Japan's core inflation rate rose 3.0% year-on-year in November, marking the 44th consecutive month above the central bank’s 2% target, further solidifying market expectations for an upcoming interest rate hike by the Bank of Japan.

Despite pressures on economic growth, persistent inflationary stickiness indicates that Japan has moved away from a deflationary environment, prompting the central bank to strike a balance between curbing price increases and supporting the economy, providing a key basis for policy normalization.

Japan’s core inflation rate remained stable in November, staying above the Bank of Japan’s target for the 44th consecutive month. This data further reinforced market expectations that the BOJ would soon raise interest rates.

On Friday, December 19, data released by the Japanese government showed that the core consumer price index (CPI), excluding fresh food, rose 3.0% year-on-year in November, matching the median market expectation and remaining unchanged from October. Meanwhile, the overall CPI growth eased slightly from 3.0% in the previous month to 2.9%. Both figures remained consistently above the Bank of Japan’s 2% target.

On Friday, December 19, data released by the Japanese government showed that the core consumer price index (CPI), excluding fresh food, rose 3.0% year-on-year in November, matching the median market expectation and remaining unchanged from October. Meanwhile, the overall CPI growth eased slightly from 3.0% in the previous month to 2.9%. Both figures remained consistently above the Bank of Japan’s 2% target.

This data release coincided with the conclusion of the Bank of Japan’s two-day policy meeting. Markets widely anticipate that the central bank will raise the policy rate from the current 0.5% to 0.75%, which would represent the highest interest rate level in Japan since 1995.

