Top News

Hassett: The latest CPI report is surprisingly good, and the Fed has significant room for rate cuts.

Kevin Hassett, Director of the White House National Economic Council, welcomed the November CPI report, stating that the U.S. economy is showing a trend of high growth with declining inflation. He remarked, "I'm not saying we should declare victory on the price front, but this is a surprisingly good CPI report."

Hassett noted that wage growth is outpacing price increases, and American taxpayers will see substantial tax refunds next year. The government will help reduce mortgage rates. He added, "The Federal Reserve has significant room to cut interest rates." Hassett, a leading candidate to succeed Powell as the next Fed Chair, also suggested that the Fed should be more transparent in the future.

I believe the Federal Reserve needs to double its transparency. Whoever leads the Federal Reserve should lay all their cards on the table so that we can understand what’s really happening within that institution.

I believe the Federal Reserve needs to double its transparency. Whoever leads the Federal Reserve should lay all their cards on the table so that we can understand what’s really happening within that institution.

Don't rejoice too soon about the cooling of US CPI. Economists suspect government shutdown distorted data, some pointing to obvious errors.

Several economists have pointed out that housing-related prices, a major component of the CPI, remained essentially flat over two months, raising doubts about the overall estimation results. Criticizing the CPI data, Sharif, an economist cited by the “New Fed Wire,” noted that the official assumption treated October’s rent and owner’s equivalent rent (OER) as zero, which is an incorrect approach and “completely unacceptable” under any circumstances. Sharif believes that missing rental data for October may have artificially depressed November’s inflation figures. Other economists suggest that it may not be possible to confirm the inflation trend until the December data is released in January.

Some economists pointed out that discount activities during the "Black Friday" period after Thanksgiving in November in the U.S. could lead to data distortions due to such delays. Economists at Wells Fargo & Co stated in a report: "The slowdown affects nearly all categories, deepening our concerns that the government shutdown caused issues with the data. Data collection did not start until late November, which may have introduced a sample bias beyond our previous expectations."

Trump praised Waller as "great," while Bowman was also mentioned; the mystery of the new Fed Chair to be unveiled within weeks.

U.S. President Donald Trump said he is interviewing "three or four" candidates for the position of Federal Reserve Chair and expects to decide "soon" who will be nominated to succeed Powell. "I think each of them would be a good choice," Trump said.

Trump said he is unsure whether he will announce his selection before the end of the year but indicated that a decision will be made "within the next few weeks."

The president has repeatedly expressed his hope that the next leader of the Federal Reserve will cut interest rates more aggressively to drive down mortgage costs. He previously hinted that he already had a clear idea in mind, saying earlier this month that he had a "pretty good sense" of whom to nominate.

Trump granted two additional days off to federal employees, but the NYSE announced normal trading hours around Christmas.

After President Donald Trump signed an executive order declaring December 24 and 26 as federal holidays, the New York Stock Exchange stated it would not alter trading hours around Christmas. The NYSE had already moved the closing time for December 24 to 1 p.m.

The exchange posted a notice on its website stating that December 26 will be a regular full trading day. The White House announced Trump's executive order on Thursday, closing the federal government on Christmas Eve and December 26, 2025.

Shou Zi Chew’s Internal Letter Reveals TikTok US Plan: ByteDance to Retain E-commerce and Advertising, Joint Venture to Handle Data Security

According to Yicai, on December 18 local time, TikTok CEO Shou Zi Chew sent an internal letter updating employees on the progress of TikTok's U.S. operations. The internal letter stated that ByteDance and TikTok have signed agreements with three investors and will establish a new TikTok U.S. joint venture.

The new joint venture is named TikTok US Data Security Joint Venture LLC and will be responsible for data protection, algorithm security, content moderation, and software assurance in the United States. Other TikTok entities in the U.S., fully owned by ByteDance, will continue to oversee commercial activities such as e-commerce, advertising, and market operations, as well as the global interconnectivity of TikTok products. Matters related to the agreement are expected to be finalized no later than January 22, 2026.

Goldman Sachs: The surge in gold prices may continue until 2026, with a target of $4,900 per troy ounce.

