Historical data shows that midterm election years during a U.S. president's term tend to be the weakest period for stock market performance. However, Trump’s market playbook for 2026 may differ. What Wall Street once viewed as a 'curse' is now transforming into a 'golden window for bottom fishing.'

If there is one lesson for investors in 2025, it is that markets can absorb shocks and continue to rise—no matter what. Despite what seems like an endless series of policy reversals since Trump returned to the White House, U.S. stocks are still on track for a surprisingly strong finish.

Now, investors are turning their attention to 2026—a midterm election year during the current presidential term, which is not typically known for being calm.

Historically, midterm election years—the second year of a president’s term—tend to be the weakest period for stock market performance within the four-year presidential cycle. Since 1948, the S&P 500 has averaged gains of just 4.6% in midterm election years, with positive returns only 58% of the time. In contrast, according to data compiled by Ned Davis Research, the year preceding an election—the third year of a president’s term—is historically the strongest period in the four-year cycle, with average gains of approximately 17.2%.

Historically, midterm election years—the second year of a president’s term—tend to be the weakest period for stock market performance within the four-year presidential cycle. Since 1948, the S&P 500 has averaged gains of just 4.6% in midterm election years, with positive returns only 58% of the time. In contrast, according to data compiled by Ned Davis Research, the year preceding an election—the third year of a president’s term—is historically the strongest period in the four-year cycle, with average gains of approximately 17.2%.

However, the upcoming midterm election year may not follow this script.

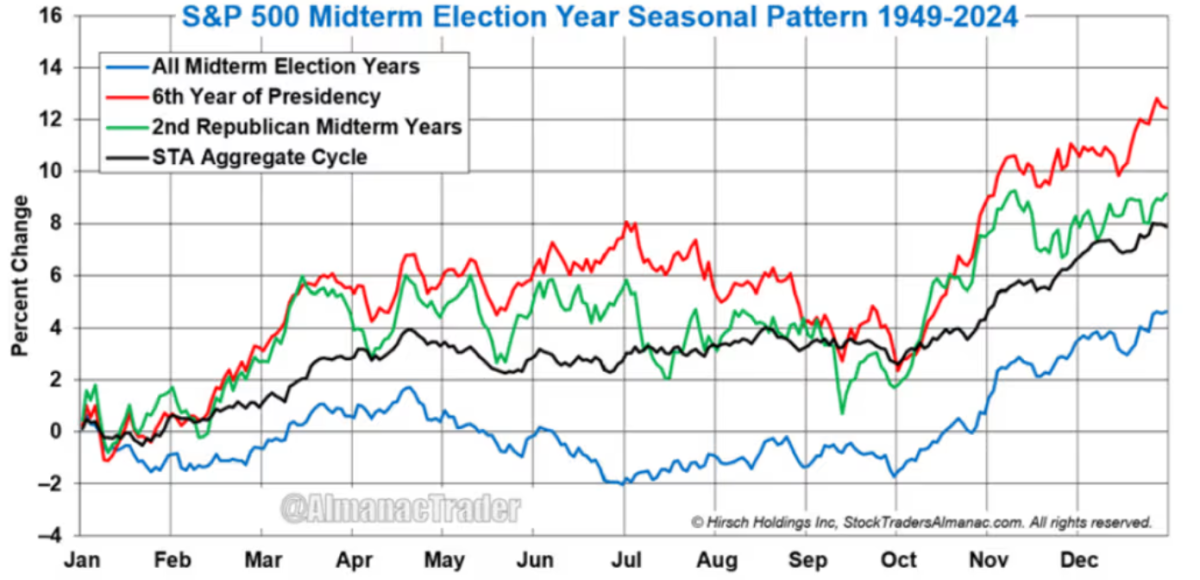

Jeffrey Hirsch, CEO of Hirsch Holdings and editor of the Stock Trader’s Almanac, notes that midterm election years during a president’s second term tend to be more favorable for the stock market.