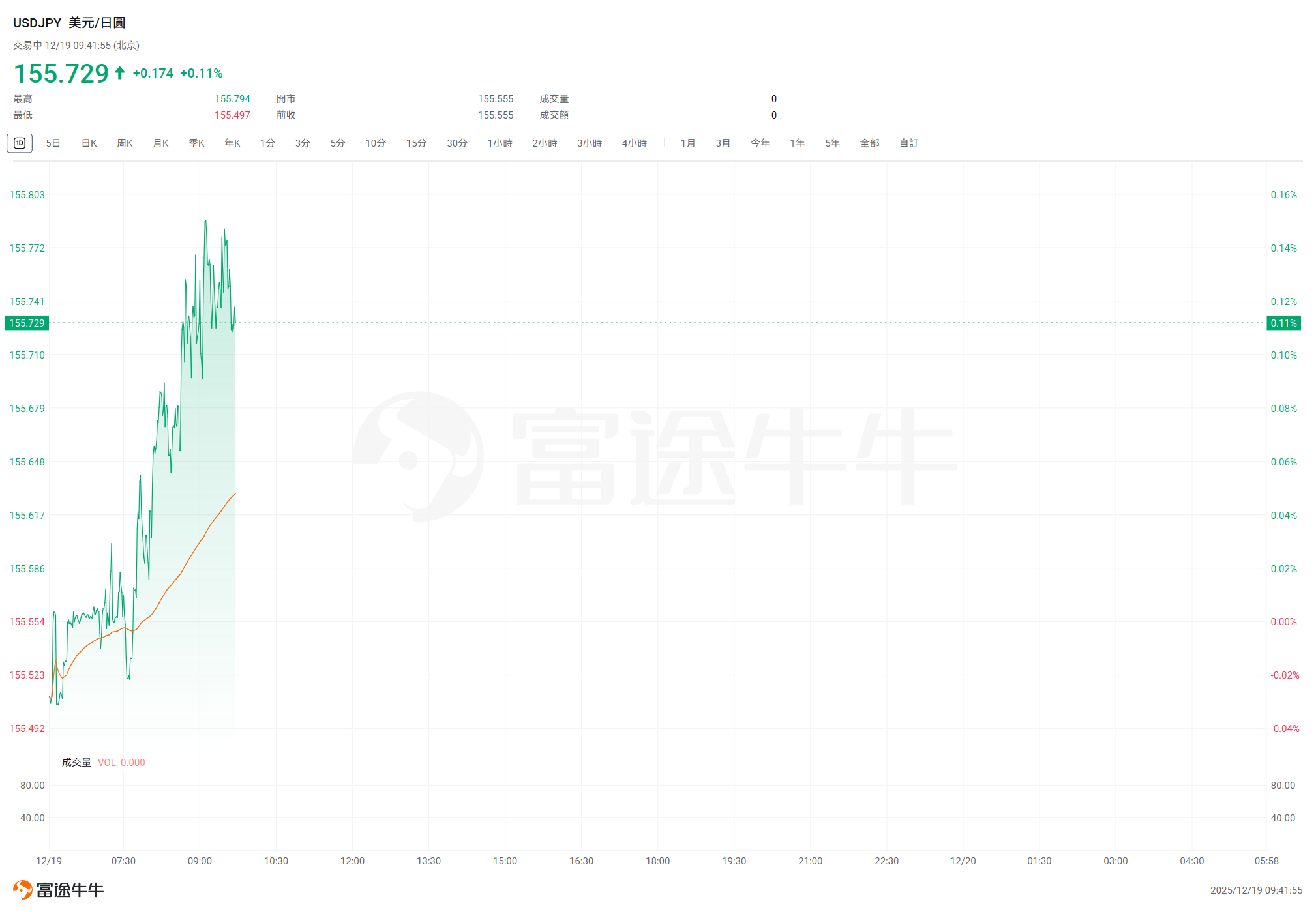

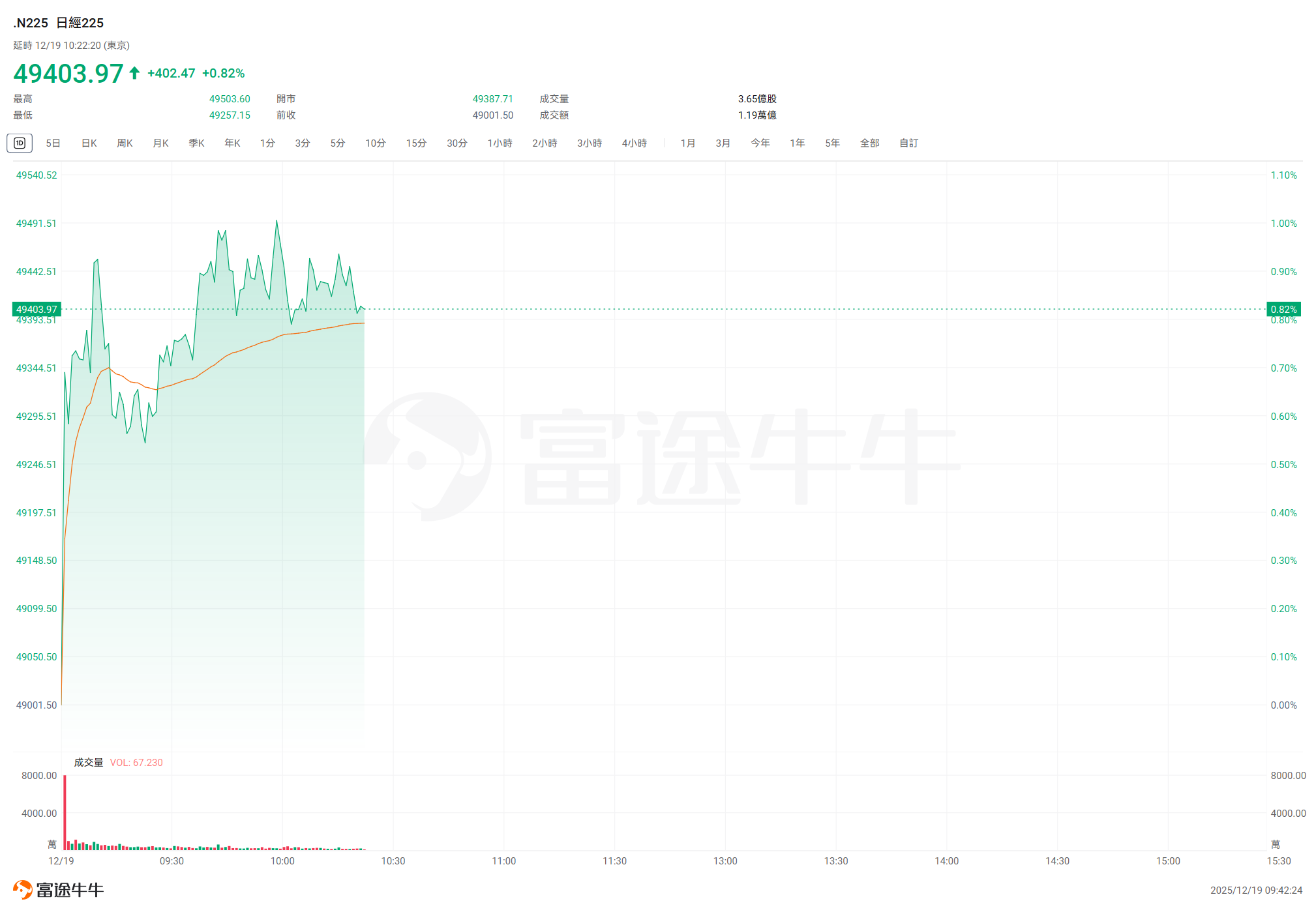

The market reacted positively overall to the data. Following the release, bolstered by reinforced expectations of a rate hike,$USD/JPY (USDJPY.FX)$strengthened slightly to 155.73,$Nikkei 225 Index (.NKY.US)$rose more than 0.8%. Meanwhile,$Japan 10-Year Treasury Notes Yield (JP10Y.BD)$edged up to 1.954%.

Although Japan’s economic growth has recently shown signs of contraction, the sustained inflation data underscores that the central bank must strike a balance between controlling prices and supporting the economy to avoid acting too slowly in addressing high inflation.

Underlying price pressures persist.

The data shows that despite a slight decline in overall inflation to 2.9%, the stickiness of core inflationary pressures remains significant.

Rising rice prices remain a key factor driving inflation, although the rate of rice inflation has slowed for the sixth consecutive month to 37.1% (having doubled year-on-year in May due to supply shortages and rising import costs). Overall food price growth shows almost no signs of easing.

The index excluding fresh food and energy prices remained at 3.0%, demonstrating the resilience of underlying inflation. Analysts noted that this trend reinforces the view that Japan’s inflation backdrop has undergone a fundamental shift from the deflationary environment of the past two decades. Current inflation is not only driven by external energy market fluctuations but also reflects ongoing changes in corporate pricing behavior and domestic demand.

The Bank of Japan's policy normalization is imminent.

The release of this CPI data coincides with the window period of the Bank of Japan's policy meeting. According to Reuters, given that persistently high food prices have kept inflation above the 2% target, an increasing number of members of the Bank of Japan’s policy board have hinted at being prepared to vote for an interest rate hike to address the risk of excessive inflation.