Goldman Sachs stated that the surge in gold futures prices to record highs in 2025 may extend into the following year. In its 2026 outlook report released on Thursday, the firm noted, "Our baseline scenario forecasts a 14% increase in gold prices to $4,900 per troy ounce by December 2026, with upside risks."

Goldman Sachs expects central banks' demand for gold to persist through 2026, with average monthly purchases reaching 70 metric tons. The primary drivers of this demand include geopolitical instability and the desire of nations to hedge risks by increasing their gold reserves.

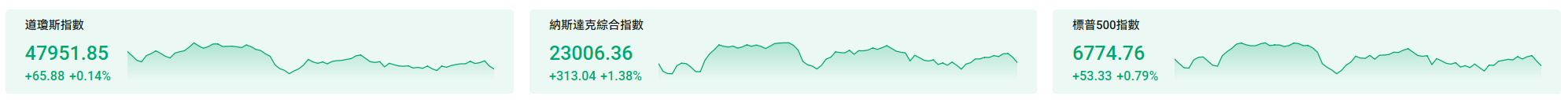

U.S. Stock Market Recap

All three major indices rose collectively, bolstered by November CPI data that lifted market sentiment, alongside strong earnings from Micron Technology.

The U.S. November CPI slowed more than expected, reigniting bets on Federal Reserve rate cuts next year. All three major indices closed higher, with $Dow Jones Index (.DJI.US)$with one index up by 0.14%,$Nasdaq Composite Index (.IXIC.US)$a rise of 1.38%, $S&P 500 Index (.SPX.US)$and an increase of 0.79%.

$明星科技股(LIST2518.US)$Broad gains were seen, with Micron Technology rising over 10%, Tesla climbing more than 3%, Amazon and Meta Platforms increasing over 2%, NVIDIA, Google, and Microsoft advancing nearly 2%, and Broadcom gaining over 1%.

$热门中概股(LIST2517.US)$Most stocks trended upward, with the Nasdaq China Golden Dragon Index closing 0.97% higher. Taiwan Semiconductor and XPeng Motors both gained nearly 3%, while PDD Holdings, JD.com, and Baidu rose approximately 1%, and Nio increased over 1%.

$存储概念股(LIST23925.US)$Across the board, Sandisk surged over 6%, Western Digital and Seagate Technology climbed over 5%, and Pure Storage rose more than 1%.

$Semiconductor(LIST2015.US)$The majority rose, with Marvell Technology up more than 3%, AMD, Broadcom, and Qualcomm up over 1%, and Intel up nearly 1%.

$太空概念(LIST2556.US)$Most stocks rose, with RKLB surging over 11% and ASTS rising more than 6%. Trump signed an executive order on space superiority, setting a vision for an “America First” space policy to ensure U.S. leadership in space exploration, security, and commerce.

$大麻股(LIST2997.US)$Stocks diverged, with CGC falling nearly 12%, TLRY down over 4%, and ACB dropping more than 3%. The Trump administration's executive order lowered the regulatory classification of cannabis. Analysts believe this may reflect a "buy the rumor, sell the fact" scenario as investors took profits.

