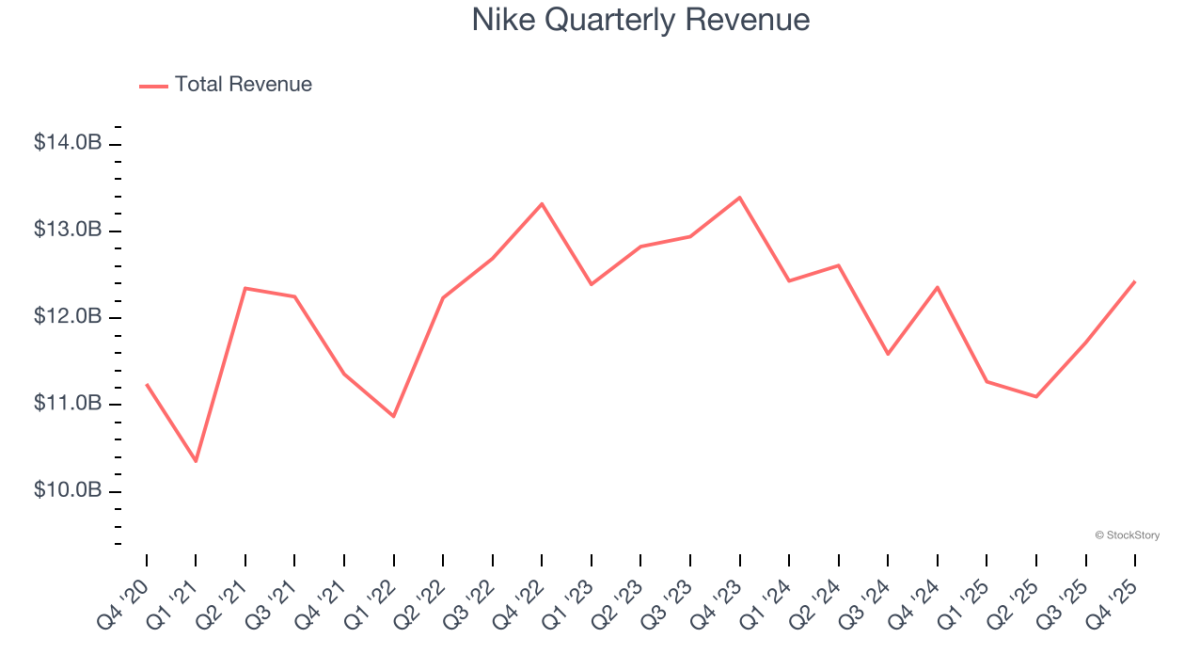

According to Zhitong Finance APP, $Nike (NKE.US)$ Nike released its fiscal year 2026 second-quarter earnings report after the market closed on Thursday. Despite revenue and profits exceeding market expectations, net profit declined year-over-year due to margin contraction and continued pressure on the direct-to-consumer business. The report showed that the company, headquartered in Beaverton, Oregon, experienced a 32% drop in net profit, declining from US$1.16 billion in the same period last year to US$792 million. Diluted earnings per share fell from 78 cents to 53 cents, surpassing market expectations of 38 cents. Net sales for the quarter amounted to US$12.43 billion, representing a 1% increase from US$12.35 billion in the same period last year, slightly exceeding market expectations of US$12.22 billion. On a constant currency basis, sales were flat compared to the prior year.

By business segment, Nike reported that Nike brand revenue for the second quarter was $12.1 billion, representing a 1% increase year-over-year. This growth was primarily driven by performance in the North American market but was partially offset by declines in Greater China and the Asia Pacific Latin America (APLA) region. In particular, challenges in the Chinese market remained significant for Nike, with revenue in Greater China falling 17% year-over-year to $1.7 billion, while earnings before interest and taxes (EBIT) plummeted by 49%. Revenue from Nike’s direct-to-consumer business was $4.6 billion, down 8% year-over-year, including a 14% decline in Nike brand digital sales and a 3% drop in revenue from Nike-owned stores.

Regarding Nike’s ongoing efforts to steadily rebuild its wholesale channel, revenue for this segment reached $7.5 billion, an 8% increase year-over-year. Converse brand revenue was $300 million, plunging 30% year-over-year due to declines across all regions. Nike disclosed that footwear revenue remained flat at $7.7 billion during the quarter; apparel category sales grew by 4% year-over-year, reaching $3.9 billion.

Regarding Nike’s ongoing efforts to steadily rebuild its wholesale channel, revenue for this segment reached $7.5 billion, an 8% increase year-over-year. Converse brand revenue was $300 million, plunging 30% year-over-year due to declines across all regions. Nike disclosed that footwear revenue remained flat at $7.7 billion during the quarter; apparel category sales grew by 4% year-over-year, reaching $3.9 billion.

Notably, gross margin declined by 3% to 40.6%, primarily due to increased tariffs in the North American region.

Looking ahead, inventory levels improved, declining by 3% to $7.7 billion. Cash and short-term investments stood at $8.3 billion at the end of the quarter, a decrease of $1.4 billion, as dividend payments, stock repurchases, debt repayments, and capital expenditures exceeded operating cash flow. The company did not provide guidance for the third quarter or full-year results.

Can Nike’s renewed embrace of the wholesale channel restore market confidence after setbacks in its DTC strategy?

Over the past few years, Nike aggressively pursued a Direct-to-Consumer (DTC) strategy, reducing reliance on traditional wholesalers, but encountered a series of difficulties in practice, prompting the company to refocus on rebuilding relationships with wholesale partners.

Currently, while Nike is further concentrating on key sports programs and core cities and working to repair relationships with retail partners, investors still hope to see greater progress in other 'problem areas.'

Poonam Goyal, senior analyst at Bloomberg Intelligence, stated: “Performance in the direct-to-consumer business and the Chinese market has been disappointing, and we need more information about when they will get back on track. Beyond that, overall results remain solid.”

The company has also prioritized repositioning Converse’s market and brand identity. For a long time, Converse has relied heavily on Chuck Taylor sneakers to drive sales but has struggled to generate consumer enthusiasm in other categories.

In response, the company’s CEO, Elliott Hill, stated in a declaration, “Nike is currently in the middle phase of a counterattack,” noting that the company still has work to do in executing its 'Win Now' strategy – including reallocating personnel and repairing retail relationships.

Hill remarked, “We are first making progress in priority areas and remain confident in measures that drive the brand's long-term growth and profitability. Fiscal year 2026 will continue to be an action year for 'Win Now,' involving team realignment, strengthening partnerships, rebalancing the product portfolio, and securing wins on the ground. We have found our rhythm in the new sports offensive and are ready to advance to the next phase of athlete-centric innovation in a higher, more integrated market.”

Matthew Friend, Nike’s Executive Vice President and Chief Financial Officer, added that the second quarter “demonstrated the resilience of the product portfolio,” achieving moderate reported revenue growth while addressing headwinds.

“We are making the necessary adjustments to prepare the product portfolio for a full recovery and making real-time decisions to support the long-term health of the brand.”

For the full year 2024, Nike’s stock ranked second-to-last among the 30 components of the Dow Jones Industrial Average, with a yearly decline of 30%. It closed at $53.27 on April 8, corresponding to a market capitalization of $82 billion, significantly down from its peak of $281 billion.

Nike's stock closed at US$65.63 on Thursday, marking a cumulative decline of 13.1% since the start of 2025, while the S&P 500 Index recorded a significant gain of 15.4% during the same period. Following the release of the latest quarterly results, the stock plummeted over 10% during after-hours trading, dropping to US$58.75.

Editor/jayden