The situation tends to be slightly better during midterm election years in a president's second term. Having tracked and refined market seasonality and historical trends for decades, Hirsch states that since 1949, the sixth year of a president’s term—the midterm election year of the second term—has seen annual average gains of approximately 8% to 12% for the S&P 500. Trump’s second term began in January, making him the first U.S. president since Grover Cleveland to serve two non-consecutive terms.

This historical pattern also underpins Hirsch's baseline forecast for 2026: in a phone interview with MarketWatch, he stated that he expects inflation concerns to “persist but not worsen,” Trump’s policy shifts to yield “complex but positive outcomes,” a seamless transition for the new Federal Reserve chair, the labor market to remain “relatively stable,” and the AI boom to continue advancing.

To be sure, many of these same forces have driven market gains this year as well, as investors successfully climbed what some have called a 'wall of worry,' including Fundstrat’s Tom Lee.

For much of this year, investors have been concerned whether Trump’s broad and evolving tariff policies could trigger a global trade war, fuel inflation, or push the world’s largest economy into recession. However, these fears have yet to fully materialize. Although investors are still awaiting the Supreme Court’s ruling on whether most of the tariffs will stand, the market has largely shrugged off most concerns beyond a brief bout of volatility in April following the announcement of Trump’s self-proclaimed 'Day of Liberation' tariffs.

In Hirsch’s view, the sharp selloff in April essentially pre-empted much of the typical stock market weakness seen in midterm election years, while Trump’s other policies remain supportive for equities—deregulation and tax cuts offsetting tariff-driven volatility on Wall Street.

Buying opportunities in 2026?

History also suggests that the period leading up to midterm elections often provides potential buying opportunities for the stock market.

Since 1934, the S&P 500 index has typically experienced a peak-to-trough decline of about 21% around or before midterm elections. Sean Clark, Chief Investment Officer of Clark Capital Management Group, stated: 'The market usually starts a fairly significant pullback within 12 months before the midterm election date, with stock prices generally bottoming out prior to that.'

Encouragingly, any volatility ahead of the 2026 midterm elections should lay the groundwork for a robust rebound thereafter — the average increase from the market low in the second year of the presidential cycle to the high in the third year is close to 46%.

'Thus, there will be opportunities to generate significant alpha during the downturn, and potentially substantial returns as the market recovers,' Clark told MarketWatch during a phone interview on Wednesday.

Top strategists on Wall Street now widely anticipate that U.S. equities could see another strong performance in 2026, as the next phase of the bull market may still have room to run. According to a recent survey by MarketWatch of at least 14 major investment banks and research institutions, their forecasts indicate a median year-end target of 7,500 points for the S&P 500 index — representing an increase of more than 10% from Thursday’s level above 6,800 points.

Many point to expectations of robust earnings growth, a surge in AI-related capital expenditures, and fiscal support (including Trump's 'big and beautiful bill') as reasons why the market could continue to climb in 2026. These strategists downplay concerns about high AI valuations and the possibility of a tech bubble, viewing them as temporary fluctuations rather than fundamental threats to the broader stock market.

However, others hold different views, with some strategists expressing concerns that elevated valuations of large-cap technology stocks, lingering inflation worries, and uncertainty surrounding the next Federal Reserve Chair and central bank independence might limit gains and make markets more susceptible to sudden setbacks.

Tom Bruce, an investment strategist at Tanglewood Macroeconomics, said that AI-related stocks may be good investments in the long term but could experience some 'irrational exuberance' in the short term, which is precisely how the sector performed in 2025.

'I’ve always been concerned that AI might enter a bubble phase,' Bruce told MarketWatch over the phone on Wednesday. 'It’s not because it lacks value, but historically, market bubbles tend to originate from new technologies where valuation methods are unclear. This makes it a prime candidate for a bubble, regardless of its long-term potential.'

Editor/Doris