Individual stock news

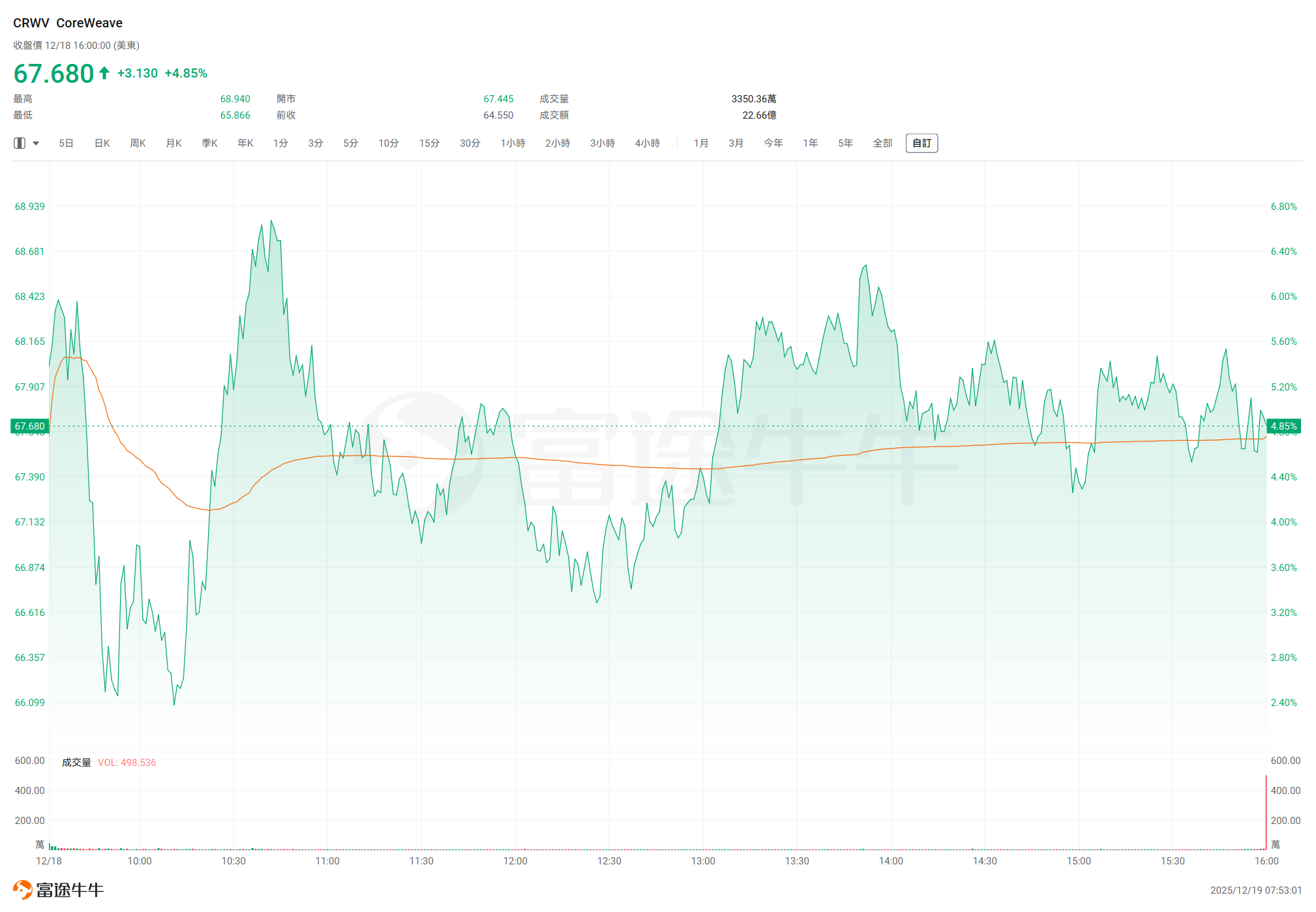

CoreWeave, Palantir, and 24 other companies have joined the U.S. AI 'Genesis Initiative.' CoreWeave and Palantir shares surged nearly 5% overnight.

Twenty-four leading artificial intelligence companies have signed up to join the U.S. government’s 'Genesis Initiative,' a Trump administration effort to promote the use of emerging AI technologies for scientific discovery and energy projects. OpenAI,$Microsoft(MSFT.US)$、$NVIDIA (NVDA.US)$、$Amazon(AMZN.US)$Cloud services (AWS),Google (GOOGL.US)、$CoreWeave(CRWV.US)$、$Palantir(PLTR.US)$among other firms, either have signed memoranda of understanding with the government, are currently collaborating with the Department of Energy and national laboratories on existing projects, or have expressed interest in participating in the initiative.

Michael Kratsios, Director of the White House Office of Science and Technology Policy, stated: "The Genesis Initiative will help U.S. scientists achieve automated experimental design, accelerate simulations, and generate predictive models that drive breakthroughs in energy, manufacturing, drug development, and more."

$Micron Technology (MU.US)$Shares surged over 10% overnight following significantly better-than-expected earnings and guidance, reinforcing narratives of tight supply and demand for memory chips and continued investment in AI computing power.