The Bank of Japan exited its decade-long aggressive stimulus program last year and raised short-term interest rates to 0.5% in January this year, based on the view that Japan is at a critical juncture for sustainably achieving the 2% inflation target.

Market expectations of a rate hike to 0.75% would mark a further step in policy normalization. Analysts warn that while a rate hike could help curb inflation and prevent prolonged yen weakness, the central bank needs to strike a delicate balance between containing inflation and avoiding excessive suppression of economic activity amid cooling personal consumption.

The interplay between politics and economic growth

Amid expectations of monetary policy tightening, domestic discussions in Japan about economic growth and fiscal policy are also heating up. Revised third-quarter GDP data shows that Japan's economic contraction was larger than initially estimated, shrinking at an annualized rate of 2.3%.

Against this backdrop, Japanese Prime Minister Sanae Takaichi told a business lobby group on Wednesday that Japan must pursue proactive fiscal spending to promote growth and tax revenue, rather than excessive fiscal austerity. As a supporter of accommodative monetary policy, Takaichi had previously criticized the Bank of Japan’s interest rate hikes.

In response, Bank of Japan Deputy Governor Masazumi Wakatabe told the same business group that the government must raise Japan’s “neutral interest rate” (the policy rate that balances economic growth and inflation) through fiscal spending and growth strategies. Wakatabe noted that if Japan’s neutral rate rises as a result, it would be natural for the central bank to raise interest rates, but he emphasized that the bank must avoid premature rate hikes or excessive withdrawal of monetary support.

Currently, the Bank of Japan does not have an official forecast for the neutral interest rate. Governor Kazuo Ueda has previously stated that it is difficult to estimate the terminal rate, while anchoring it between 1% and 2.5%.

Editor/melody