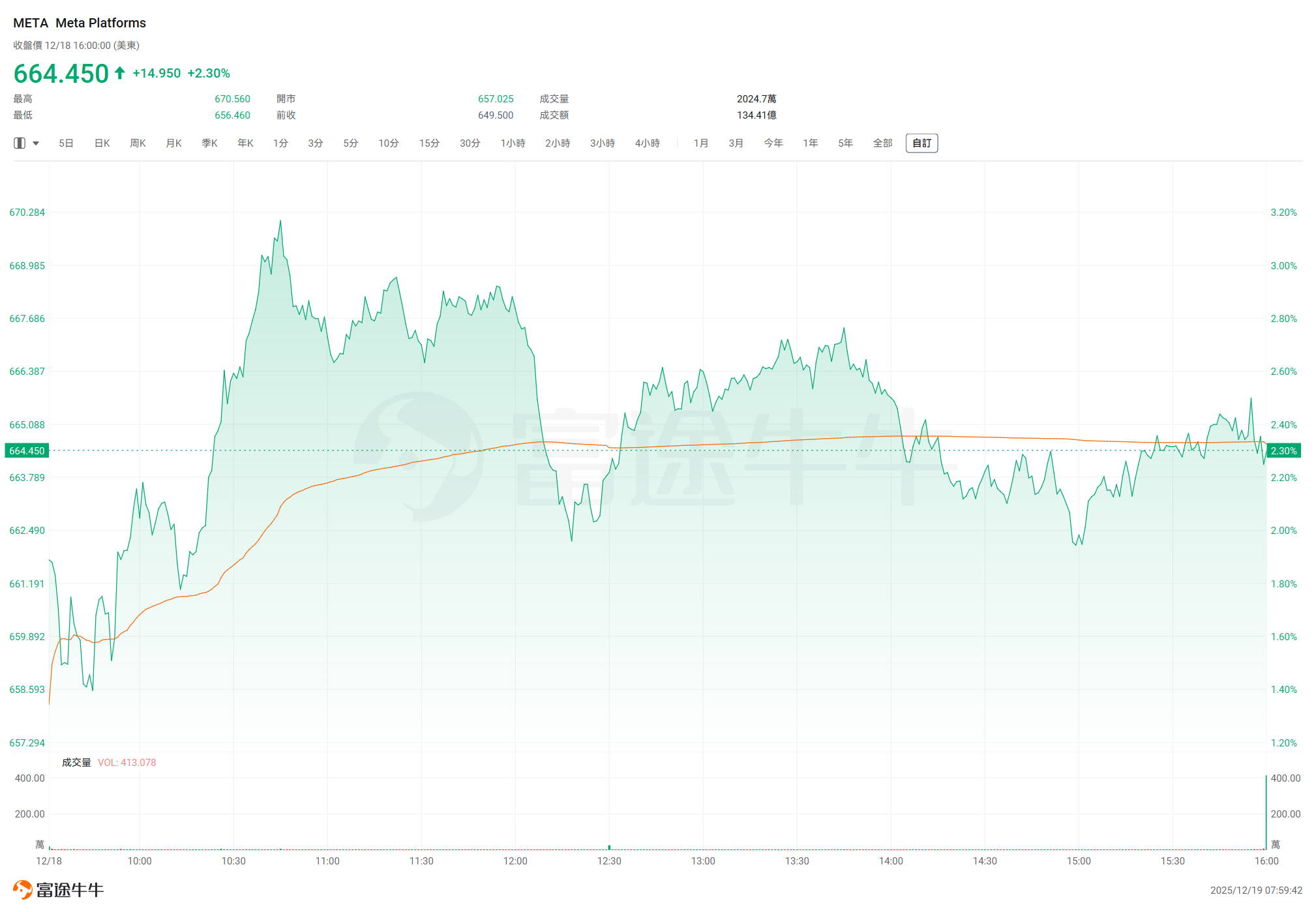

Meta Platforms rose over 2% overnight amid reports of its secret project codenamed Mango, a new model slated for release in the first half of next year.

According to a report by The Wall Street Journal,$Meta Platforms(META.US)$A new artificial intelligence model for images and videos, codenamed Mango, is currently under development, alongside the company’s next-generation large language model for text.

According to sources familiar with the matter, Meta's Chief AI Officer Alexandr Wang discussed these AI models during an internal employee Q&A session with Chief Product Officer Chris Cox on Thursday. These models are expected to be released in the first half of 2026.

Trump Media & Technology surged nearly 42% overnight, planningMergers and acquisitionsFusion startup TAE plans to begin construction of a fusion power plant next year

$Trump Media & Technology (DJT.US)$A definitive merger agreement has been signed with fusion energy startup TAE Technologies. This all-stock transaction is valued at over $6 billion. The merger aims to create one of the first publicly listed fusion energy companies in the market. According to reports by Bloomberg and Fox News on the 18th, the merged company plans to select a site and commence construction of a utility-scale fusion power plant by 2026.

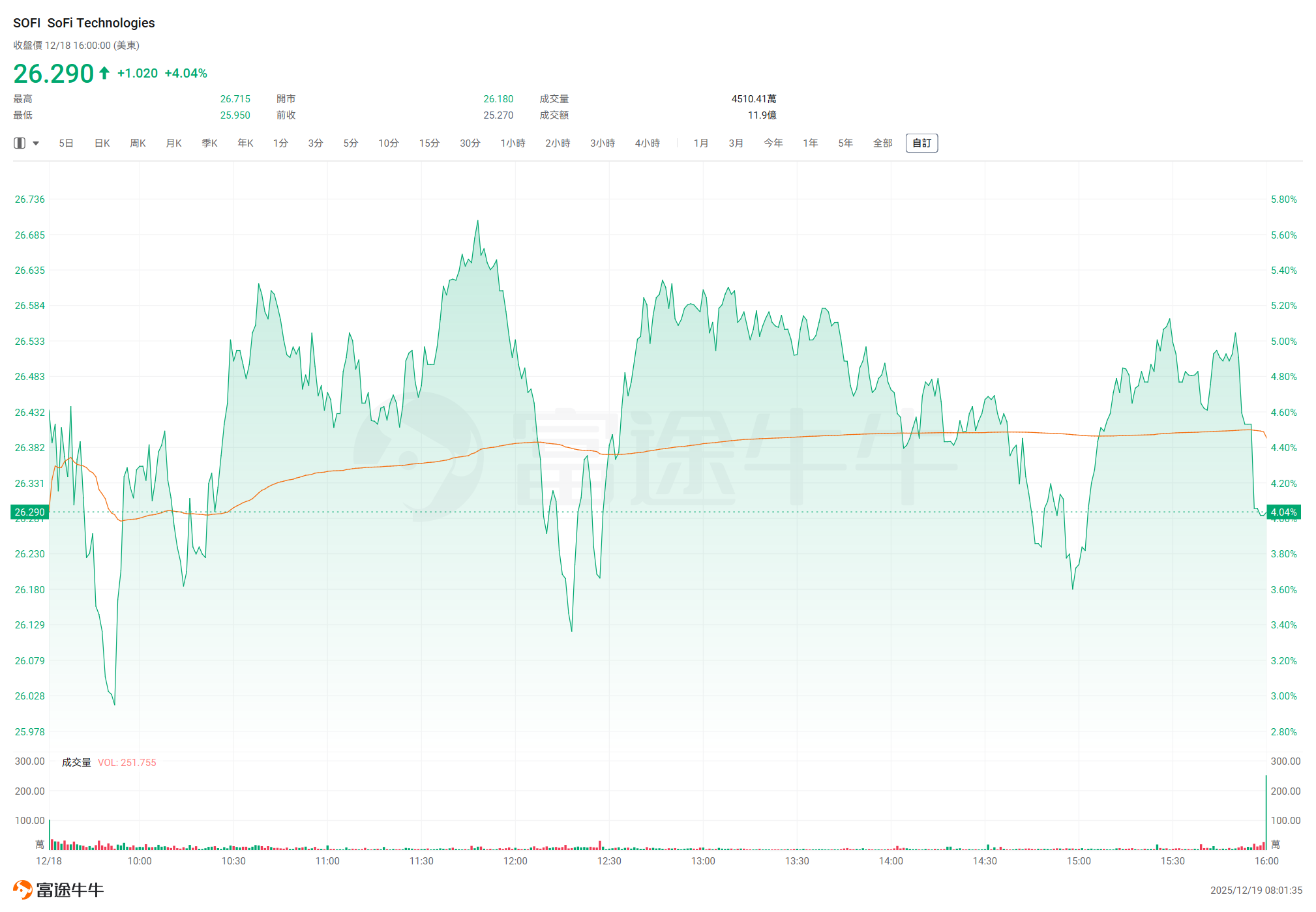

$SoFi Technologies(SOFI.US)$Surged over 4% overnight, announcing entry into the stablecoin sector with the launch of SoFiUSD, a stablecoin fully backed by U.S. dollar reserves

Taiwan Semiconductor rose nearly 3% overnight, with Morgan Stanley forecasting that the company’s gross margin will exceed 60% in the fourth quarter

It was reported that$Taiwan Semiconductor (TSM.US)$Mass production of the 2nm process will officially commence by the end of this year. The 2nm capacity of the two factories has already been fully booked, and Taiwan Semiconductor needs to build additional factories to meet customer demand, with this project expected to require an investment of $28.6 billion.

It is reported that Apple, Qualcomm, MediaTek, AMD, and several other companies are customers of Taiwan Semiconductor’s 2nm process. Taiwan Semiconductor is unable to meet all customer demands, with Apple securing more than half of the initial capacity, while the remaining capacity is divided among other clients. As planned, Taiwan Semiconductor will increase its monthly production to 100,000 wafers by the end of 2026.

Morgan Stanley raised its target price for Taiwan Semiconductor from NT$1,688 to NT$1,888. The firm believes there is growth potential in both revenue and profit margins and recommends investors hold an overweight position in the stock until early 2026. It is expected that Taiwan Semiconductor’s guidance will show a mid-20% range of revenue growth for 2026, eventually achieving a 30% year-over-year increase. Additionally, the firm forecasts that Taiwan Semiconductor’s gross margin will exceed 60% in Q4 2025 and remain above 60% throughout 2026.

$Lululemon Athletica(LULU.US)$Surged over 3% overnight; activist investor Elliott reportedly holds a stake exceeding $1 billion and has nominated a new CEO candidate

Oracle shares rose nearly 6% in after-hours trading following the approval of electricity supply for its and OpenAI’s planned data center in Michigan.

Regulators in the U.S. state of Michigan have approved a request by power supplier DTE to provide electricity for$Oracle (ORCL.US)$a large-scale data center development project planned by Oracle and OpenAI. Regulatory bodies have stated that the proposed contracts between utility companies and technology firms will safeguard the interests of the power grid and the general public.

DTE earlier sought expedited regulatory approval for its power supply plan to support the facility located in Saline Township, which is worth tens of billions of dollars and has a capacity of 1.4 gigawatts (GW). According to Oracle and OpenAI, their collaboration across the United States is projected to exceed 8 GW of planned capacity and bring over USD 450 billion in investments within the next three years.

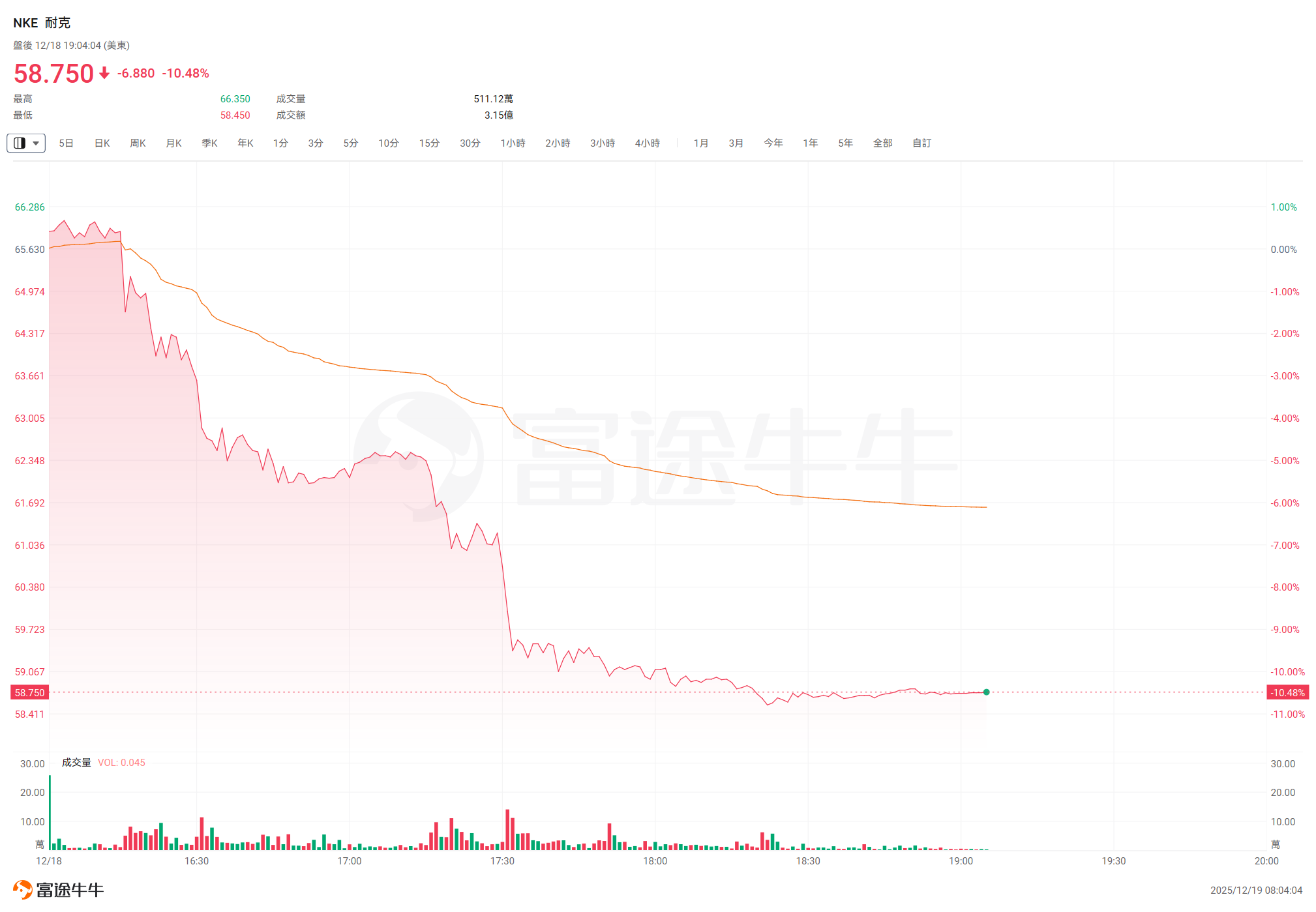

Nike shares plummeted more than 10% in after-hours trading as the company reported a 32% year-over-year decline in net profit for the second fiscal quarter to USD 792 million.

Nike (NKE.US) Revenue for the second fiscal quarter was USD 12.43 billion, representing a 0.6% year-over-year increase and surpassing estimates of USD 12.24 billion. Net profit for the second fiscal quarter fell 32% year-over-year to USD 792 million, while earnings per share were USD 0.53, marking a 32% year-over-year decline. The company's gross margin stood at 40.6%, compared with 43.6% in the same period last year, in line with expectations of 40.6%.

Top 20 by Trading Value

Market Outlook

Mainland investors increased their positions in Xiaomi by over HKD 900 million and purchased Meituan shares worth more than HKD 400 million, while selling Tracker Fund shares exceeding HKD 1.4 billion.

On Thursday, December 18, southbound funds recorded a net purchase of HKD 1.258 billion worth of Hong Kong stocks.

$Xiaomi Group-W(01810.HK)$、$Meituan-W(03690.HK)$、$Changfei Fiber Optic and Cable (06869.HK)$Net inflows amounted to HKD 904 million, HKD 434 million, and HKD 370 million respectively;

Tracker Fund of Hong Kong (02800.HK)、$China Mobile (00941.HK)$、$CNOOC Limited (00883.HK)$while net outflows totaled HKD 1.422 billion, HKD 1.294 billion, and HKD 225 million respectively.

Haitian: Cash dividend payout ratio to be no less than 80% annually over the next three years (2025-2027).

$Haitian (03288.HK)$The announcement stated that the company has formulated a shareholder return plan for the next three years (2025-2027). The plan indicates that the total annual cash dividend will account for no less than 80% of the net profit attributable to parent company shareholders for that year. This plan still needs to be submitted to the shareholders' meeting for review. Meanwhile, the company has introduced a special dividend proposal for returning value to shareholders in 2025: a cash dividend of RMB 3.0 per 10 shares (tax included).

Deloitte: Estimates Hong Kong IPO proceeds to exceed HKD 300 billion next year.

Deloitte Capital Markets Services estimates that Hong Kong will see at least seven new listings with fundraising sizes exceeding HKD 10 billion next year, and a total of 160 IPOs are expected throughout the year, with the total amount of funds raised likely to exceed HKD 300 billion for the first time since 2021.

The U.S. interest rate cuts and treasury bond purchases, Chinese companies' outbound strategies, domestic demand policies, support for hard tech and new productivity industries, as well as reforms in Hong Kong's capital markets, will attract massive IPOs, along with listing candidates from various industries and regions to go public in Hong Kong next year.

Eddie Ng, Managing Partner of Deloitte China's South China region, stated that by fundraising volume, Hong Kong will remain in the top three next year, despite the potential IPOs of large aerospace and mortgage companies in the United States.

According to the bank’s estimates, Hong Kong will complete 114 IPOs this year, raising approximately HKD 286.3 billion, representing an increase of about 63% in the number of deals, while the total amount raised is expected to more than triple.

Hong Kong Exchange (00388.HK)In terms of total IPO proceeds in 2025, Hong Kong is projected to rank first, followed by Nasdaq, where 175 new listings are expected to raise HKD 205.2 billion. The National Stock Exchange of India ranks third, with 222 IPOs collectively raising HKD 168.2 billion.

Hong Kong Exchanges and Clearing Limited has initiated a consultation on reforming the board lot size, which could lower the investment threshold for certain companies.

On December 18,Hong Kong Exchange (00388.HK)a consultation paper was published seeking market feedback on proposed improvements to the framework for board lot sizes in Hong Kong’s securities market, aiming to enhance trading, clearing, and settlement efficiency. This consultation period lasts 12 weeks and will conclude on March 12, 2026.

The Hong Kong Exchange has comprehensively reviewed the current trading mechanism per lot and is consulting the market on simplifying the framework for trading units per lot. The number of shares per lot for applicable securities (including stocks and real estate investment trusts) will be consolidated into eight standardized options. Additionally, the guidance floor for the value per lot will be significantly reduced, and a ceiling for the guidance value per lot will be introduced.

Ministry of Commerce: Regarding the sale of overseas port assets by CK Hutchison, China will conduct reviews and supervision in accordance with the law.

At the regular press conference held by the Ministry of Commerce yesterday afternoon, spokesperson He Yadong stated that regarding$CK Hutchison Holdings (00001.HK)$Regarding the sale of overseas port assets, relevant departments have issued multiple statements previously. The Chinese government will conduct reviews and supervision in accordance with the law, protect fair market competition, safeguard public interest, and resolutely uphold national sovereignty, security, and development interests.

Today's Focus

Keywords: Bank of Japan Interest Rate Decision, US December University of Michigan Consumer Sentiment Index

In terms of economic data, key focus can be placed on Japan’s November Core CPI and the US December University of Michigan Consumer Sentiment Index.

15:00 Germany's November PPI Month-over-Month, UK's November Public Sector Net Borrowing (in billion GBP), UK's November Seasonally Adjusted Retail Sales Month-over-Month

17:00 Eurozone's October Seasonally Adjusted Current Account Balance (in billion EUR)

19:00 UK's December CBI Retail Sales Differential

21:30 Canada's October Retail Sales Month-over-Month

23:00 Eurozone's December Preliminary Consumer Confidence Index, US's December Final University of Michigan Consumer Sentiment Index, US's December Final One-Year Inflation Expectations, US's November Annualized Existing Home Sales (in million units)

In terms of financial events, the Bank of Japan will announce the outcome of its interest rate decision. The market broadly anticipates a rate hike and is closely watching for signals regarding the future direction of monetary policy.

To be determined: Bank of Japan announces interest rate decision

14:30 Bank of Japan Governor Kazuo Ueda holds a press conference on monetary policy

![]()

Morning Reading by Niuniu:

A true investor does not place funds arbitrarily like gambling; instead, he only invests in instruments with sufficient potential for profit.

— Roy Neuberger

![]() AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

AI Portfolio Strategist goes live!Gain comprehensive insights into your holdings, fully grasp opportunities and risks with a single click.

Editor/melody